South Africa CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

South Africa CCTV Camera Market Overview:

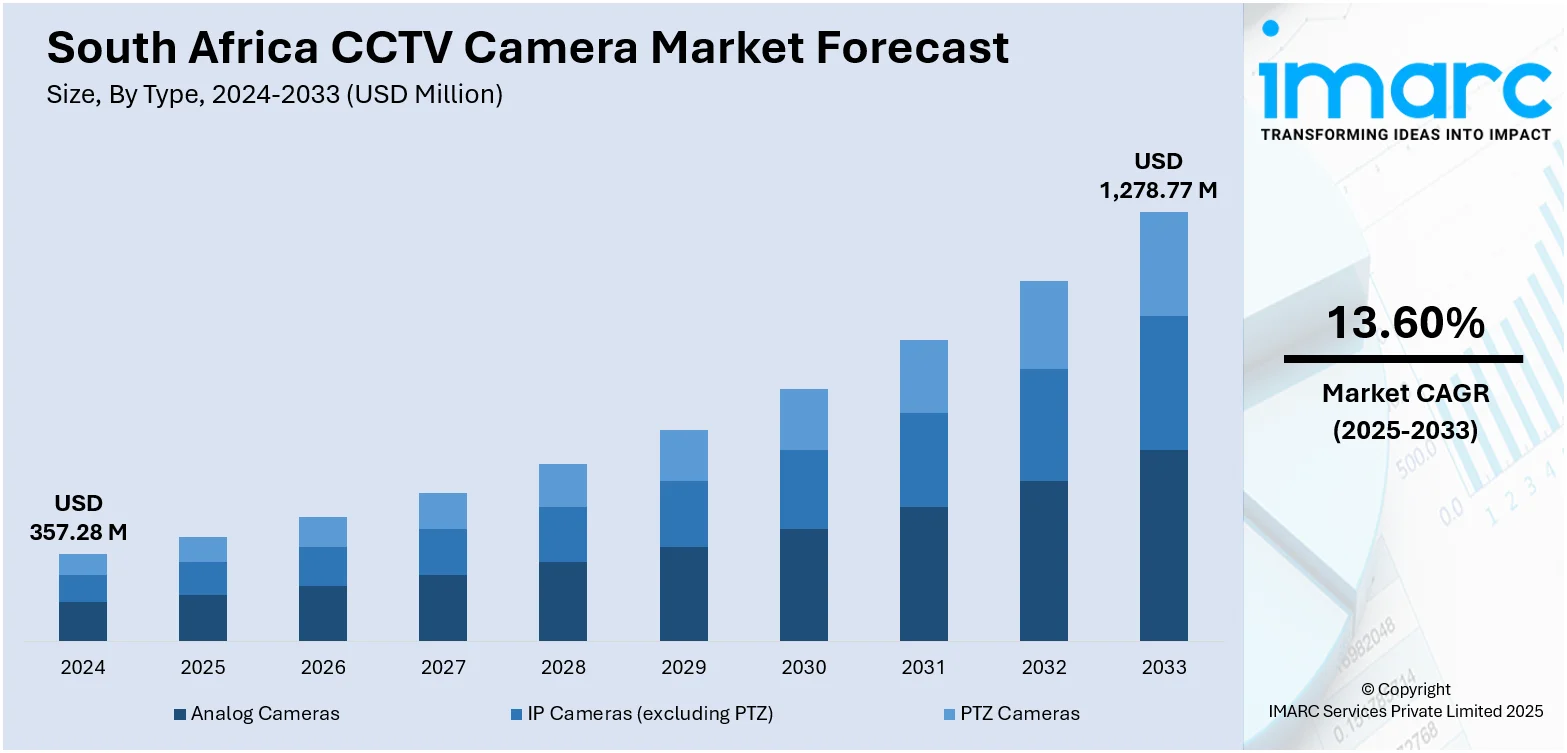

The South Africa CCTV camera market size reached USD 357.28 Million in 2024. Looking forward, the market is projected to reach USD 1,278.77 Million by 2033, exhibiting a growth rate (CAGR) of 13.60% during 2025-2033. The market is witnessing steady growth driven by rising security concerns, infrastructure development, and increasing adoption of advanced surveillance technologies. Demand is supported by urban expansion, smart city projects, and the shift toward IP-based and AI-enabled systems. Growing commercial, industrial, and residential installations are enhancing market opportunities, with competition intensifying among global and local suppliers in the South Africa CCTV camera market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 357.28 Million |

| Market Forecast in 2033 | USD 1,278.77 Million |

| Market Growth Rate 2025-2033 | 13.60% |

South Africa CCTV Camera Market Trends:

Integration of CCTV with Cloud Storage for Flexible and Scalable Video Management

The CCTV camera market in South Africa is increasingly adopting cloud storage solutions which offer enhanced flexibility and scalability for video management. Cloud-enabled systems allow users to store, access, and oversee video footage from anywhere removing the necessity for extensive on-site equipment. This approach cuts down on infrastructure expenses and bolsters security with encrypted data storage. The integration of cloud services allows for seamless expansion of the system simplifying the process for businesses to scale operations without needing complex upgrades. Additionally, it enables real-time monitoring and analytics leading to quicker decision-making and more effective incident management. As more organizations focus on accessibility, scalability, and data security, cloud-based CCTV systems are becoming a preferred choice across commercial, industrial, and public sector applications in South Africa.

To get more information on this market, Request Sample

Growing Demand for Wireless and Mobile-Enabled Surveillance Solutions

In South Africa there is a growing demand for wireless and mobile-enabled surveillance systems spurred by the desire for flexibility and ease of installation. Wireless systems remove the need for extensive cabling making them particularly suitable for temporary arrangements, remote sites, and locations where wiring is not feasible. These solutions now frequently come with mobile app integration allowing users to access video in real-time, receive alerts, and control the system via smartphones or tablets. Both businesses and homeowners appreciate the convenience of managing security remotely which improves incident responsiveness. Moreover, advancements in wireless technology have enhanced video quality, reliability of connectivity, and integration with other smart devices. This increasing adoption signifies a shift toward portable, user-friendly, and cost-effective security solutions that meet contemporary lifestyle and business requirements in South Africa.

Rising Adoption of AI-Powered Features

The South Africa CCTV camera market growth is greatly impacted by the swift incorporation of artificial intelligence (AI) into surveillance technologies. Contemporary CCTV cameras are now increasingly outfitted with AI-driven capabilities, such as facial recognition, object detection, and behavior analytics, which enhance the management of security in a more proactive and precise manner. These advancements facilitate the real-time detection of suspicious behaviors, optimize response times, and minimize false alarms. For instance, in July 2025, Duxbury Networking introduced Axis AI-powered PTZ cameras to South Africa, enhancing security with real-time tracking and advanced analytics. The cameras, featuring 1080p and 4K UHD resolution, improve perimeter security by automatically classifying objects, reducing false alarms, and integrating seamlessly with existing surveillance system. Sectors like retail, banking, transportation, and public safety are utilizing AI-focused analytics to boost both operational efficiency and security measures. Furthermore, the capacity to process and analyze extensive video data instantaneously aids in more informed decision-making and enhances threat prevention overall. This movement is also in sync with the country's increasing adoption of smart city projects, where AI-enabled surveillance is pivotal for public safety and effective urban management.

South Africa CCTV Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

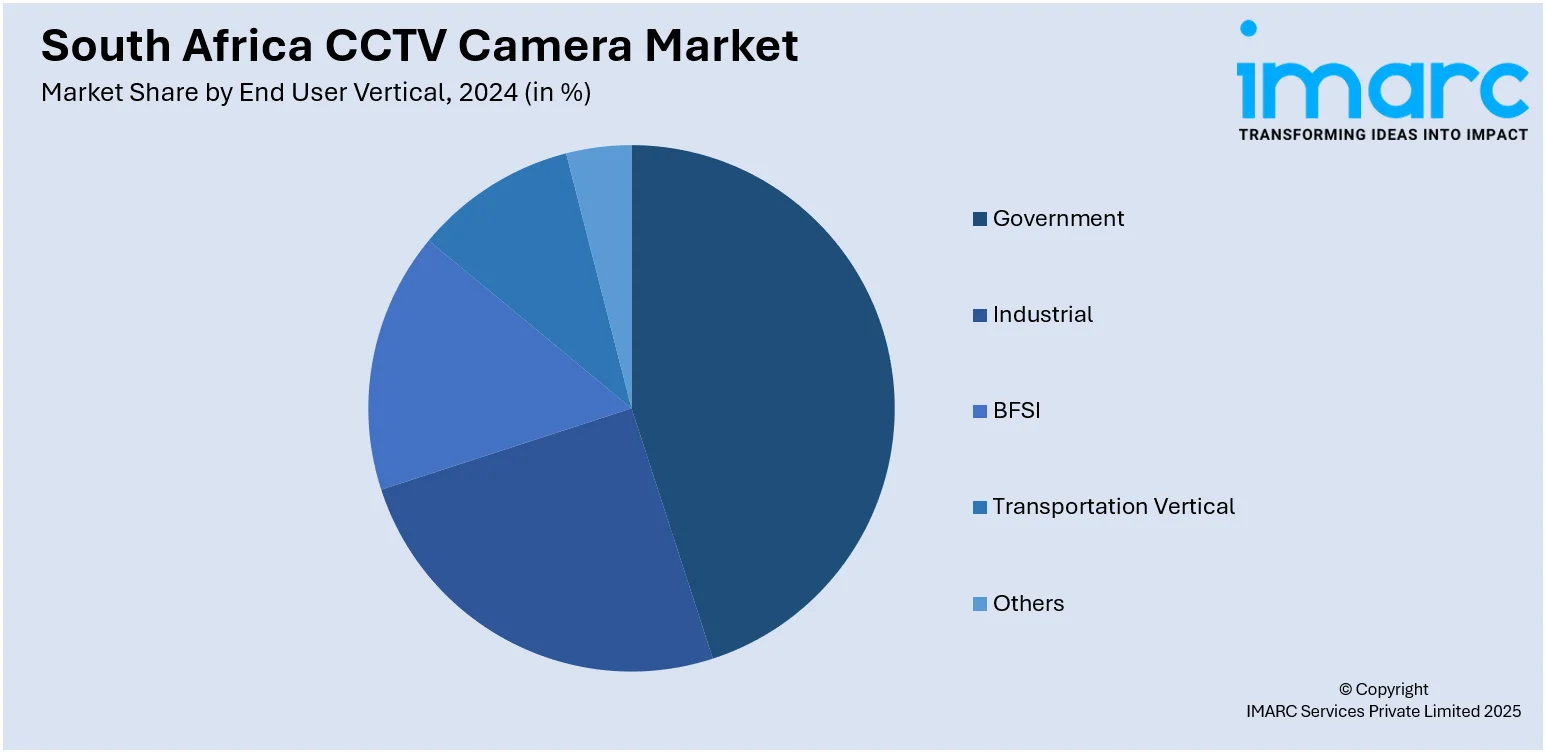

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa CCTV Camera Market News:

- In February 2025, the City of Johannesburg enacted a new by-law requiring CCTV camera registration to enhance law enforcement and deter crime. The regulation covers various surveillance technologies, ensuring data confidentiality and compliance with privacy rights.

- In February 2024, the Gauteng Provincial Government partnered with Vuma Cam to deploy 6,000 CCTV cameras to enhance crime-fighting efforts across the province. Premier Panyaza Lusufi emphasized the importance of technology in ensuring safety, especially in high-crime areas. The initiative includes collaboration with various government departments and extends to underserved communities.

South Africa CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa CCTV camera market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa CCTV camera market on the basis of type?

- What is the breakup of the South Africa CCTV camera market on the basis of end user vertical?

- What is the breakup of the South Africa CCTV camera market on the basis of region?

- What are the various stages in the value chain of the South Africa CCTV camera market?

- What are the key driving factors and challenges in the South Africa CCTV camera market?

- What is the structure of the South Africa CCTV camera market and who are the key players?

- What is the degree of competition in the South Africa CCTV camera market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa CCTV camera market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa CCTV camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa CCTV camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)