South Africa Chocolate Market Size, Share, Trends and Forecast by Product Type, Product Form, Application, Pricing, Distribution, and Province, 2026-2034

South Africa Chocolate Market Summary:

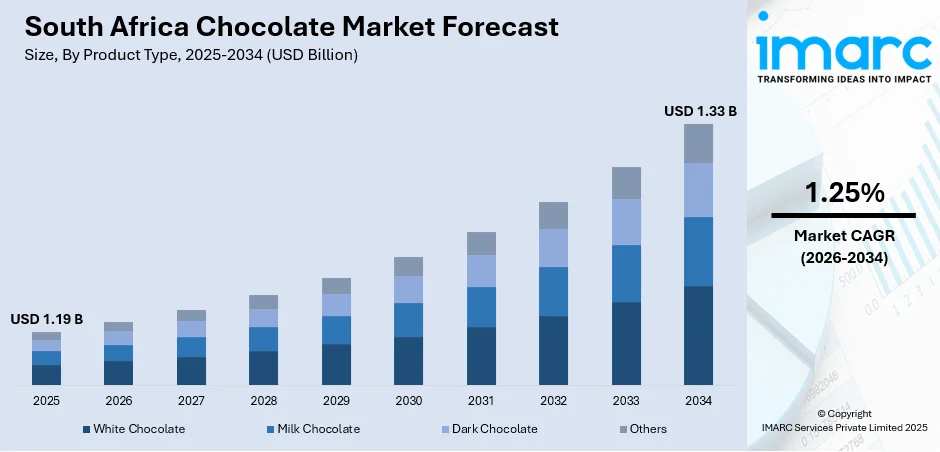

The South Africa chocolate market size was valued at USD 1.19 Billion in 2025 and is projected to reach USD 1.33 Billion by 2034, growing at a compound annual growth rate of 1.25% from 2026-2034.

The South Africa chocolate market continues demonstrating resilience driven by evolving consumer preferences and expanding retail infrastructure across urban centers. Growing demand for indulgent confectionery products among the youth population, coupled with increasing disposable incomes in metropolitan areas, is sustaining market momentum. The market benefits from established distribution networks and strong brand loyalty toward both international and domestic chocolate manufacturers, supporting the South Africa chocolate market share.

Key Takeaways and Insights:

- By Product Type: Milk Chocolate dominates the market with a share of 54% in 2025, driven by widespread consumer preference for its creamy taste profile and versatility across various confectionery applications.

- By Product Form: Molded leads the market with a share of 59% in 2025, owing to the popularity of chocolate bars and slabs as convenient everyday indulgence options across retail channels.

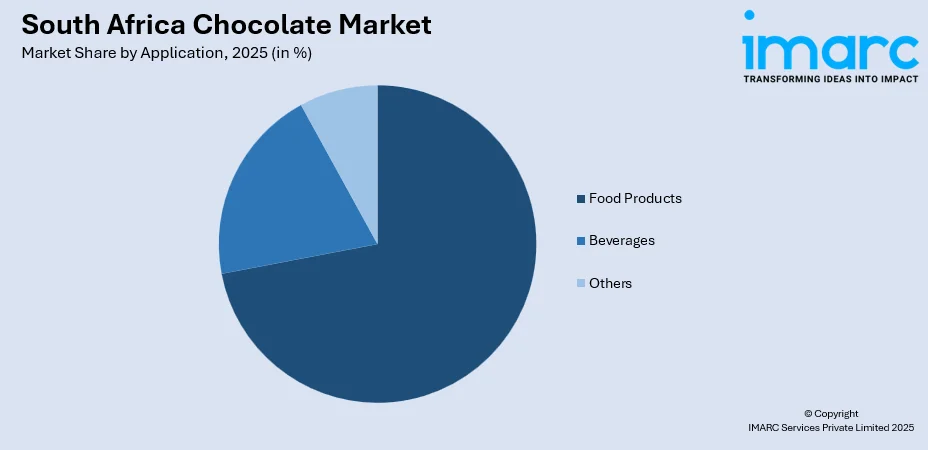

- By Application: Food Products represent the largest segment with a market share of 72% in 2025, attributed to extensive usage of chocolate in bakery items, desserts, and sugar confectionery preparations.

- By Pricing: Everyday Chocolate holds a share of 47% in 2025, reflecting the price-sensitive nature of South African consumers seeking affordable indulgence options.

- By Distribution: Supermarkets and Hypermarkets dominate with 45% share in 2025, supported by extensive product variety, promotional schemes, and convenient shopping experiences.

- Key Players: The South African chocolate market exhibits a consolidated competitive structure, with a few major players holding a significant share through established brand portfolios and extensive distribution networks.

To get more information on this market Request Sample

The South Africa chocolate market is experiencing transformation driven by changing consumer behaviors and digital retail expansion. With internet penetration reaching significant levels across the country, online sales channels are reshaping purchasing patterns alongside traditional retail formats. A recent report projects that South Africa’s online retail turnover will exceed R130 billion (nearly US$7.42 billion) in 2025, marking the first time e‑commerce will account for nearly 10% of total retail sales. The market benefits from a growing young population increasingly attracted to diverse chocolate flavors and premium offerings. International manufacturers continue expanding their presence while local producers leverage heritage brands and competitive pricing strategies. Rising health consciousness is driving demand for dark chocolate variants and sugar-reduced formulations, while seasonal products including Easter eggs maintain strong cultural relevance and sales contribution throughout the annual calendar.

South Africa Chocolate Market Trends:

Rising Demand for Premium and Artisanal Chocolate Products

South African consumers are increasingly gravitating toward premium chocolate experiences featuring single-origin cocoa, bean-to-bar production methods, and artisanal craftsmanship. According to a 2025 overview by Eighty20, there is a growing shift towards “authentic, ethical experiences,” with artisanal chocolatiers such as Honest Chocolate using single‑origin Tanzanian cocoa and inviting consumers to view the chocolate‑making process first‑hand, a clear signal of demand for premium, traceable chocolates. This premiumization trend reflects growing sophistication among urban consumers willing to pay higher prices for superior quality and unique flavor profiles. Local boutique chocolatiers in Cape Town and Johannesburg are capitalizing on this shift by offering ethically sourced, handcrafted products that appeal to discerning palates.

Growing Health Consciousness Driving Dark Chocolate Consumption

Health-conscious consumers are fueling demand for dark chocolate products recognized for their antioxidant properties and potential cardiovascular benefits. For instance, a recent article in a South African media outlet highlights that dark chocolate is “rich in antioxidants” and that its flavonoids may improve heart health and boost brain function. This trend aligns with broader wellness movements prompting manufacturers to develop sugar-free, organic, and functional chocolate variants. Product innovation increasingly incorporates natural ingredients and clean labels to satisfy consumers seeking indulgence without compromising health objectives.

Expansion of E-Commerce and Digital Retail Channels

Digital transformation is reshaping chocolate distribution as online platforms gain traction among South African consumers. The South Africa e-commerce market size reached USD 187.60 billion in 2024 and is projected to surge to USD 2,199.27 billion by 2033, reflecting a robust growth rate of 27.91% during 2025–2033, highlighting the immense potential for online chocolate sales. E-commerce channels offer convenience, broader product selection, and doorstep delivery that appeal to urban professionals and younger demographics. Social media marketing and influencer partnerships are becoming increasingly important for brand engagement, while direct-to-consumer models enable boutique chocolatiers to reach nationwide audiences beyond traditional retail footprints.

Market Outlook 2026-2034:

The South Africa chocolate market outlook remains cautiously optimistic despite macroeconomic challenges and raw material price volatility. Continued urbanization and rising middle-class populations will sustain consumption growth, while product innovation addressing health and sustainability preferences will attract new consumer segments. Strategic investments in manufacturing capabilities and distribution infrastructure are expected to enhance market competitiveness. The market generated a revenue of USD 1.19 Billion in 2025 and is projected to reach a revenue of USD 1.33 Billion by 2034, growing at a compound annual growth rate of 1.25% from 2026-2034.

South Africa Chocolate Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Milk Chocolate | 54% |

| Product Form | Molded | 59% |

| Application | Food Products | 72% |

| Pricing | Everyday Chocolate | 47% |

| Distribution | Supermarkets and Hypermarkets | 45% |

Product Type Insights:

- White Chocolate

- Milk Chocolate

- Dark Chocolate

- Others

The milk chocolate dominates with a market share of 54% of the total South Africa chocolate market in 2025.

Milk chocolate maintains commanding market leadership as the preferred chocolate variety among South African consumers across all age demographics. The segment benefits from its universally appealing creamy taste profile and extensive product availability ranging from affordable everyday slabs to premium offerings. Established brands have built strong consumer loyalty through consistent quality and nostalgic associations spanning generations of South African families.

The segment encompasses diverse formats including chocolate bars, slabs, countlines, and seasonal novelties that cater to various consumption occasions. Manufacturers continue innovating within the milk chocolate category by introducing new flavor combinations, textural variations, and portion sizes to maintain consumer interest. In September 2025, KitKat extended its South African product line with three new slab variants, Double Chocolate, Hazelnut, and Salted Caramel, signalling renewed investment in larger‑format milk‑chocolate products alongside traditional wafer bars. Despite growing competition from dark chocolate alternatives, milk chocolate's approachable sweetness and versatility sustain its dominant position across retail channels.

Product Form Insights:

- Molded

- Countlines

- Others

The molded leads with a share of 59% of the total South Africa chocolate market in 2025.

Molded chocolate products including bars and slabs command market leadership owing to their versatility and value proposition for everyday consumption. These formats offer consumers flexibility in portion control while providing manufacturers efficient production economics. Popular local and international brands have established strong shelf presence in this segment through iconic product designs and consistent quality delivery.

The molded segment benefits from extensive retail distribution across supermarkets, convenience stores, and informal trading channels reaching diverse consumer demographics. Seasonal variations including Easter eggs and festive shapes contribute significant sales volumes during peak gifting periods. Ongoing product innovation focusing on new flavors, inclusions, and packaging formats sustains consumer engagement within this foundational market segment.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food Products

- Bakery Products

- Sugar Confectionery

- Desserts

- Others

- Beverages

- Others

The food products dominate with a market share of 72% of the total South Africa chocolate market in 2025.

Food products application dominates chocolate consumption driven by extensive usage across bakery, confectionery, and dessert categories. Industrial chocolate ingredients supply bakeries, ice cream manufacturers, and confectionery producers who incorporate chocolate into diverse product formulations. For example, Barry Callebaut, a major global chocolate and cocoa‑products supplier, recently expanded its presence in South Africa by setting up a direct distribution network to better serve local bakers, pastry producers, and food‑service clients with its gourmet and compound chocolate ranges. The growing foodservice sector and expanding bakery retail chains are amplifying demand for both compound and couverture chocolate across professional applications.

Consumer preferences for chocolate-flavored products spanning cakes, pastries, biscuits, and frozen desserts sustain robust demand within this application segment. Manufacturers are responding with specialized chocolate formulations optimized for specific food processing requirements including temperature stability and flavor release characteristics. The trend toward premium bakery products featuring high-quality chocolate ingredients is elevating value creation opportunities within the food products application.

Pricing Insights:

- Everyday Chocolate

- Premium Chocolate

- Seasonal Chocolate

The everyday chocolate leads with a share of 47% of the total South Africa chocolate market in 2025.

Everyday chocolate maintains market leadership reflecting the price-sensitive nature of South African consumers navigating economic pressures. This segment encompasses affordable chocolate slabs, bars, and countlines positioned for regular consumption rather than special occasions. Manufacturers compete intensively on value proposition, offering competitive pricing while maintaining acceptable quality standards to capture volume-driven market share. Recently, major chocolate companies such as Mondelez International, owner of leading confectionery brands, publicly warned that “unprecedented cocoa cost inflation” is forcing them to pass on higher costs to consumers, signaling that even everyday chocolate isn’t immune from global input‑cost shocks.

The segment faces margin pressure from rising cocoa costs and input price inflation, prompting manufacturers to implement strategic pricing adjustments and package size modifications. Private label products have gained traction within this segment as retailers offer budget-conscious alternatives to branded options. Despite premiumization trends in broader confectionery categories, everyday chocolate remains foundational to market volume given consumer purchasing power constraints.

Distribution Insights:

- Direct Sales (B2B)

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The supermarkets and hypermarkets dominate with a market share of 45% of the total South Africa chocolate market in 2025.

Supermarkets and hypermarkets dominate chocolate distribution through extensive store networks, diverse product assortments, and competitive pricing enabled by scale advantages. Major retail chains provide comprehensive chocolate category coverage spanning value to premium tiers. These formats benefit from impulse purchasing behavior at checkout areas and promotional activities driving category awareness.

The channel maintains competitive advantage through private label offerings, loyalty programs, and seasonal promotional campaigns that stimulate chocolate sales. Store format expansion into township and rural areas is extending modern retail reach to previously underserved consumer segments. Strategic shelf placement and category management partnerships between retailers and manufacturers optimize product visibility and conversion within these high-traffic retail environments.

Provincial Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Gauteng dominates South Africa's chocolate market as the country's economic powerhouse housing Johannesburg and Pretoria metropolitan areas. The province's concentrated urban population, highest disposable incomes, and extensive modern retail infrastructure drive superior per capita chocolate consumption. Premium and artisanal chocolate segments demonstrate strongest penetration in Gauteng's affluent suburbs.

KwaZulu-Natal represents a significant chocolate market anchored by the Durban metropolitan area and surrounding coastal communities. The province hosts Beacon's historical manufacturing heritage in Mobeni, contributing to strong regional brand loyalty. Tourism activity along the coastline generates seasonal demand spikes while diverse demographic composition supports varied product preference patterns.

Western Cape leads in premium and artisanal chocolate consumption driven by Cape Town's sophisticated consumer base and tourism economy. The province hosts numerous boutique chocolatiers including internationally recognized bean-to-bar producers attracting discerning local and international customers. Strong gifting culture and hospitality sector demand support premium chocolate segment growth throughout the region.

Mpumalanga's chocolate market serves diverse consumer segments across mining communities, agricultural areas, and tourism corridors near Kruger National Park. The province demonstrates preference for value-oriented everyday chocolate products distributed through supermarket chains and convenience retail formats. Tourism-related gifting purchases contribute seasonal demand particularly in Lowveld destinations.

Eastern Cape presents growth opportunities with urban centers including Port Elizabeth and East London driving chocolate consumption alongside expanding retail infrastructure. The province's price-sensitive consumer base demonstrates strong preference for everyday chocolate segments while automotive industry employment supports stable purchasing power in metropolitan areas.

Remaining provinces including Free State, North West, Limpopo, and Northern Cape collectively contribute to market demand through agricultural communities, mining operations, and provincial administrative centers. These regions demonstrate preference for affordable chocolate formats distributed through supermarket chains and informal trading channels serving dispersed rural populations.

Market Dynamics:

Growth Drivers:

Why is the South Africa Chocolate Market Growing?

Expanding Urban Population and Rising Middle-Class Consumption

South Africa's ongoing urbanization is concentrating consumer populations in metropolitan areas where modern retail formats and diverse chocolate product availability stimulate consumption growth. The expanding middle class demonstrates increasing appetite for indulgent confectionery products as lifestyle aspirations evolve. In fact, in 2025 SPAR Group announced plans to launch a chain of 30–40 high‑end grocery stores under its “Gourmet” brand, targeting affluent and urban shoppers with premium foods, bakery items, and indulgent products, signalling growing demand for upscale confectionery among more affluent consumers. Young urban professionals represent a particularly dynamic consumer segment driving demand for both everyday treats and premium chocolate experiences that align with contemporary lifestyles.

Modern Retail Expansion and Distribution Network Development

Continued expansion of supermarket and hypermarket networks across South African provinces is enhancing chocolate accessibility in previously underserved markets. Retail format diversification including convenience stores, forecourt shops, and e-commerce platforms creates multiple touchpoints for chocolate purchases. The South African retail market reached USD 134.96 Billion in 2024, reflecting strong consumption potential, and is expected to grow to USD 213.36 Billion by 2033, highlighting expanding opportunities for chocolate manufacturers. Strategic investments in cold chain logistics and distribution infrastructure are enabling manufacturers to reach broader geographic coverage while maintaining product quality throughout supply chains.

Product Innovation and Premiumization Trends

Manufacturers are driving market growth through continuous product innovation addressing evolving consumer preferences for novel flavors, health-conscious formulations, and premium experiences. For instance, in South Africa, artisan brand Rrraw Chocolate recently launched two new flavour variants: a “Red Tart Chocolate” (in a coconut‑white base inspired by African hibiscus tea) and a “Spekboom Chocolate,” which is made using an indigenous South African plant, giving the chocolate a unique, locally rooted taste profile. Introduction of dark chocolate variants, sugar-reduced options, and artisanal products is attracting health-conscious and sophisticated consumers willing to pay premium prices. Seasonal innovations and limited-edition releases generate consumer excitement and support repeat purchasing behavior throughout annual sales cycles.

Market Restraints:

What Challenges the South Africa Chocolate Market is Facing?

Volatile Cocoa Prices and Input Cost Inflation

Global cocoa price volatility driven by supply disruptions in West African producing regions is creating significant cost pressures for South African chocolate manufacturers. Input costs have escalated substantially, with cocoa prices experiencing dramatic increases that compress manufacturer margins and necessitate consumer price increases. These cost dynamics threaten affordability for price-sensitive consumer segments fundamental to market volume.

Economic Pressure on Consumer Purchasing Power

Challenging macroeconomic conditions including inflation, unemployment, and currency depreciation are constraining consumer disposable income available for discretionary confectionery purchases. Consumers demonstrate trading-down behavior toward cheaper alternatives and private label products as budgets tighten. These economic headwinds particularly impact everyday chocolate segments where value sensitivity determines purchase decisions.

Competition from Imported Products and Private Labels

Increasing competition from imported chocolate products and retailer private label offerings is intensifying pressure on domestic manufacturers and established brands. Low-cost imports capture price-sensitive market segments while private labels benefit from retail shelf placement advantages and competitive pricing. This competitive intensity challenges brand differentiation strategies and margin preservation for traditional market participants.

Competitive Landscape:

The South African chocolate market exhibits a consolidated competitive structure, with multinational and domestic manufacturers competing across different market tiers. Leading players maintain strong brand portfolios that drive consumer loyalty, while others leverage local manufacturing experience to strengthen their position. Competition is largely shaped by pricing strategies, distribution partnerships, and ongoing product innovation. Companies are increasingly exploring premiumization opportunities, offering high-quality or specialty chocolate products to attract discerning consumers. At the same time, they continue to defend volumes in everyday chocolate segments through competitive pricing, promotional campaigns, and widespread retail availability. Overall, market participants focus on balancing innovation, brand equity, and affordability to capture diverse consumer preferences and sustain growth across both premium and mainstream categories.

Recent Developments:

- In May 2025 Lindt has launched its viral “Dubai‑Style” Chocolate in South Africa, featuring Swiss chocolate with 45% pistachio filling and a crispy pastry texture. Available as slabs in selected retailers and pralines exclusively at Lindt Boutiques, the launch is described as “the chocolate taking South Africa by storm.”

South Africa Chocolate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | White Chocolate, Milk Chocolate, Dark Chocolate, Others |

| Product Forms Covered | Molded, Countlines, Others |

| Applications Covered |

|

| Pricings Covered | Everyday Chocolate, Premium Chocolate, Seasonal Chocolate |

| Distributions Covered | Direct Sales (B2B), Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Africa chocolate market size was valued at USD 1.19 Billion in 2025.

The South Africa chocolate market is expected to grow at a compound annual growth rate of 1.25% from 2026-2034 to reach USD 1.33 Billion by 2034.

Milk Chocolate dominated the market with 54% share, driven by widespread consumer preference for its creamy taste profile and extensive availability across retail channels serving diverse demographic segments.

Key factors driving the South Africa chocolate market include expanding urban populations, rising middle-class consumption, modern retail network expansion, product innovation addressing health-conscious preferences, and premiumization trends among sophisticated consumer segments.

Major challenges include volatile global cocoa prices creating cost pressures, economic constraints on consumer purchasing power, competition from imported products and private labels, infrastructure limitations, and electricity supply issues affecting manufacturing operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)