South Africa Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Province, 2026-2034

South Africa Commercial Insurance Market Summary:

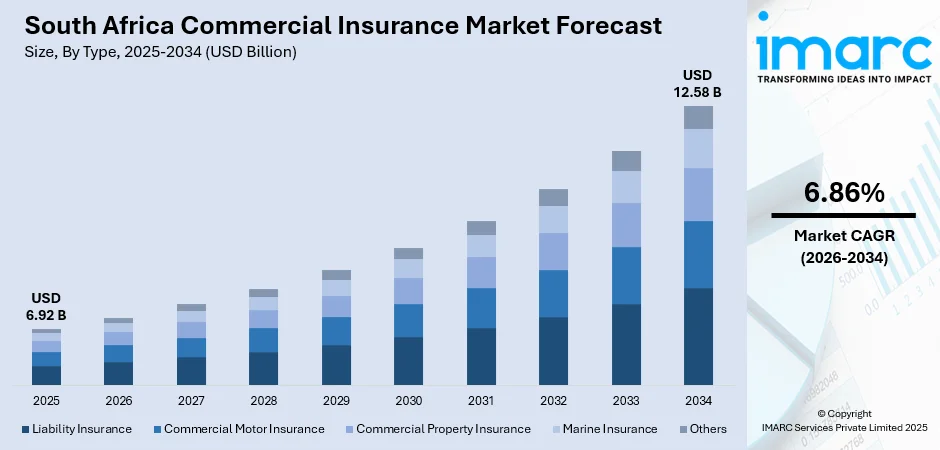

The South Africa commercial insurance market size was valued at USD 6.92 Billion in 2025 and is projected to reach USD 12.58 Billion by 2034, growing at a compound annual growth rate of 6.86% from 2026-2034.

The South Africa commercial insurance market is experiencing growth on account of the expanding corporate risk awareness, regulatory modernization under the Twin Peaks model, and increasing adoption of digital insurance solutions. Economic diversification across manufacturing, logistics, and financial services sectors is catalyzing demand for comprehensive commercial coverage. The rising frequency of cyber threats, coupled with infrastructure development initiatives and enhanced corporate governance requirements, continues to reshape risk management priorities across industries, positioning insurers to expand their South Africa commercial insurance market share.

Key Takeaways and Insights:

- By Type: Commercial motor insurance dominates the market with a share of 28.12% in 2025, driven by extensive fleet operations across transportation and logistics sectors, rising vehicle acquisitions among businesses, and mandatory coverage requirements for commercial vehicles operating throughout South Africa and cross-border into neighboring countries.

- By Enterprise Size: Large enterprises hold the largest market share of 62.16% in 2025, reflecting their substantial asset portfolios requiring comprehensive protection, complex operational risks across multiple locations, and complex risk management systems that call for specialized multi-line commercial insurance solutions.

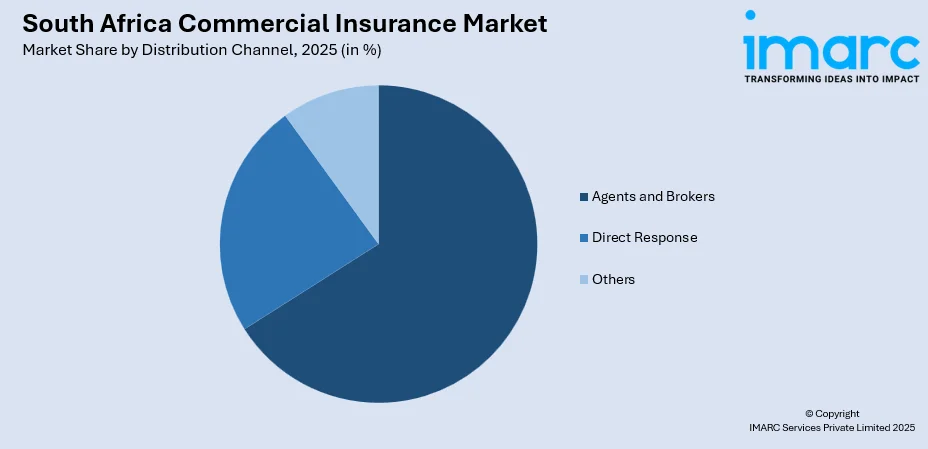

- By Distribution Channel: Agents and brokers lead the market with a share of 65.09% in 2025, owing to their specialized expertise in navigating complex commercial insurance products, established relationships with corporate clients, ability to provide tailored risk assessment services, and trusted advisory role in securing optimal coverage terms.

- By Industry Vertical: Transportation and logistics hold the largest share of 20.12% in 2025, driven by South Africa's strategic position as a regional logistics hub, extensive road freight networks extending into sub-Saharan Africa, high-value cargo movements, and significant fleet insurance requirements across the supply chain sector.

- Key Players: The South Africa commercial insurance market exhibits strong competitive intensity, with established domestic insurers and international underwriters competing across product segments. Market participants are focusing on digital transformation, specialized industry solutions, and strategic partnerships to strengthen market positioning.

To get more information on this market Request Sample

The South Africa commercial insurance market is advancing as businesses across diverse sectors recognize the importance of comprehensive risk transfer solutions in an evolving economic landscape. Growing corporate governance standards and regulatory requirements are compelling organizations to strengthen their insurance portfolios. The market benefits from South Africa's position as Africa's most developed insurance market, with sophisticated underwriting capabilities and established distribution networks. For instance, in December 2025, Santam recently received final permission from Lloyd's to launch Syndicate 1918, demonstrating the market's international competitiveness. Digital innovation is transforming customer engagement, enabling insurers to offer streamlined policy administration and enhanced claims processing that support South Africa commercial insurance market growth.

South Africa Commercial Insurance Market Trends:

Digital Transformation and Insurtech Integration

South African commercial insurers are increasingly adopting digital technologies to enhance operational efficiency and customer experience. Artificial intelligence and machine learning applications are revolutionizing underwriting processes, enabling more accurate risk assessment and personalized pricing models. Digital platforms facilitate streamlined policy management, automated claims processing, and enhanced customer service capabilities. Regulatory frameworks are emphasizing digital innovation, encouraging insurers to develop technology-driven solutions while maintaining robust consumer protection standards. The integration of advanced analytics and data-driven decision-making tools is reshaping competitive dynamics across the commercial insurance landscape, enabling insurers to deliver faster, more responsive services to business clients.

Rising Demand for Cyber Insurance Coverage

The commercial insurance sector is witnessing substantial growth in cyber insurance demand as businesses face escalating digital threats. Rapid digitization across industries has expanded attack surfaces, compelling organizations to seek comprehensive cyber liability coverage. According to the South African Banking Risk Information Centre, the country experienced a 22% surge in cyberattacks in 2023 compared to the previous year, with small businesses being particularly vulnerable. This heightened risk environment is driving insurers to develop specialized cyber products addressing data breaches, ransomware attacks, and business interruption losses stemming from cyber incidents.

ESG Integration and Climate Risk Solutions

Environmental, social, and governance considerations are increasingly shaping commercial insurance product development and underwriting practices. Insurers are incorporating climate risk assessments into their risk evaluation frameworks, developing parametric insurance solutions for natural catastrophe exposures. The increased frequency of extreme weather events has elevated demand for comprehensive property coverage. According to the South African Reserve Bank, the combined ratio for primary insurers increased from 87.7% in March 2023 to 92.5% in March 2024, reflecting rising claims from natural catastrophe events and prompting premium rate adjustments across commercial property lines.

Market Outlook 2026-2034:

The South Africa commercial insurance market is positioned for sustained revenue expansion, driven by economic diversification, infrastructure development initiatives, and evolving corporate risk management requirements. The market generated a revenue of USD 6.92 Billion in 2025 and is projected to reach a revenue of USD 12.58 Billion by 2034, growing at a compound annual growth rate of 6.86% from 2026-2034. The pending implementation of the Conduct of Financial Institutions Bill will modernize the regulatory framework, enhancing market transparency and consumer protection. Continued investment in digital capabilities, expansion of specialized industry solutions, and strategic partnerships will shape competitive dynamics, while growing cyber risk awareness and infrastructure investments create new revenue opportunities across commercial insurance segments.

South Africa Commercial Insurance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Commercial Motor Insurance | 28.12% |

| Enterprise Size | Large Enterprises | 62.16% |

| Distribution Channel | Agents and Brokers | 65.09% |

| Industry Vertical | Transportation and Logistics | 20.12% |

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

Commercial motor insurance dominates with 28.12% share of the South Africa commercial insurance market in 2025.

The commercial motor insurance segment maintains its leading position driven by South Africa's extensive road freight network and substantial commercial vehicle fleet operations. Businesses across transportation, logistics, construction, and service sectors require comprehensive coverage for their vehicle assets, including heavy commercial vehicles, light delivery vehicles, and passenger transport fleets. The segment benefits from mandatory third-party liability requirements and growing demand for comprehensive coverage protecting against theft, hijacking, and accident-related losses. Rising vehicle acquisition costs and replacement values have elevated the importance of adequate motor insurance protection across commercial operations.

Market growth is supported by expanding fleet management practices and the adoption of telematics-based insurance solutions that enable usage-based pricing and enhanced risk monitoring. Insurers are developing specialized products addressing the unique requirements of different commercial vehicle categories, from heavy haulage trucks operating cross-border routes to urban delivery fleets. For instance, Santam Heavy Haulage maintains a market share exceeding 30% in the heavy commercial vehicle insurance segment, insuring approximately 9,500 heavy haulage trucks on South African roads. The integration of advanced risk management tools and loss prevention services strengthens the value proposition for commercial motor insurance products.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises lead with 62.16% share of the South Africa commercial insurance market in 2025.

Large enterprises dominate the commercial insurance market due to their extensive asset bases, complex operational structures, and sophisticated risk management requirements. These organizations typically maintain substantial property portfolios, significant vehicle fleets, and diverse workforce exposures requiring comprehensive multi-line insurance programs. Corporate governance standards and regulatory compliance obligations compel large enterprises to secure adequate liability coverage, directors’ and officers’ insurance, and professional indemnity protection. The segment's premium contribution reflects both higher coverage limits and more comprehensive policy structures compared to smaller business segments.

Large corporations benefit from dedicated risk management resources enabling informed insurance procurement decisions and active loss prevention programs. Insurers serve this segment through specialized commercial divisions offering customized solutions, dedicated account management, and sophisticated claims handling capabilities. Strategic partnerships between insurers and large enterprise clients facilitate integrated risk management approaches addressing evolving business requirements.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Agents and Brokers

- Direct Response

- Others

Agents and brokers exhibit a clear dominance with 65.09% share of the South Africa commercial insurance market in 2025.

The agent and broker channel maintains dominance in commercial insurance distribution due to the complexity of business insurance products and the value of professional advisory services. Commercial clients benefit from brokers' expertise in assessing risk exposures, comparing coverage options across multiple insurers, and negotiating favorable terms. Intermediaries provide essential guidance through the insurance procurement process, ensuring appropriate coverage structures align with specific business requirements. The trusted advisory relationship between brokers and commercial clients strengthens customer retention and supports premium growth across the distribution channel.

Insurance brokers are increasingly leveraging digital tools to enhance service delivery while maintaining personalized client relationships. The continued confidence in intermediary-led distribution reflects the enduring importance of professional guidance for commercial insurance products. Brokers add value through specialized industry knowledge, claims advocacy services, and ongoing risk management support that differentiates their proposition from direct distribution alternatives. Regulatory requirements under the Financial Advisory and Intermediary Services Act ensure professional standards across the intermediary sector, reinforcing trust and accountability in broker-client engagements.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

Transportation and logistics represent the largest industry vertical with a share of 20.12% of the South Africa commercial insurance market in 2025.

The transportation and logistics sector generates significant commercial insurance demand driven by South Africa's position as a major regional logistics hub serving sub-Saharan Africa. The industry encompasses road freight operators, warehousing providers, shipping companies, and integrated logistics firms requiring comprehensive coverage across motor fleet, cargo, liability, and property exposures. High-value cargo movements, extensive vehicle fleets, and complex supply chain operations create diverse insurance requirements. The sector's contribution to GDP and employment underscores its economic importance and corresponding insurance market significance.

Logistics companies face unique risk profiles including cargo theft, vehicle hijacking, driver safety, and cross-border operational challenges requiring specialized insurance solutions. Insurers have developed tailored products addressing the transportation sector's distinctive exposures, including goods-in-transit coverage, carrier liability insurance, and comprehensive fleet programs. The South African logistics sector demonstrated resilience with reported yearly growth contributing to GDP expansion. Fleet management technology adoption is enabling usage-based insurance models and enhanced risk monitoring capabilities, supporting the development of sophisticated insurance solutions for transportation and logistics operators.

Provincial Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Gauteng dominates the commercial insurance market as South Africa's economic powerhouse, hosting major corporate headquarters, financial institutions, and manufacturing operations. The province's concentration of large enterprises and sophisticated business infrastructure generates substantial premium volumes across all commercial insurance lines, supported by advanced distribution networks and specialized insurance intermediaries.

KwaZulu-Natal represents a significant provincial market driven by the port of Durban's strategic importance as a major continental shipping hub. The province's manufacturing sector, agricultural operations, and tourism industry contribute substantial premium volumes across property, liability, marine, and motor insurance segments serving diverse commercial enterprises.

Western Cape maintains a strong market position anchored by Cape Town's financial services sector, agricultural operations, and growing technology industry. The province's diversified economy supports balanced demand across commercial insurance product categories, with particular strength in professional services, hospitality sector coverage, and agribusiness insurance requirements.

Mpumalanga's commercial insurance market is characterized by significant demand from mining operations, energy sector activities, and agricultural enterprises. The province's industrial base requires specialized coverage solutions addressing heavy equipment, operational liabilities, and property exposures associated with resource extraction and power generation facilities serving national energy requirements.

Eastern Cape generates commercial insurance demand primarily from automotive manufacturing operations, port activities, and agricultural enterprises. The province's industrial corridors require comprehensive coverage for manufacturing facilities, supply chain operations, and workforce-related exposures, while coastal business activities drive marine and logistics insurance requirements across the province.

Market Dynamics:

Growth Drivers:

Why is the South Africa Commercial Insurance Market Growing?

Economic Diversification and Infrastructure Development

South Africa's economic diversification initiatives across manufacturing, financial services, and technology sectors are driving increased demand for commercial insurance products. Infrastructure development programs, including transportation networks, energy projects, and urban development initiatives, create substantial construction and engineering insurance requirements. The expansion of business operations into new facilities and geographic provinces generates additional property, liability, and motor insurance demand. Corporate investment in productive assets and operational expansion supports premium growth across commercial insurance lines. Strong performance in key economic sectors continues bolstering the general insurance industry. Infrastructure projects require comprehensive insurance programs protecting against construction risks, professional liability exposures, and operational hazards during development phases.

Regulatory Modernization and Enhanced Governance Standards

The evolving regulatory landscape under South Africa's Twin Peaks model is strengthening corporate governance requirements and risk management expectations across business sectors. The pending Conduct of Financial Institutions Bill will consolidate conduct regulation, enhancing market transparency and consumer protection standards. Companies are increasingly recognizing the importance of adequate insurance protection as part of comprehensive risk management frameworks aligned with regulatory expectations. Directors and officers face heightened accountability, driving demand for management liability coverage. Regulatory authorities continue emphasizing preparation for legislative implementation, signaling continued regulatory evolution. Enhanced reporting requirements and governance standards compel organizations to strengthen their insurance programs, supporting premium growth across liability and professional indemnity segments while ensuring compliance with evolving regulatory frameworks.

Rising Cyber Risk Awareness and Digital Transformation

The accelerating digital transformation across South African businesses is elevating cyber risk exposures and driving demand for specialized cyber insurance coverage. Organizations are increasingly dependent on technology infrastructure, digital platforms, and data assets vulnerable to cyberattacks, data breaches, and system failures. The country has experienced significant increases in cyber incidents, with small businesses being particularly exposed to digital threats. The cyber insurance segment represents one of the fastest-growing areas within the commercial insurance market. Rising awareness of cyber threats among business leaders is translating into growing insurance procurement across company sizes. Regulatory developments around data protection and privacy requirements further incentivize organizations to secure adequate cyber liability coverage protecting against financial losses from digital incidents.

Market Restraints:

What Challenges the South Africa Commercial Insurance Market is Facing?

Economic Pressures and Premium Affordability Concerns

Persistent economic challenges including elevated unemployment rates and constrained consumer spending affect business profitability and insurance affordability. Rising premium rates driven by increasing claims costs may pressure smaller enterprises to reduce coverage or defer insurance purchases. Economic volatility creates uncertainty in business planning, potentially limiting corporate insurance program expansions.

Infrastructure Vulnerabilities and Operational Risks

Infrastructure challenges including energy supply constraints and aging public utilities create operational uncertainties affecting business continuity and insurance risk assessments. Power instability impacts commercial operations across sectors, complicating underwriting evaluations and potentially increasing loss ratios. These systemic risks require careful management by insurers seeking to maintain profitable portfolio performance.

Climate-Related Claims Escalation

The increasing frequency and severity of natural catastrophe events is elevating claims costs across property insurance lines. Flood events, severe storms, and other climate-related incidents create significant insured losses requiring premium adjustments. Reinsurance cost increases following catastrophic events flow through to primary insurance pricing, potentially affecting market affordability.

Competitive Landscape:

The South Africa commercial insurance market exhibits strong competitive dynamics with established domestic insurers and international underwriters competing across product segments. Market leaders focus on developing specialized industry solutions, enhancing digital capabilities, and expanding distribution networks to strengthen competitive positioning. Insurers are investing in advanced analytics and technology infrastructure to improve underwriting precision and customer service delivery. Strategic partnerships between traditional insurers and insurtech companies are fostering innovation in product development and distribution approaches. Competition extends across pricing, coverage breadth, claims service quality, and risk management support capabilities. Market consolidation through strategic acquisitions continues reshaping competitive dynamics, while new market entrants leverage technology-enabled business models to address underserved segments.

South Africa Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Africa commercial insurance market size was valued at USD 6.92 Billion in 2025.

The South Africa commercial insurance market is expected to grow at a compound annual growth rate of 6.86% from 2026-2034 to reach USD 12.58 Billion by 2034.

Commercial motor insurance, holding the largest revenue share of 28.12%, remains pivotal for South Africa's commercial insurance market, driven by extensive fleet operations, mandatory coverage requirements, and growing vehicle acquisitions across transportation and logistics sectors.

Key factors driving the South Africa commercial insurance market include economic diversification and infrastructure development, regulatory modernization under the Twin Peaks framework, rising cyber risk awareness, enhanced corporate governance standards, digital transformation across industries, and growing demand for specialized coverage solutions.

Major challenges include economic pressures affecting premium affordability, infrastructure vulnerabilities impacting operational risks, escalating climate-related claims costs, elevated reinsurance expenses, and competitive pressures on underwriting margins across commercial insurance lines.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)