South Africa Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2025-2033

South Africa Confectionery Market Overview:

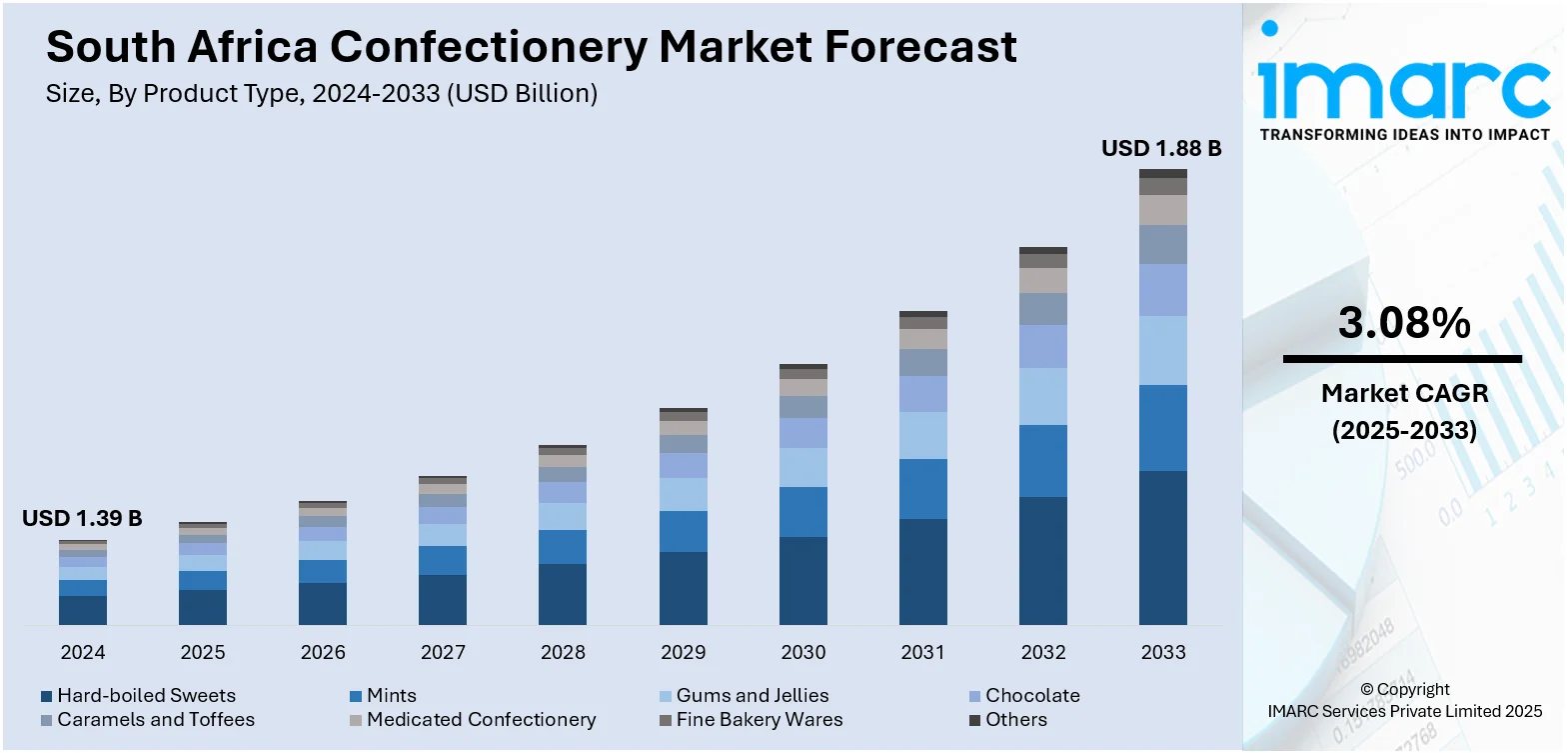

The South Africa confectionery market size reached USD 1.39 Billion in 2024. The market is projected to reach USD 1.88 Billion by 2033, exhibiting a growth rate (CAGR) of 3.08% during 2025-2033. The market has shown consistent growth with accelerating consumer demand for premium, health-oriented, and convenient products. Rising disposable incomes and urbanization are driving innovation in flavors, packaging, and functional benefits. The market is defined by a vibrant combination of traditional confectionery and innovative offerings to meet varied consumer tastes. Growth in retail channels and exports also supports this growth pattern. These aspects combined make a boost in the South Africa confectionery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.39 Billion |

| Market Forecast in 2033 | USD 1.88 Billion |

| Market Growth Rate 2025-2033 | 3.08% |

South Africa Confectionery Market Trends:

Increased Demand for Premium and Artisan Confectionery

The confectionery industry in South Africa is witnessing a major transformation in the direction of premium and artisan confectionery due to the growing enthusiasm of customers for quality and novelty. Increased disposable incomes, particularly in urban areas, have motivated a trend for indulgent sweets with better ingredients and craftsmanship. Handcrafted chocolates and specialty confections with creative combinations of flavors and old-fashioned techniques are gaining more popularity. For instance, in July 2025, Think Flavour launched Pimp My Party, an alcohol-free cocktail-inspired gummy range with new-age flavours such as Brandy and Cola, available nationally across South African stores and online. Moreover, this is a current trend that mirrors a worldwide movement where consumers want authenticity and uniqueness in their confectionery products. Such consumption is one of the factors driving South Africa confectionery market growth as manufacturers invest in product variation and branding efforts to satisfy the demand. In addition, this is in line with wider market trends focusing on the blend of heritage and innovation to improve both local consumption and export opportunities. Premiumization is anticipated to remain a driving force in product portfolios and market dynamics in the future.

To get more information on this market, Request Sample

Growing Demand for Health-Conscious and Functional Confectioneries

The South African confectionery market is increasingly adopting health-conscious and functional products in line with changing consumer tastes. As awareness of nutrition and health increases, consumers are reaching for confectionery that provides less sugar, natural ingredients, and other health benefits like vitamins or probiotics. Demand for clean-label and allergen-free confectionery is also on the rise, demonstrating a need for simplicity and healthier indulgence. This trend is especially true with younger, urban consumers who value wellness but want to still have enjoyable indulgences. These trends favorably impact market development through product innovation and widening consumer bases. Incorporating health benefits into confectionery products aligns with South Africa confectionery market trends centered on indulgence and nutrition balance. As this trend ages, it will be anticipated to impact product development and marketing strategy across the confectionery sector.

Growth of Convenient and On-the-Go Confectionery Formats

The busy lifestyle of South African shoppers has increased demand for easy-to-use and portable confectionery items. Single-serve packs, re-sealable and closed packaging, and snack-sized packages are gaining popularity since they fit into busy lifestyles and ensure ease of use. Convenience stores, supermarkets, and online retail channels are increasing ranges to support impulse purchases and on-the-move eating. This is underpinned by trends like urbanization, greater mobility, and shifting work patterns, including remote and hybrid working models. Convenient confectionery formats are a significant driver of South Africa confectionery market growth through greater access and purchase frequency. It is one of the key trends in the the market influencing product form and go-to-market approaches. Packaging innovation and portion-control manufacturers are poised to address changing consumer demands in this category.

South Africa Confectionery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, price point, and distribution channel.

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others.

Age Group Insights:

- Children

- Adult

- Geriatric

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children, adult, and geriatric.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The report has provided a detailed breakup and analysis of the market based on the price point. This includes economy, mid-range, and luxury.

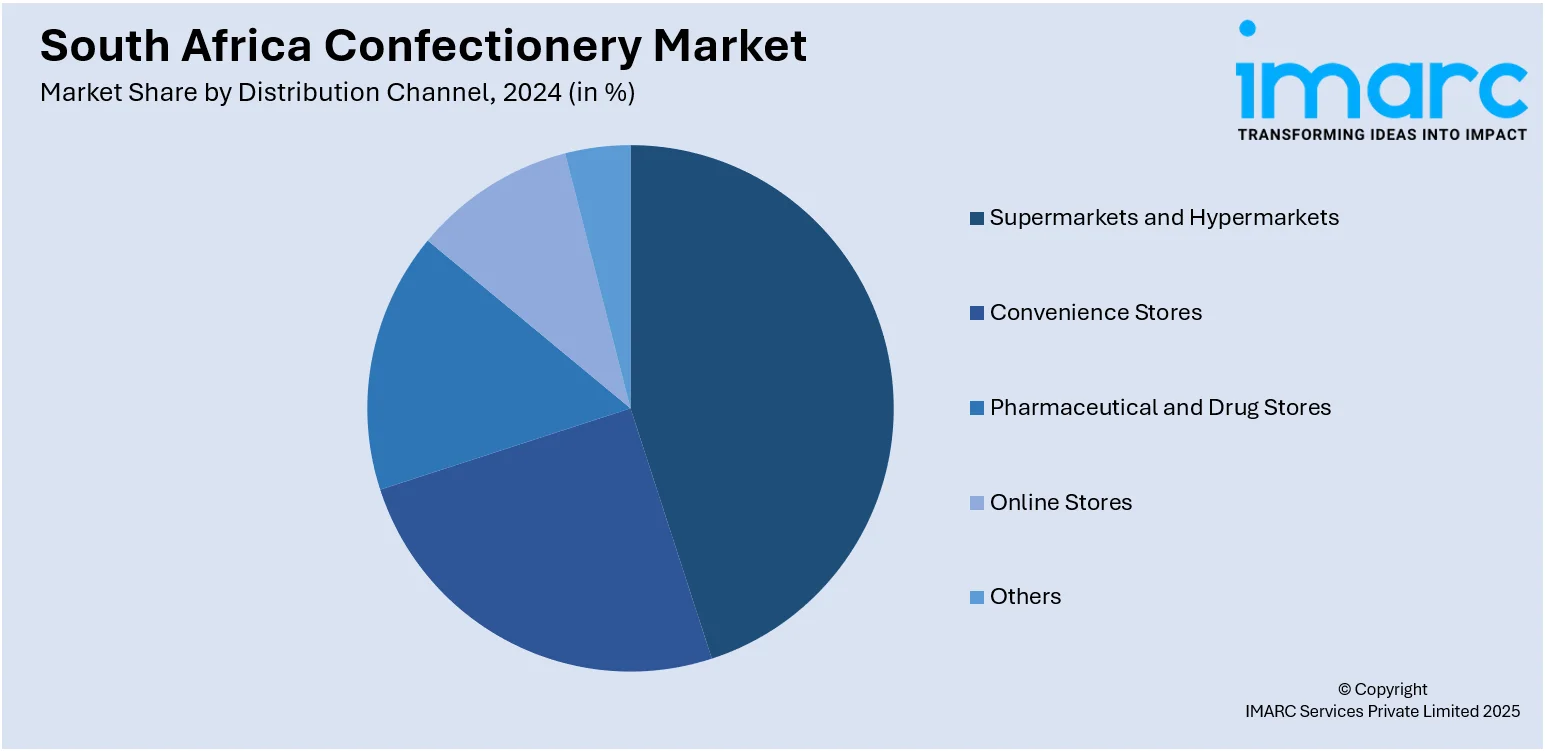

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Confectionery Market News:

- In June 2025, Danone launched UltraMel Delight in South Africa, a low-fat dessert with chocolate, vanilla, and caramel flavors. The extensively tested product gained top consumer scores for taste, texture, and aroma, signaling Danone's strategic diversification into the confectionery market with an emphasis on healthier indulgence.

- In February 2025, Nestlé introduced new KitKat tablets in South Africa with double chocolate, hazelnut, and salted caramel. Made in an extended European factory, the tablets appeal to younger consumers who want indulgent, shareable chocolate experiences, cementing KitKat's place in the expanding confectionery market.

South Africa Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa confectionery market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa confectionery market on the basis of product type?

- What is the breakup of the South Africa confectionery market on the basis of age group?

- What is the breakup of the South Africa confectionery market on the basis of price point?

- What is the breakup of the South Africa confectionery market on the basis of distribution channel?

- What is the breakup of the South Africa confectionery market on the basis of region?

- What are the various stages in the value chain of the South Africa confectionery market?

- What are the key driving factors and challenges in the South Africa confectionery market?

- What is the structure of the South Africa confectionery market and who are the key players?

- What is the degree of competition in the South Africa confectionery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa confectionery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa confectionery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa confectionery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)