South Africa Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033

South Africa Cryptocurrency Market Overview:

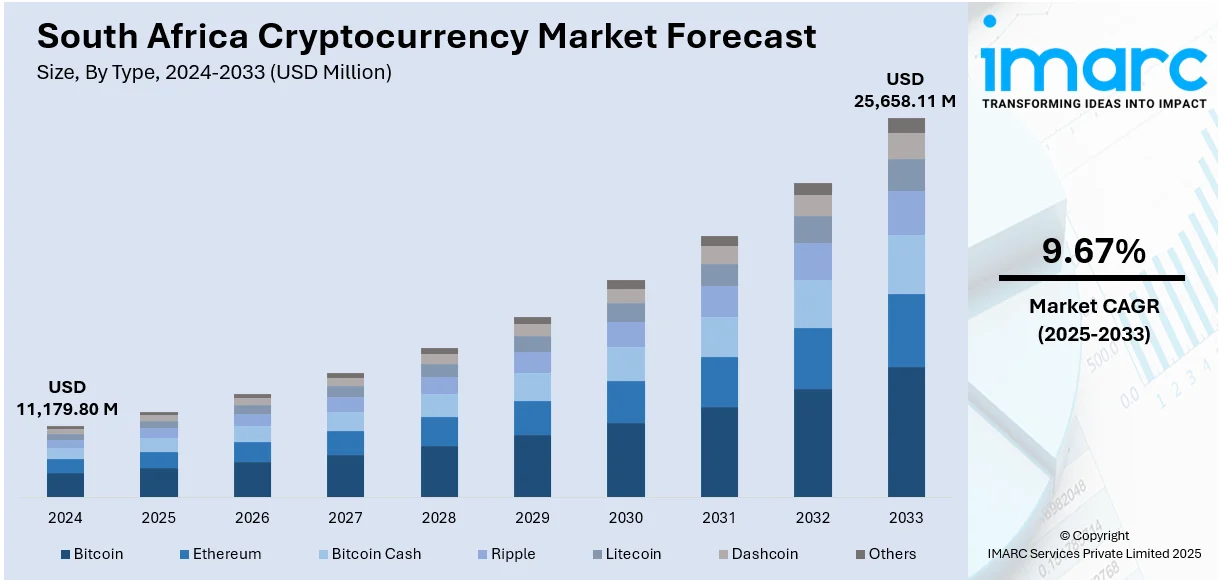

The South Africa cryptocurrency market size reached USD 11,179.80 Million in 2024. The market is projected to reach USD 25,658.11 Million by 2033, exhibiting a growth rate (CAGR) of 9.67% during 2025-2033. With the rising need for fast and affordable payment solutions in urban and semi-urban areas, more people, businesses, and platforms are incorporating cryptocurrency into their operations. Besides this, the growing awareness about blockchain-based ownership, which is encouraging individuals to explore wider crypto uses, is contributing to the expansion of the South Africa cryptocurrency market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11,179.80 Million |

| Market Forecast in 2033 | USD 25,658.11 Million |

| Market Growth Rate 2025-2033 | 9.67% |

South Africa Cryptocurrency Market Trends:

Growing need for quicker and more economical transactions

Rising need for quicker and more economical transactions is positively influencing the market in South Africa. Traditional banking systems in the country often involve high transaction fees, delays in processing, and limited financial access, especially in rural areas. In contrast, cryptocurrencies offer a decentralized, borderless, and real-time method of transaction that appeals to individuals and businesses seeking efficiency. With the rise of digital payments and mobile platforms, more South Africans are turning to cryptocurrencies for everyday spending. According to crypto platform Luno, as of June 2025, South Africans employed cryptocurrency to spend more than R2 Million (USD 112,000) every month on groceries, flights, furniture, and other purchases. This trend highlights a growing trust and reliance on crypto for routine transactions. Furthermore, the ability to make peer-to-peer payments and avoid long wait times and service charges enhances its popularity. As the demand is increasing for quick and low-cost solutions in both urban and semi-urban regions, more individuals, merchants, and platforms are integrating crypto into their operations.

To get more information on this market, Request Sample

Growing awareness about digital collectibles

Increased awareness about digital collectibles is impelling the South Africa cryptocurrency market growth. As more individuals are becoming interested in owning unique verifiable assets like non-fungible tokens (NFTs), ranging from digital art and music to sports highlights and in-game items, they are naturally introduced to cryptocurrencies as the primary means of transaction. This growing familiarity with blockchain-backed ownership is encouraging people to explore broader crypto applications, including payments and investments. The appeal of digital collectibles lies in their exclusivity, traceability, and potential future value, especially among younger and tech-savvy South Africans. Platforms and influencers are playing a strong role in promoting digital collectibles, creating awareness and educating the public. As a result, more people are setting up wallets and participating in decentralized ecosystems. This growing curiosity and usage are translating into increased activity in the crypto space. Bitcoin Events’ reports indicated that as of July 2025, approximately 10% of South Africa's population, about 6 Million individuals, possessed or utilized cryptocurrency, underlining a substantial user base. As digital collectibles continue to gain popularity, they are serving as a gateway for more individuals to engage with crypto assets.

South Africa Cryptocurrency Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, process, and application.

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware and software.

Process Insights:

- Mining

- Transaction

The report has provided a detailed breakup and analysis of the market based on the process. This includes mining and transaction.

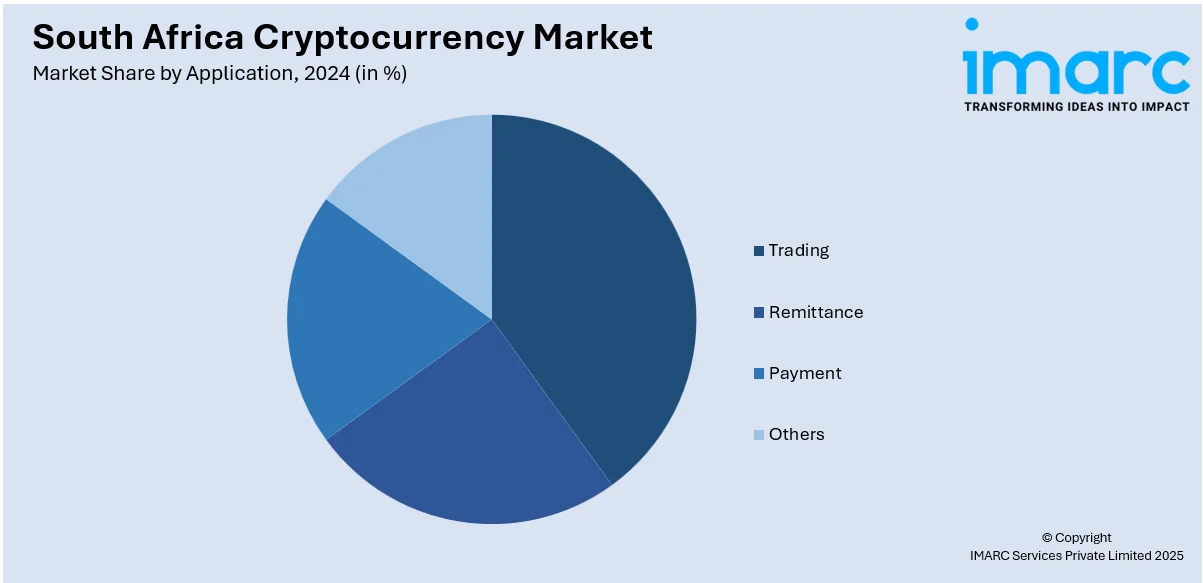

Application Insights:

- Trading

- Remittance

- Payment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trading, remittance, payment, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Cryptocurrency Market News:

- In July 2025, Peach Payments, a prominent payment services provider, teamed up with MoneyBadger, a solution for Bitcoin and crypto payments, allowing its merchants to accept payments in Bitcoin and various other crypto assets within South Africa. It aimed to improve the checkout options for customers, offering a valuable benefit that delivered convenience for them.

- In July 2025, Bitcoin Events revealed two significant cryptocurrency events in South Africa: ‘Crypto Fest 2025 and Blockchain Africa Conference 2025.’ These gatherings aimed to unite numerous innovators, pioneers, financiers, and enthusiasts to examine the revolutionary capability of cryptocurrency and blockchain technology. Participating in the Blockchain Africa Conference and Crypto Fest provided a distinctive chance to connect firsthand with transformative developments, acquire knowledge from industry experts, and explore how blockchain technology could enable practical business solutions.

South Africa Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa cryptocurrency market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa cryptocurrency market on the basis of type?

- What is the breakup of the South Africa cryptocurrency market on the basis of component?

- What is the breakup of the South Africa cryptocurrency market on the basis of process?

- What is the breakup of the South Africa cryptocurrency market on the basis of application?

- What is the breakup of the South Africa cryptocurrency market on the basis of region?

- What are the various stages in the value chain of the South Africa cryptocurrency market?

- What are the key driving factors and challenges in the South Africa cryptocurrency market?

- What is the structure of the South Africa cryptocurrency market and who are the key players?

- What is the degree of competition in the South Africa cryptocurrency market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa cryptocurrency market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa cryptocurrency market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)