South Africa Cybersecurity Market Size, Share, Trends and Forecast by Component, Deployment Type, User Type, Industry Vertical, and Province, 2026-2034

South Africa Cybersecurity Market Summary:

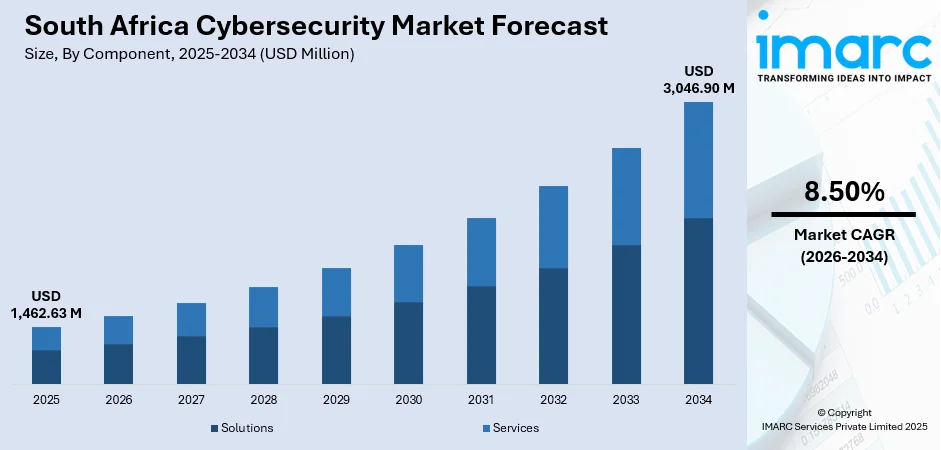

The South Africa cybersecurity market size was valued at USD 1,462.63 Million in 2025 and is projected to reach USD 3,046.90 Million by 2034, growing at a compound annual growth rate of 8.50% from 2026-2034.

The market expansion is propelled by escalating cyber threats targeting critical infrastructure, stringent regulatory mandates, and accelerating digital transformation across key industries. Rising sophistication of phishing campaigns, ransomware attacks, and digital fraud incidents is encouraging organizations across the banking, government, and telecommunication sectors to prioritize cybersecurity investments. Hyperscale data center deployments in Johannesburg and Cape Town, combined with the growing mobile payment adoption, continue to drive the demand for advanced threat protection solutions, managed detection and response services, and zero-trust architecture implementations.

Key Takeaways and Insights:

- By Component: Services dominate the market with a share of 54% in 2025, driven by acute cybersecurity talent shortages, motivating organizations to delegate security operations to managed service providers that provide 24/7 monitoring and incident response services.

- By Deployment Type: On-premises lead the market with a share of 58% in 2025, owing to stringent data sovereignty requirements, financial sector regulatory mandates for local data storage, and organizational preferences for maintaining direct control over sensitive infrastructure.

- By User Type: Large enterprises represent the largest segment with a market share of 70% in 2025, attributed to substantial information technology (IT) budgets enabling comprehensive security stack investments, regulatory compliance obligations, and heightened exposure to sophisticated targeted attacks.

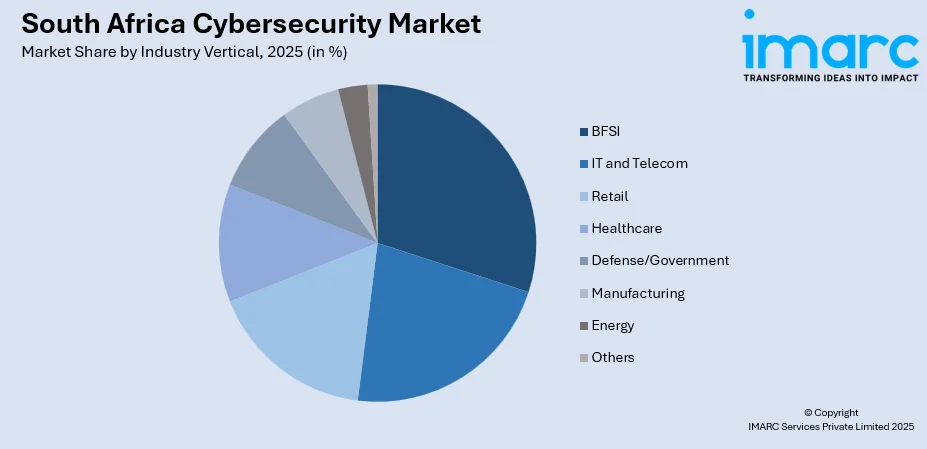

- By Industry Vertical: BFSI prevails the market with a share of 24% in 2025, driven by mandatory cyber-resilience requirements and escalating digital banking fraud incidents.

- Key Players: The South Africa cybersecurity market exhibits moderate competitive intensity with multinational technology corporations competing alongside regional managed service providers. Market participants leverage strategic acquisitions, local partnerships, and specialized service offerings to strengthen their competitive positions.

To get more information on this market Request Sample

The market demonstrates robust growth fundamentals underpinned by increasing cyber threat sophistication and regulatory enforcement driving sustained investments across industries. In March 2025, Microsoft announced a ZAR 5.4 billion investment into expanding cloud infrastructure and digital skills programs in South Africa, with strong emphasis on cybersecurity readiness and advanced threat intelligence capabilities. Demand for managed security services is expected to grow strongly as businesses facing skills shortages outsource threat monitoring and incident response. The adoption of artificial intelligence (AI) for threat detection and automation is further improving efficiency and response speed. Government initiatives are reinforcing data protection protocols and cybersecurity measures, creating compliance-driven demand. The growing recognition of cybersecurity as a board-level strategic priority continues to accelerate market maturation, as organizations are transitioning from reactive to proactive security postures.

South Africa Cybersecurity Market Trends:

Accelerating Zero-Trust Architecture Adoption

South African enterprises are increasingly embracing zero-trust security frameworks as traditional perimeter-based defenses prove inadequate against sophisticated threat actors. In January 2024, Google Cloud launched its Johannesburg region, providing low-latency access to workload-isolation tools that underpin zero-trust designs. Organizations are deploying identity-centric controls emphasizing continuous verification regardless of user location, particularly as hybrid-cloud adoption expands. This architectural shift addresses vulnerabilities exposed by remote work proliferation and enables granular access management across distributed environments and cloud platforms.

AI-Powered Threat Detection and Response

AI and machine learning (ML) technologies are revolutionizing cybersecurity operations across South Africa, as organizations are seeking automated solutions to combat evolving threats. As per IMARC Group, the South Africa artificial intelligence market size reached USD 809.34 Million in 2024. The emergence of AI-facilitated fraud techniques, including deepfake voice technologies and sophisticated phishing campaigns, has accelerated the demand for equally advanced defensive capabilities. Organizations are deploying AI-driven behavioral analytics, automated threat hunting, and predictive security platforms to detect anomalies in real-time. These technologies enable security teams to manage increasing alert volumes while addressing persistent talent shortages affecting the sector.

Regulatory-Driven Compliance Investments

Heightened regulatory enforcement is encouraging substantial cybersecurity investments across South African industries as compliance mandates become increasingly stringent. Organizations must implement cyber risk governance structures, breach notification protocols, and quarterly resilience testing. This regulatory environment is driving capital expenditure towards forensic readiness capabilities, security operations upgrades, and board-level cybersecurity training programs.

Market Outlook 2026-2034:

The market growth will be sustained by escalating threat sophistication, regulatory compliance requirements, and continued digital transformation across industries. The market generated a revenue of USD 1,462.63 Million in 2025 and is projected to reach a revenue of USD 3,046.90 Million by 2034, growing at a compound annual growth rate of 8.50% from 2026-2034. Cloud security solutions, managed detection and response services, and identity management platforms will experience particularly strong demand as organizations modernize legacy infrastructure. The BFSI sector will remain the largest revenue contributor while healthcare and manufacturing verticals are anticipated to demonstrate accelerating adoption rates. Increasing hyperscale data center investments and growing fintech ecosystem expansion will further stimulate market development throughout the forecast period.

South Africa Cybersecurity Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Services | 54% |

| Deployment Type | On-Premises | 58% |

| User Type | Large Enterprises | 70% |

| Industry Vertical | BFSI | 24% |

Component Insights:

- Solutions

- Identity and Access Management (IAM)

- Infrastructure Security

- Governance, Risk and Compliance

- Unified Vulnerability Management Service Offering

- Data Security and Privacy Service Offering

- Others

- Services

- Professional Services

- Managed Services

Services (professional services and managed services) dominate with a market share of 54% of the total South Africa cybersecurity market in 2025.

The services segment's leadership position reflects fundamental shifts in how South African organizations approach cybersecurity operations amid persistent talent constraints. Increasing number of cyberattacks is encouraging enterprises to leverage external expertise through managed security service providers capable of delivering comprehensive monitoring, incident response, and threat intelligence capabilities.

Professional and managed services enable organizations to access specialized security expertise without incurring substantial recruitment and retention costs associated with building in-house capabilities. Managed security service providers offer Security-Operations-Center-as-a-Service (SOCaaS) bundles, combining continuous threat hunting, compliance monitoring, and rapid incident response under unified service agreements. The growth trajectory is further supported by subscription-based delivery models that reduce capital expenditure barriers while ensuring access to continuously updated threat intelligence and security technologies. Organizations across the banking, retail, and government sectors increasingly recognize outsourced security operations as strategic enablers rather than cost centers.

Deployment Type Insights:

- Cloud-Based

- On-Premises

On-premises lead with a share of 58% of the total South Africa cybersecurity market in 2025.

The preference for on-premises deployment additionally reflects organizational requirements for direct infrastructure control, reduced latency in threat detection and response, and concerns regarding cloud vendor dependencies. Enterprises in regulated sectors, such as banking and healthcare, prioritize maintaining physical control over security appliances and data loss prevention systems.

On-premises cybersecurity deployments maintain market dominance driven by regulatory frameworks mandating local data storage and processing for specific industries and data categories. In May 2024, the final national data and cloud policy, which encompassed data residency requirements, was adopted by the South African Department of Communications and Digital Technologies. The policy pertained to cloud computing and data management in South Africa. The directive required that government data related to the protection and preservation of national security and sovereignty must be stored exclusively on digital infrastructure located in South Africa. Financial institutions and telecommunications operators face particularly stringent data residency obligations imposed by sector-specific regulators, compelling investments in locally-hosted security infrastructure to maintain compliance while protecting sensitive customer information.

User Type Insights:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises exhibit a clear dominance with a 70% share of the total South Africa cybersecurity market in 2025.

Large enterprises maintain commanding market share owing to substantial cybersecurity budgets, enabling comprehensive security stack implementations, spanning endpoint detection and deception technologies. The 2024 IITPSA ICT Skills Survey indicates that 27% of South African employers report current skills shortages in information security and cybersecurity, with large organizations better positioned to attract scarce talent through competitive compensation packages while simultaneously leveraging managed services to supplement internal capabilities.

Large financial institutions, telecommunications operators, and government entities represent primary demand drivers given their exposure to sophisticated threat actors and significant reputational risks associated with security breaches. These organizations deploy multi-layered defense architectures incorporating advanced threat protection, behavioral analytics, and integrated security platforms. The emergence of pay-as-you-go security models is gradually democratizing access to enterprise-grade protection.

Industry Vertical Insights:

Access the Comprehensive Market Breakdown Request Sample

- IT and Telecom

- Retail

- BFSI

- Healthcare

- Defense/Government

- Manufacturing

- Energy

- Others

BFSI represents the leading segment with a 24% share of the total South Africa cybersecurity market in 2025.

The BFSI sector commands market leadership driven by stringent regulatory requirements and heightened threat exposure as primary targets for cybercriminals. The South African Banking Risk Information Centre indicated that in 2024, cybercriminals executed over 100,000 attacks on bank accounts, siphoning nearly ZAR 1.8 Billion from their victims. This alarming threat landscape compels financial institutions to continuously upgrade defensive capabilities spanning real-time transaction monitoring, behavioral biometrics, and fusion-center intelligence operations.

Regulatory mandates have intensified compliance-driven investments across the financial sector. Major banks are deploying advanced fraud detection platforms, zero-trust architectures, and enhanced identity verification systems to combat increasingly sophisticated social engineering and account takeover attacks. Healthcare and manufacturing sectors demonstrate strong growth trajectories driven by operational technology security requirements and medical data protection mandates.

Provincial Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Gauteng maintains overwhelming market leadership as South Africa's economic and technological hub, hosting the majority of corporate headquarters, financial institutions, and data center infrastructure. The province's Tier IV data center corridor attracts cybersecurity investments from multinational technology corporations and regional managed service providers.

KwaZulu-Natal holds prominence in the market, driven by critical port infrastructure at Durban and growing manufacturing sector cybersecurity requirements. Durban's expanding technology ecosystem supports growing demand for skilled cybersecurity professionals and managed services.

Western Cape serves as an emerging cybersecurity hub centered on Cape Town's vibrant technology startup ecosystem and innovation-focused economy. The province hosts numerous cybersecurity consulting firms, penetration testing specialists, and managed service providers serving financial services and retail sectors.

Mpumalanga's cybersecurity market is primarily driven by mining and energy sector requirements for operational technology security and industrial control system protection. The province's critical infrastructure supporting electricity generation creates sustained demand for specialized security solutions addressing both information technology and operational technology convergence.

Eastern Cape's cybersecurity landscape is shaped by automotive manufacturing sector requirements and port operations at Gqeberha. Automotive supply chain digitalization and Industry 4.0 adoption create expanding attack surfaces requiring comprehensive security strategies, spanning enterprise networks and manufacturing execution systems.

Market Dynamics:

Growth Drivers:

Why is the South Africa Cybersecurity Market Growing?

Escalating Cyber Threat Sophistication and Attack Frequency

South Africa is experiencing one of the highest cyber-attack rates, with organizations facing relentless threats from ransomware operators, phishing campaigns, and sophisticated social engineering attacks. The 2024 Fortinet Cybersecurity Skills Gap report revealed that only 4% of surveyed South African organizations reported experiencing no cyber-attacks in the preceding twelve months, while 10% suffered nine or more attacks during the same period. This persistent threat environment is encouraging organizations across all sectors to continuously strengthen defensive capabilities and increase cybersecurity budget allocations. The financial impact of successful breaches drives recognition of cybersecurity as business-critical investment rather than discretionary technology spending. Deepfake technologies, AI-enhanced malware, and coordinated attack campaigns targeting supply chains represent emerging threat vectors requiring advanced defensive responses. State-owned enterprises and critical infrastructure operators remain high-value targets, with recent incidents affecting government agencies underscoring systemic vulnerabilities requiring urgent remediation.

Stringent Regulatory Compliance and Data Protection Mandates

The regulatory landscape governing cybersecurity in South Africa has intensified substantially, creating compliance-driven investment requirements across industries. Financial sector regulations have become particularly stringent with the publication of Joint Standard 2 of 2024 establishing comprehensive cybersecurity and cyber resilience requirements for financial institutions. Banks must implement cyber risk governance frameworks, conduct quarterly resilience testing, and maintain breach notification protocols aligned with international best practices. Companies are wagering on encryption, identity management, endpoint protection, and continuous monitoring to avoid heavy penalties, legal action, and reputational damage. Regular audits and reporting obligations are also increasing demand for managed security services and compliance-focused software solutions. Remote work arrangements are expanding the compliance surface, further boosting the demand for advanced security tools in South Africa.

Rapid Digital Transformation and Cloud Adoption

Accelerating digital transformation across South African industries is creating expanding attack surfaces requiring corresponding security investments. E-commerce expansion, mobile payment proliferation, and remote workforce enablement each introduce distinct vulnerability categories requiring specialized protective measures. As per IMARC Group, the South Africa e-commerce market size reached USD 187.60 Billion in 2024. The financial services sector exemplifies this transformation dynamic, with digital banking channels experiencing sustained transaction volume growth alongside corresponding fraud exposure increases. Mobile payment platform transaction values continue to expand rapidly, creating opportunities for cybercriminals targeting account credentials and payment authorization systems. Hyperscale data center investments are accelerating cloud workload migration while localizing data residency and reducing latency for cloud-native security controls. This infrastructure maturation supports enterprise confidence in cloud security architectures.

Market Restraints:

What Challenges the South Africa Cybersecurity Market is Facing?

Acute Cybersecurity Skills Shortage and Talent Migration

Acute cybersecurity skills shortages and rising talent migration are slowing the growth of the market by limiting service delivery capacity and increasing operational costs. Skilled professionals moving to global markets create gaps in advanced threat management, forensic analysis, and security architecture roles. This raises salary levels and makes cybersecurity services more expensive for local businesses, especially SMEs. At the same time, project delays and lower service quality reduce customer trust.

Infrastructure Reliability Challenges

Load-shedding and inconsistent electricity supply create operational challenges for on-premises security infrastructure requiring continuous power availability for effective threat monitoring and response. Organizations must invest in redundant power systems and backup capabilities adding to total cost of ownership for security deployments. These infrastructure reliability concerns accelerate migration towards cloud-delivered security services less susceptible to local power disruptions.

Budget Constraints and Competing Technology Priorities

SMEs face particular challenges allocating sufficient resources to cybersecurity amid competing technology investment priorities and constrained operating budgets. Organizations must balance security spending against digital transformation initiatives, operational technology upgrades, and core business system modernization. Economic pressures affecting South African businesses compound resource allocation challenges, limiting security investment capacity across substantial portions of the enterprise landscape.

Competitive Landscape:

The South Africa cybersecurity market competitive landscape encompasses global technology corporations, specialized security vendors, regional managed service providers, and boutique consulting firms competing across solution and service categories. Major international players maintain strong positions through comprehensive product portfolios, established brand recognition, and substantial research and development (R&D) capabilities, enabling continuous innovations. Regional providers compete through localized service delivery, specialized expertise in South African regulatory requirements, and responsive customer engagement models. The market has witnessed notable consolidation activity, as international firms are seeking to establish or expand African presence through strategic acquisitions and partnerships. Competition is intensifying across managed services segments, as organizations are increasingly outsourcing security operations to address internal skills constraints.

Recent Developments:

- In November 2025, the University of the Witwatersrand in Johannesburg, South Africa, was set to introduce two new postgraduate programs in cybersecurity focused on cultivating highly skilled experts to protect Africa’s digital future. The two newly accredited programmes, the Bachelor of Science Honours (BScHons) and the Master of Science (MSc) in Cybersecurity, could be found on the Wits online application system.

- In January 2025, Integrity360 purchased Nclose, a reputable and well-known cyber security services firm based in both Cape Town and Johannesburg in South Africa. Nclose clients would gain from accessing Integrity360’s broad and complementary portfolio of cyber services, which covers cyber risk and assurance, cyber security testing, incident response, infrastructure, PCI compliance, and a wide-ranging variety of managed cyber security services, featuring cutting-edge XDR/MDR solutions.

South Africa Cybersecurity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | Cloud-Based, On-Premises |

| User Types Covered | Large Enterprises, Small and Medium Enterprises |

| Industry Verticals Covered | IT and Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Africa cybersecurity market size was valued at USD 1,462.63 Million in 2025.

The South Africa cybersecurity market is expected to grow at a compound annual growth rate of 8.50% from 2026-2034 to reach USD 3,046.90 Million by 2034.

Services dominate the market with 54% share, driven by acute cybersecurity talent shortages, encouraging organizations to outsource security operations to managed service providers offering comprehensive monitoring and incident response capabilities.

Key factors driving the South Africa cybersecurity market include escalating cyber threat sophistication, stringent regulatory compliance mandates, rapid digital transformation and cloud adoption expanding attack surfaces, and the growing recognition of cybersecurity as board-level strategic priority.

Major challenges include acute cybersecurity skills shortages, skilled labor migration to international remote opportunities, infrastructure reliability concerns from load-shedding affecting on-premises deployments, budget constraints limiting security investments, and rapid threat evolution requiring continuous defensive adaptation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)