South Africa Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2025-2033

South Africa Drones Market Overview:

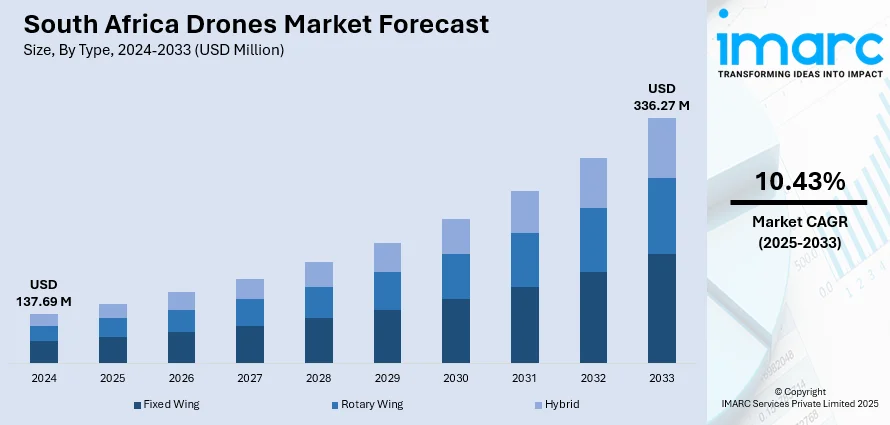

The South Africa drones market size reached USD 137.69 Million in 2024. Looking forward, the market is expected to reach USD 336.27 Million by 2033, exhibiting a growth rate (CAGR) of 10.43% during 2025-2033. The market is spurred by rising drone adoption by commercial and small-scale farmers to increase productivity and resource effectiveness. Increased technological awareness, domestic innovation, and encouraging pilot schemes further stimulate uptake. As these industries continue to adopt UAVs for efficiency and safety, they have a substantial contribution to the increased South Africa drones market share in the public and private spheres.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 137.69 Million |

| Market Forecast in 2033 | USD 336.27 Million |

| Market Growth Rate 2025-2033 | 10.43% |

South Africa Drones Market Trends:

Rural Innovation and Agricultural Efficiency

South Africa's farming industry is a key contributor to the expansion of the drone market, particularly where conventional agriculture is hampered by climate uncertainty, water stress, and expansive land cover. Commercial farmers and new agripreneurs are increasingly using drones to track the health of crops, determine irrigation requirements, and maximize the use of fertilizers. Specifically, Western Cape vineyards and Free State maize crops are using drones for precision agriculture. South Africa stands out in this regard with the range of agricultural regions and the requirement to cater to both large and small farm operators. Local drone firms are adapting UAV solutions for various crops and landscapes and assisting farmers in lifting production while keeping costs down. In addition, rural development programs and agricultural cooperatives are making drones accessible to under-resourced areas, and it is becoming a technology for efficiency, and for inclusion. Being both dual in purpose places drones at the forefront of innovation in South Africa's developing agricultural sector.

To get more information on this market, Request Sample

Wildlife Conservation and Anti-Poaching Operations

One of the singular and world-relevant uses of drones in South Africa is in wildlife conservation and anti-poaching operations. With its huge game parks, such as Kruger National Park and other protected habitats, the nation continues to be threatened by poaching and wildlife trafficking. Drones with thermal imaging and night vision cameras are now part of park patrols, allowing rangers to survey huge tracks of land without putting themselves at risk. These UAVs are employed to monitor animal migrations, alert for intruders, and be in close proximity to respond to threats in real time. In far-flung regions where conventional patrol tactics prove wasteful or perilous, drones provide a viable, unobtrusive option. Outside of anti-poaching, drones are employed in research to track species habit, patterns of migration, and climate or human-related changes in habitat. The adoption of drone technology into conservation efforts is a demonstration of South Africa's dedication to safeguarding its vibrant biodiversity while adopting cutting-edge measures to further green conservation efforts and sustainability, which also supports the South Africa drone market growth.

Urban Security, Infrastructure, and Delivery Services

In urban and semi-urban regions, South Africa is investigating an increasing number of drone use cases, especially in security, infrastructure maintenance, and logistics. Major cities such as Johannesburg, Pretoria, and Cape Town have begun to employ drones for crime hotspot surveillance, traffic management, and assisting emergency services. Private security companies, to meet growing demand for monitoring in business districts and gated communities, have started adding drones as an extension to their services. Infrastructure inspection, particularly of power lines, railroad systems, and highways, is also becoming increasingly effective with the use of UAVs. Emerging among the trends is the use of drones for logistics, especially in remote rural areas or locations where conventional logistics are unpredictable. Startups are testing medical supply drop-offs to off-grid clinics, demonstrating the potential for drones to fill infrastructure gaps. As regulations adapt to enable commercial drone operations, cities in South Africa will be poised to become proving grounds for innovation, with drones contributing significantly to safety enhancement, connectivity, and efficiency.

South Africa Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 Kilograms, 25-170 Kilograms, and >170 Kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

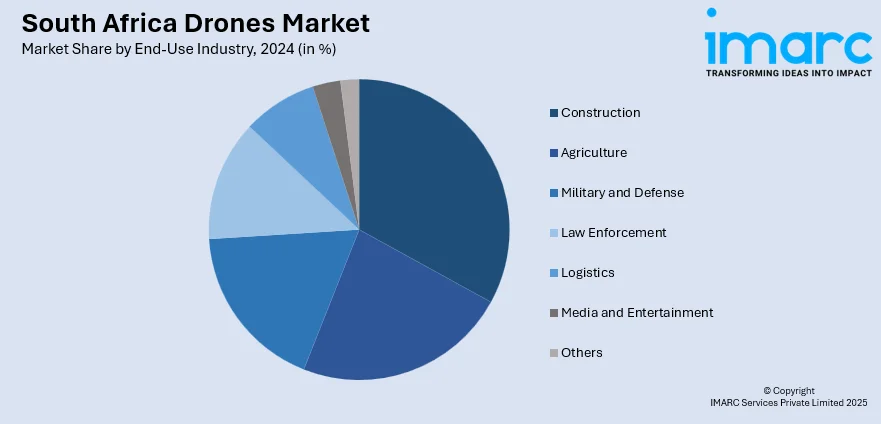

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which includes Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Drones Market News:

- In August 2025, an official from the Border Management Authority (BMA) stated that South Africa improved security at entry points by implementing measures like drones and traceable stamps. Michael Masiapato, the BMA commissioner, shared these comments while informing the media about new security protocols to be enforced at various entry points. He stated that they sent eight border guards for drone pilot training, with six of them having graduated on July 14, according to Xinhua news agency.

- In May 2025, South Africa’s Border Management Authority introduced a new advanced program focused on enhancing border security and reducing illegal trade that drains the country of millions of dollars annually. Home Affairs Minister Leon Schreiber recently revealed the new security initiative, which involves deploying four quadcopter-style drones to oversee entry points and border regions notorious for illegal crossings. The drones are capable of functioning both during the day and at night. Their cameras are capable of tracking targets from a distance of 2 kilometers, while infrared cameras can identify the heat signatures of individuals crossing at night. Artificial intelligence (AI) assists in recognizing and monitoring objects. A laser rangefinder measures the distance to a target and identifies its position.

South Africa Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Point of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa drones market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa drones market on the basis of type?

- What is the breakup of the South Africa drones market on the basis of component?

- What is the breakup of the South Africa drones market on the basis of payload?

- What is the breakup of the South Africa drones market on the basis of point of sale?

- What is the breakup of the South Africa drones market on the basis of end-use industry?

- What is the breakup of the South Africa drones market on the basis of region?

- What are the various stages in the value chain of the South Africa drones market?

- What are the key driving factors and challenges in the South Africa drones market?

- What is the structure of the South Africa drones market and who are the key players?

- What is the degree of competition in the South Africa drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)