South Africa Ecotourism Market Size, Share, Trends and Forecast by Traveler Type, Age Group, Sales Channel, and Region, 2025-2033

South Africa Ecotourism Market Overview:

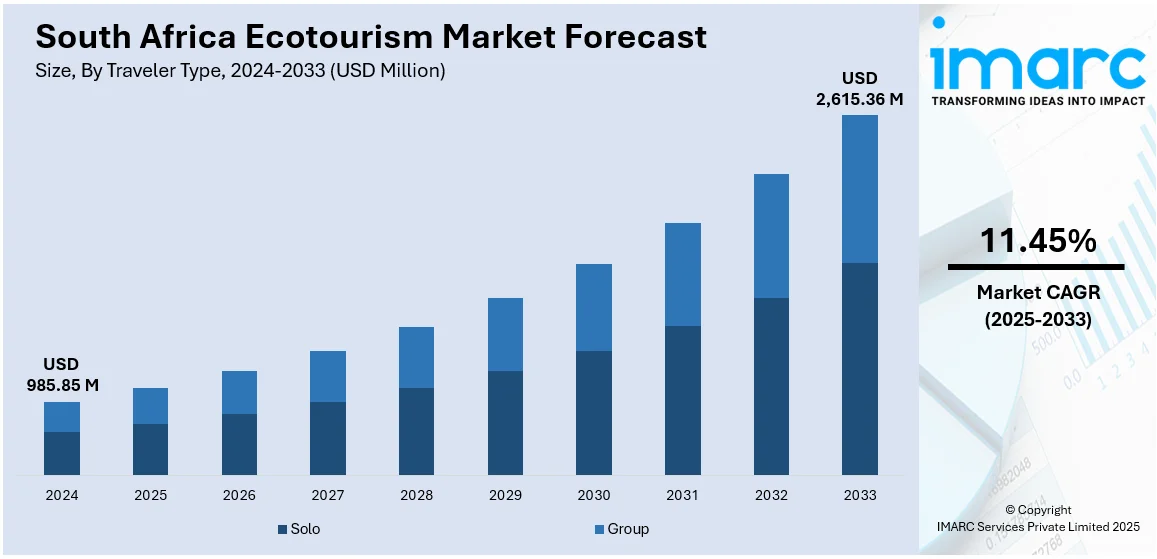

The South Africa ecotourism market size reached USD 985.85 Million in 2024. The market is projected to reach USD 2,615.36 Million by 2033, exhibiting a growth rate (CAGR) of 11.45% during 2025-2033. The market is propelled by the nation's high biodiversity, iconic wildlife, and varied ecosystems that draw nature-oriented visitors from all over the world. Furthermore, a global increase in awareness regarding sustainable tourism and community-based experiences is promoting the development of eco-friendly travel facilities throughout the region. Additionally, an enhanced government backing of sustainable tourism activities and conservation-oriented travel experiences is further augmenting the South Africa ecotourism market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 985.85 Million |

| Market Forecast in 2033 | USD 2,615.36 Million |

| Market Growth Rate 2025-2033 | 11.45% |

South Africa Ecotourism Market Trends:

Government Support for Sustainable Ecotourism Infrastructure

The growing government commitment to developing sustainable tourism infrastructure is positively impacting the market. National and provincial authorities are prioritizing eco-conscious planning through investments in green transportation systems, renewable energy-powered accommodations, and low-impact visitor facilities within protected areas. In addition, regulatory frameworks and environmental assessment guidelines are being strengthened to ensure that tourism development aligns with conservation goals and climate resilience objectives. Infrastructure development is also extended to remote and underserved regions to boost access to ecotourism sites while promoting inclusive economic growth. Notably, on July 1, 2025, the African Development Bank approved a loan of USD 474.6 Million under the Infrastructure Governance and Green Growth Programme (IGGGP). This funding is intended to improve energy efficiency, modernize the rail sector, and enhance institutional governance, forming part of a broader international financing effort to address infrastructure constraints, including persistent power shortages and port inefficiencies. These infrastructure initiatives are frequently executed in collaboration with conservation agencies, private stakeholders, and development organizations, ensuring coordinated and sustainable implementation. Through the promotion of eco-certified infrastructure and responsible land use planning, the government is establishing a robust foundation for a resilient, future-oriented ecotourism sector across South Africa.

To get more information on this market, Request Sample

Digital Transformation of the Ecotourism Sector

The digitalization of South Africa's ecotourism sector is emerging as a transformative trend that enhances accessibility, engagement, and operational efficiency. This, in turn, is significantly contributing to the South Africa ecotourism market growth. Travelers are increasingly turning to technology-driven solutions that support sustainable and responsible tourism. Digital visa systems, sustainability-focused apps and platforms that offer carbon offset options, promote ethical travel choices, and provide real-time environmental data, are becoming popular among eco-conscious visitors. A key example of this shift is the Trusted Tour Operator Scheme (TTOS), launched by South Africa's Department of Home Affairs in late February 2025. As of May 27, the initiative had facilitated digital visa approvals for over 11,000 tourists from China and India. Operated through 65 accredited tour operators, the TTOS pilot significantly streamlined the visa process, with daily applications rising from approximately 50 in March to over 210 in May. This surge reflects the growing demand for seamless, tech-enabled travel experiences that align with sustainability values. Furthermore, travel operators and eco-lodges are leveraging digital platforms for bookings, marketing, and virtual storytelling, making it easier for global audiences to discover and plan eco-friendly experiences. Besides, augmented reality (AR), drone videography, and immersive social media content are utilized to showcase the country's diverse landscapes and conservation efforts, thereby building emotional connections with potential visitors. This digital shift is not only enhancing competitiveness but also promoting transparency and accountability across the ecotourism value chain.

South Africa Ecotourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on traveler type, age group, and sales channel.

Traveler Type Insights:

- Solo

- Group

The report has provided a detailed breakup and analysis of the market based on the traveler type. This includes solo and group.

Age Group Insights:

- Generation X

- Generation Y

- Generation Z

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes generation X, generation Y, and generation Z.

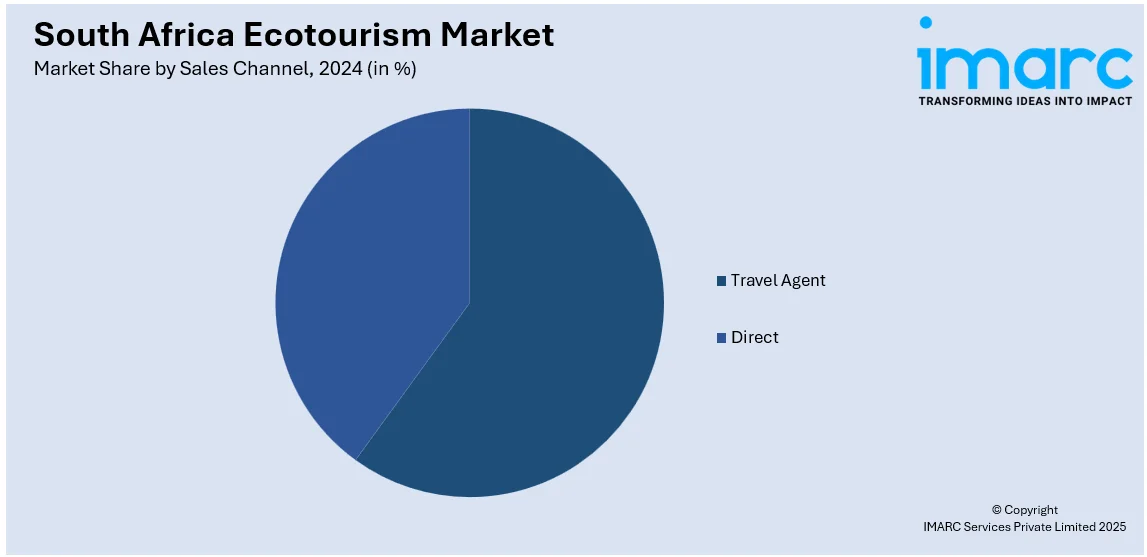

Sales Channel Insights:

- Travel Agent

- Direct

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes travel agent and direct.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Ecotourism Market News:

- On October 26, 2024, Few & Far announced the launch of its first safari eco-lodge, Few & Far Luvhondo, in the Soutpansberg Mountains of Limpopo, South Africa. Designed by Nicholas Plewman Architects and Ohkre Collective, the six-suite lodge features carbon-neutral operations, biophilic design, and a solar-powered “Solfari” aerial cable car for wildlife viewing. Situated within the Vhembe Biosphere Reserve, the lodge offers immersive sustainability and conservation experiences through guided game drives, nature walks, and hands-on restoration activities.

South Africa Ecotourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Traveler Types Covered | Solo, Group |

| Age Groups Covered | Generation X, Generation Y, Generation Z |

| Sales Channels Covered | Travel Agent, Direct |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa ecotourism market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa ecotourism market on the basis of traveler type?

- What is the breakup of the South Africa ecotourism market on the basis of age group?

- What is the breakup of the South Africa ecotourism market on the basis of sales channel?

- What is the breakup of the South Africa ecotourism market on the basis of region?

- What are the various stages in the value chain of the South Africa ecotourism market?

- What are the key driving factors and challenges in the South Africa ecotourism market?

- What is the structure of the South Africa ecotourism market and who are the key players?

- What is the degree of competition in the South Africa ecotourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa ecotourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa ecotourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa ecotourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)