South Africa Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2025-2033

South Africa Electric Two-Wheeler Market Overview:

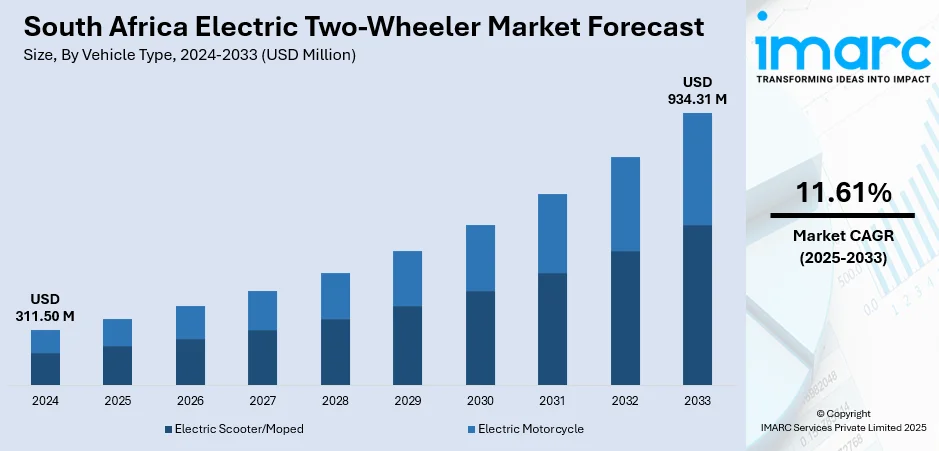

The South Africa electric two-wheeler market size reached USD 311.50 Million in 2024. The market is projected to reach USD 934.31 Million by 2033, exhibiting a growth rate (CAGR) of 11.61% during 2025-2033. The market is driven by supportive government policies, growing urban congestion, rising fuel costs, and the demand for efficient last-mile delivery solutions. Technological advancements in batteries are improving range, charging speed, and reliability, while local manufacturing reduces costs and adapts designs for local conditions. Increasing environmental awareness is also encouraging adoption, as consumers and businesses seek cleaner, more cost-effective transport options. These combined factors are creating a favorable environment for electric two-wheelers to move from niche to mainstream mobility solutions thus aiding the South Africa electric two-wheeler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 311.50 Million |

| Market Forecast in 2033 | USD 934.31 Million |

| Market Growth Rate 2025-2033 | 11.61% |

South Africa Electric Two-Wheeler Market Trends:

Urbanization, Congestion & Last-Mile Delivery Demand

As cities grow in South Africa, traffic congestion is increasingly a daily problem is a key South Africa electric two-wheeler market trends. Electric two-wheelers provide a compact, efficient means to travel busy roadways, saving time and minimizing travel stress. The quiet ride and zero emissions at the tailpipe make them attractive to environmentally aware riders and companies. In the expanding delivery market, they are especially useful for last-mile delivery, allowing goods to be transported quicker and more nimbly without the expense of fuel associated with conventional vehicles. For passengers, they offer an affordable option to car and public transportation, particularly over short to medium distances. With city lives calling for faster, cleaner, and more versatile mobility solutions, electric two-wheelers are naturally becoming part of both personal and business users' needs.

To get more information on this market, Request Sample

Government Incentives & Policy Support

The South African government is actively promoting electric mobility through supportive policies, tax benefits, and infrastructure expansion plans. Starting in March 2026, manufacturers will be able to claim a 150% tax deduction on investments in electric and hydrogen vehicle production, boosting local manufacturing and reducing reliance on imports. Local initiatives are also encouraging the production of electric two-wheelers and their components, aligning with national sustainability goals to cut carbon emissions and foster cleaner transport. These incentives make electric two-wheelers more affordable and appealing to both individual buyers and commercial operators. The government’s top-down approach, combined with public awareness campaigns, is creating a favorable environment for businesses to invest in production, distribution, and service networks. Together, these measures are positioning electric two-wheelers as a practical, mainstream mobility solution in South Africa’s transition toward a greener transport future.

Advancements in Battery Technology & Local Manufacturing

Advances in battery life, charging time, and endurance are making electric two-wheelers more practical and convenient. New battery technologies lower the time to recharge, increase travel distance, and decrease maintenance, dispelling many typical misgivings about the usability of electric vehicles. Domestic production and assembly of electric two-wheelers are also growing, which decreases costs, provides greater accessibility of spares, and enables designs to be optimized for South African road conditions and climate. This local manufacture also makes the economy more robust by generating employment and fostering technical capability. Together with continuing technological development and local capacity, consumer confidence is being boosted, affordability is being enhanced, and electric two-wheelers are becoming a more appealing option for daily mobility thus aiding the South Africa electric two-wheeler market growth.

South Africa Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped and electric motorcycle.

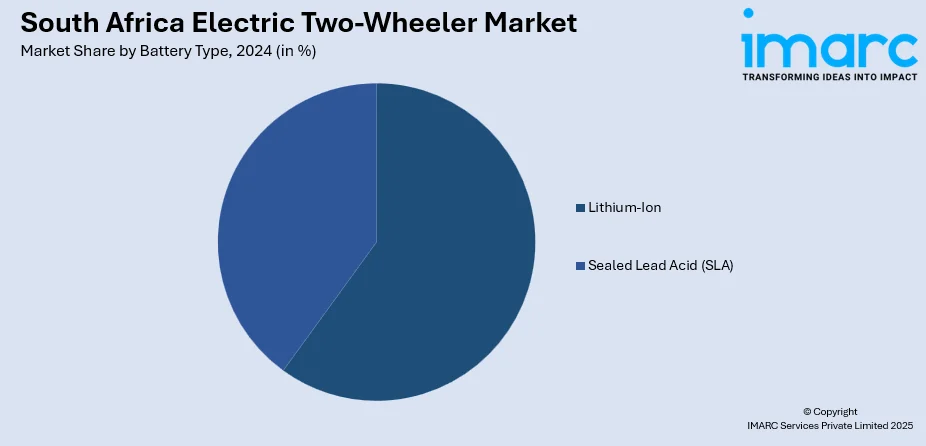

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type and chassis mounted.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Electric Two-Wheeler Market News:

- In February 2024, Kofa and Autopax partnered to assemble and distribute a new electric motorcycle designed and tested in Kenya and Ghana for African conditions. Announced on February 15, 2024, in Nairobi, the venture supports Kenya’s Green Transport Initiative. The durable, efficient model targets boda-boda services, fleets, and personal use, with Kofa developing a sustainable battery swap network to enhance convenience and promote eco-friendly mobility across the continent.

South Africa Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the South Africa electric two-wheeler market on the basis of battery type?

- What is the breakup of the South Africa electric two-wheeler market on the basis of voltage type?

- What is the breakup of the South Africa electric two-wheeler market on the basis of peak power?

- What is the breakup of the South Africa electric two-wheeler market on the basis of battery technology?

- What is the breakup of the South Africa electric two-wheeler market on the basis of motor placement?

- What is the breakup of the South Africa electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the South Africa electric two-wheeler market?

- What are the key driving factors and challenges in the South Africa electric two-wheeler market?

- What is the structure of the South Africa electric two-wheeler market and who are the key players?

- What is the degree of competition in the South Africa electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)