South Africa Energy Drinks Market Size, Share, Trends and Forecast by Type, End User, Distribution Channel, and Region, 2025-2033

South Africa Energy Drinks Market Overview:

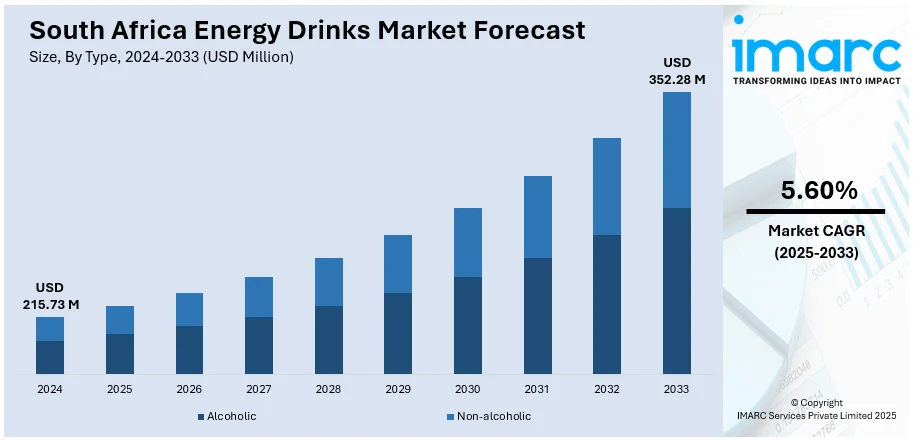

The South Africa energy drinks market size reached USD 215.73 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 352.28 Million by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. Rising involvement with gyms, sports clubs, and outdoor activities is generating stable demand for functional drinks offering quick energy and performance boosts. Moreover, the growing urban lifestyle trends is driving the demand for on-the-move energy beverages that adapt to commuting routines. Furthermore, increase in number of firms focusing on new product offerings, healthier ingredients, and diversified products, is expanding the South Africa energy drinks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 215.73 Million |

| Market Forecast in 2033 | USD 352.28 Million |

| Market Growth Rate 2025-2033 | 5.60% |

South Africa Energy Drinks Market Trends:

Rising Health and Fitness Awareness

The market for South African energy drinks is seeing a rapid growth as consumers are increasingly taking up active and fitness lifestyles. Rising involvement with gyms, sports clubs, and outdoor activities is generating stable demand for functional drinks offering quick energy and performance boosts. Younger segments, especially the 18 to 35 age group, are increasingly demanding energy drinks that mix hydration with supplementary vitamins, caffeine, and natural extracts. Such a trend is going along with the international move toward performance beverages, making energy drinks part of daily lifestyle consumables instead of being used as occasional pick-me-ups. The industry is also gaining strength from brand partnerships with sporting events and health and fitness personalities, which are strengthening consumer associations between energy drinks and being required companions for stamina and endurance. In 2024, Challenger South African energy drink brand Switch introduced three flavors in a new 275ml glass bottle. The initiative aims to elevate the brand's status to a more premium level and occurs as Switch has teamed up with distributor Halewood South Africa. The recently introduced variants in glass bottles will be Dry Lemon, Original, and Switch’s Springbok (the brand sponsors the national rugby team).

To get more information on this market, Request Sample

Growing Youth Population and Urban Lifestyle Trends

The South African energy drinks sector is experiencing strong momentum as the country’s large youth population is shaping beverage consumption habits. As per the most recent Quarterly Labour Force Survey (QLFS) published by Statistics South Africa (Stats SA) for Q1:2025, individuals aged 15 to 34 constitute about 50.2% of the working-age population in South Africa, amounting to around 20.9 million people. And this group is consistently seeking beverages that match their fast-paced, urban lifestyles. Growing urban lifestyle trends is driving the demand for on-the-move energy beverages that adapt to commuting lifestyles, late-night studying, and longer working hours. Global big brands and local variants are riding the wave by launching new product flavors, smaller pack sizes, and low-cost pricing strategies. Digital marketing campaigns, social media sponsorships, and esports sponsorships are further striking a chord among urban youth, keeping energy drinks in touch with fashion. The youth are constantly shaping patterns of demand, and the youth-oriented urban culture is therefore a key driver perpetuating the consumption of energy drinks in South Africa.

Aggressive Product Innovation and Market Diversification

The increase in number of firms focusing on new product offerings, healthier ingredients, and diversified products, is impelling the South Africa energy drinks market growth. Companies are continuously introducing sugar-free, low-calorie, and vitamin-supplemented products to respond to consumer need for healthy drinks. Local brands are also trying out local flavors like rooibos and marula to connect with local tastes while retaining international appeal. Innovations in packaging like recyclable cans and resealable bottles are enhancing convenience and sustainability positioning, especially with eco-friendly consumption becoming more mainstream. Competitive promotion strategies like bundling with snacks and sponsorship of high-profile events are also broadening market reach. This ongoing cycle of product innovation and expansion in the market is making energy drinks a vibrant and appealing category in South Africa.

South Africa Energy Drinks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, end user, and distribution channel.

Type Insights:

- Alcoholic

- Non-alcoholic

The report has provided a detailed breakup and analysis of the market based on the type. This includes alcoholic and non-alcoholic.

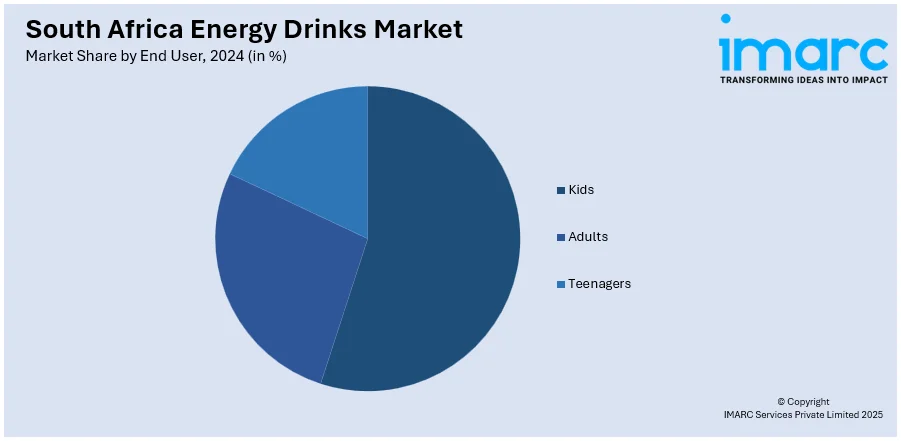

End User Insights:

- Kids

- Adults

- Teenagers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes kids, adults, and teenagers.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, convenience stores, online stores, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Energy Drinks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Alcoholic, Non-Alcoholic |

| End Users Covered | Kids, Adults, Teenagers |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa energy drinks market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa energy drinks market on the basis of type?

- What is the breakup of the South Africa energy drinks market on the basis of end user?

- What is the breakup of the South Africa energy drinks market on the basis of distribution channel?

- What is the breakup of the South Africa energy drinks market on the basis of region?

- What are the various stages in the value chain of the South Africa energy drinks market?

- What are the key driving factors and challenges in the South Africa energy drinks market?

- What is the structure of the South Africa energy drinks market and who are the key players?

- What is the degree of competition in the South Africa energy drinks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa energy drinks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa energy drinks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa energy drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)