South Africa Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033

South Africa Foreign Exchange Market Overview:

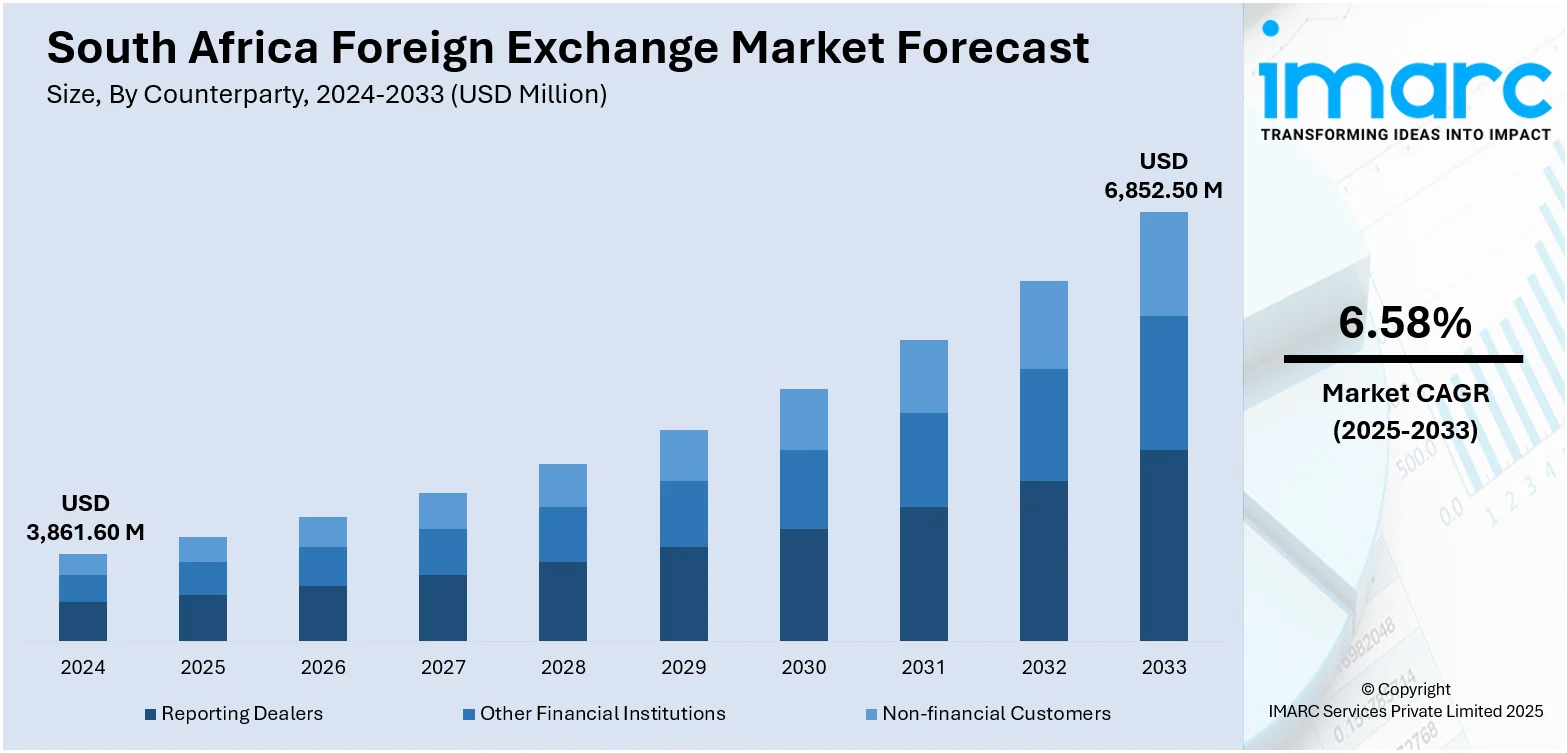

The South Africa foreign exchange market size reached USD 3,861.60 Million in 2024. The market is projected to reach USD 6,852.50 Million by 2033, exhibiting a growth rate (CAGR) of 6.58% during 2025-2033. The market is fueled by strong trade flows, growing investor interest in emerging markets, and South Africa’s role as a financial hub in sub-Saharan Africa. Apart from that, continued reforms in monetary policy, liberalization of capital accounts, and improved digital trading infrastructure have increased participation from both domestic and foreign players. Besides, fluctuations in commodity prices and interest rate differentials also influence currency volatility, which further augments South Africa foreign exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,861.60 Million |

| Market Forecast in 2033 | USD 6,852.50 Million |

| Market Growth Rate 2025-2033 | 6.58% |

South Africa Foreign Exchange Market Trends:

Increased Adoption of Electronic Trading Platforms

The market has seen a substantial move towards electronic dealing, primarily fueled by development in financial technology and the demand for higher efficiency and transparency. Additionally, electronic communication networks (ECNs) and algorithmic trading systems are being increasingly utilized by market participants such as banks, asset managers, hedge funds, and corporates to trade forex. The trend has lowered dependence on voice-based dealing, transaction costs have decreased, and price discovery has enhanced. Additionally, electronic trading provides for quicker execution and increased liquidity, most prominently in the USD/ZAR pair, the most heavily traded in the nation. Besides this, the South African Reserve Bank (SARB) facilitated this shift through enhanced market infrastructure and improved regulatory clarity, stimulating wider adoption by institutional and retail segments. In addition, e-trading platforms provide improved audit trails and reporting facilities to facilitate compliance with local and international regulations. The market has thus become more competitive with enhanced accessibility for smaller market participants.

To get more information on this market, Request Sample

Volatility Driven by Commodity Price Fluctuations and Global Risk Sentiment

South Africa's position as a commodity-based economy renders its currency extremely responsive to fluctuations in international commodity prices, especially gold, platinum, coal, and iron ore. For example, in 2024, gold was South Africa's second-largest export among 1,214 products, with export earnings of ZAR150 Billion. They constitute a big proportion of foreign exchange receipts. Consequently, changes in commodity prices and demand, usually driven by performance in the large economies like China and the United States, directly impact the value of the South African rand (ZAR). Furthermore, times of increasing commodity prices tend to make the ZAR stronger because of augmented export revenues and capital flows. Apart from this, commodity cycle slumps or global trade disruptions result in devaluation, heightened hedging, and higher volatility in the FX market. Over and above this are global risk sentiment shifts, which guide investor demand for emerging market currencies. Additionally, political tensions, Federal Reserve policy changes to interest rates, and geopolitical issues all shape capital inflows or outflows into South Africa. The outcome is an FX market that is often volatile and responsive, with far-reaching implications for monetary policy, inflation management, and investment planning.

Evolving Regulatory Environment and Market Liberalization

The regulatory reforms aimed at modernizing operations, encouraging transparency, and aligning with global best practices are positively impacting the South Africa foreign exchange market growth. The South African Reserve Bank (SARB) and the National Treasury have progressively lifted certain exchange controls, relaxed limits on foreign currency transactions, and introduced reporting standards that promote market discipline. These efforts have been instrumental in enhancing investor confidence and integrating the local FX market with global capital markets. Besides this, regulatory changes include the reclassification of exchange control categories, simplification of inward and outward investment rules, and the digitization of reporting obligations. These steps have facilitated smoother cross-border flows and made the environment more conducive for foreign portfolio investment. The commitment to a flexible exchange rate regime also supports price discovery and limits speculative distortions. In parallel, regulatory oversight has improved to monitor systemic risk without deterring innovation. The gradual liberalization, combined with prudent supervision, has expanded the market's depth and resilience while encouraging broader participation from both domestic and international stakeholders.

South Africa Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, other financial institutions, and non-financial customers.

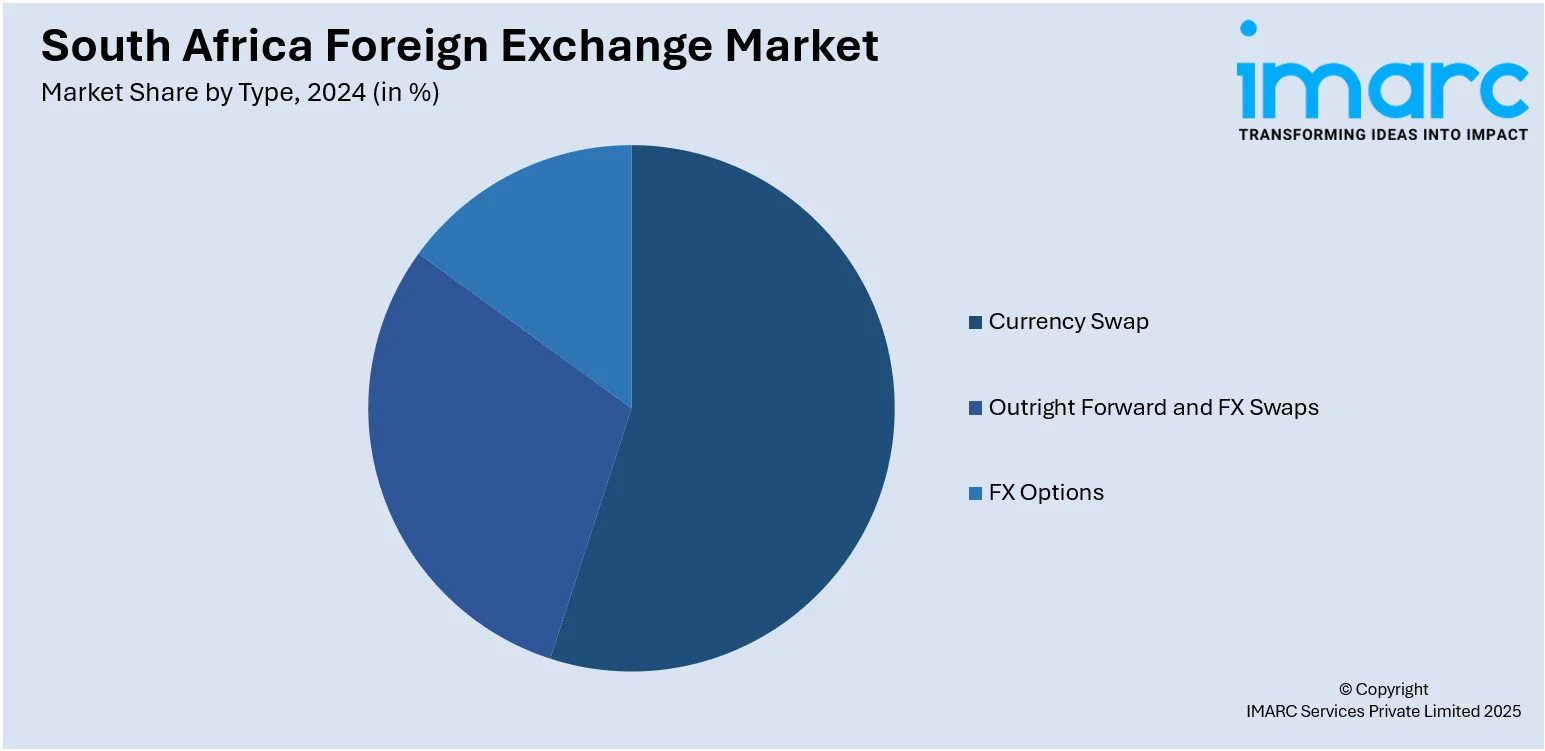

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Foreign Exchange Market News:

- July 2025: South Africa’s National Treasury announced plans to secure at least USD 500 Million in foreign-currency funding for the 2025/26 fiscal year. The Treasury is exploring alternatives to traditional Eurobond issuance by inviting innovative financing proposals, including ESG-linked instruments, from qualified entities such as primary dealers, global banks, institutional investors, and multilateral institutions. This move aligns with a broader trend among emerging markets like Angola and Ghana, which are also seeking diverse funding strategies amid global financial uncertainty.

- March 2025: The Pan‑African Payments and Settlement System (PAPSS), supported by 15 central banks, is piloting a new foreign exchange platform to be launched later this year. The platform is intended to enable direct conversions between local African currencies, eliminating reliance on intermediary hard currencies like the US dollar, through a market‑driven matching mechanism that taps into participants’ rate quotes. By addressing liquidity constraints and shallow FX depth in intra‑African trade corridors such as South Africa and Nigeria, PAPSS expects that this innovation will significantly boost regional commercial efficiency and reduce currency volatility.

South Africa Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-Financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa foreign exchange market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa foreign exchange market on the basis of counterparty?

- What is the breakup of the South Africa foreign exchange market on the basis of type?

- What is the breakup of the South Africa foreign exchange market on the basis of region?

- What are the various stages in the value chain of the South Africa foreign exchange market?

- What are the key driving factors and challenges in the South Africa foreign exchange market?

- What is the structure of the South Africa foreign exchange market and who are the key players?

- What is the degree of competition in the South Africa foreign exchange market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa foreign exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)