South Africa Frozen Fruits and Vegetables Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Province, 2026-2034

South Africa Frozen Fruits and Vegetables Market Summary:

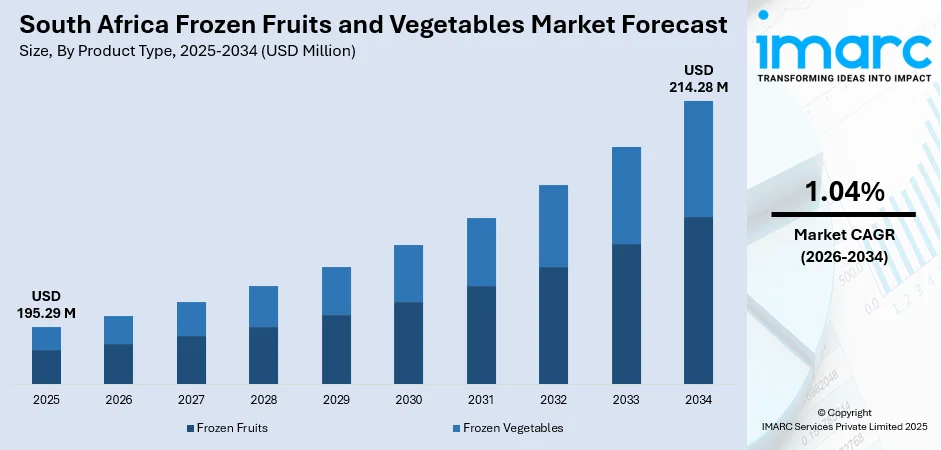

The South Africa frozen fruits and vegetables market size was valued at USD 195.29 Million in 2025 and is projected to reach USD 214.28 Million by 2034, growing at a compound annual growth rate of 1.04% from 2026-2034.

The market is gaining momentum as health-conscious consumers increasingly seek nutritious, convenient food solutions that retain quality while offering extended shelf life. Rising urbanization, busier lifestyles, and growing retail penetration are strengthening adoption across metropolitan and semi-urban areas. Advancements in freezing technologies, expanding cold chain infrastructure, and supportive government initiatives are reshaping food preservation practices, positioning South Africa as an emerging hub for frozen produce innovation. These factors collectively reinforce the South Africa frozen fruits and vegetables market share.

Key Takeaways and Insights:

- By Product Type: Frozen vegetables hold the largest market share at 65% in 2025, establishing themselves as the leading driver of nutritional convenience and operational efficiency across South Africa's food service and retail sectors.

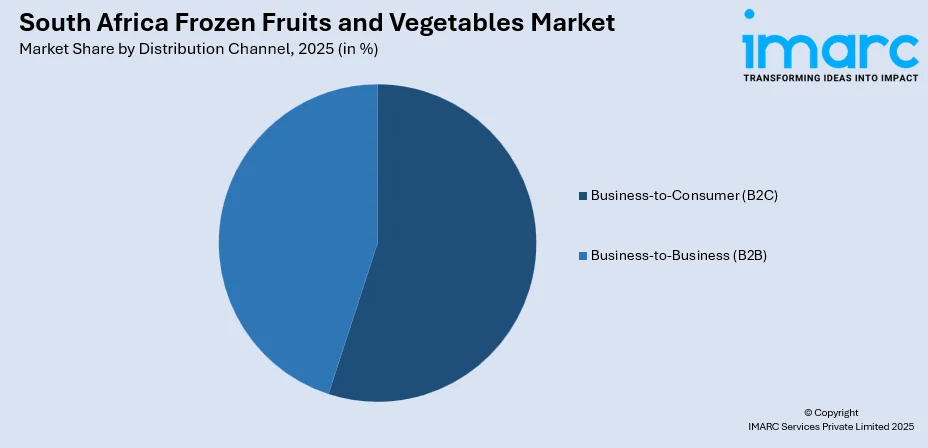

- By Distribution Channel: Business-to-Consumer (B2C) dominates the market with 55% share in 2025, enabled by widespread supermarket penetration, expanding online grocery platforms, and increasing consumer preference for accessible frozen produce options.

- Key Players: The South Africa frozen fruits and vegetables market features major manufacturers expanding product portfolios, investing in cold chain infrastructure, forming strategic partnerships with retail chains, and implementing sustainable sourcing practices to strengthen market presence and meet evolving consumer demands.

To get more information on this market Request Sample

The South Africa frozen fruits and vegetables market is advancing as consumers, retailers, and food service operators embrace convenient preservation solutions that minimize food waste while maintaining nutritional integrity. Growing health awareness is driving demand for frozen produce that offers year-round availability of seasonal fruits and vegetables. Consumer preferences for frequent, smaller grocery purchases rather than large, infrequent shopping trips are reinforcing demand for accessible frozen options. Modern retail expansion, including the growth of supermarkets and online platforms in townships and rural areas, is broadening market reach. Ongoing cold chain investments are enhancing supply chain efficiency and product quality across distribution networks.

South Africa Frozen Fruits and Vegetables Market Trends:

Rising Health Consciousness and Demand for Convenient Nutrition

The market is expanding as health-conscious consumers increasingly seek nutritious food options that accommodate busy lifestyles without compromising dietary quality. South African consumers are demonstrating growing preference for frequent, smaller grocery purchases rather than large, infrequent shopping trips, creating sustained demand for frozen produce that offers extended shelf life while retaining essential nutrients. Urban households and working professionals are driving this preference shift, recognizing frozen fruits and vegetables as practical alternatives that reduce food waste and enable convenient meal preparation. The combination of rising nutritional awareness and evolving time constraints is encouraging broader adoption across diverse consumer segments, thereby supporting South Africa frozen fruits and vegetables market growth throughout the forecast period.

Expansion of Modern Retail Infrastructure and Distribution Channels

Retail infrastructure development is accelerating market accessibility across South Africa. Large retailers are expanding their frozen food offerings while extending their footprint into townships, rural areas, and underserved neighborhoods. In November 2024, South Africa came up with new food additive regulations set to take effect from 2025, strengthening food safety standards and bringing local practices in line with global norms. Supermarkets and hypermarkets are dedicating increased shelf space to frozen fruits and vegetables, improving product visibility and consumer access. The growth of online grocery platforms and e-commerce channels is further enhancing distribution reach, enabling consumers to purchase frozen produce through convenient home delivery services.

Cold Chain Infrastructure Investment and Modernization

Significant investments in cold chain infrastructure are transforming South Africa's frozen food logistics capabilities. In October 2025, Maersk inaugurated the Belcon Cold Store in Cape Town as part of a USD 100+ million investment enhancing perishable logistics infrastructure. Industry stakeholders are expanding refrigerated storage facilities, upgrading transportation networks, and implementing advanced temperature monitoring systems to ensure product integrity throughout the supply chain. New cold storage developments in strategic locations are enhancing capacity for both domestic distribution and export operations. These infrastructure improvements are reducing post-harvest losses, extending product shelf life, and maintaining nutritional quality from processing facilities to retail outlets. The modernization of cold chain systems is also enabling greater geographic reach, allowing frozen fruits and vegetables to penetrate previously underserved markets.

Market Outlook 2026-2034:

The South Africa frozen fruits and vegetables market is poised for steady expansion. The market generated a revenue of USD 195.29 Million in 2025 and is projected to reach a revenue of USD 214.28 Million by 2034, growing at a compound annual growth rate of 1.04%. Continued urbanization, expanding retail networks, and investments in cold chain infrastructure will support this trajectory. Government initiatives promoting food safety standards and agricultural modernization, combined with growing consumer preference for convenient, nutritious food options, position the market for sustained development throughout the forecast period.

South Africa Frozen Fruits and Vegetables Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Frozen Vegetables | 65% |

| Distribution Channel | Business-to-Consumer (B2C) | 55% |

Product Type Insights:

- Frozen Fruits

- Frozen Vegetables

Frozen vegetables dominate with a market share of 65% of the total South Africa frozen fruits and vegetables market share in 2025.

The frozen vegetables segment dominates the South Africa frozen fruits and vegetables market due to widespread adoption across food service establishments and retail channels. Restaurants, hotels, schools, and hospitals increasingly rely on frozen vegetables for operational efficiency, consistent quality, and reduced food waste. Products including peas, corn, butternut squash, broccoli, artichoke hearts, okra, and cauliflower rice are readily available across major retail chains. Major manufacturers continue expanding product portfolios to meet diverse consumer preferences for convenient, nutritious vegetable options.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Business-to-Consumer (B2C)

- Supermarkets/Hypermarkets

- Independent Retailers

- Convenience Stores

- Online

- Others

- Business-to-Business (B2B)

Business-to-Consumer (B2C) holds a market share of 55% of the total South Africa frozen fruits and vegetables market share in 2025.

The B2C distribution channel dominates the South Africa frozen fruits and vegetables market, driven by extensive supermarket and hypermarket networks. Major retailers lead frozen food sales, continuously expanding their frozen produce offerings and store footprints into townships, rural areas, and underserved neighborhoods. Online grocery platforms are enhancing accessibility, with e-commerce channels contributing increasingly to overall food market revenue. The integration of click-and-collect services and home delivery options is further strengthening B2C channel growth across metropolitan and emerging markets.

Province Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Gauteng leads the provincial market as South Africa's most urbanized and economically active province. The region's high population density, concentrated retail infrastructure, and significant working-class population create strong demand for convenient food solutions including frozen fruits and vegetables. Metropolitan areas within the province exhibit robust consumption patterns driven by busy lifestyles and dual-income households seeking time-efficient meal preparation options. The extensive presence of supermarkets, hypermarkets, and modern retail formats ensures widespread product availability across diverse consumer segments.

KwaZulu-Natal represents a significant market for frozen fruits and vegetables, supported by its large population base and diverse economic activities. The province benefits from the presence of major port infrastructure in Durban, facilitating efficient distribution and logistics operations. Growing urbanization in metropolitan areas combined with expanding retail networks in semi-urban and rural regions is driving market penetration. The tourism and hospitality sector further contributes to demand through food service establishments requiring consistent frozen produce supplies.

Western Cape serves as a strategic hub for cold chain logistics and frozen food processing within South Africa. The province leverages its Mediterranean climate conditions favorable for agricultural production, along with strategic port access in Cape Town that supports both domestic distribution and export operations. The region hosts significant food processing infrastructure and cold storage facilities that strengthen supply chain capabilities. Growing retail penetration and health-conscious consumer demographics further support frozen produce consumption across the province.

Mpumalanga contributes to the frozen fruits and vegetables market through its agricultural production capabilities and strategic geographic positioning. The province's favorable climate supports cultivation of various fruits and vegetables suitable for freezing and processing. Growing urbanization and expanding retail presence in key towns are increasing consumer access to frozen produce offerings. The region also benefits from proximity to Gauteng, enabling efficient distribution linkages to major consumption centers and supporting broader market supply chains.

Eastern Cape represents an emerging market for frozen fruits and vegetables with significant growth potential. The province is witnessing infrastructure development including new cold storage facilities that enhance distribution capabilities and product quality. Agricultural activities, particularly citrus production in certain areas, support local processing operations. Expanding retail networks in urban centers and ongoing efforts to improve cold chain connectivity are gradually increasing market penetration across previously underserved communities within the province.

The remaining provinces, including Limpopo, North West, Free State, and Northern Cape, collectively contribute to the South Africa frozen fruits and vegetables market through agricultural production and growing consumer demand. These regions are witnessing gradual retail expansion and infrastructure improvements that enhance frozen food accessibility. Agricultural activities in these provinces support raw material supply for processing operations, while increasing urbanization and rising disposable incomes are driving consumption growth across emerging market segments.

Market Dynamics:

Growth Drivers:

Why is the South Africa Frozen Fruits and Vegetables Market Growing?

Increasing Urbanization and Changing Consumer Lifestyles

The urban population value from 2024 is 69.3 percent, an improvement from 68.82 percent in 2023. Rapid urbanization and evolving consumer lifestyles are driving sustained demand for frozen fruits and vegetables across South Africa. The rise in dual-income households and busier urban schedules has increased preference for convenient, quick-to-prepare food options that retain nutritional value. Working professionals and students favor frozen produce for its extended shelf life, reduced preparation time, and consistent quality. Metropolitan areas including Johannesburg, Cape Town, and Durban exhibit particularly strong demand patterns. The ongoing migration from rural to urban centers continues to expand the consumer base seeking accessible, nutritious food solutions that accommodate modern time constraints while supporting healthy dietary habits throughout the country.

Government Support and Food Safety Regulations

Government initiatives are strengthening market foundations through infrastructure investment and regulatory modernization. The Agriculture and Agro-processing Master Plan has distributed substantial funding to support agricultural infrastructure improvements, including packhouses, cold rooms, and rural road upgrades. These investments are enhancing the capacity of farmers and processors to deliver high-quality frozen produce to domestic and export markets. Additionally, South Africa has introduced new food additive regulations aimed at strengthening food safety standards and aligning local practices with global norms. These regulatory developments enhance consumer confidence in frozen food quality while creating favorable conditions for domestic and international market participants. The combination of infrastructure support and regulatory modernization is establishing a robust framework that encourages investment and sustainable growth across the frozen fruits and vegetables value chain.

Reduction of Post-Harvest Food Losses Through Freezing Technologies

Ten million tons of food are wasted annually in South Africa. This accounts for a third of the 31 Million Tons that are produced annually in the country. Fruits, vegetables and grains account for 70% of the wastage and loss collectively. This wastage and loss mainly happens in the initial stages of the food supply chain. Owing to this loss, there is a rise in the use of the freezing technology, which offers critical solutions for reducing substantial post-harvest food losses across South Africa's agricultural sector. Flash freezing and modern preservation technologies enable farmers and processors to extend shelf life, reduce spoilage, and capture greater value from harvested produce. This waste reduction imperative is encouraging investment in freezing infrastructure and positioning frozen produce as an economically and environmentally sustainable alternative to fresh products susceptible to rapid deterioration.

Market Restraints:

What Challenges the South Africa Frozen Fruits and Vegetables Market is Facing?

High Energy Costs and Power Supply Instability

Electricity supply challenges and rising energy costs present significant operational hurdles for frozen food value chain participants. Frequent power outages, locally known as load-shedding, disrupt refrigeration systems and threaten product integrity across storage and distribution networks. Continued increases in electricity tariffs have substantially elevated operational costs for cold chain providers, affecting profitability across manufacturing, storage, and retail segments. These energy-related challenges require industry participants to invest in backup power solutions and alternative energy sources to maintain consistent cold chain operations.

Competition from Low-Cost Imports

Domestic frozen vegetable producers face margin pressure from lower-priced imports originating from Europe and China. These imported products, often produced at scale with lower input costs, present pricing challenges for local manufacturers competing in a price-sensitive market. This competitive dynamic has historically affected industry consolidation and investment decisions within South Africa's frozen vegetable processing sector.

Limited Cold Chain Infrastructure in Rural Areas

Despite ongoing investments, cold chain infrastructure remains inadequate in many rural and semi-urban areas. Limited availability of refrigerated transport, certified storage facilities, and reliable electricity supply in remote regions restricts market penetration and product accessibility. These infrastructure gaps create distribution challenges that prevent frozen produce from reaching potential consumers beyond major metropolitan markets.

Competitive Landscape:

The South Africa frozen fruits and vegetables market features a mix of established multinational corporations and specialized local producers competing on product quality, distribution reach, and pricing strategies. Key players are actively expanding product portfolios and strengthening distribution partnerships to capture growing consumer demand. Companies are investing in cold chain infrastructure enhancements to maintain product integrity throughout the supply chain, from processing facilities to retail shelves. Sustainable sourcing practices and product innovation initiatives are becoming increasingly important as manufacturers seek to meet evolving consumer preferences for healthy and environmentally responsible food options. Strategic collaborations between manufacturers and major retail chains are enhancing product visibility and market accessibility across urban and emerging market segments. Additionally, players are focusing on developing value-added frozen products and convenient packaging formats to differentiate their offerings in an increasingly competitive marketplace.

Recent Developments:

- In February 2024, Godrej Yummiez stated ambitions of entering the South African market by Q1 of 2025 to cater to the huge Indian community in the country. The company specializes in frozen ready-to-cook vegetarian and non-vegetarian goods.

South Africa Frozen Fruits and Vegetables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Frozen Fruits, Frozen Vegetables |

| Distribution Channels Covered |

|

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Africa frozen fruits and vegetables market size was valued at USD 195.29 Million in 2025.

The South Africa frozen fruits and vegetables market is expected to grow at a compound annual growth rate of 1.04% from 2026-2034 to reach USD 214.28 Million by 2034.

Frozen vegetables hold the largest revenue share of 65%, driven by widespread adoption across food service establishments including restaurants, hotels, schools, and hospitals seeking operational efficiency, consistent quality, and reduced food waste.

Key factors driving the South Africa frozen fruits and vegetables market include increasing urbanization, changing consumer lifestyles favoring convenience, expanding retail infrastructure, government support for food safety regulations, cold chain investments, and growing awareness of frozen produce as a solution for reducing post-harvest food losses.

Major challenges include high energy costs and power supply instability affecting refrigeration operations, competition from low-cost imports pressuring domestic producers, inadequate cold chain infrastructure in rural areas, and consumer perceptions regarding frozen versus fresh produce quality.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)