South Africa Hot Sauce Market Size, Share, Trends and Forecast by Product Type, Application, Packaging, Distribution Channel, End Use, and Region, 2025-2033

South Africa Hot Sauce Market Overview:

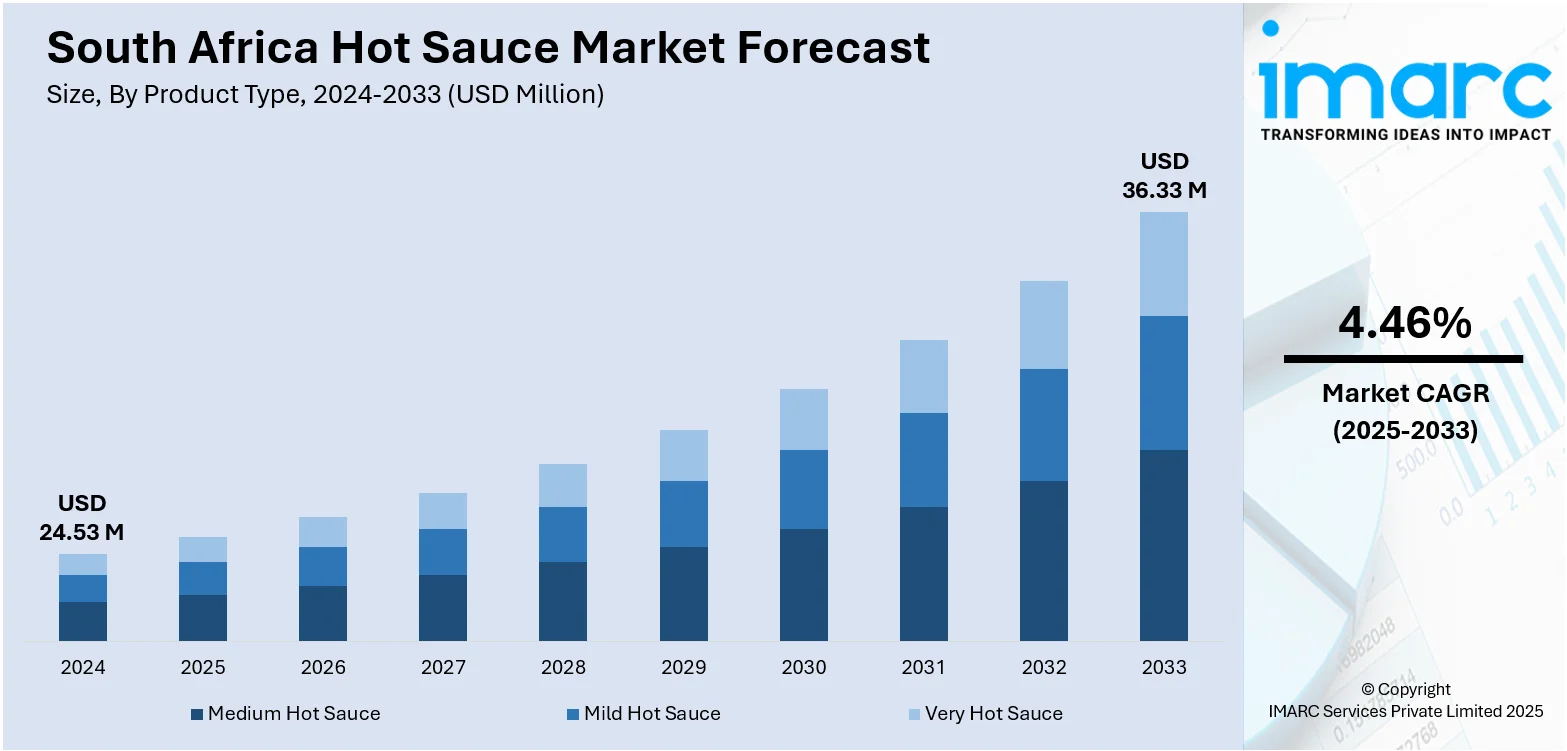

The South Africa hot sauce market size reached USD 24.53 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 36.33 Million by 2033, exhibiting a growth rate (CAGR) of 4.46% during 2025-2033. At present, rising demand for spicy, bold, and ethnic taste profiles in everyday diets by consumers is propelling the market growth. This, along with the expanding presence of quick-service restaurants (QSRs) and street food vendors, is supporting the market growth. Moreover, the increasing presence and availability of artisanal and locally-made sauce brands are expanding the South Africa hot sauce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 24.53 Million |

| Market Forecast in 2033 | USD 36.33 Million |

| Market Growth Rate 2025-2033 | 4.46% |

South Africa Hot Sauce Market Trends:

Growing Consumers' Demand for Ethnic and Hot Flavors

The hot sauce market in South Africa is experiencing growth as there is a rising demand for spicy, bold, and ethnic taste profiles in everyday diets by consumers. This is being driven by the increasing multiculturalism in urban areas and the growing popularity of international cuisines, especially from Asia, Latin America, and West Africa. Younger consumers, in general, are demonstrating increased interest in foods that include exotic spices and chili peppers as condiments. Foodservice operations are meeting this demand by expanding menus to include more spicy products, thus introducing additional consumers to hot sauces as part of mainstream condiments. Additionally, hot sauce is being used not just as a flavor conditioner, but as a dip in its own right and as an ingredient in the preparation of meals. This ongoing consumer shift towards bold eating patterns is generating consistent demand for hot sauce options in a wide range of flavors, and it is stimulating domestic manufacturers and global players to expand their offerings. In 2024, African Dream Foods, the daring and socially aware brand transforming the hot sauce industry, announced its plans to launch in Giant Food stores in March 2025, with more retail collaborations anticipated to begin later in the year. African Dream Foods is expanding its array of lively, genuine African flavors to more American households, with its African Ghost Pepper Sauce noted as one of the quickest-growing hot sauces on the B2B platform RangeMe.

To get more information on this market, Request Sample

Development of Quick-Service Restaurants (QSRs) and Street Food Culture

South Africa's hot sauce market is gaining advantage from the expanding presence of quick-service restaurants (QSRs) and street food vendors' growth in urban and semi-urban locations. Foodservice channels are increasingly using spicy condiments, such as different types of hot sauce, to meet changing consumer demand for quick, tasty, and customizable meals. Fast food popular chains are now making it standard to have hot sauces in burgers, chicken meals, wraps, and fries as a common accompaniment. At the same time, street food culture in metropolises like Cape Town, Johannesburg, and Durban is also flourishing with vendors often using locally made hot sauces as a value-adding and authenticator component of their products. This repeated exposure is building consumer knowledge and liking for chili-related condiments, as well as encouraging innovation among sauce makers to respond to diverse flavor and heat requirements. With the growth in QSRs and street vendors, the dependence on unique hot sauces is further fueling the South Africa hot sauce market growth. For instance, in 2025, British multi-national sandwich and coffee shop franchise Pret A Manger declared its plans to launch in South Africa at Melrose Arch in Johannesburg.

Heightened Availability and Retail Coverage of Artisan and Locally-Made Brands

The South African hot sauce sector is being further galvanized by the increasing presence and availability of artisanal and locally made sauce brands. Small-and medium-sized businesses are taking advantage of the movement towards authenticity, local origin, and craft manufacturing, creating hot sauces using indigenous ingredients like peri-peri, bird's eye chili, and endemic herbs. These local manufacturers are increasingly using farmers' markets, specialty retailers, internet platforms, and natural food stores to access niche consumer segments that place a premium on handmade and sustainable foods. This trend is also finding alignment with the wider consumer desire to support local business, fuelling preference for home-grown over mass-produced imports. The use of eco-friendly packaging and clean-label ingredients is also appealing to health- and environmentally-aware purchasers. As these craft brands win shelf space and online visibility, they are constantly broadening consumer availability of high-end hot sauce choices, driving sustained growth in the marketplace.

South Africa Hot Sauce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, packaging, distribution channel, and end use.

Product Type Insights:

- Medium Hot Sauce

- Mild Hot Sauce

- Very Hot Sauce

The report has provided a detailed breakup and analysis of the market based on the product type. This includes medium hot sauce, mild hot sauce, and very hot sauce.

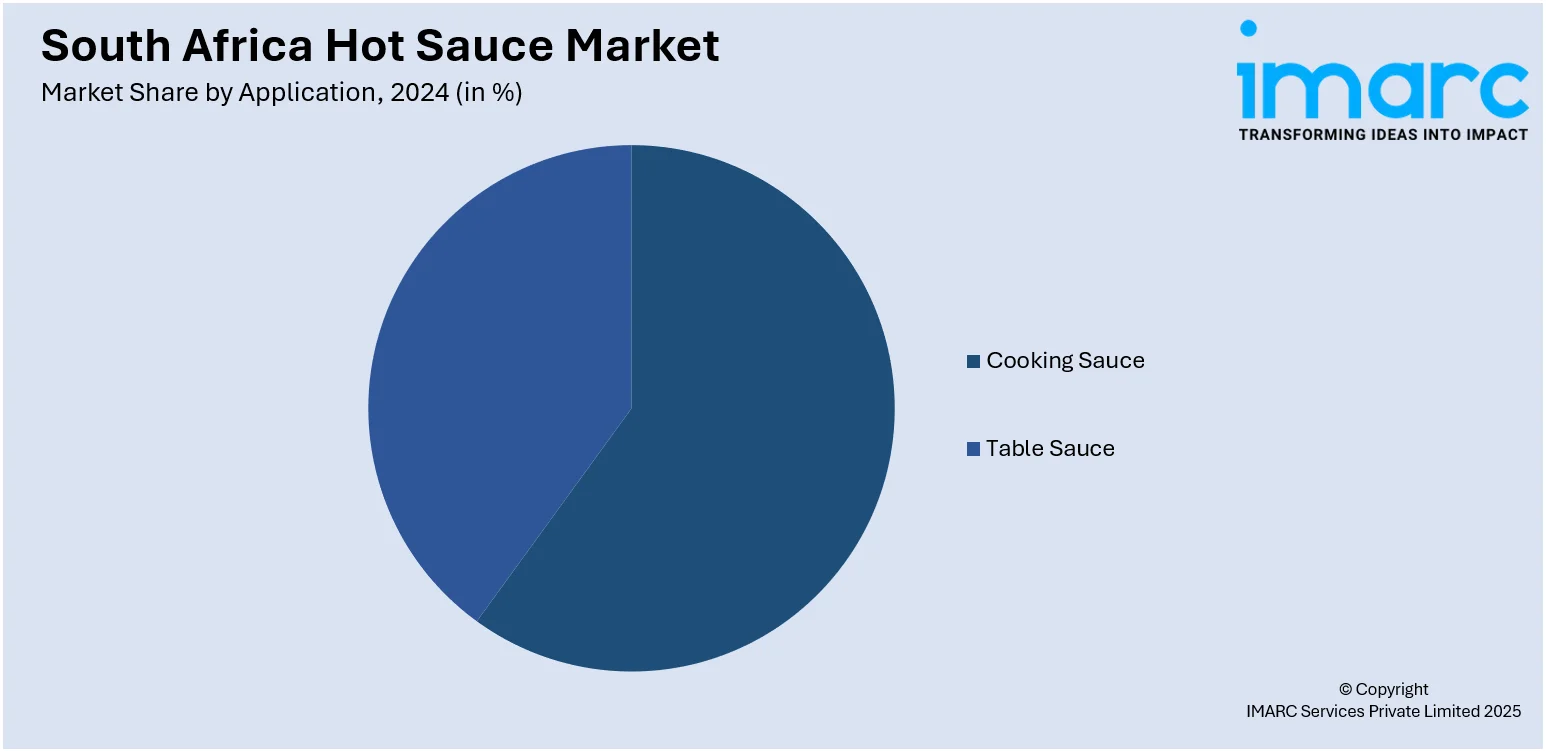

Application Insights:

- Cooking Sauce

- Table Sauce

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cooking sauce and table sauce.

Packaging Insights:

- Jars

- Bottles

- Others

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes jars, bottles, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Traditional Grocery Retailers

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, traditional grocery retailers, online stores, and others.

End Use Insights:

- Commercial

- Household

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial and household.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Hot Sauce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Medium Hot Sauce, Mild Hot Sauce, Very Hot Sauce |

| Applications Covered | Cooking Sauce, Table Sauce |

| Packagings Covered | Jars, Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Grocery Retailers, Online Stores, Others |

| End Uses Covered | Commercial, Household |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa hot sauce market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa hot sauce market on the basis of product type?

- What is the breakup of the South Africa hot sauce market on the basis of application?

- What is the breakup of the South Africa hot sauce market on the basis of packaging?

- What is the breakup of the South Africa hot sauce market on the basis of distribution channel?

- What is the breakup of the South Africa hot sauce market on the basis of end use?

- What is the breakup of the South Africa hot sauce market on the basis of region?

- What are the various stages in the value chain of the South Africa hot sauce market?

- What are the key driving factors and challenges in the South Africa hot sauce market?

- What is the structure of the South Africa hot sauce market and who are the key players?

- What is the degree of competition in the South Africa hot sauce market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa hot sauce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa hot sauce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa hot sauce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)