South Africa Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

South Africa Insurtech Market Overview:

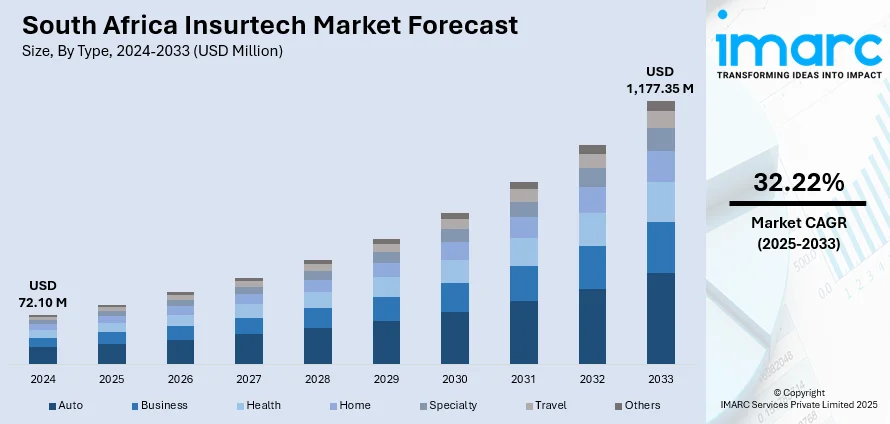

The South Africa Insurtech market size reached USD 72.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,177.35 Million by 2033, exhibiting a growth rate (CAGR) of 32.22% during 2025-2033. South Africa Insurtech market growth is attributed to expanding digital payment infrastructure and strategic partnerships with fintech and e-commerce platforms. These developments simplify premium collection, streamline onboarding, and embed insurance into everyday digital interactions, making coverage more accessible for underserved and digitally engaged populations, thus influencing the South Africa Insurtech share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 72.10 Million |

| Market Forecast in 2033 | USD 1,177.35 Million |

| Market Growth Rate 2025-2033 | 32.22% |

South Africa Insurtech Market Trends:

Expansion of Digital Payment Infrastructure

The expansion of mobile wallets and digital payment infrastructure is significantly reducing barriers to insurance adoption in South Africa, particularly among underserved and underbanked populations. Traditional insurance models have long relied on debit orders, annual premiums, or formal banking channels, methods that often exclude low-income or rural individuals who lack access to credit cards or stable bank accounts. In contrast, Insurtech providers are integrating premium collection directly into mobile billing systems and widely used digital wallets. This enables users to make small, recurring payments using platforms already familiar to them for airtime top-ups, utility payments, or peer-to-peer transfers. Such frictionless payment mechanisms make short-term and micro-insurance products both practical and appealing. A recent example reinforcing this trend is Paymentology’s 2025 launch of PayoCard in South Africa. This mobile-first card management platform is designed to support fintech firms and digital banks in offering user-driven, self-service card experiences. By simplifying card deployment and enhancing user control, PayoCard aligns with the broader growth in South Africa’s digital payments landscape. As more people adopt mobile-first financial behavior, such solution is demonstrating how embedded infrastructure can facilitate insurance uptake. The convergence of mobile finance and Insurtech is thus enabling wider access to coverage across segments that have historically been excluded from the formal insurance market.

To get more information on this market, Request Sample

Partnerships with E-commerce and Fintech Platforms

In South Africa, Insurtech companies are progressively forming alliances with unconventional digital platforms, such as e-commerce marketplaces, mobile payment apps, and ride-hailing services, to offer micro-insurance and embedded insurance solutions. Such partnerships allow insurers to tap into extensive, already engaged user groups without facing the expenses tied to developing separate distribution networks. Integrating insurance seamlessly into digital user interactions, including online purchases or digital borrowing applications, enhances the chances of policy uptake by providing convenience and relevance when the transaction occurs. This method is effective due to the size of South Africa’s digital commerce industry, with the e-commerce market projected to attain a value of USD 2,199.27 Billion by 2033, as per the IMARC Group. Incorporating insurance products into these platforms not only simplifies user onboarding but also enhances the efficiency of back-end processes. Collaborative data infrastructure allows quicker onboarding, automated identity checks, and faster claims processing, lowering administrative expenses and enhancing the overall user experience. Moreover, these collaborations facilitate the creation of customized insurance offerings that match user habits and buying behaviors, increasing both relevance and uptake. Insurtech companies in South Africa are broadening their access, enhancing operational efficiency, and tackling coverage gaps by integrating insurance into popular digital platforms used by a digitally engaged and increasingly mobile-first population. These developments are playing a key role in supporting the South Africa Insurtech market growth, driven by increased digital adoption, strategic cross-sector partnerships, and rising demand for accessible, embedded insurance solutions.

South Africa Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

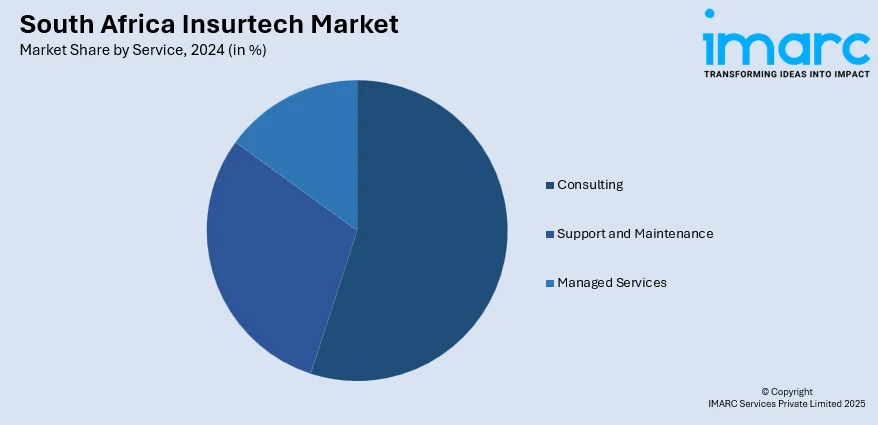

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Insurtech Market News:

- In July 2025, the Insurtech and Digital Insurance Summit 2025 was held in Sandton, South Africa, focusing on how AI, blockchain, and digital ecosystems are transforming the insurance industry. The event brought together key industry leaders, innovators, and regulators. Themes included digital transformation, fintech partnerships, and mobile-first solutions for financial inclusion.

- In January 2025, South African Insurtech Naked raised $38 million in its Series B2 funding round. Naked offers fully digital, AI-driven car, home, and single-item insurance policies, with a unique model that donates surplus premiums to customer-chosen charities. The funds will support expansion of its AI capabilities, product range, and market presence.

South Africa Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa Insurtech market on the basis of type?

- What is the breakup of the South Africa Insurtech market on the basis of service?

- What is the breakup of the South Africa Insurtech market on the basis of technology?

- What is the breakup of the South Africa Insurtech market on the basis of region?

- What are the various stages in the value chain of the South Africa Insurtech market?

- What are the key driving factors and challenges in the South Africa Insurtech market?

- What is the structure of the South Africa Insurtech market and who are the key players?

- What is the degree of competition in the South Africa Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)