South Africa Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

South Africa Meat Market Overview:

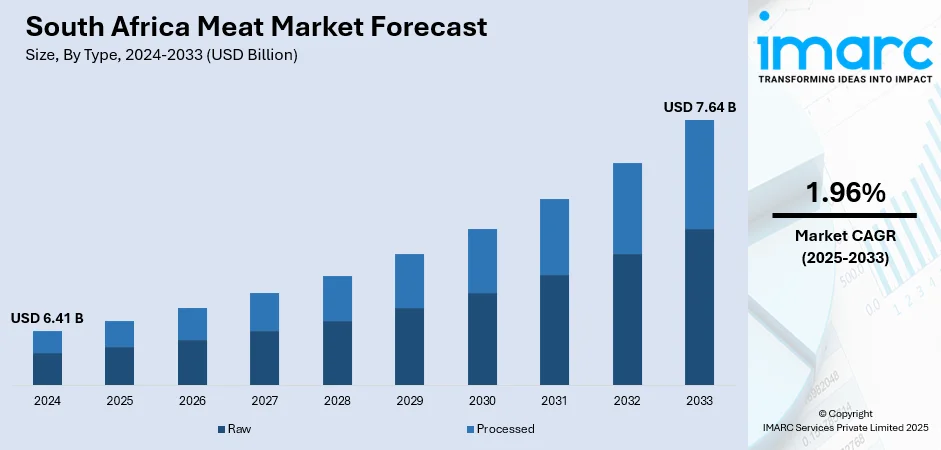

The South Africa meat market size reached USD 6.41 Billion in 2024. The market is projected to reach USD 7.64 Billion by 2033, exhibiting a growth rate (CAGR) of 1.96% during 2025-2033. The market is driven by rising urbanization and a growing middle class, leading to higher demand for convenient, protein-rich foods. Poultry dominates due to its affordability compared to red meat, supported by government policies and its strong presence in fast-food and informal markets. In addition to this, rising health awareness fuels demand for leaner, high-protein options, boosting interest in chicken, premium beef cuts, and free-range products thus strengthening the South Africa meat market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.41 Billion |

| Market Forecast in 2033 | USD 7.64 Billion |

| Market Growth Rate 2025-2033 | 1.96% |

South Africa Meat Market Trends:

Rising Urbanization & Middle-Class Growth

South African urbanization is triggering shifts in dietary trends, with consumers switching to convenient, high-protein food in increased numbers. With increased urban dwellers, the demand for processed and ready-to-eat meat products has grown substantially. The shift is caused by increased disposable incomes and a growing middle class that requires varied, superior-quality meat like chicken, beef, and pork. Urban families also have better access to supermarkets and fast-food restaurants, encouraging more meat consumption. With this, along with lifestyle changes and unavailability of time, local demand for value-added meat items like marinated pieces, deli items, and ready-to-cook meats has grown. An expanding rate of Western food culture and quick-service restaurants is supporting the growth of the South Africa meat market at a growing pace. In addition, these improvements are revolutionizing the market, escalating competition between producers and promoting innovation in processing and marketing of meat.

To get more information on this market, Request Sample

Consumer Health & Protein Trends

Poultry now accounts for about 60% of total meat consumption in South Africa, reflecting its affordability, lean profile, and alignment with evolving health and wellness trends. Consumers are increasingly aware of the nutritional benefits of protein-rich diets, driving demand for leaner options like chicken and select cuts of beef. This shift is influenced by global health campaigns, fitness culture, and the rising prevalence of lifestyle diseases such as obesity and diabetes, encouraging balanced eating habits. Meat producers are responding by introducing low-fat, high-protein products and enhancing processed meats with nutritional fortification. The rising popularity of high-protein diets, like keto and paleo, has created new opportunities for premium, organic, and free-range meats. Retailers are diversifying with hormone-free and grass-fed options, reshaping supply chains and fostering innovation to cater to South Africa’s increasingly health-conscious consumers.

Poultry Dominance & Price Competitiveness

Poultry remains the cornerstone of South Africa’s meat market trends, accounting for the largest share of consumption due to its affordability compared to red meat. High beef and lamb prices, driven by feed costs and production constraints, have led consumers to favor chicken as a cost-effective protein source. Government support for domestic poultry producers and import controls also bolster local production. Additionally, poultry aligns with health-conscious consumers seeking leaner meat options, enhancing its appeal across income groups. Fast-food chains and informal street vendors heavily rely on chicken, further boosting demand. This price competitiveness makes poultry a critical stabilizer in a market impacted by economic challenges and inflationary pressures. From frozen cuts to ready-to-cook (RTC) and spiced variations, poultry not only leads home consumption but also spurs product development innovation.

South Africa Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

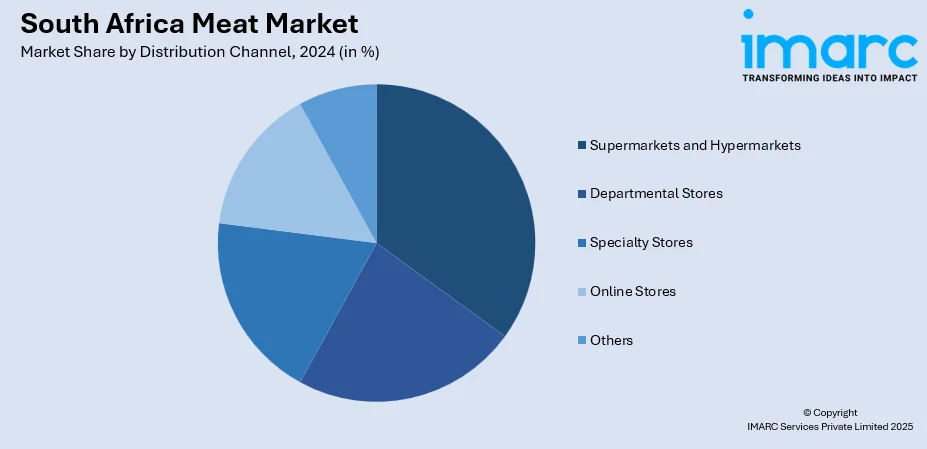

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Meat Market News:

- In June 2025, South Africa launched a nationwide livestock vaccination drive to curb a foot-and-mouth disease outbreak impacting the beef industry. Agriculture Minister John Steenhuisen kicked off the campaign at Karan Beef in Gauteng, which accounts for about 30% of the sector. The outbreak has halted operations, causing price shocks. Chief Veterinarian Dr. Wynton Rabolao said the effort aims to reduce viral spread, ease movement restrictions, and stabilize trade and production.

South Africa Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa meat market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa meat market on the basis of type?

- What is the breakup of the South Africa meat market on the basis of product?

- What is the breakup of the South Africa meat market on the basis of distribution channel?

- What is the breakup of the South Africa meat market on the basis of region?

- What are the various stages in the value chain of the South Africa meat market?

- What are the key driving factors and challenges in the South Africa meat market?

- What is the structure of the South Africa meat market and who are the key players?

- What is the degree of competition in the South Africa meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)