South Africa Menswear Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Province, 2026-2034

South Africa Menswear Market Summary:

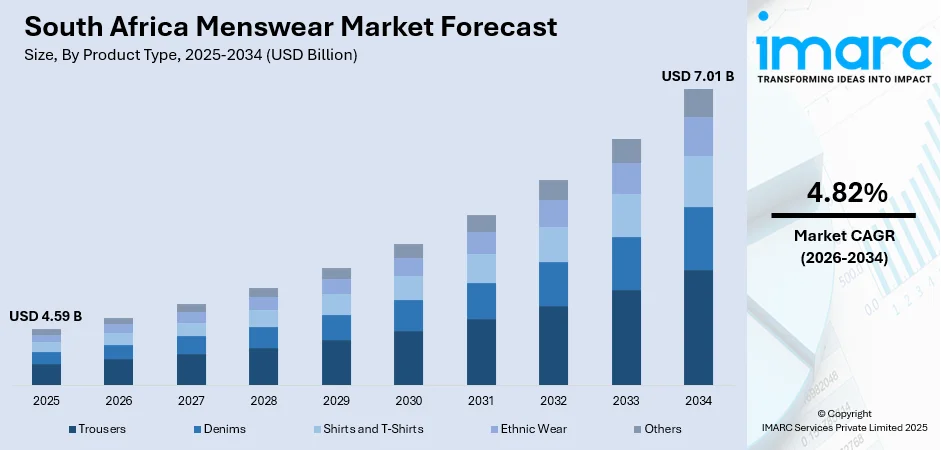

The South Africa menswear market size was valued at USD 4.59 Billion in 2025 and is projected to reach USD 7.01 Billion by 2034, growing at a compound annual growth rate of 4.82% from 2026-2034.

The South African menswear market demonstrates robust expansion driven by evolving consumer preferences toward smart-casual and athleisure styling that balances comfort with contemporary aesthetics. Urbanization trends concentrating over two-thirds of the population in metropolitan areas have intensified demand for versatile wardrobes suitable for professional and social settings. Rising discretionary spending among the young demographic, combined with the rapid proliferation of multi-brand retail outlets and digital commerce platforms, continues to strengthen South Africa menswear market share.

Key Takeaways and Insights:

- By Product Type: Shirts and t-shirts dominate the market with a share of 38% in 2025, driven by their versatility across casual and semi-formal occasions and the growing preference for comfortable everyday wear among style-conscious male consumers.

- By Season: Summer wear leads the market with a share of 40% in 2025, reflecting South Africa's predominantly warm climate and consumer demand for lightweight, breathable fabrics suited to extended summer seasons.

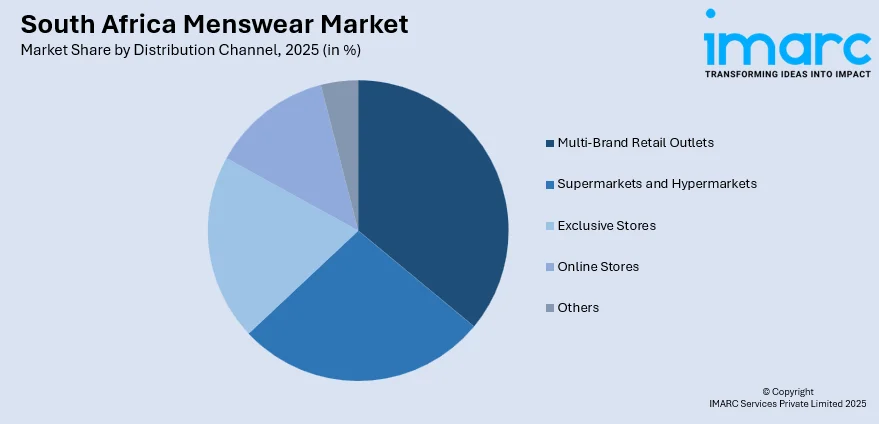

- By Distribution Channel: Multi-Brand retail outlets represent the largest segment with a market share of 28% in 2025, supported by their comprehensive product assortments enabling consumers to compare brands and access diverse price points under unified retail environments.

- Key Players: The South Africa menswear market exhibits moderate competitive intensity, featuring established domestic retail groups alongside international fashion entrants. Major players leverage extensive store networks, brand portfolio diversification, and omnichannel strategies to capture market share across varying consumer segments.

To get more information on this market Request Sample

The menswear landscape in South Africa reflects a dynamic intersection of global fashion influences and distinctly local styling preferences, with consumers increasingly gravitating toward brands that balance quality craftsmanship with accessible pricing. Retail modernization has accelerated following strategic international partnerships, exemplified by TFG signing a franchise agreement with JD Sports Fashion in March 2024 to launch over 40 stores across South Africa within five years. The expansion of organized retail channels and e-commerce platforms has democratized fashion access, enabling consumers from metropolitan centers to regional towns to engage with contemporary menswear trends. Sustainability consciousness is emerging as a meaningful purchase criterion, particularly among younger demographics seeking ethically produced garments that align with their values while delivering on style expectations.

South Africa Menswear Market Trends:

Smart-Casual Versatility Reshaping Wardrobes

The evolution of hybrid work culture continues reshaping menswear preferences across South African workplaces. According to PwC's Global Workforce Hopes and Fears Survey 2024, 59% of African respondents embrace hybrid working models, while 51% indicate their work can be done from home. A Venture Workspace survey of 94 South African companies found that 60% have fully embraced hybrid work models, with 44% resolving never to return to traditional offices. This workplace transformation drives demand for versatile garments that transition seamlessly between professional meetings and casual environments, with wool-blend over-shirts, utility jackets, and tailored joggers becoming wardrobe staples that serve multiple contexts throughout increasingly fluid daily schedules.

Athleisure Integration into Everyday Fashion

Performance-inspired clothing continues expanding beyond traditional fitness settings into mainstream South African menswear. Cisco's Global Hybrid Work Report found that 86% of South African respondents reported improved wellbeing from hybrid/remote work, with 70% exercising more when working remotely. Discovery Insure data shows 23% of clients who began working from home during the pandemic have not returned to offices full-time. These lifestyle shifts fuel demand for activewear-inspired menswear featuring moisture-wicking fabrics, four-way stretch materials, and performance technical details that support active urban lifestyles, as consumers prioritize comfort alongside contemporary aesthetics.

Sustainable and Ethical Fashion Gaining Momentum

Environmental consciousness increasingly influences South African menswear purchasing decisions as consumers embrace circular fashion principles. The second-hand clothing sector in South Africa is now worth nearly R10 billion, with 9.1% (approximately R9.9 billion) of the country's apparel market revenue stemming from second-hand apparel as of 2024. The government's R-CTFL Masterplan has created over 20,000 jobs, with R1.87 billion approved for 154 businesses employing nearly 24,000 people as of July 2024, supporting sustainable production. Designers championing slow fashion and local artisanship continue attracting environmentally conscious consumers seeking transparency about garment origins and ethical manufacturing practices.

Market Outlook 2026-2034:

The South African menswear market is positioned for sustained expansion, underpinned by favorable demographic trends and retail infrastructure modernization. Continued urbanization, alongside a youthful population with a median age of 28.7 years, ensures robust demand for contemporary fashion offerings. E-commerce channel development and international brand partnerships will enhance product accessibility while intensifying competitive dynamics. The market generated a revenue of USD 4.59 Billion in 2025 and is projected to reach a revenue of USD 7.01 Billion by 2034, growing at a compound annual growth rate of 4.82% from 2026-2034.

South Africa Menswear Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Shirts and T-Shirts | 38% |

| Season | Summer Wear | 40% |

| Distribution Channel | Multi-Brand Retail Outlets | 28% |

Product Type Insights:

- Trousers

- Denims

- Shirts and T-Shirts

- Ethnic Wear

- Others

Shirts and t-shirts dominate with a market share of 38% of the total South Africa menswear market in 2025.

The shirts and t-shirts segment maintains market leadership through their fundamental role in male wardrobes across casual, semi-formal, and professional contexts. As customers prioritize supporting domestic brands, there is an increasing demand in South Africa for T-shirts that are ethically produced and locally designed. This segment benefits from high purchase frequency as consumers regularly refresh basic and statement pieces to maintain contemporary appearances. The versatility of shirts and t-shirts across seasonal variations and their compatibility with diverse styling approaches reinforces sustained demand, particularly among younger demographics seeking affordable fashion rotation.

Consumer preference for layered styling has expanded opportunities within this segment, with retailers offering expanded ranges spanning essential basics through premium fashion-forward designs. Brand consciousness among male shoppers has elevated demand for quality fabrics, distinctive cuts, and recognizable labels that communicate personal style identity. The intersection of comfort, affordability, and style expression positions shirts and t-shirts as foundational wardrobe investments driving consistent retail performance across price tiers.

Season Insights:

- Summer Wear

- Winter Wear

- All-Season Wear

Summer wear leads with a share of 40% of the total South Africa menswear market in 2025.

South Africa's predominantly warm climate sustains year-round demand for summer-appropriate menswear, with lightweight fabrics, breathable materials, and relaxed silhouettes dominating consumer preferences. Metropolitan centers experience extended warm seasons requiring wardrobes adapted to heat and humidity while maintaining professional and social presentability. Resort wear has a structured nautical take as well as a more natural relaxed luxury feel, with sheers seen in abstract animal georgettes, African printed meshes, and geometric printed voiles. This seasonal segment benefits from continuous product development as brands innovate with performance fabrics, moisture-wicking technologies, and UV-protective materials.

The summer wear category encompasses diverse product offerings from casual shorts and polos through tailored linen ensembles suitable for warm-weather formal occasions. Consumer spending concentrates on breathable shirts, lightweight trousers, and versatile footwear capable of transitioning between beach, office, and social environments. Coastal tourism and outdoor lifestyle orientations further amplify demand for summer-focused menswear collections throughout the year.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Exclusive Stores

- Multi-Brand Retail Outlets

- Online Stores

- Others

Multi-brand retail outlets exhibit a clear dominance with a 28% share of the total South Africa menswear market in 2025.

Multi-brand retail outlets maintain market leadership by offering comprehensive product assortments enabling consumers to compare styles, quality, and pricing across multiple labels within unified shopping environments. These retail formats leverage extensive store networks, established consumer trust, and integrated credit facilities that facilitate accessible purchasing for value-conscious shoppers. The concentration of fashion retail in mall environments enhances foot traffic and impulse purchasing opportunities.

The multi-brand format addresses diverse consumer preferences by curating product ranges spanning value to premium price segments within accessible locations. Retailers have strengthened their competitive positioning through loyalty programs, store credit offerings, and enhanced in-store experiences. The channel benefits from established distribution infrastructure and brand recognition, although evolving consumer behaviors are driving investments in omnichannel capabilities to complement physical retail presence.

Province Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Gauteng dominates the South African menswear market, driven by the concentration of economic activity in Johannesburg and Pretoria metropolitan areas. The South African online retail fashion sector is dominated by major cities like Johannesburg, Cape Town, and Durban because of their high levels of economic activity, urbanization, and population density. The province’s high urban population density, substantial corporate employment base, and concentration of premium retail developments create favorable demand conditions across all menswear categories. Major fashion retailers maintain flagship presence in Gauteng, ensuring comprehensive product availability and consumer access to latest collections.

KwaZulu-Natal represents a significant market anchored by the Durban metropolitan area, where coastal lifestyle orientations influence menswear preferences toward casual and resort-inspired styling.

Western Cape functions as South Africa's fashion capital, with Cape Town hosting major fashion events and designer communities that influence national styling trends. Provincial fashion councils in South Africa's cities including the Cape Town, KwaZulu-Natal, and Gauteng Fashion Councils have been established with goals to help communities gain success through finance or creative expression while gaining international recognition. The province attracts style-conscious consumers and benefits from tourism-driven retail opportunities in central business districts and waterfront developments.

Mpumalanga demonstrates emerging retail potential as population growth and economic development expand consumer spending capacity. The province’s proximity to Gauteng enables consumer access to metropolitan retail offerings while local retail infrastructure develops to serve growing demand for accessible fashion options.

Eastern Cape represents developing market opportunities, with urban centers supporting organized menswear retail. Demographic characteristics and income levels influence preference for value-oriented fashion offerings from established retail chains with provincial presence.

Market Dynamics:

Growth Drivers:

Why is the South Africa Menswear Market Growing?

Urbanization and Rising Middle Class Driving Consumption

Accelerating urbanization continues transforming South African consumer demographics, concentrating purchasing power in metropolitan areas where fashion consciousness and retail accessibility converge. Growing middle class population with increasing levels of disposable income driven by rapid urbanization and industrialization and the thriving e-commerce sector are expected to drive South Africa Apparel Market during the forecast period. Urban environments foster exposure to contemporary styling trends through media, workplace interactions, and retail marketing, intensifying consumer desire for updated wardrobes. Shopping mall developments in metropolitan centers have created accessible fashion retail ecosystems enabling convenient purchasing. The concentration of professional employment in urban areas creates sustained demand for smart-casual and formal menswear suitable for corporate environments, while social activities drive complementary casual purchases.

Young Population Seeking Contemporary Fashion

South Africa's youthful demographic structure creates substantial market opportunity as young consumers demonstrate heightened fashion consciousness and willingness to invest in personal style. This demographic cohort, entering workforce participation without dependent obligations, allocates greater discretionary spending toward fashion purchases. Social media influence accelerates trend adoption among young consumers who seek garments aligned with digital culture aesthetics. Retailers are developing targeted collections and marketing strategies addressing youthful preferences for bold styling, brand authenticity, and value propositions that resonate with emerging consumer priorities.

E-Commerce Expansion Enhancing Market Accessibility

Digital commerce transformation is fundamentally reshaping menswear distribution, enabling broader consumer access beyond traditional retail catchment limitations. The e-commerce segment is driven by increased internet penetration and digital payment adoption. Online platforms offer convenience, comprehensive product discovery, and competitive pricing that attract time-constrained and value-conscious consumers. Fashion retailers are investing substantially in omnichannel capabilities, integrating digital and physical touchpoints to deliver seamless shopping experiences. Mobile commerce growth particularly expands market reach among younger demographics who demonstrate preference for smartphone-based purchasing behaviors, while digital marketing enables targeted customer acquisition across geographic boundaries.

Market Restraints:

What Challenges the South Africa Menswear Market is Facing?

Competition from Cheap Imports

The influx of low-cost imported apparel continues pressuring domestic manufacturing and retail margins, particularly as economically constrained consumers prioritize affordability. The industry faces stiff competition from imports, which, while providing cheaper options for consumers facing financial hardships, threaten local manufacturers. International fast-fashion platforms have intensified price competition, compelling local retailers to compress margins while managing quality expectations.

Infrastructure and Operational Challenges

Power supply instability and logistics infrastructure limitations impose significant operational burdens on retail and manufacturing operations throughout the menswear value chain. Unreliable electricity supply disrupts production schedules, increases operational costs through backup power requirements, and reduces manufacturing output capacity. Port congestion and transportation network inefficiencies delay fabric and raw material deliveries, creating supply chain bottlenecks that affect inventory replenishment cycles and retail stock availability. These compounding infrastructure constraints elevate production costs, complicate demand forecasting, reduce operational efficiency, and ultimately diminish profit margins while hindering the sector's competitive positioning against imported alternatives.

Economic Pressures on Consumer Spending

Macroeconomic headwinds including elevated inflation and interest rates continue constraining consumer discretionary expenditure on fashion purchases. The South African Reserve Bank has raised interest rates multiple times to combat persistently high inflation and high fuel costs and elevated food prices continue to squeeze consumer wallets. These pressures redirect spending toward essential categories while limiting fashion purchase frequency and average transaction values.

Competitive Landscape:

The South African menswear market operates within a moderately consolidated competitive environment, featuring established domestic retail groups alongside expanding international fashion entrants. Major players maintain extensive store networks and diversified brand portfolios addressing varied consumer segments across value through premium positioning. International partnerships are intensifying competitive dynamics, with franchise agreements and brand launches introducing global fashion propositions to local consumers. Omnichannel investment priorities reflect recognition that digital commerce integration represents essential competitive capability. Retailers differentiate through brand curation, credit accessibility, loyalty programming, and exclusive collections developed through designer collaborations.

South Africa Menswear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Trousers, Denims, Shirts and T-Shirts, Ethnic Wear, Others |

| Seasons Covered | Summer Wear, Winter Wear, All-Season Wear |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Exclusive Stores, Multi-Brand Retail Outlets, Online Stores, Others |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Africa Menswear market size was valued at USD 4.59 Billion in 2025.

The South Africa Menswear market is expected to grow at a compound annual growth rate of 4.82% from 2026-2034 to reach USD 7.01 Billion by 2034.

Shirts and T-Shirts held the largest product type share at 38% in 2025, driven by their versatility across casual and semi-formal occasions and the growing preference for comfortable everyday wear among style-conscious consumers.

Key factors driving the South Africa Menswear market include rising urbanization concentrating consumer purchasing power in metropolitan areas, a youthful demographic structure seeking contemporary fashion, expanding e-commerce channels enhancing market accessibility, and strategic international brand partnerships strengthening retail offerings.

Major challenges include intense competition from low-cost imported apparel pressuring domestic manufacturers and retailers, infrastructure constraints including power supply instability and logistics bottlenecks, economic pressures from elevated inflation and interest rates constraining consumer discretionary spending, and competition from international fast-fashion platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)