South Africa Mushroom Market Size, Share, Trends and Forecast by Mushroom Type, Form, Distribution Channel, End Use, and Province, 2025-2033

South Africa Mushroom Market Overview:

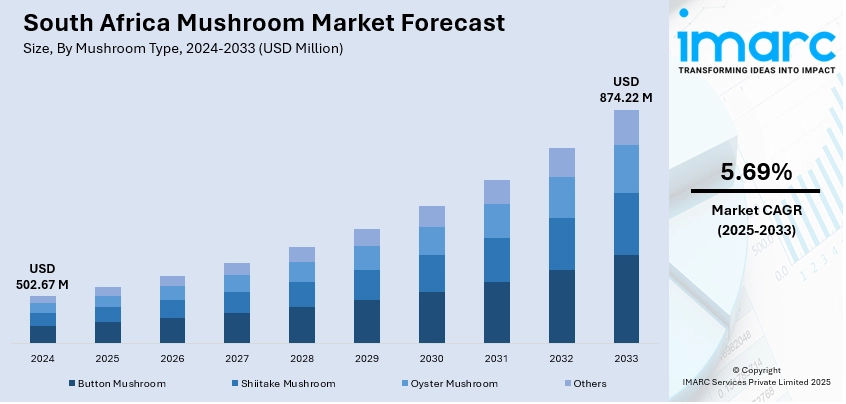

The South Africa mushroom market size reached USD 502.67 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 874.22 Million by 2033, exhibiting a growth rate (CAGR) of 5.69% during 2025-2033. The mushroom market in South Africa is growing owing to advancements in farming techniques like controlled-environment agriculture and hydroponics, supporting sustainability. Additionally, emergence of various retail channels, both in stores and online, are improving consumer access, further expanding the South Africa mushroom market share and meeting the rising demand for convenient, eco-friendly options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 502.67 Million |

| Market Forecast in 2033 | USD 874.22 Million |

| Market Growth Rate 2025-2033 | 5.69% |

South Africa Mushroom Market Trends:

Agricultural Advancements and Sustainable Practices

The South African mushroom industry is gaining from improvements in farming methods and an increasing focus on sustainable agricultural practices. Advancements like controlled-environment agriculture and hydroponics are facilitating higher yields and steadier mushroom production, even in urban settings. This is broadening the market reach by enabling mushroom farming to be more accessible and feasible in areas that were once unsuitable. The growing emphasis on sustainability is emerging as a crucial factor in the industry, where methods like utilizing organic waste for mushroom farming not only minimize waste but also support a circular economy. These environment-friendly practices match the rising consumer demand for food cultivated sustainably. For instance, the University of Pretoria (UP) initiated a project in 2025 to cultivate white button mushrooms in converted shipping containers, with the goal of establishing portable, small-scale mushroom farms. Under the direction of Prof. Lise Korsten, the project not only offers a sustainable substitute for peat but also assists the Student Nutrition and Progress Programme (SNAPP) by providing fresh mushrooms to students in need. Furthermore, mushrooms are becoming increasingly favored by farmers because they need less water and resources than other crops, reinforcing their status as an eco-friendly choice. With consumers placing greater importance on sustainability in their food selections, the demand for mushrooms cultivated through these practices is expanding.

To get more information on this market, Request Sample

Expansion of Retail Channels

The mushroom market in South Africa is experiencing notable growth as retail channels expand, enhancing accessibility for a broader range of consumers. Supermarkets, convenience stores, and e-commerce sites provide an assortment of fresh, packaged, and enhanced mushroom products, appealing to diverse consumer tastes. The evolution of contemporary retail infrastructure, especially in cities, is increasing the accessibility of mushrooms in various forms, simplifying the process for consumers to discover products that meet their requirements. The growing number of e-commerce platforms is enabling consumers to purchase fresh mushrooms straight from producers, improving convenience and facilitating direct-to-consumer (DTC) sales. This wider distribution, via both physical and online platforms, is contributing to the South Africa mushroom market growth by accessing a larger and more varied audience. The IMARC Group stated that the South African e-commerce sector attained USD 187.60 Billion by 2024, highlighting the swift growth of online shopping within the nation. With the expansion of e-commerce, mushroom producers can explore new markets and consumer groups, allowing increased access to fresh mushrooms and fostering industry-wide growth. The growing accessibility and ease of buying mushrooms, whether in physical stores or online, is offering a favorable market outlook.

South Africa Mushroom Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on mushroom type, form, distribution channel, and end use.

Mushroom Type Insights:

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Others

The report has provided a detailed breakup and analysis of the market based on the mushroom type. This includes button mushroom, shiitake mushroom, oyster mushroom, and others.

Form Insights:

- Fresh Mushroom

- Canned Mushroom

- Dried Mushroom

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes fresh mushroom, canned mushroom, dried mushroom, and others.

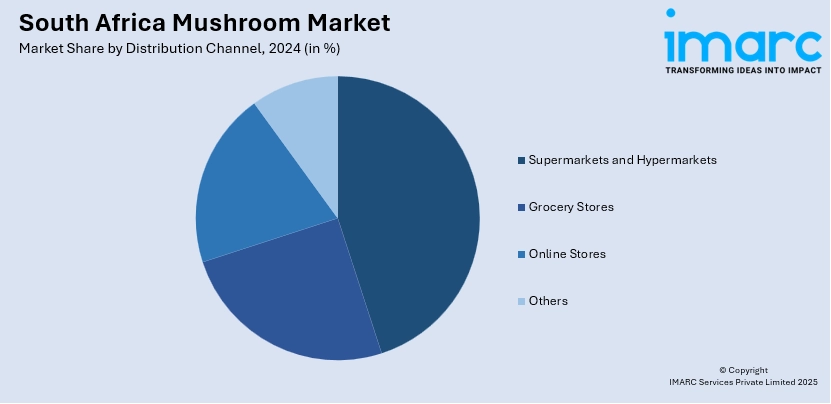

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, grocery stores, online stores, and others.

End Use Insights:

- Food Processing Industry

- Food Service Sector

- Direct Consumption

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes food processing industry, food service sector, direct consumption, and others.

Provinceial Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Mushroom Market News:

- In May 2025, South Africa’s Mother of Peace launched a R400,000 fundraising campaign to expand its successful oyster mushroom farm. This project, vital for supporting over 60 children in need, aims to boost long-term sustainability through income-generating initiatives.

- In February 2024, the South African Mushroom Farmers' Conference in Johannesburg featured insightful discussions, including a panel on composting. The event honored Dr. Martmarie for her 30+ years of contributions to the industry. Mush Comb emphasized the importance of collaboration and knowledge sharing at this inspiring gathering.

South Africa Mushroom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mushroom Types Covered | Button Mushroom, Shiitake Mushroom, Oyster Mushroom, Others |

| Forms Covered | Fresh Mushroom, Canned Mushroom, Dried Mushroom, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Online Stores, Others |

| End Uses Covered | Food Processing Industry, Food Service Sector, Direct Consumption, Others |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa mushroom market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa mushroom market on the basis of mushroom type?

- What is the breakup of the South Africa mushroom market on the basis of form?

- What is the breakup of the South Africa mushroom market on the basis of distribution channel?

- What is the breakup of the South Africa mushroom market on the basis of end use?

- What is the breakup of the South Africa mushroom market on the basis of province?

- What are the various stages in the value chain of the South Africa mushroom market?

- What are the key driving factors and challenges in the South Africa mushroom market?

- What is the structure of the South Africa mushroom market and who are the key players?

- What is the degree of competition in the South Africa mushroom market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa mushroom market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa mushroom market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa mushroom industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)