South Africa Organic Food and Beverages Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Province, 2026-2034

South Africa Organic Food and Beverages Market Summary:

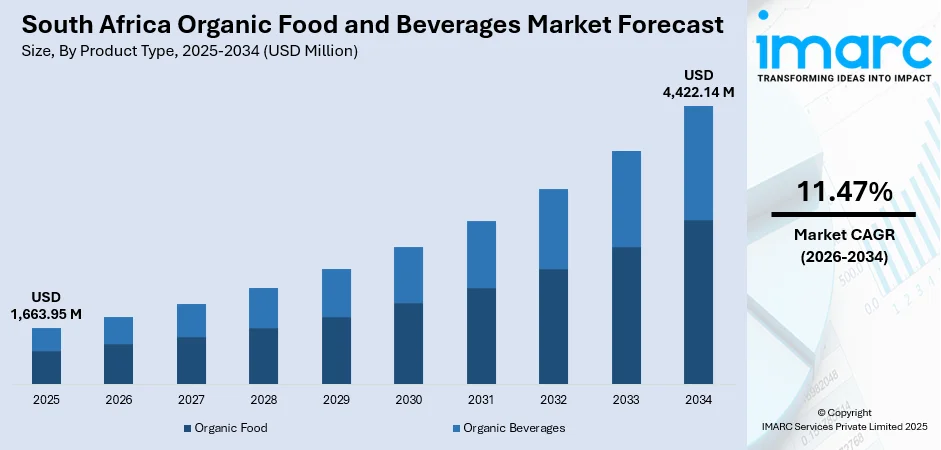

The South Africa organic food and beverages market size was valued at USD 1,663.95 Million in 2025 and is projected to reach USD 4,422.14 Million by 2034, growing at a compound annual growth rate of 11.47% from 2026-2034.

The South Africa organic food and beverages market is experiencing robust expansion driven by rising health consciousness among urban consumers and increasing awareness of sustainable agricultural practices. The market benefits from growing middle-class purchasing power, expanding retail infrastructure, and strengthening local organic farming initiatives across the nation's diverse agricultural regions.

Key Takeaways and Insights:

-

By Product Type: Organic food dominates the market with a share of 65% in 2025, driven by strong consumer demand for organic fruits, vegetables, dairy products, and processed foods that align with health-conscious dietary preferences.

-

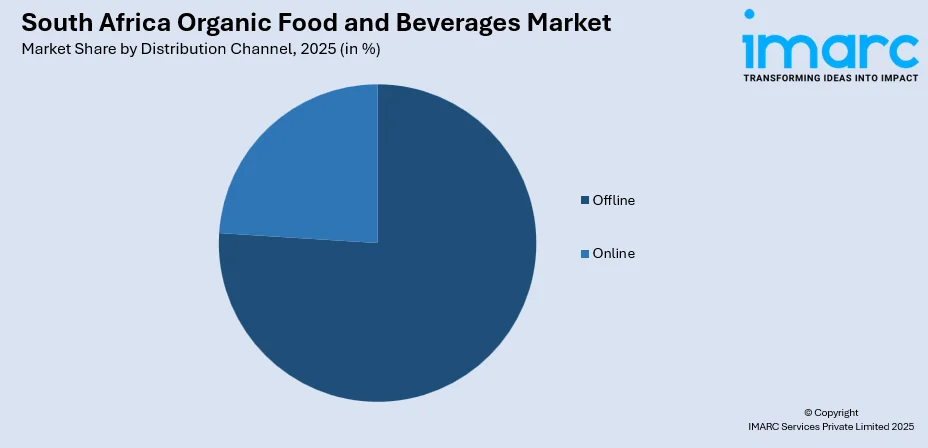

By Distribution Channel: Offline channels lead the market with a share of 75.63% in 2025, supported by extensive supermarket networks, specialty health food stores, and thriving farmers' markets across major metropolitan areas.

-

Key Players: The South Africa organic food and beverages market exhibits a fragmented competitive landscape, with established retailers, local organic producers, and specialty health food distributors competing alongside emerging direct-to-consumer brands.

To get more information on this market Request Sample

South Africa's organic food and beverages industry is positioned at the intersection of agricultural innovation and evolving consumer wellness priorities. The market landscape encompasses diverse product categories ranging from certified organic produce sourced from local farms to imported specialty items meeting international organic standards. Urban centers, particularly Johannesburg, Cape Town, and Durban, serve as primary consumption hubs where affluent demographics demonstrate strong willingness to pay premium prices for organic alternatives. In 2024, the Western Cape Department of Agriculture expanded its Sustainable Agriculture Programme to support small organic farmers with training and market access initiatives, boosting participation in certified organic value chains. The regulatory framework continues strengthening through the South African Organic Sector Organisation and various participatory guarantee systems that provide certification pathways for local producers. The foodservice sector increasingly incorporates organic ingredients to cater to health-conscious patrons, while institutional procurement programs explore organic options for schools and healthcare facilities.

South Africa Organic Food and Beverages Market Trends:

Expansion of Urban Organic Farming Initiatives

South African cities witness growing establishment of urban food gardens and community-supported agriculture programs that supply fresh organic produce to local markets. These initiatives connect urban consumers directly with sustainable farming practices while addressing food security challenges in underserved communities through education and skill development programs. For instance, in 2024–25 the South African Urban Food & Farming Trust (SAUFFT) has supported over 1,500 urban-area farmers across more than 230 growing sites, helping expand access to fresh produce and build community resilience.

Rising Popularity of Organic Box Delivery Services

Subscription-based organic produce delivery services gain traction among time-constrained urban professionals seeking convenient access to fresh, locally-sourced organic products. In South Africa, for example, subscription platforms such as Orchard Food (servicing areas including Pretoria and Johannesburg) now offer weekly or bi-weekly veggie/fruit boxes sourced from small-scale organic farms and delivered directly to customers. These platforms aggregate supply from small-scale organic farmers while providing consistent market access and fair pricing arrangements that support sustainable agricultural livelihoods.

Integration of Indigenous and Traditional Food Products

Consumer interest expands toward organically cultivated indigenous crops and traditional African food products that offer nutritional benefits and cultural significance. This shift is gaining momentum, especially after a landmark 2025 policy decision in July 2025, when the government officially declared indigenous crops and medicinal plants as formal “agricultural products,” a move estimated to unlock an annual indigenouscrop economy worth around R 12 billion. Market participants develop product lines featuring indigenous superfoods, heritage grains, and traditional preparations that align with organic principles while preserving agricultural biodiversity.

Market Outlook 2026-2034:

The South Africa organic food and beverages market demonstrates favorable growth prospects throughout the forecast period, supported by strengthening consumer awareness, expanding retail presence, and maturing local organic supply chains. Government initiatives promoting sustainable agriculture and private sector investments in organic farming infrastructure contribute to enhanced production capacity and product availability. The market generated a revenue of USD 1,663.95 Million in 2025 and is projected to reach a revenue of USD 4,422.14 Million by 2034, growing at a compound annual growth rate of 11.47% from 2026-2034.

South Africa Organic Food and Beverages Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Organic Food | 65% |

| Distribution Channel | Offline | 75.63% |

Product Type Insights:

- Organic Food

- Organic Fruits and Vegetables

- Organic Meat, Fish and Poultry

- Organic Dairy Products

- Organic Frozen and Processed Foods

- Others

- Organic Beverages

- Fruit and Vegetable Juices

- Dairy

- Coffee

- Tea

- Others

The organic food dominates with a market share of 65% of the total South Africa organic food and beverages market in 2025.

The organic food segment encompasses diverse product categories including fresh fruits and vegetables, dairy products, meat and poultry, and processed food items that meet certified organic standards. In 2024, SAOSO and PGS SA launched a nationwide programme in South Africa to train smallholder organic farmers, expand certification access, and enable more farms to join the certified-organic supply chain. South African consumers demonstrate particular preference for organic produce, driven by concerns about pesticide residues and nutritional quality.

Local organic farms across the Western Cape, Gauteng, and KwaZulu-Natal provinces supply fresh produce to urban markets through established distribution networks. The segment benefits from expanding certification infrastructure and growing farmer participation in organic production systems that ensure traceability and quality assurance throughout the supply chain.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

The offline leads with a share of 75.63% of the total South Africa organic food and beverages market in 2025.

Offline channels encompass supermarket chains, hypermarkets, specialty health food stores, farmers' markets, and organic-focused retail outlets that provide consumers with direct product inspection and immediate purchase convenience. As of October 2025, South Africa has 93 dedicated organicfood stores nationwide, with the highest concentrations in Gauteng, Western Cape, and KwaZuluNatal. Major retailers increasingly dedicate shelf space to organic product ranges.

Farmers' markets across Johannesburg, Cape Town, Durban, and other urban centers serve as important distribution points connecting local organic producers directly with consumers. These venues foster community engagement around sustainable food systems while providing small-scale farmers with viable market access and premium pricing opportunities.

Provincial Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Gauteng province represents South Africa's largest organic food consumption market, anchored by the Johannesburg-Pretoria metropolitan complex with its affluent consumer base and extensive retail infrastructure. The region hosts numerous organic farmers' markets, specialty health food retailers, and urban farming initiatives that connect health-conscious consumers with locally-sourced organic products.

KwaZulu-Natal's organic market centers on the Durban metropolitan area and Midlands region, featuring vibrant farmers' markets and specialty food outlets serving health-conscious consumers. The province's subtropical climate supports diverse organic crop cultivation, while coastal tourism drives demand for organic dining experiences in the hospitality sector.

Western Cape dominates organic production in South Africa, with Cape Town serving as a hub for organic innovation and sustainable food culture. The region benefits from Mediterranean-like climate conditions ideal for diverse crop production, established participatory guarantee systems for organic certification, and strong consumer engagement through prominent farmers' markets and community-supported agriculture programs.

Mpumalanga province contributes to organic supply through its subtropical fruit production regions, including organically cultivated bananas, avocados, and macadamia nuts. The province's agricultural diversity and proximity to Gauteng markets position it as an emerging organic production hub with growing participation in sustainable farming certification programs.

Eastern Cape presents growth opportunities in organic citrus, deciduous fruits, and pineapple production leveraging the province's favorable climatic conditions. The region's agricultural transformation initiatives increasingly incorporate organic farming principles while supporting smallholder farmers through training programs and market access facilitation.

The remaining provinces, including Free State, Limpopo, North West, and Northern Cape, contribute to national organic supply through specialized production suited to local agricultural conditions. These regions focus on organic grain cultivation, livestock production, and niche crops while developing distribution linkages to major urban consumption centers.

Market Dynamics:

Growth Drivers:

Why is the South Africa Organic Food and Beverages Market Growing?

Rising Health Consciousness Among Urban Consumers

South African consumers increasingly prioritize health and wellness in dietary choices, driving demand for organic products perceived as safer and more nutritious alternatives to conventionally produced foods. According to the 2025 PwC “Voice of the Consumer” survey, 75 % of respondents expressed concern about pesticide use and ultraprocessed ingredients, and 70 % said they plan to eat more fresh produce in the coming months. Growing awareness of links between pesticide exposure and health risks motivates preference for organic options, particularly among families with young children and health-focused demographics. The expanding middle class demonstrates willingness to pay premium prices for products aligned with wellness objectives, supporting market expansion across urban centers.

Strengthening Local Organic Production and Certification Infrastructure

The organic sector benefits from maturing certification systems, including participatory guarantee schemes registered with international organic bodies, that provide accessible pathways for local farmers to achieve recognized organic status. Small-scale farmers increasingly participate in organic production networks that offer technical support, market connections, and premium pricing opportunities. Government and non-governmental initiatives promote sustainable agriculture practices that align with organic principles, expanding the domestic production base.

Expanding Retail and Distribution Networks

Major retail chains expand organic product offerings in response to demonstrated consumer demand, dedicating increased shelf space to certified organic ranges across food categories. The South African retail market reached USD 134.96 billion in 2024, highlighting the scale and potential of formal retail channels for organic products. Looking forward, IMARC Group expects the market to reach USD 213.36 billion by 2033, exhibiting a growth rate (CAGR) of 5.22% during 2025–2033. Specialty health food stores proliferate in affluent urban neighborhoods, providing curated organic product selections. Farmers' markets establish regular operations in metropolitan areas, creating direct producer-consumer connections that support local organic supply chains while building consumer awareness and loyalty.

Market Restraints:

What Challenges the South Africa Organic Food and Beverages Market is Facing?

Premium Pricing Limiting Mass Market Accessibility

Organic products command significant price premiums over conventional alternatives, restricting market penetration beyond affluent consumer segments. Economic pressures and cost-of-living concerns constrain household budgets, prioritizing affordability over organic preferences for many South African families.

Limited Consumer Awareness in Broader Population

Understanding of organic production principles and associated benefits remains concentrated among educated urban consumers, while broader population segments demonstrate limited awareness or skepticism regarding organic claims. Inconsistent labeling practices and certification confusion undermine consumer confidence in organic product authenticity.

Supply Chain and Distribution Challenges

Organic producers face logistical challenges in maintaining product integrity through distribution networks that may lack dedicated organic handling protocols. Geographic distances between production regions and urban consumption centers increase costs and complicate freshness maintenance for perishable organic products.

Competitive Landscape:

The South Africa organic food and beverages market features a fragmented competitive structure comprising large retail chains with private label organic ranges, specialty health food retailers, independent organic producers and distributors, and direct-to-consumer brands leveraging e-commerce platforms. Market participants differentiate through product quality, certification credentials, sourcing transparency, and sustainability narratives that resonate with target consumers. Local organic producers compete on freshness and provenance while imported organic products offer variety and brand recognition. Strategic initiatives focus on supply chain development, consumer education, and distribution expansion to capture growing demand across product categories.

Recent Developments:

-

In September 2025, Westfalia Fruit unveiled its new sustainable packaging, following recognition at the inaugural South African Food and Beverage Awards. The update highlights the company’s focus on innovation, food-safety compliance, and environmentally responsible practices, reinforcing its leadership position in the processed food and ingredient sector.

-

In October 2024, PureFinest prepared to enter Africa with its organic vitamin, sports, and vitality beverages across Nigeria and multiple regions. Made for health-focused consumers, the drinks blend Austrian spring water, moringa, guarana, maca, hibiscus, and acerola to boost energy and immunity.

South Africa Organic Food and Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Africa organic food and beverages market size was valued at USD 1,663.95 Million in 2025.

The South Africa organic food and beverages market is expected to grow at a compound annual growth rate of 11.47% from 2026-2034 to reach USD 4,422.14 Million by 2034.

Organic food dominated the South Africa organic food and beverages market with a share of 65%, driven by strong consumer demand for organic fruits, vegetables, dairy products, and processed foods.

Key factors driving the South Africa organic food and beverages market include rising health consciousness among urban consumers, strengthening local organic production and certification infrastructure, and expanding retail and distribution networks.

Major challenges include premium pricing limiting mass market accessibility, limited consumer awareness in broader population segments, supply chain and distribution challenges, and competition from conventional products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)