South Africa Palm Oil Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

South Africa Palm Oil Market Overview:

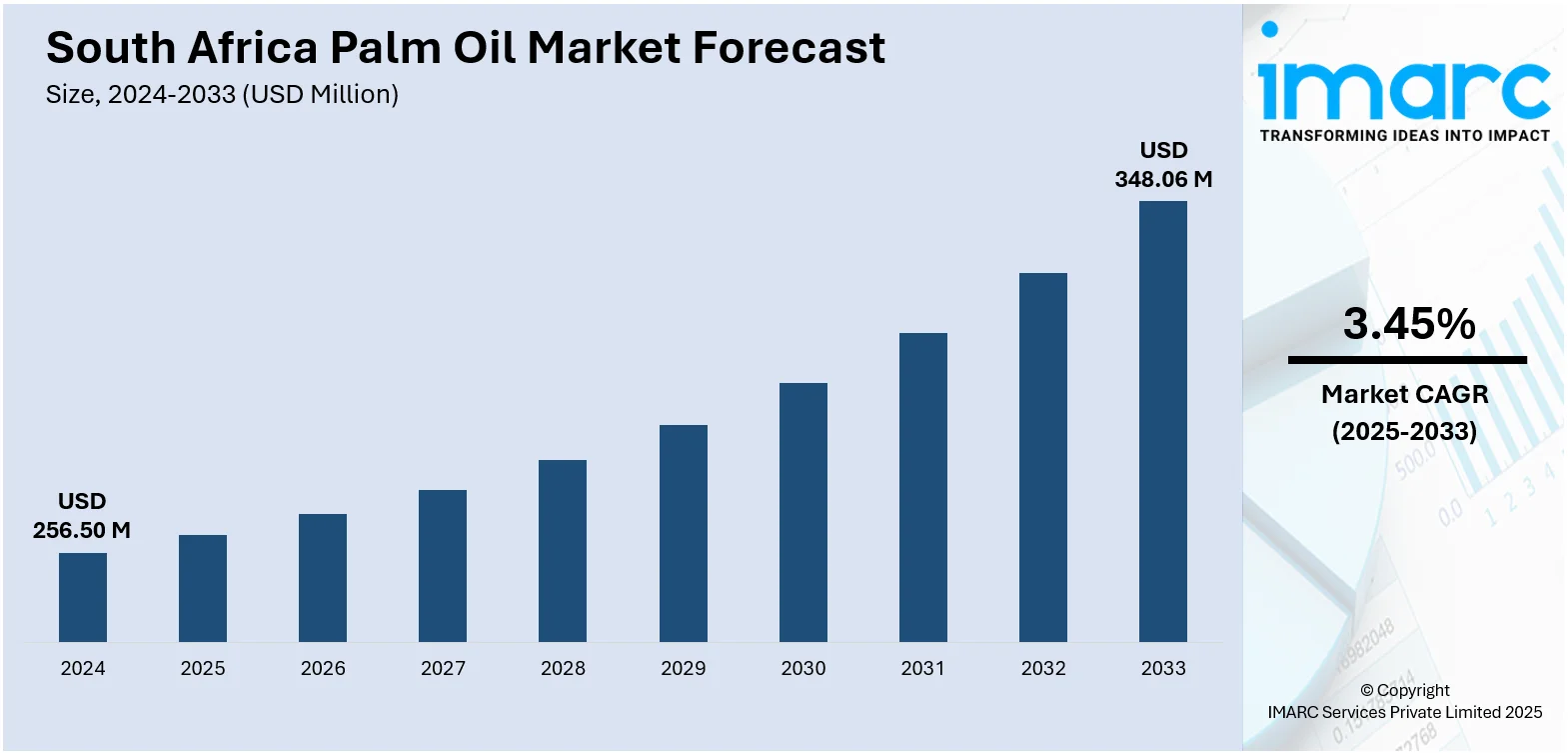

The South Africa palm oil market size reached USD 256.50 Million in 2024. Looking forward, the market is projected to reach USD 348.06 Million by 2033, exhibiting a growth rate (CAGR) of 3.45% during 2025-2033. The market is witnessing steady growth driven by increasing demand from the food processing, personal care, and biofuel sectors. Rising urbanization and changing dietary habits are supporting greater consumption of processed foods, boosting palm oil usage. Manufacturers are focusing on sustainable sourcing to align with environmental standards, while ongoing investments in refining and distribution infrastructure are enhancing market efficiency, contributing to the steady expansion of the South Africa palm oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 256.50 Million |

| Market Forecast in 2033 | USD 348.06 Million |

| Market Growth Rate 2025-2033 | 3.45% |

South Africa Palm Oil Market Trends:

Shift Toward Sustainable Sourcing

South African palm oil industry is experiencing a sharp transition towards sustainable procurement practices. Consumers are gravitating towards ethically sourced products, which is pushing manufacturers to adopt green procurement techniques. Therefore, companies are actively seeking certifications like RSPO (Roundtable on Sustainable Palm Oil) to demonstrate their environmental concern and gain consumer confidence. For instance, in April 2024, the Roundtable on Sustainable Palm Oil (RSPO) is hosting its first Africa Downstream Supply Chain Forum in Cape Town. The event aims to promote sustainability among downstream palm oil suppliers in Africa by increasing the adoption of RSPO Certified Sustainable Palm Oil (CSPO). This change is driven not only by environmental advocacy but also by global trade expectations and corporate sustainability objectives. Retailers and food manufacturers are reformulating their product lines to incorporate sustainably sourced palm oil aligning their operations with green policies. Additionally, sustainable sourcing is being woven into supply chain strategies to guarantee long-term availability and compliance with changing regulations. These initiatives are transforming the industry's landscape and are a significant factor in the ongoing South Africa palm oil market growth.

To get more information on this market, Request Sample

Expansion of Domestic Refining Capacity

The palm oil market in South Africa is undergoing a significant change as investments in domestic refining infrastructure increase. This strategic move is intended to enhance local value addition by processing crude palm oil domestically thus decreasing dependence on imported refined products. For instance, in May 2024, Wilmar Processing launched Phase 1 of its USD 68M edible oils refining plant in Richards Bay, South Africa featuring four 40,000-ton tanks for palm oil. The plant aims to refine and package various products integrating local supply chains while sourcing 20% of raw materials domestically enhancing local agricultural production. Domestic refining not only elevates industrial self-sufficiency but also creates job opportunities and supports related sectors such as packaging and logistics. By improving and expanding refining facilities companies in the industry can achieve the specific quality standards needed by food processors and cosmetic manufacturers which in turn boosts the overall competitiveness of locally produced palm oil. Additionally, enhanced refining capacity allows for quicker responses to fluctuations in market demand and supply aiding in price stabilization and ensuring product availability. These infrastructure improvements are positioning South Africa as a more resilient participant in the regional supply chain fostering long-term stability and growth in the palm oil sector.

South Africa Palm Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application.

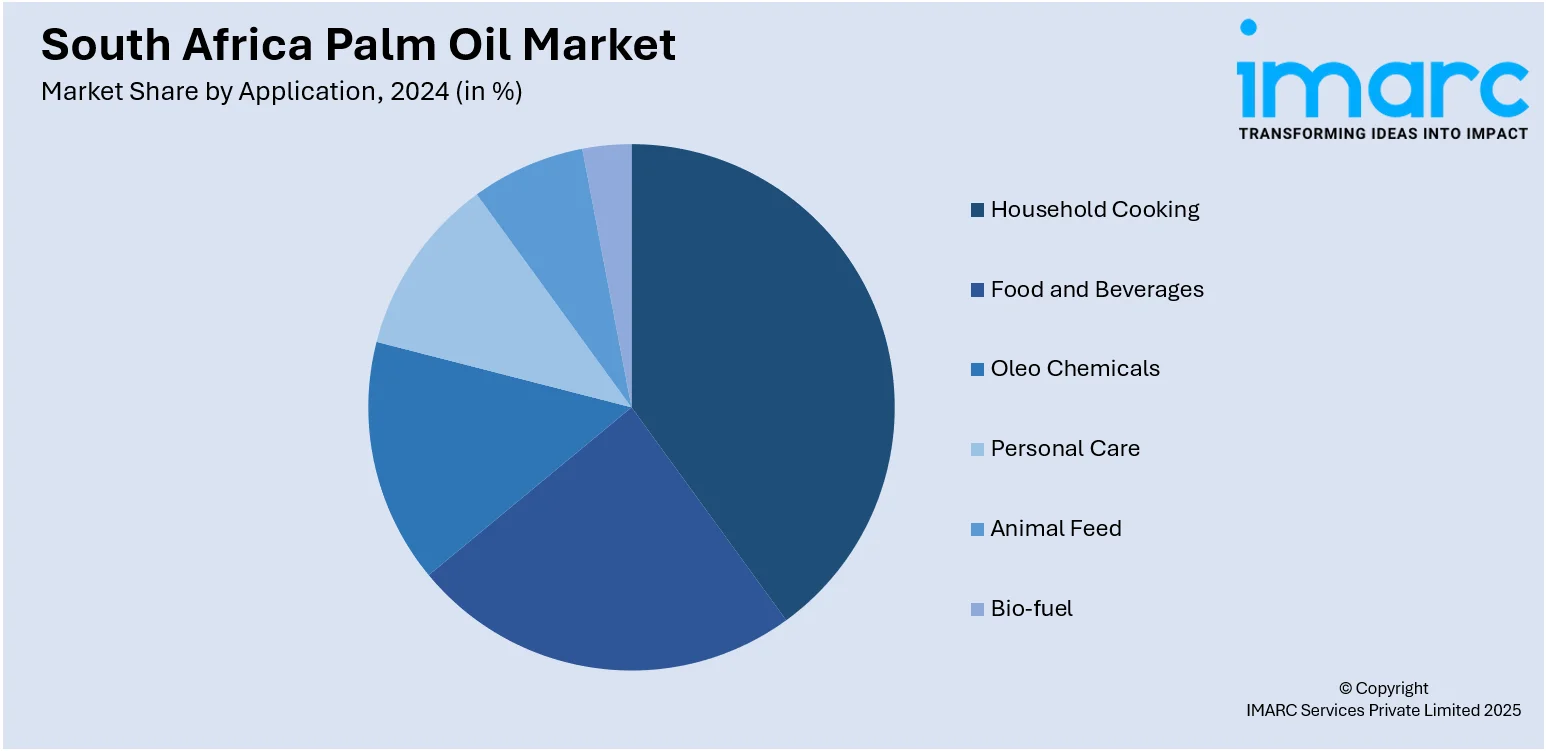

Application Insights:

- Household Cooking

- Food and Beverages

- Oleo Chemicals

- Personal Care

- Animal Feed

- Bio-fuel

The report has provided a detailed breakup and analysis of the market based on the application. This includes household cooking, food and beverages, oleo chemicals, personal care, animal feed, and bio-fuel.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Palm Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Household Cooking, Food and Beverages, Oleo Chemicals, Personal Care, Animal Feed, Bio-fuel |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa palm oil market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa palm oil market on the basis of application?

- What is the breakup of the South Africa palm oil market on the basis of region?

- What are the various stages in the value chain of the South Africa palm oil market?

- What are the key driving factors and challenges in the South Africa palm oil market?

- What is the structure of the South Africa palm oil market and who are the key players?

- What is the degree of competition in the South Africa palm oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa palm oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa palm oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa palm oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)