South Africa Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Region, 2025-2033

South Africa Paper Packaging Market Overview:

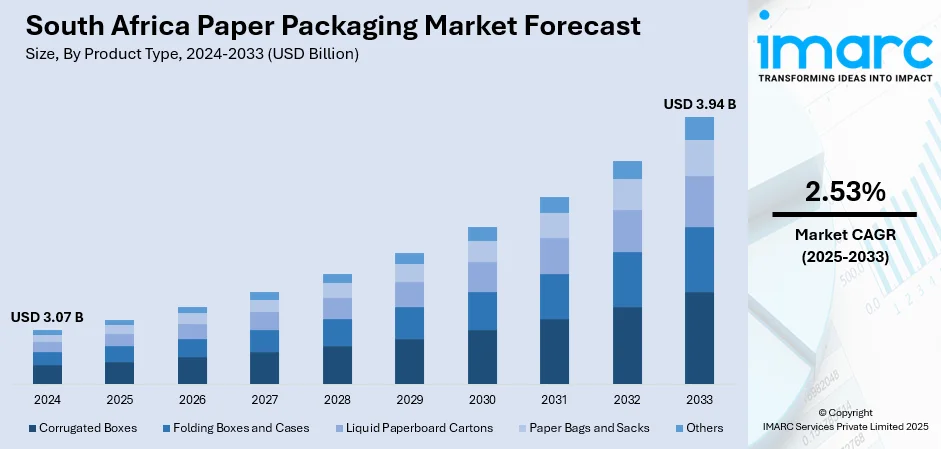

The South Africa paper packaging market size reached USD 3.07 Billion in 2024. The market is projected to reach USD 3.94 Billion by 2033, exhibiting a growth rate (CAGR) of 2.53% during 2025-2033. The market is driven by stricter environmental regulations discouraging single‑use plastics, alongside growing consumer preference for recyclable and biodegradable packaging. The expansion of e‑commerce and food delivery services fuels demand for durable, sustainable packaging like corrugated boxes, bags, and cartons. Additionally, advancements in domestic manufacturing, improved logistics infrastructure, and innovations in paper quality and recycling strengthen local production capacity thus aiding the South Africa paper packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.07 Billion |

| Market Forecast in 2033 | USD 3.94 Billion |

| Market Growth Rate 2025-2033 | 2.53% |

South Africa Paper Packaging Market Trends:

Booming e‑commerce & food delivery sectors

The growing adoption of online shopping and food delivery services in South Africa is driving strong demand for paper‑based packaging. As more people order products and meals for home delivery, businesses are turning to paper packaging for its reliability, affordability, and eco‑friendly reputation. Corrugated boxes and folding cartons are popular for shipping goods safely, while paper bags and wraps are widely used for takeaway food. In the food sector, the emphasis on hygiene, convenience, and sustainable disposal makes paper packaging an ideal choice. The rise in modern urban lifestyles and changing consumer habits is fueling the need for packaging solutions that are not only functional and protective but also environmentally responsible, making paper a preferred material for businesses operating in these sectors.

To get more information on this market, Request Sample

Regulatory push and environmental awareness

Government regulations and rising public concern for the environment is another key South Africa paper packaging market trend. Authorities are discouraging single‑use plastics through stricter policies while encouraging recyclable and biodegradable materials. Consumers are also becoming more eco‑conscious, preferring packaging that supports sustainability and waste reduction. This shift has prompted retailers, food outlets, and manufacturers to adopt paper‑based alternatives for bags, boxes, and cartons. On the recycling front, the country recovered about 1.15 million tonnes of paper and packaging in 2021, achieving a 61–70% recovery rate, highlighting the strong use of recycled content in production. Companies are further responding to global supply‑chain expectations for eco‑friendly solutions. Together, these regulatory, cultural, and recycling advancements make paper packaging an increasingly attractive choice for businesses balancing compliance, sustainability, and customer demands.

Infrastructure growth, domestic manufacturing & innovation

South Africa’s improving industrial and logistics infrastructure is giving a strong boost to the paper packaging market. Local manufacturers are expanding operations to meet rising demand, supported by better transport links, upgraded production facilities, and stronger supply networks. Established players are also focusing on innovation, introducing new types of paper packaging with improved durability, moisture resistance, and aesthetic appeal. These advances allow paper products to compete with plastic in functionality while retaining their eco‑friendly edge. Furthermore, investment in recycling technology and sustainable raw materials is making the paper packaging industry more resilient and future‑ready. Together, these developments create a favorable environment for growth, helping businesses deliver high‑quality, sustainable packaging solutions for sectors like retail, e‑commerce, food, and manufacturing thus aiding the South Africa paper packaging market growth.

South Africa Paper Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, grade, packaging level, and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes solid bleached, coated recycled, uncoated recycled, and others.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

A detailed breakup and analysis of the market based on the packaging level have also been provided in the report. This includes primary packaging, secondary packaging, and tertiary packaging.

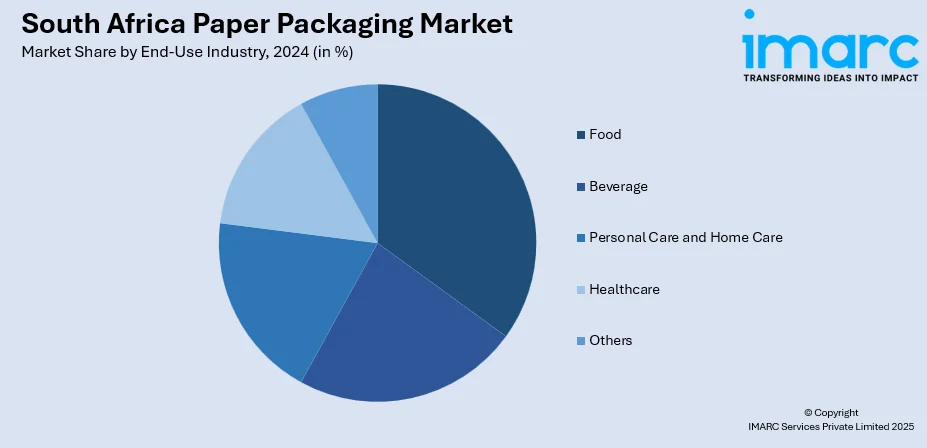

End-Use Industry Insights:

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes food, beverage, personal care and home care, healthcare, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Paper Packaging Market News:

- In November 2024, The Frugal Bottle, which is constructed of 94% recycled paperboard and has an 84% smaller carbon footprint than glass, is being introduced to South Africa by British sustainable packaging company Frugalpac in collaboration with CTP Packaging. The partnership aims to grow local demand and eventually establish a Frugal Bottle Assembly Machine in the country. Already adopted by wineries like Journey’s End and Stellenbosch Vineyards, the bottles are part of Frugalpac’s global expansion across 25 countries.

South Africa Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa paper packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa paper packaging market on the basis of product type?

- What is the breakup of the South Africa paper packaging market on the basis of grade?

- What is the breakup of the South Africa paper packaging market on the basis of packaging level?

- What is the breakup of the South Africa paper packaging market on the basis of end-use industry?

- What is the breakup of the South Africa paper packaging market on the basis of region?

- What are the various stages in the value chain of the South Africa paper packaging market?

- What are the key driving factors and challenges in the South Africa paper packaging market?

- What is the structure of the South Africa paper packaging market and who are the key players?

- What is the degree of competition in the South Africa paper packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa paper packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa paper packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)