South Africa Pectin Market Size, Share, Trends and Forecast by Raw Material, End Use, and Region, 2026-2034

South Africa Pectin Market Summary:

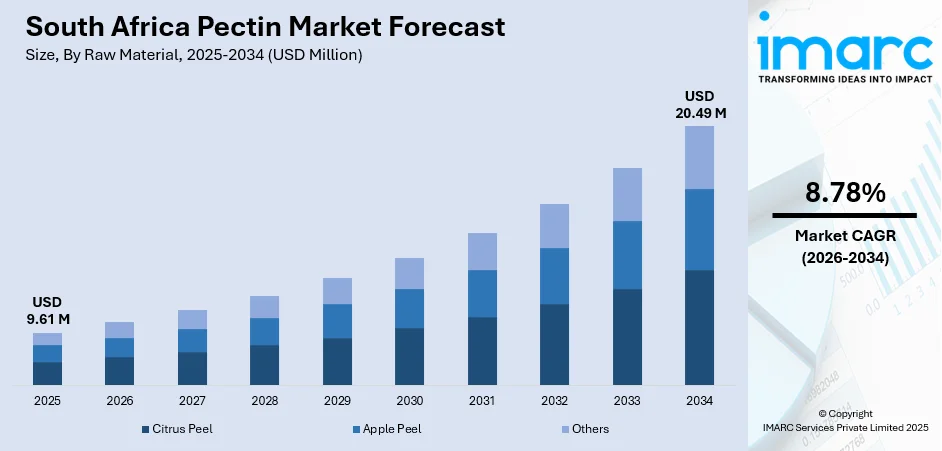

The South Africa pectin market size was valued at USD 9.61 Million in 2025 and is projected to reach USD 20.49 Million by 2034, growing at a compound annual growth rate of 8.78% from 2026-2034.

The market is expanding as food, beverage, and nutraceutical manufacturers increase their use of pectin for clean label formulations, texture enhancement, and natural stabilisation. Demand is supported by growing interest in fruit-based ingredients, rising health focused consumption, and the shift toward plant derived alternatives. Local producers and importers are strengthening supply capabilities as companies seek consistent quality, improved processing performance, and cost-efficient solutions for jams, beverages, dairy products, and functional foods.

Key Takeaways and Insights:

- By Raw Material: Citrus peel dominates the market with a share of 75% in 2025, owing to South Africa's extensive citrus cultivation and processing infrastructure that provides abundant, cost-effective raw materials for pectin extraction.

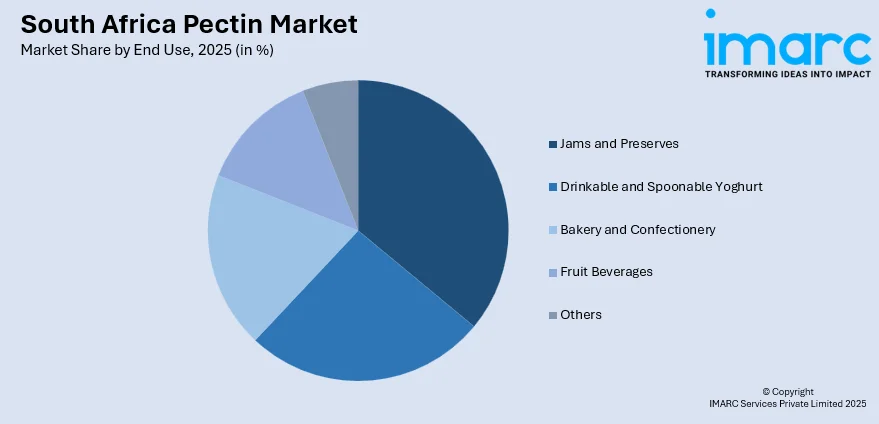

- By End Use: Jams and preserves lead the market with a share of 30% in 2025, driven by traditional consumption patterns, expanding retail distribution networks, and growing demand for premium artisanal spreads.

- Key Players: The South Africa pectin market exhibits moderate competitive intensity, with multinational ingredient manufacturers and regional distributors competing across specialty food applications. Companies are focusing on product innovation, sustainable sourcing practices, and strategic partnerships to expand their market presence.

To get more information on this market Request Sample

The South Africa pectin market is expanding as food and beverage manufacturers increase their use of natural stabilizers to meet rising consumer demand for clean label and plant-based products. The South Africa plant-based food market size reached USD 82.39 Million in 2024 and is projected to reach USD 201.40 Million by 2033, which is further supporting pectin usage in multiple formulations. Pectin plays a key role in enhancing gelling, thickening, and mouthfeel, making it essential for jams, fruit preparations, yogurt alternatives, and reduced sugar products. Demand is also rising due to growing interest in digestive health, where pectin is used in fiber-enriched foods and wellness-oriented applications. Pharmaceutical and nutraceutical sectors contribute to additional growth as pectin is incorporated into controlled release tablets, dietary supplements, and soothing digestive remedies. With a stronger focus on product quality, improved formulations, and health-centered innovations, the South Africa pectin market continues to advance across both domestic production and imported ingredient supply channels.

South Africa Pectin Market Trends:

Plant-Based and Clean-Label Demand

Rising demand for plant-based and clean-label ingredients is shaping the South Africa pectin market as manufacturers prioritise natural stabilisers and healthier formulations. Pectin supports improved texture, viscosity, and product consistency in jams, beverages, and functional foods. As consumers seek transparent labels and natural ingredients, pectin continues to gain traction across multiple processed food categories, reinforcing its role as a preferred plant-derived additive.

Low-Sugar Product Development Growth

Growth in low-sugar and reduced-sugar product development is increasing the use of pectin due to its ability to enhance mouthfeel and gelling properties without relying on additional sweeteners. Manufacturers are adopting pectin to maintain product quality and stability while meeting calorie-conscious preferences. This trend aligns with rising health awareness, encouraging broader utilisation of pectin in beverages, fruit-based products, and wellness-oriented food lines.

Pharmaceutical and Personal Care Expansion

Expanding applications in pharmaceuticals and personal care are boosting adoption in the South Africa pectin market as the ingredient supports controlled release formulations and natural stabilisation. The South Africa pharmaceutical market size reached USD 11.52 Billion in 2024. Looking forward, the market is expected to reach USD 24.10 Billion by 2033, reinforcing demand for functional, plant derived ingredients. Pectin is increasingly used in wound care products and bio based cosmetic solutions due to its gentle properties, compatibility, and biodegradability. Growing interest in sustainable and skin friendly formulations continues to drive uptake across medical, wellness, and personal care categories.

Market Outlook 2026-2034:

The South Africa pectin market is expected to witness steady growth as food, beverage, and personal care manufacturers increase their use of natural and plant-based ingredients. Demand is supported by the rising shift toward clean-label formulations, low-sugar product development, and sustainable sourcing practices. Expanding adoption in pharmaceuticals, where pectin offers controlled-release and therapeutic benefits, further strengthens market prospects. As consumer preference continues to move toward healthier and bio-based products, pectin usage is set to grow across multiple application segments. The market generated a revenue of USD 9.61 Million in 2025 and is projected to reach a revenue of USD 20.49 Million by 2034, growing at a compound annual growth rate of 8.78% from 2026-2034.

South Africa Pectin Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Raw Material | Citrus Peel | 75% |

| End Use | Jams and Preserves | 30% |

Raw Material Insights:

- Citrus Peel

- Apple Peel

- Others

The citrus peel dominates with a market share of 75% of the total South Africa pectin market in 2025.

The citrus peel segment holds the dominant share of the South Africa pectin market due to its high pectin content, consistent functional quality, and strong suitability for food-grade applications. Manufacturers prefer citrus-derived pectin for its superior gelling, stabilising, and thickening properties, which are essential for jams, beverages, confectionery, and dairy alternatives. The large availability of citrus processing byproducts in global markets also supports a stable supply pipeline for South African producers and importers. According to the data publihed by the United States Department of Agriculture (USDA), in 2024/25, orange production is forecast to rise by 1% to 1.69 MMT. Grapefruit production increases to 425,000 MT. Tangerine output is set to rise 3% to 790,000 MT. Lemon production will grow 7% to 780,000 MT.

Growing demand for clean-label, plant-based, and reduced-sugar foods continues to strengthen reliance on citrus peel-sourced pectin, as it delivers reliable performance in natural formulations. Its versatility enables manufacturers to optimise texture, improve mouthfeel, and enhance product stability across a wide range of applications. Additionally, continuous improvements in extraction techniques and growing global citrus processing volumes help ensure better consistency, higher yields, and competitive pricing, reinforcing the dominance of the citrus peel category.

End Use Insights:

Access the Comprehensive Market Breakdown Request Sample

- Jams and Preserves

- Drinkable and Spoonable Yoghurt

- Bakery and Confectionery

- Fruit Beverages

- Others

The jams and preserves lead with a share of 30% of the total South Africa pectin market in 2025.

The jams and preserves segment lead the South Africa pectin market as the ingredient is critical for achieving the desired gel structure, firmness, and spreadability in fruit-based products. Pectin ensures uniform consistency, enhances stability, and supports reduced-sugar formulations, aligning with shifting consumer preferences for healthier and clean-label options. Manufacturers prioritise high-quality pectin to maintain product standards and meet rising demand for premium and artisanal fruit preserves.

The segment further benefits from growing consumption of breakfast spreads, packaged fruit preparations, and flavour-rich condiments across both household and foodservice channels. Pectin’s ability to stabilise fruit pulp, prevent syneresis, and enhance shelf life makes it indispensable for this end-use category. As innovation expands in low-sugar, organic, and plant-based spreads, demand within the jams and preserves segment is expected to remain strong, supporting its continued leadership in the market.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

Gauteng is one of the largest pectin-consuming region due to its strong food-processing base, expanding beverage production, and rising demand for plant-based ingredients. Manufacturers in the province increasingly use pectin to enhance product stability, texture, and reduced sugar formulations across multiple categories.

KwaZulu-Natal records steady pectin usage growth as its fruit processing, dairy alternatives, and confectionery industries expand. The region benefits from access to agricultural outputs and rising consumer demand for natural, clean-label ingredients that support healthier product development in beverages, jams, and functional foods.

The Western Cape shows strong adoption driven by its established fruit processing sector, export-oriented food manufacturing, and growing emphasis on natural stabilizers. Pectin demand is supported by innovation in low-sugar preserves, premium beverages, and plant-based formulations aligned with shifting consumer health preferences.

Mpumalanga demonstrates increasing pectin consumption due to its growing fruit cultivation, agro-processing activities, and rising interest in value-added food applications. Manufacturers use pectin to enhance consistency and quality in jams, juices, and confectionery products, supporting broader regional food industry expansion.

The Eastern Cape experiences gradual growth in pectin demand supported by expanding dairy, beverage, and small-scale food manufacturing enterprises. The region’s shift toward natural stabilizers and clean-label formulations continues to strengthen adoption across spoonable yoghurt, fruit beverages, and locally processed jam products.

Market Dynamics:

Growth Drivers:

Why is the South Africa Pectin Market Growing?

Processed Food Sector Expansion

Expansion of the processed food sector is driving strong growth in the South Africa pectin market as manufacturers increase usage in jams, confectionery, beverages, and dairy alternatives. Pectin supports thickening, gelling, and stabilization, helping brands develop consistent and high-quality textures. As demand rises for convenient, shelf-stable, and plant-based food products, pectin becomes a preferred clean-label ingredient that aligns with evolving consumer expectations for natural and healthier formulations.

Functional Food Consumption Growth

Growth in functional food consumption is supporting increased demand for pectin due to its soluble fiber benefits. Consumers are prioritizing digestive wellness, heart health, and natural ingredients, making pectin an attractive choice for fortified beverages, nutrition bars, and wellness-focused foods. Its ability to improve viscosity and stability enhances product quality while contributing to better nutritional profiles. As awareness of fiber-rich diets rises, pectin continues to gain traction across health-oriented food categories.

Advancements in Extraction Technology

Advancements in extraction technology are playing a key role in improving efficiency and overall product consistency in the South Africa pectin market. Modern extraction methods enable better yield, enhanced purity levels, and more controlled functional properties that meet specific formulation needs across food, beverage, pharmaceutical, and personal-care applications. Improved processing techniques also support sustainable production by reducing waste and optimizing raw material utilization, helping manufacturers deliver high-quality, plant-based, and clean-label pectin solutions that align with evolving industry standards.

Market Restraints:

What Challenges the South Africa Pectin Market is Facing?

Limited Raw Material Availability

Limited availability of high-quality raw materials continues to restrain the South Africa pectin market since manufacturers rely heavily on imported citrus peels and fruit byproducts. This dependence increases procurement costs, reduces supply predictability, and creates vulnerability to global market fluctuations, making it challenging for producers to maintain consistent production volumes and meet rising demand for natural, plant-based ingredients across food, beverage, and personal care applications.

High Production and Extraction Costs

High production and extraction costs remain a major barrier to market growth because pectin processing requires specialized equipment, energy-intensive procedures, and skilled labor. These operational demands significantly raise overall manufacturing expenses. Smaller producers often struggle to scale up efficiently due to limited capital investment capacity, which restricts local supply expansion and widens the gap between production demand and regional availability in South Africa.

Agriculture-Based Supply Fluctuations

Fluctuating supply from agriculture-based sources continues to create uncertainty in raw material procurement for the South Africa pectin market. Weather shifts, crop diseases, and seasonal yield variations affect the availability of citrus peels and fruit residues needed for pectin extraction. These disruptions impact production planning, increase sourcing risks, and lead to inconsistent pricing conditions, making market stability harder to achieve for manufacturers and downstream users.

Competitive Landscape:

The competitive landscape of the South Africa pectin market is shaped by rising demand for plant-based and clean-label ingredients, encouraging both local processors and global suppliers to strengthen their presence. Companies are focusing on improving extraction efficiency, enhancing product purity, and expanding application support for food, beverage, pharmaceutical, and personal-care industries. Competition is increasing as manufacturers invest in reliable citrus-based raw material sourcing and develop customized pectin grades tailored to functional needs such as gelling, thickening, and stabilizing. Strategic partnerships, improved distribution networks, and product innovation continue to define market positioning and long-term growth potential.

South Africa Pectin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Citrus Peel, Apple Peel, Others |

| End Uses Covered | Jams and Preserves, Drinkable and Spoonable Yoghurt, Bakery and Confectionary, Fruit Beverages, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Africa pectin market size was valued at USD 9.61 Million in 2025.

The South Africa pectin market is expected to grow at a compound annual growth rate of 8.78% from 2026-2034 to reach USD 20.49 Million by 2034.

Citrus peel held the largest share of the South Africa pectin market, accounting for 75%. Its high pectin yield, consistent availability, and strong suitability for commercial extraction make it the preferred raw material for manufacturers.

Key factors driving the South Africa pectin market include rising demand for plant-based and clean-label products, expanding processed food manufacturing, and increasing use of pectin in functional foods, pharmaceuticals, and personal-care formulations supported by improved extraction technology.

Major challenges include limited availability of high-quality raw materials, high extraction and production costs, and fluctuating supply from agriculture-based sources. These issues create pricing pressure, affect manufacturing stability, and restrict the ability of producers to scale operations efficiently.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)