South Africa Pet Food Market Size, Share, Trends and Forecast by Pet Type, Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Region, 2025-2033

South Africa Pet Food Market Overview:

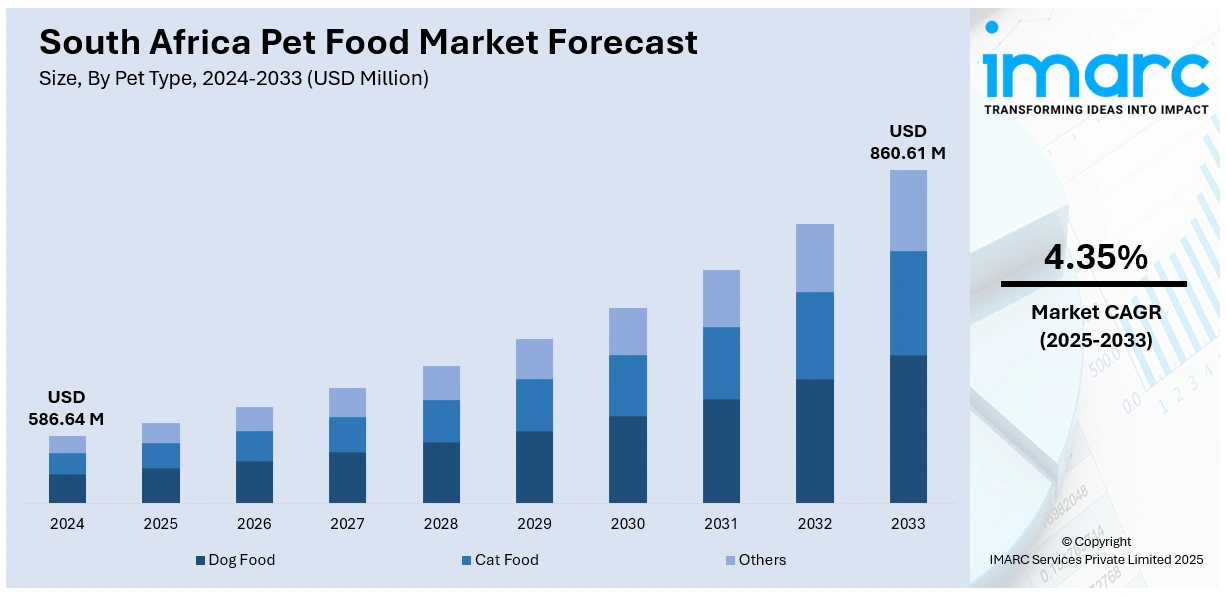

The South Africa pet food market size reached USD 586.64 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 860.61 Million by 2033, exhibiting a growth rate (CAGR) of 4.35% during 2025-2033. The increasing number of households that are considering pets as family members, also referred to as pet humanization, is impelling the market growth. Apart from this, urban changes are playing a major role in pet adoption patterns in the country, where people in developed areas are increasingly keeping pets as companions. Additionally, the fast growth in retail infrastructure and online commerce is expanding South Africa pet food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 586.64 Million |

| Market Forecast in 2033 | USD 860.61 Million |

| Market Growth Rate 2025-2033 | 4.35% |

South Africa Pet Food Market Trends:

Growing Pet Humanization and Premiumization

The pet food industry in South Africa is witnessing consistent growth as an increasing number of households are considering pets as full-fledged family members, also referred to as pet humanization. People are seeking higher-quality, premium pet foods that reflect the nutritional quality of human foods. The trend is leading manufacturers to concentrate on natural, organic, and functional ingredients that support the overall pet health, such as immune function, digestive health, and joint care. Pet parents are also becoming more discerning in terms of ingredient sourcing, with a preference for grain-free, high-protein, and additive-free formulations. Concurrently, specialty foods for particular breeds, life stages, or health status are in demand, driving innovation in ranges. Health benefits and emotional appeals are being targeted through marketing campaigns, further driving this trend. With disposable incomes rising, city-based households are spending more on high-quality pet nutrition, thus generating consistent demand. In 2025, Amazon South Africa announced its plans to expand the online marketplace with three newly presented categories, including non-perishable groceries, pet food, and vitamins and nutritional supplements. The initiative aims to satisfy the daily demands of local consumers and mirrors the most commonly sought-after product types by South African buyers.

To get more information on this market, Request Sample

Urban Developments and Lifestyle Changes

Urban changes are playing a major role in pet adoption patterns in South Africa, where people in developed areas are increasingly keeping pets as companions for smaller households and apartments. This demographic trend is driving the demand for convenient, packaged, and nutritionally complete pet food that conserves preparation time while addressing new lifestyle requirements. People are turning to ready-to-feed pet food as opposed to home-cooked meals because busy lifestyles are diminishing the capacity to prepare food for pets. In parallel, increased awareness of pet health and lifespan is motivating urban pet owners to turn to scientifically formulated diets. A growing middle class is adopting international practices in pet care, with support from greater exposure to international brands and retail formats. Internet sites and supermarkets are opening up product availability, facilitating consumer access to specialized pet food. These changes in lifestyle are continually influencing consumption trends, supporting the South Africa pet food market growth and driving the dominance of commercial pet food products.

Growth in Distribution Channels and E-commerce

The South African pet food sector is favorably impacted by the fast growth in retail infrastructure and online commerce. Large supermarket chains, veterinary clinics, and pet specialty stores are increasing their product offerings, allowing pet parents to access various brands and formulations. At the same time, the online platforms are becoming very popular as consumers increasingly look for convenience, competitive prices, and home delivery on pet food purchases. Subscription programs and loyalty cards are being introduced online, with repeat buys and brand loyalty being promoted. Social media sites and web marketing campaigns are also helping to generate awareness of new product releases and nutritional gains. Rural communities are slowly gaining from enhanced retail penetration, taking the market out of urban spaces. This expanding multichannel distribution system not only makes the products more accessible but also enhances competition between brands, fueling innovation and affordability. IMARC Group predicts that the South Africa e-commerce market is projected to attain USD 2,199.27 Billion by 2033.

South Africa Pet Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on pet type, product type, pricing type, ingredient type, and distribution channel.

Pet Type Insights:

- Dog Food

- Cat Food

- Others

The report has provided a detailed breakup and analysis of the market based on the pet type. This includes dog food, cat food, and others.

Product Type Insights:

- Dry Pet Food

- Wet and Canned Pet Food

- Snacks and Treats

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes dry pet food, wet and canned pet food, and snacks and treats.

Pricing Type Insights:

- Mass Products

- Premium Products

A detailed breakup and analysis of the market based on the pricing type have also been provided in the report. This includes mass products and premium products.

Ingredient Type Insights:

- Animal Derived

- Plant Derived

A detailed breakup and analysis of the market based on the ingredient type have also been provided in the report. This includes animal derived and plant derived.

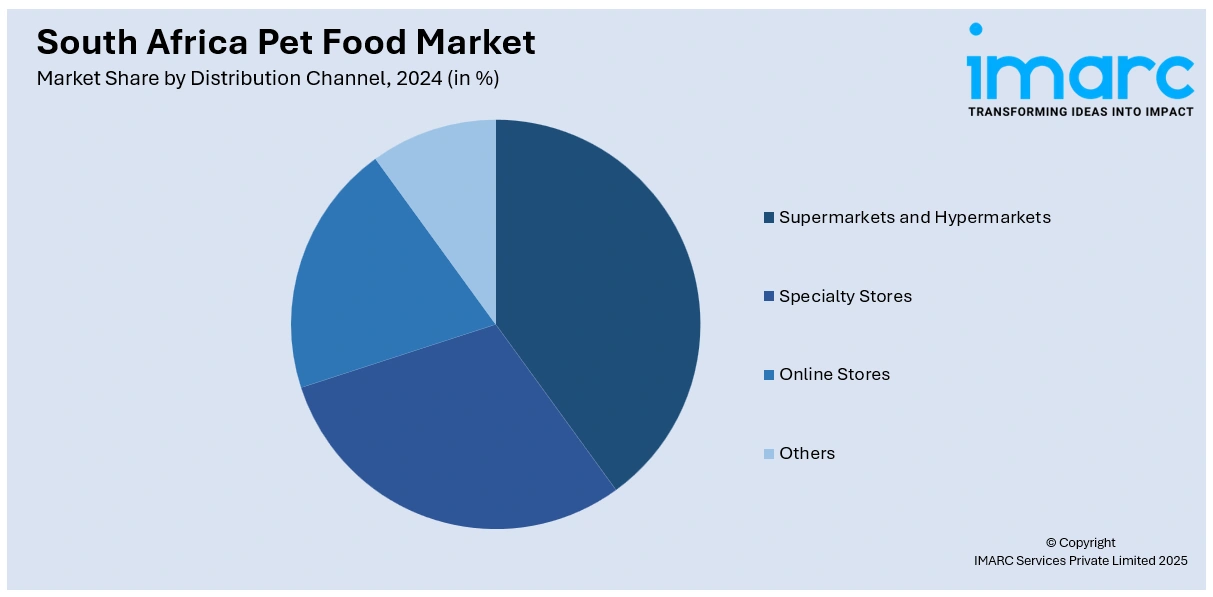

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Pet Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pet Types Covered | Dog Food, Cat Food, Others |

| Product Types Covered | Dry Pet Food, Wet And Canned Pet Food, Snacks And Treats |

| Pricing Types Covered | Mass Products, Premium Products |

| Ingredient Types Covered | Animal Derived, Plant Derived |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa pet food market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa pet food market on the basis of pet type?

- What is the breakup of the South Africa pet food market on the basis of product type?

- What is the breakup of the South Africa pet food market on the basis of pricing type?

- What is the breakup of the South Africa pet food market on the basis of ingredient type?

- What is the breakup of the South Africa pet food market on the basis of distribution channel?

- What is the breakup of the South Africa pet food market on the basis of region?

- What are the various stages in the value chain of the South Africa pet food market?

- What are the key driving factors and challenges in the South Africa pet food market?

- What is the structure of the South Africa pet food market and who are the key players?

- What is the degree of competition in the South Africa pet food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa pet food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa pet food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa pet food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)