South Africa Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033

South Africa Private Equity Market Overview:

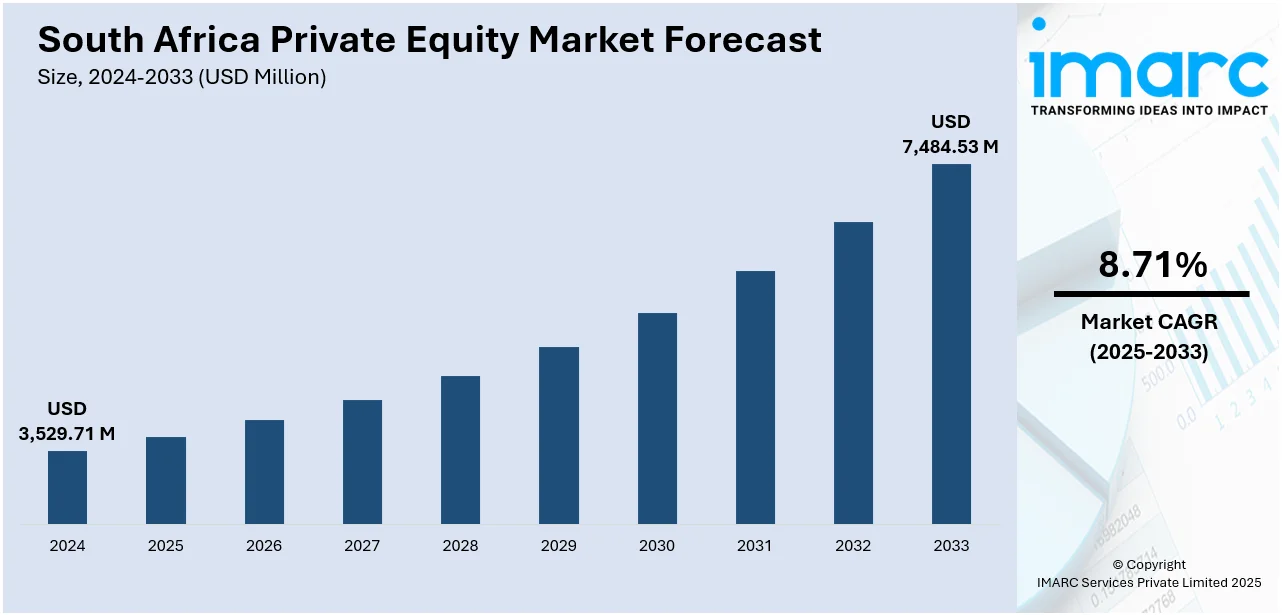

The South Africa private equity market size reached USD 3,529.71 Million in 2024. The market is projected to reach USD 7,484.53 Million by 2033, exhibiting a growth rate (CAGR) of 8.71% during 2025-2033. The market is fueled by robust fundraising, foreign capital inflows, impact and ESG mandates, and a focus on mid‑market technology-enabled firms. Broader sectoral diversification and sustained domestic value creation propel South Africa private equity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,529.71 Million |

| Market Forecast in 2033 | USD 7,484.53 Million |

| Market Growth Rate 2025-2033 | 8.71% |

South Africa Private Equity Market Trends:

ESG and Impact-Driven Capital

ESG and social impact investing are at the forefront of South Africa private equity market growth. According to SAVCA, 55% of PE funds have specific impact mandates, while 35% employ dedicated ESG professionals. Institutional investors demand transparent ESG integration and performance measurement across portfolios. The alignment with national policies like B‑BBEE further reinforces governance and socio‑economic development requirements within fund strategies. These factors enhance the appeal of the South African PE market to global LPs seeking both returns and impact. Driving capital deployment into socially responsible and inclusive investment vehicles, the ESG focus is reshaping dealmaking and elevating market depth.

To get more information on this market, Request Sample

Infrastructure and Renewable Energy Expansion

Infrastructure and renewable energy are emerging pillars of South African private equity investment strategies. Government-led blended finance structures and credit guarantee mechanisms are catalyzing capital deployment into transmission and clean energy assets. Notable investments include solar rollouts scaling from post-Eskom reform efforts. These sectors benefit from favorable national policy support, rising institutional interest in impact-oriented infrastructure, and increasing demand for sustainable power. Private equity deployments into resilient renewable platforms are reshaping the investment landscape and solidifying South Africa private equity market growth via infrastructure-led expansion. For instance, in July 2025, Mergence Investment Managers made a follow-on investment of $3.4 Million in Solarise Africa, supporting its commercial and industrial renewable energy rollout in South Africa. Structured via preference shares, the mezzanine funding builds on a prior $9 Million injection in 2024. The capital will accelerate deployment of solar PV and hybrid systems, advancing South Africa’s clean energy transition.

South Africa Private Equity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on fund type.

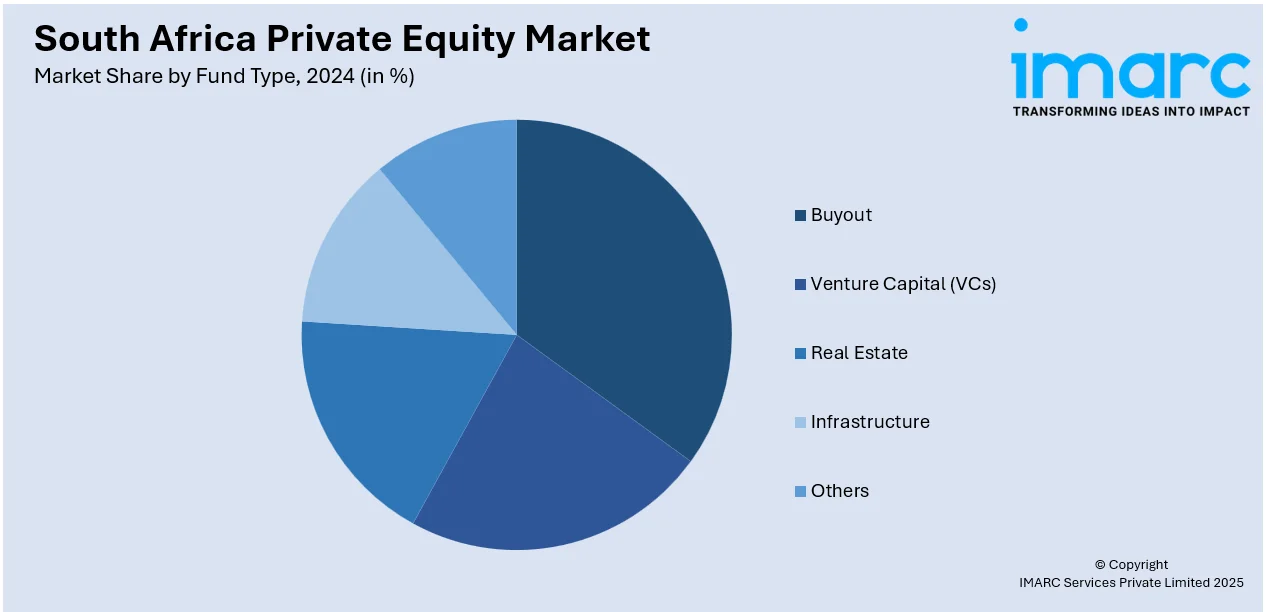

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major provinces, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Private Equity Market News:

- In July 2025, Goodwell Investments and Alitheia Capital, through uMunthu II, a private equity fund they manage, invested in Nigeria’s Hinckley E-Waste Recycling to support the development of lithium-ion and lead acid battery recycling facilities in Ogun State. The initiative is designed to process up to 30,000 tonnes of e-waste annually, addressing Nigeria’s growing e-waste challenge.

- In June 2025, Vital Capital invested in Vastpoint, a geospatial land management company, to help improve land use and ownership in vulnerable regions across Africa, Asia, and Latin America. Using GIS technologies, Vastpoint enhances land administration, reduces conflicts, and promotes economic development, especially for women. The investment aligns with Vital’s strategy to address systemic development challenges, ensuring long-term social and economic resilience.

South Africa Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa private equity market on the basis of fund type?

- What is the breakup of the South Africa private equity market on the basis of region?

- What are the various stages in the value chain of the South Africa private equity market?

- What are the key driving factors and challenges in the South Africa private equity market?

- What is the structure of the South Africa private equity market and who are the key players?

- What is the degree of competition in the South Africa private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa private equity market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)