South Africa Pro AV Market Size, Share, Trends and Forecast by Solution, Distribution Channel, Application, and Province, 2025-2033

South Africa Pro AV Market Overview:

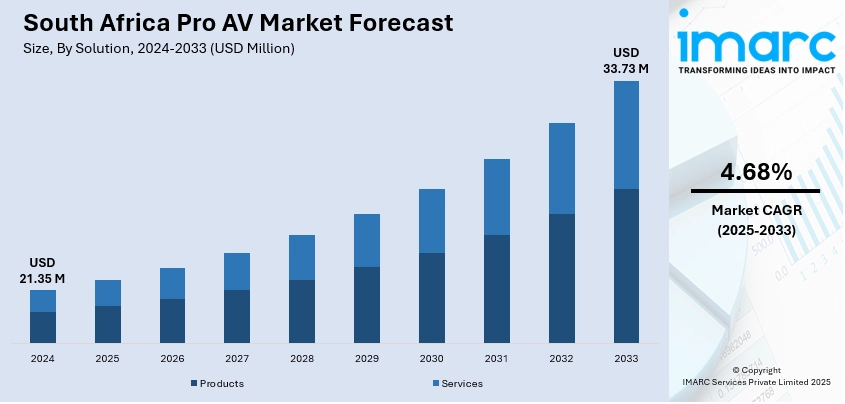

The South Africa Pro AV market size reached USD 21.35 Million in 2024. The market is projected to reach USD 33.73 Million by 2033, exhibiting a growth rate (CAGR) of 4.68% during 2025-2033. Growing use of advanced display systems, video conferencing tools, and digital signage across corporate offices and educational institutions is supporting demand. Ongoing investments in smart infrastructure and hybrid work solutions continue to boost South Africa Pro AV market share across key urban centers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 21.35 Million |

| Market Forecast in 2033 | USD 33.73 Million |

| Market Growth Rate 2025-2033 | 4.68% |

South Africa Pro AV Market Trends:

Demand Grows Across Learning Spaces

Interactive learning environments are becoming standard across many South African educational institutions. Moreover, audio-visual tools are no longer limited to elite schools public and private institutions alike are allocating budgets toward smart boards, projectors, video walls, and centralized AV systems. This change supports the broader South Africa Pro AV market growth, especially as digital learning programs continue to expand in both basic and higher education. In recent months, tenders have been issued for smart classroom installations in rural districts, aiming to bridge the technology gap between urban and non-urban areas. AV companies are also seeing increased requests for maintenance and cloud-based management platforms to reduce downtime and IT overhead. Local manufacturers are beginning to collaborate with education departments to supply scalable, durable products that suit the region’s infrastructure challenges. Furthermore, with digital skills now a national development priority, AV integration is being seen as part of long-term capacity building across the education system.

To get more information on this market, Request Sample

Offices Embrace Hybrid Collaboration Tools

Meeting spaces are being redesigned across many South African companies, with hybrid collaboration becoming the standard rather than the exception. In addition, AV upgrades in boardrooms, huddle rooms, and co-working hubs include large-format displays, wireless presentation systems, advanced microphones, and real-time cloud integration. This shift is driven by productivity goals and the need to stay compatible with remote clients and partners. Since late 2024, local distributors have reported rising interest in bundled AV solutions that combine hardware, software, and long-term service contracts. In cities like Cape Town and Durban, tech parks and shared office providers are investing in multi-room AV infrastructure that supports remote access, automation, and content distribution. Flexible installation options and power-efficient designs are now influencing purchasing decisions, with sustainability teams involved in AV planning discussions. As companies revisit their office strategies post-pandemic, AV investments are shifting from optional upgrades to essential assets. Furthermore, enterprise clients are prioritizing ease of use, remote support, and future-proofing—pressuring integrators to offer customizable packages suited to fast-moving business environments.

South Africa Pro AV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on solution, distribution channel, and application.

Solution Insights:

- Products

- Display

- AV Acquisition and Delivery Products

- Projectors

- Sound Reinforcement Products

- Conferencing Products

- Others

- Services

- Installation Services

- Maintenance Services

- IT Networking Services

- System Designing Services

- Others

The report has provided a detailed breakup and analysis of the market based on the solution. This includes products (display, AV acquisition and delivery products, projectors, sound reinforcement products, conferencing products, and others) and services (installation services, maintenance services, IT networking services, system designing services, and others).

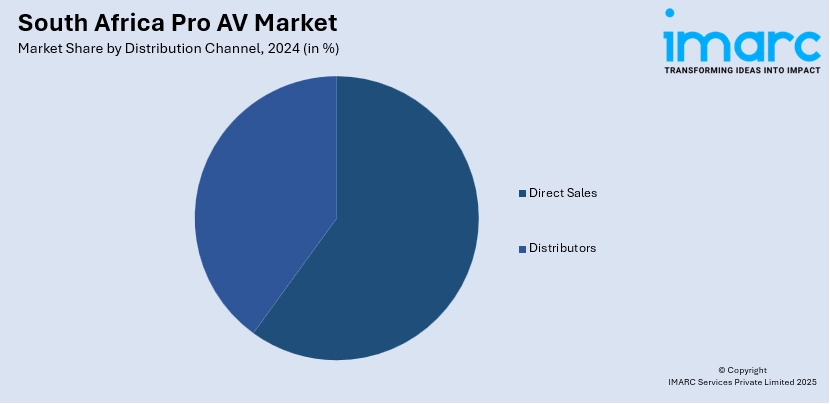

Distribution Channel Insights:

- Direct Sales

- Distributors

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales and distributors.

Application Insights:

- Home Use

- Commercial

- Education

- Government

- Hospitality

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes home use, commercial, education, government, hospitality, and others.

Provinical Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Pro AV Market News:

- May 2025: Electrosonic SA opened Crestron House in Johannesburg, a dedicated hub for Crestron control and automation systems. Featuring demo rooms, training areas, and increased stock capacity, the facility improved service, training, and logistics, strengthening South Africa's Pro AV integration and distribution capabilities.

- May 2025: The DCDT, NEMISA, and Google launched the #NextGenCreatorsSA program to train 100 content creators and 25 filmmakers in South Africa. Focused on digital production and storytelling, the initiative strengthened Pro AV skills, boosting local content creation and supporting the creative digital economy.

South Africa Pro AV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Distribution Channels Covered | Direct Sales, Distributors |

| Applications Covered | Home Use, Commercial, Education, Government, Hospitality, Others |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa pro AV market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa Pro AV market on the basis of solution?

- What is the breakup of the South Africa Pro AV market on the basis of distribution channel?

- What is the breakup of the South Africa Pro AV market on the basis of application?

- What is the breakup of the South Africa Pro AV market on the basis of province?

- What are the various stages in the value chain of the South Africa Pro AV market?

- What are the key driving factors and challenges in the South Africa Pro AV market?

- What is the structure of the South Africa Pro AV market and who are the key players?

- What is the degree of competition in the South Africa Pro AV market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa Pro AV market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa Pro AV market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa Pro AV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)