South Africa Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Region, 2025-2033

South Africa Real Estate Market Overview:

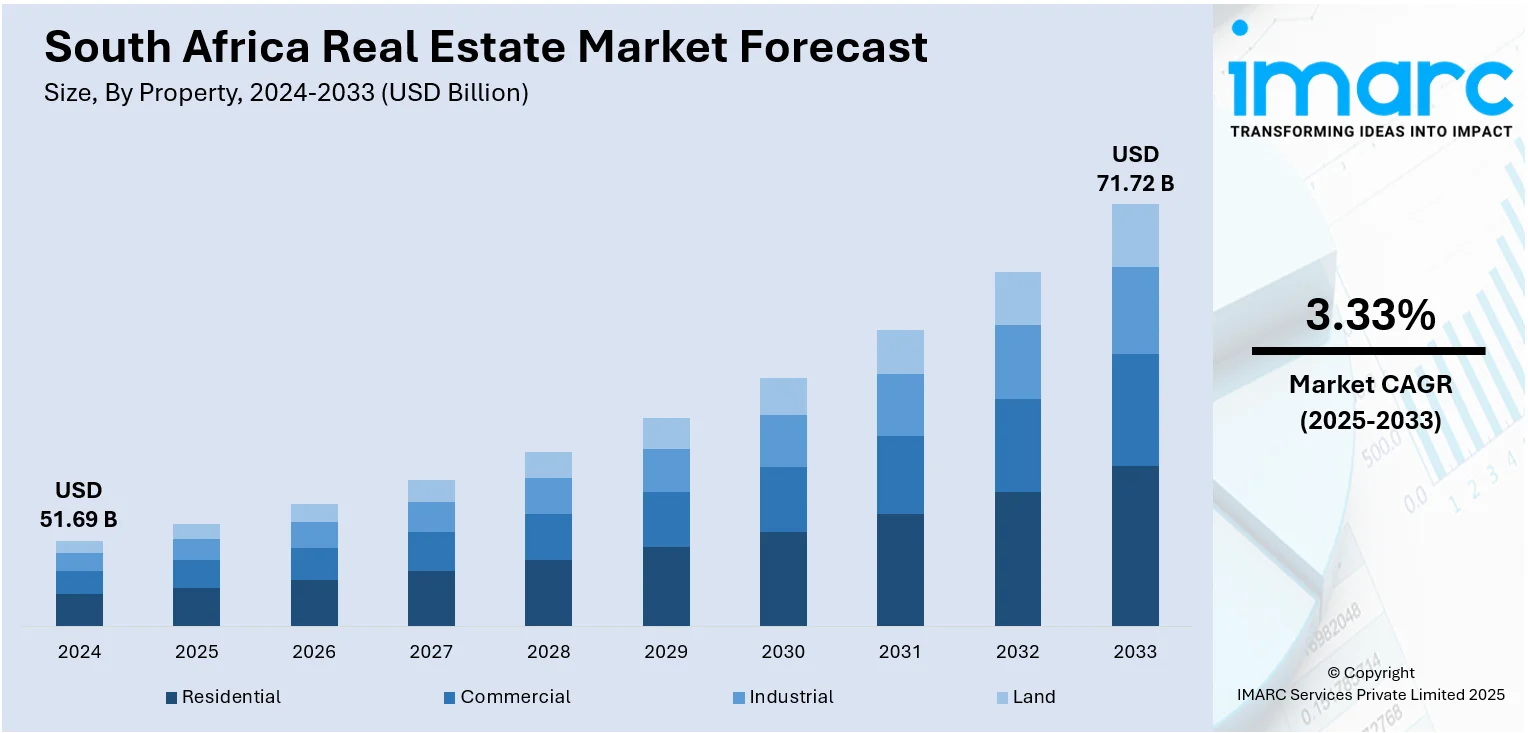

The South Africa real estate market size reached USD 51.69 Billion in 2024. The market is projected to reach USD 71.72 Billion by 2033, exhibiting a growth rate (CAGR) of 3.33% during 2025-2033. Urbanization, the health of the economy, and government policies all influence the market. Particularly in large cities, urban migration raises demand for affordable housing and mixed-use developments. Economic determinants such as development in gross domestic product (GDP), inflation, and interest rates drive property affordability and investor sentiment. Moreover, government policies such as land reform policies, housing subsidies, and infrastructure development influence the market by impacting the potential for development and property value thereby making the South Africa real estate market share stronger.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 51.69 Billion |

| Market Forecast in 2033 | USD 71.72 Billion |

| Market Growth Rate 2025-2033 | 3.33% |

South Africa Real Estate Market Trends:

Urbanization and Population Growth

South Africa's urbanization at breakneck speeds is still a major driver of its property market. Johannesburg, Cape Town, and Durban cities are still magnets for individuals in search of job opportunities, education, and better standards of living. This migration is driving the demand for residential properties, particularly affordable homes, rentals, and mixed-use developments. Urban renewal projects supported by the government and upgrading of infrastructure also increase the popularity of city life, leading to investment in the residential and commercial property sectors. The growing middle class also requires improved housing and lifestyle-oriented developments that shape property types and planning of communities. Urbanization, though, comes with issues like congestion and service delivery deficits that contribute to the development of satellite towns and gated estates on city peripheries. Such urban sprawl generates opportunities for investors who target suburban and peri-urban property markets serving an emerging urban population.

To get more information on this market, Request Sample

Economic Performance and Interest Rates

The macroeconomic conditions in South Africa, especially GDP growth, inflation, and interest rates, significantly affect its real estate sector. Economic instability, load-shedding, and joblessness hurt consumer confidence and lower purchasing power, softening demand for property. In contrast, times of economic stability and low interest rates increase accessibility of property finance, stimulating residential home buyers and commercial investors alike. The interest rates of the South African Reserve Bank impact mortgage affordability directly, driving homeownership levels and rental levels. A growing or stable economy promotes business growth, which increases the need for retail, office, and industrial space. Conversely, it can generate increasing vacancies and declining property values in a downturn. In addition, the confidence of foreign investors is linked to the performance of the economy, which will determine capital inflows into the sector. As such, economic indicators continue to be fundamental for assessing market attitude and deciding prospective property investment directions in South Africa.

Government Policy and Land Reform

Another significant South Africa real estate market trend is the shift towards the government policy and land reforms. Land reform, as a politically charged and changing issue, affects investor sentiment and long-term development schemes. Uncertainty in regards to expropriation without compensation has dampened local and foreign investors' spirits, particularly in agriculture and land that is undeveloped. On the negative side, government-sponsored housing schemes like the Reconstruction and Development Programme (RDP) and first-time buyer subsidies promote affordable housing construction and renovate low-income areas. Zoning regulations, building codes, and environmental plans also influence supply and pricing of properties nationwide. Also, massive public infrastructure initiatives like highway expansions and special economic zones boost the value of properties nearby and release new possibilities for development. Therefore, state policies, clarity on land rights, and urban planning approaches continue to be vital for fostering South Africa real estate market growth.

South Africa Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on property, business, and mode.

Property Insights:

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

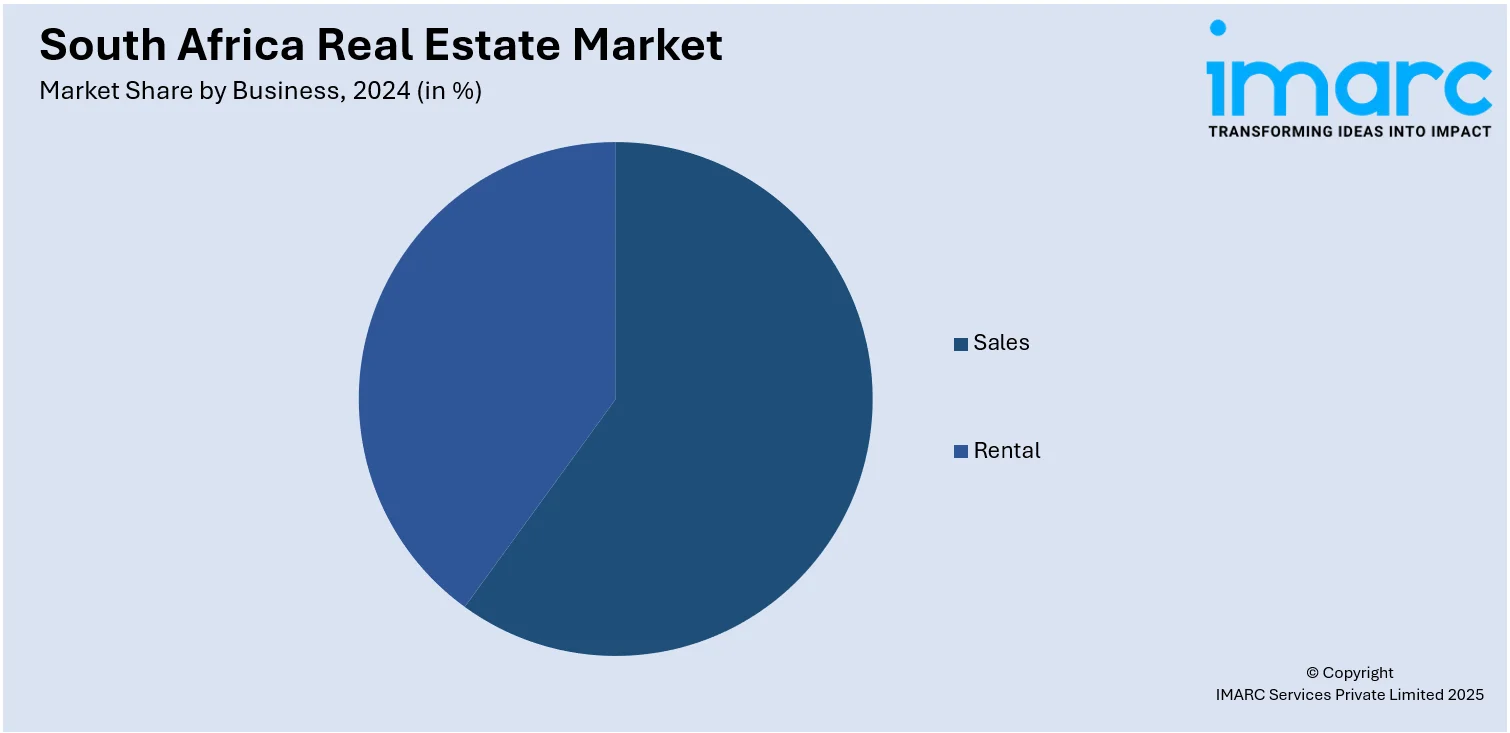

Business Insights:

- Sales

- Rental

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes sales and rental.

Mode Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the mode. This includes online and offline.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Real Estate Market News:

- In April 2025, Ata Terra, a unit of Ata Capital, completed its first real estate acquisition by purchasing prime logistics properties from Equites Property Fund. The assets, located in Waterfall City and Lords View Logistics hubs, are backed by long-term triple net leases with top-tier tenants, ensuring stable income and low risk. This marks Ata Capital’s strategic entry into South Africa’s high-quality logistics and industrial property market, supporting its diversification and value-driven growth strategy.

South Africa Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa real estate market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa real estate market on the basis of property?

- What is the breakup of the South Africa real estate market on the basis of business?

- What is the breakup of the South Africa real estate market on the basis of mode?

- What is the breakup of the South Africa real estate market on the basis of region?

- What are the various stages in the value chain of the South Africa real estate market?

- What are the key driving factors and challenges in the South Africa real estate market?

- What is the structure of the South Africa real estate market and who are the key players?

- What is the degree of competition in the South Africa real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)