South Africa Seaweed Market Size, Share, Trends and Forecast by Environment, Product, Application, and Region, 2025-2033

South Africa Seaweed Market Overview:

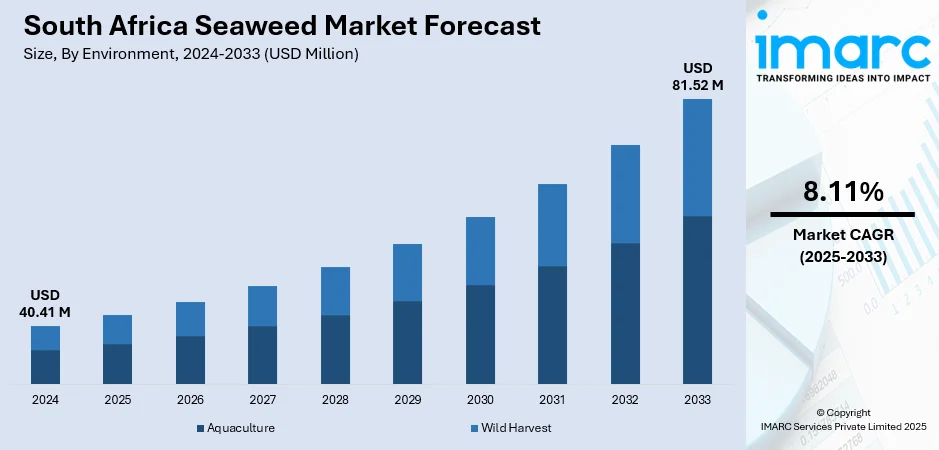

The South Africa seaweed market size reached USD 40.41 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 81.52 Million by 2033, exhibiting a growth rate (CAGR) of 8.11% during 2025-2033. South Africa is actively advancing its blue economy activities, and seaweed farming is becoming a strategic part of this agenda. Moreover, consumers are rapidly looking for natural, nutrient-rich, and sustainable food products in the country. Additionally, the application of natural ingredients in agriculture and animal nutrition is expanding the South Africa seaweed market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 40.41 Million |

| Market Forecast in 2033 | USD 81.52 Million |

| Market Growth Rate 2025-2033 | 8.11% |

South Africa Seaweed Market Trends:

Increased Need for Natural and Sustainable Foodstuffs

The South African seaweed market is witnessing great momentum as consumers are rapidly looking for natural, nutrient-rich, and sustainable food products. Seaweed is being touted as a superfood as it contains a deep concentration of vitamins, minerals, antioxidants, and plant proteins, which are very appealing to health-conscious consumers. This change is being driven by the increasing trend of lifestyle diseases, where consumers are opting for functional foods that enhance immunity, digestion, and overall well-being. Moreover, the clean-label movement is constantly urging food manufacturers to re-formulate their products using natural preservatives, and seaweed is being used as a thickener, stabilizer, or salt substitute. Restaurants and retailers are also increasing their shelves with seaweed-based foods, seasonings, and drinks, further boosting demand. As global plant-based consumption is opening up to South Africa, seaweed is more and more used as an animal-free ingredient in line with changing consumer needs. The Veganuary campaign took place in South Africa in January 2025 with ProVeg South Africa as a major partner to offer free guided programs for 31 days on healthy plant-based food consumption.

To get more information on this market, Request Sample

Growing Use in Agriculture and Animal Feed

The application of seaweed in agriculture and animal nutrition is at the forefront of defining the South African market. Seaweed-based biofertilizers and biostimulants are adopted by farmers since these products boost soil fertility, increase crop yield, and facilitate resistance against pests and environmental stresses. With the agricultural industry struggling with climate variability, water shortages, and soil erosion, seaweed solutions are being adopted as cost-effective and environment friendly substitutes for synthetic chemicals. In the same way, livestock producers are adding seaweed to animal feed to enhance animal welfare, boost nutrition, and mitigate methane emissions, which is supporting sustainability goals. Government and private investors are constantly promoting the use of natural agricultural inputs, providing conducive environments for seaweed-based solutions. The significance of seaweed for Tanzania was emphasized by the Permanent Secretary of the Ministry of Livestock and Fisheries, Mainland Tanzania, Professor Riziki S. Shemdoe, during the inauguration of the workshop on Enhancing Africa's Blue Economy Potential - A Program to Fortify Africa’s Seaweed Value Chains. The capacity building occasion taking place in Dar-es-Salaam, Tanzania, from 28-31 May 2024, was arranged by AUDA-NEPAD and was hosted by the Ministry of Livestock and Fisheries of the United Republic of Tanzania. Other collaborators of the workshop comprised the Ministry of Blue Economy and Fisheries - Zanzibar, the Zanzibar Seaweed Cluster Initiative, FAO, AU-IBAR, WWF, and the World Bank.

Increasing Emphasis on Blue Economy and Aquaculture Development

South Africa is actively advancing its blue economy activities, and seaweed farming is becoming a strategic part of this agenda. The government, industry actors, and research institutions are increasingly putting resources into marine resource development to diversify sources of income, create jobs, and enhance coastal economies, thereby impelling the South Africa seaweed market growth. Seaweed cultivation is being framed as a sustainable aquaculture activity because it has low resource demands and environmental advantages like carbon sequestration and water cleansing. Aquaculture growth is continually generating prospects for seaweed integration, both in the form of a single product and also as a supporting input to fish farming. Demand for seaweed is also increasing internationally, and South Africa is becoming identified as a possible exporter, especially to Asian and European markets in which seaweed consumption is already well established. Using its long coastline and favorable sea conditions, the nation is quietly establishing a competitive presence in the international seaweed market.

South Africa Seaweed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on environment, product, and application.

Environment Insights:

- Aquaculture

- Wild Harvest

The report has provided a detailed breakup and analysis of the market based on the environment. This includes aquaculture and wild harvest.

Product Insights:

- Red

- Brown

- Green

The report has provided a detailed breakup and analysis of the market based on the product. This includes red, brown, and green.

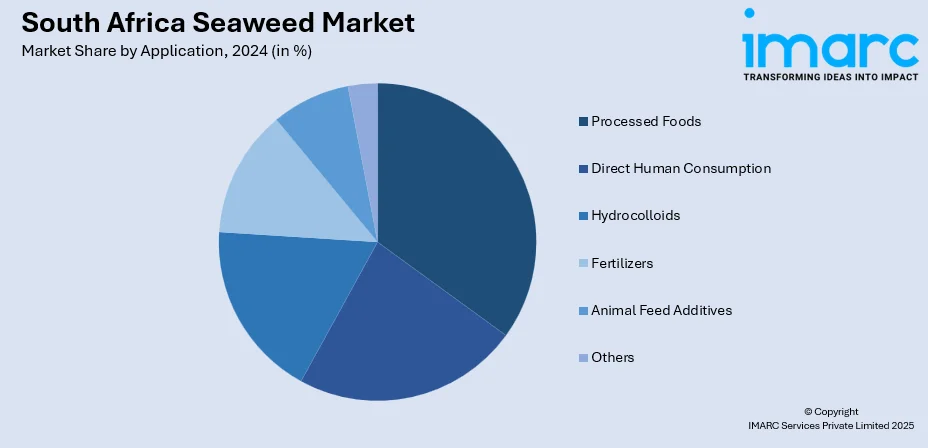

Application Insights:

- Processed Foods

- Direct Human Consumption

- Hydrocolloids

- Fertilizers

- Animal Feed Additives

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes processed foods, direct human consumption, hydrocolloids, fertilizers, animal feed additives, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Seaweed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Aquaculture, Wild Harvest |

| Products Covered | Red, Brown, Green |

| Applications Covered | Processed Foods, Direct Human Consumption, Hydrocolloids, Fertilizers, Animal Feed Additives, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa seaweed market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa seaweed market on the basis of environment?

- What is the breakup of the South Africa seaweed market on the basis of product?

- What is the breakup of the South Africa seaweed market on the basis of application?

- What is the breakup of the South Africa seaweed market on the basis of region?

- What are the various stages in the value chain of the South Africa seaweed market?

- What are the key driving factors and challenges in the South Africa seaweed market?

- What is the structure of the South Africa seaweed market and who are the key players?

- What is the degree of competition in the South Africa seaweed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa seaweed market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa seaweed market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa seaweed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)