South Africa Sportswear Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2025-2033

South Africa Sportswear Market Overview:

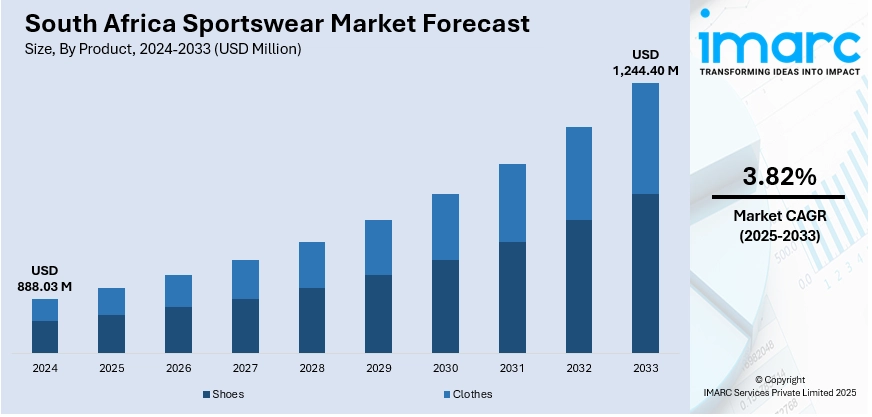

The South Africa sportswear market size reached USD 888.03 Million in 2024. Looking forward, the market is expected to reach USD 1,244.40 Million by 2033, exhibiting a growth rate (CAGR) of 3.82% during 2025-2033. The market is expanding steadily, fueled by rising health consciousness, increased participation in fitness and outdoor activities, and a growing demand for versatile athleisure wear. Social media influence and urban fashion trends further boost consumer interest. E-commerce growth and local brand innovation are also enhancing the South Africa sportswear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 888.03 Million |

| Market Forecast in 2033 | USD 1,244.40 Million |

| Market Growth Rate 2025-2033 | 3.82% |

South Africa Sportswear Market Trends:

Youth Demographics and Cultural Identity

South Africa has a predominantly young population, and this demographic is playing a crucial role in shaping the demand for sportswear. Youth-driven street style, music influences like hip-hop and amapiano, and the growing popularity of sneaker culture are merging athletic wear with expressions of cultural identity. This blending of sport and fashion creates a dynamic market where sportswear is not only used for physical activity but also as a symbol of lifestyle and individuality. Local designers and global brands are tapping into this demand by launching collections that reflect South African trends and heritage. As self-expression becomes central to youth consumption, sportswear that aligns with cultural narratives and modern aesthetics is gaining momentum, driving market growth in both urban and township regions.

To get more information on this market, Request Sample

Expansion of Organized Retail and Local Manufacturing

The growth of organized retail chains and shopping malls across South Africa has improved access to branded sportswear, particularly in second-tier cities and peri-urban areas, which is driving the South Africa sportswear market growth. Simultaneously, government incentives and infrastructure support are encouraging local production of activewear, reducing dependence on imports and supporting economic empowerment. Domestic manufacturing also allows brands to respond quickly to seasonal and trend changes, increasing affordability and availability. Retailers are investing in modern in-store experiences, integrating sports tech and customer personalization, which elevates buyer engagement. Additionally, partnerships between local textile producers and sportswear companies are contributing to more efficient supply chains. This dual expansion, of both retail infrastructure and homegrown production capacity, is helping scale distribution and meet the increasing demand for affordable and fashionable sportswear.

Sponsorship of Local Sports and Grassroots Initiatives

Corporate sponsorship and investment in local sports events, school programs, and community leagues are fueling sportswear demand across South Africa. Brands actively sponsor rugby, soccer, athletics, and cricket events, creating strong associations with performance, national pride, and youth development. These initiatives not only boost brand visibility but also cultivate early brand loyalty among aspiring athletes and active youth. The promotion of grassroots sports helps embed physical activity into community culture, driving consistent demand for sports apparel and footwear. Additionally, collaborations with local sports personalities and influencers enhance relatability and trust in brands. By fostering talent and promoting inclusive access to sport, these sponsorships play a vital role in broadening the consumer base and accelerating long-term growth in the South African sportswear market.

South Africa Sportswear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, distribution channel, and end user.

Product Insights:

- Shoes

- Clothes

The report has provided a detailed breakup and analysis of the market based on the product. This includes shoes and clothes.

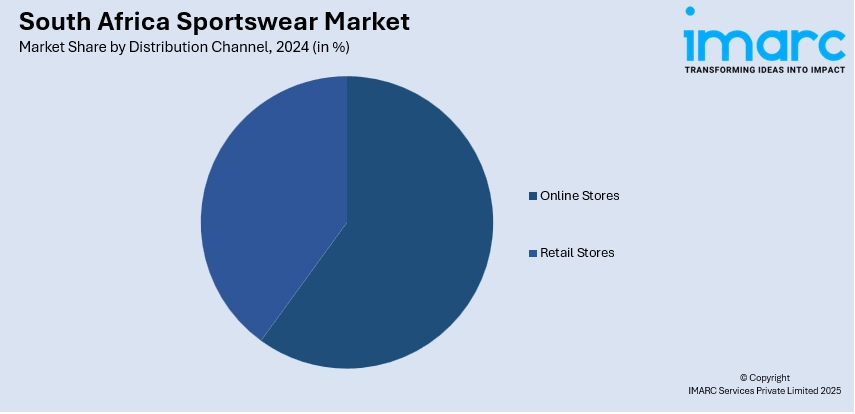

Distribution Channel Insights:

- Online Stores

- Retail Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online stores and retail stores.

End User Insights:

- Men

- Women

- Kids

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and kids.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Sportswear Market News:

- In July 2025, Swimming South Africa (SSA) unveiled a dynamic new collaboration with FILA, the iconic Italian sportswear giant celebrated worldwide for its heritage of innovation, performance, and style across global sports platforms. This partnership marks a significant step forward for SSA in aligning with a brand known for excellence in athletic apparel.

- In February 2025, Cricket South Africa entered into a five-year agreement with global sportswear brand Macron. Announced on February 13, the partnership designates the Italian manufacturer as the official supplier of technical sportswear for all national teams under Cricket South Africa’s umbrella. This collaboration marks a significant move in outfitting the teams with high-performance gear.

South Africa Sportswear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Shoes, Clothes |

| Distribution Channels Covered | Online Stores, Retail Stores |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa sportswear market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa sportswear market on the basis of product?

- What is the breakup of the South Africa sportswear market on the basis of distribution channel?

- What is the breakup of the South Africa sportswear market on the basis of end user?

- What is the breakup of the South Africa sportswear market on the basis of region?

- What are the various stages in the value chain of the South Africa sportswear market?

- What are the key driving factors and challenges in the South Africa sportswear market?

- What is the structure of the South Africa sportswear market and who are the key players?

- What is the degree of competition in the South Africa sportswear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa sportswear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa sportswear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa sportswear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)