South Africa Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

South Africa Steel Tubes Market Overview:

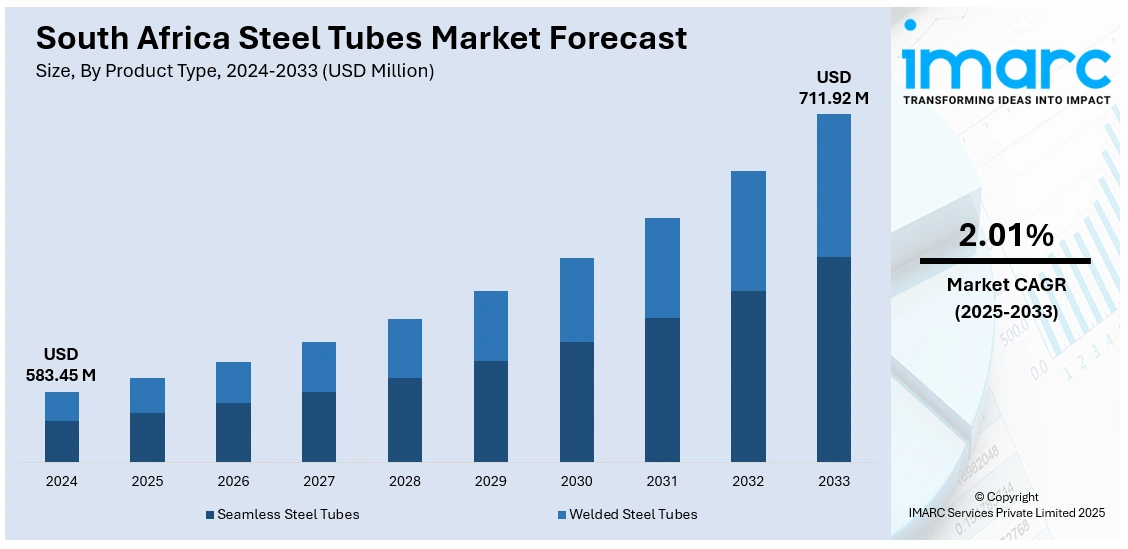

The South Africa steel tubes market size reached USD 583.45 Million in 2024. The market is projected to reach USD 711.92 Million by 2033, exhibiting a growth rate (CAGR) of 2.01% during 2025-2033. The market is witnessing steady growth, driven by increasing demand across construction, automotive, and industrial sectors. Technological developments in manufacturing and the growing requirement for resilient and interchangeable materials are shaping market trends. Seamless as well as welded steel tubes are finding increased usage owing to their extensive applications. Moreover, developing infrastructure projects and an emphasis on industrialization are driving market growth. This report discusses major trends, opportunities, and geospatial outlook for the South Africa steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 583.45 Million |

| Market Forecast in 2033 | USD 711.92 Million |

| Market Growth Rate 2025-2033 | 2.01% |

South Africa Steel Tubes Market Trends:

Infrastructure-Driven Momentum

In August 2024, the Association of Steel Tube and Pipe Manufacturers of South Africa (ASTPM) emphasized that the steel tubes sector is experiencing renewed momentum, driven largely by public infrastructure expansion. With the seventh administration prioritizing investment in essential services like transportation networks, water infrastructure, and energy delivery steel tubes are becoming a critical component across numerous projects. A noticeable shift is taking place in procurement strategies as both public and private sector buyers increasingly favor locally produced tubes over imports, which supports domestic manufacturing and enhances job creation. Government-backed initiatives such as bridge reinforcement and urban redevelopment programs are translating into consistent demand for steel tubing, particularly carbon steel variants. Manufacturers are responding by scaling up capacity and ensuring materials meet the technical standards required by civil and structural engineers. These infrastructure projects, often spanning several years, are expected to form the bedrock of steady market demand well into the next decade. In this context, South Africa steel tubes market growth is being shaped not just by economic recovery, but by tangible construction pipelines backed by national infrastructure policy and execution.

To get more information on this market, Request Sample

Automation and Custom Fabrication Take-Off

In April 2025, new perspectives on South Africa's structural steel tube industry revealed a steep increase in automation and digital tooling adoption throughout fabrication lines. With construction and renewable energy projects becoming more specialized in nature, the demand for lightweight, high-strength steel tubes customized for specific purposes has increased exponentially. Automated cutting, robotic welding, and high-precision laser technology are increasingly applied to provide tubes that precisely meet highly specialized engineering and environmental requirements. This transformation is providing quicker turnaround times, greater quality control, and lower material waste factors that are increasingly important for cost-driven markets such as solar and commercial building. Moreover, intelligent integration into building information modeling (BIM) provides better pre-installation accuracy, avoiding expensive on-site modification. Manufacturers are not only positioning themselves as suppliers but as design-integrated partners for large infrastructural projects. This is a significant shift from standardized mass production to high-spec, demand-sensitive production. Future South Africa steel tubes market trends are clearly shifting towards more automation, fabrication flexibility, and digital integration to match the changing needs of new-age infrastructure development.

Strategic Safeguarding Through Policy

In May 2025, the International Trade Administration Commission of South Africa (Itac) confirmed the implementation of safeguard duties on hot-rolled steel imports following a significant rise in volumes over recent years, which threatened domestic steel producers supplying the tube and pipe sectors. The commission's investigation pointed to a clear link between these surging imports and the financial strain on local manufacturers. This move is seen as an important step toward restoring balance in the local steel value chain. The duty imposed applies broadly to key import sources while maintaining trade relationships with regional partners. For steel tube manufacturers, this means a more stable pipeline of raw materials, allowing better planning and pricing stability amid infrastructure demand. The safeguard also encourages local upstream producers to ramp up coil output and reinvest in maintenance and upgrades. By creating a more protected and consistent supply environment, manufacturers are better positioned to meet the ongoing requirements of national infrastructure programs. In turn, this adds much-needed security and momentum to South Africa steel tubes market.

South Africa Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

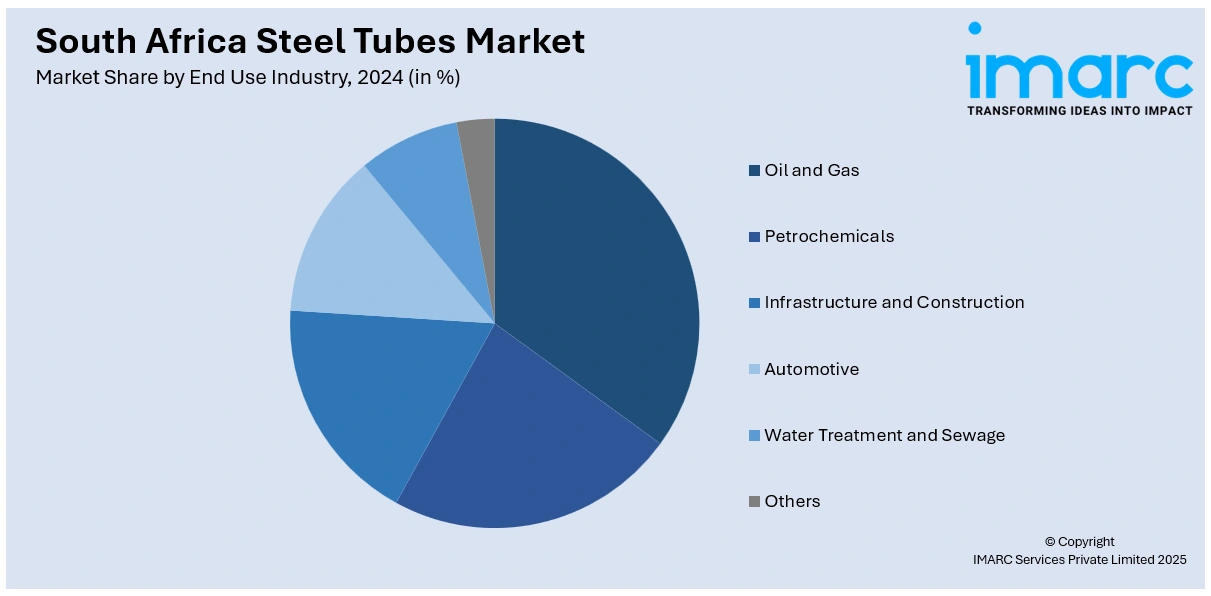

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Others |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa steel tubes market on the basis of product type?

- What is the breakup of the South Africa steel tubes market on the basis of material type?

- What is the breakup of the South Africa steel tubes market on the basis of end use industry?

- What is the breakup of the South Africa steel tubes market on the basis of region?

- What are the various stages in the value chain of the South Africa steel tubes market?

- What are the key driving factors and challenges in the South Africa steel tubes market?

- What is the structure of the South Africa steel tubes market and who are the key players?

- What is the degree of competition in the South Africa steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)