South Africa Vegan Food Market Size, Share, Trends and Forecast by Product, Source, Distribution Channel, and Region, 2025-2033

South Africa Vegan Food Market Overview:

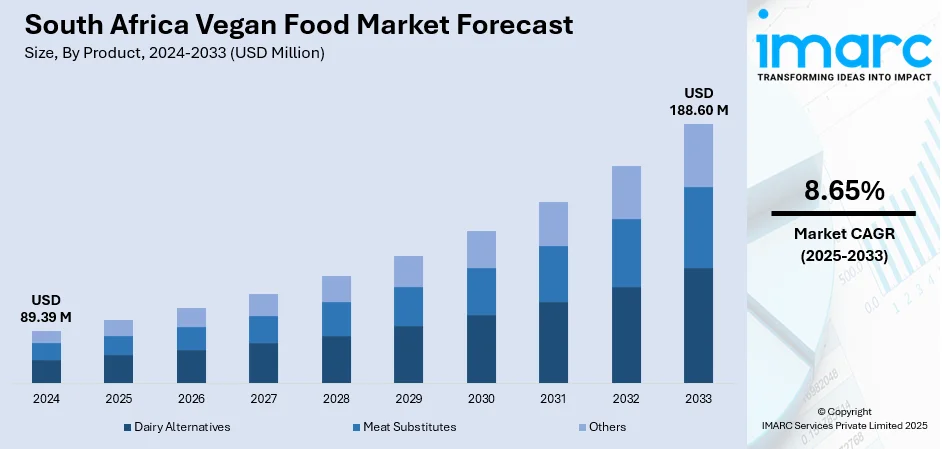

The South Africa vegan food market size reached USD 89.39 Million in 2024. The market is projected to reach USD 188.60 Million by 2033, exhibiting a growth rate (CAGR) of 8.65% during 2025-2033. Rising incidence of lactose intolerance and lifestyle diseases, such as obesity and diabetes, is encouraging people to seek dairy-free, cholesterol-free, and nutrient-rich vegan options. Besides this, the broadening of retail outlets, which aids in enhancing the availability and visibility of plant-based products, is contributing to the expansion of the South Africa vegan food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 89.39 Million |

| Market Forecast in 2033 | USD 188.60 Million |

| Market Growth Rate 2025-2033 | 8.65% |

South Africa Vegan Food Market Trends:

Increasing adoption of veganism

Rising adoption of veganism is a significant factor in the growth of the market in South Africa, as an increasing number of individuals are moving away from animal-derived products towards healthier and more sustainable options. The growing vegan population in the nation is impacted by concerns about health, ecological sustainability, and animal rights, encouraging people to adopt plant-centered eating patterns. ProVeg reported that by January 2024, vegan, vegetarian, and flexitarian consumers accounted for 10-12% of the South African population. Veganism is increasingly popular among young people, driven by global trends, social media influence, and celebrity support that emphasize the advantages of a plant-based lifestyle. Additionally, the increasing prevalence of lactose intolerance and lifestyle-related conditions like obesity and diabetes is motivating individuals to look for dairy-free, cholesterol-free, and nutrient-dense vegan alternatives. Restaurants, cafés, and fast-food chains are addressing this demand by launching plant-based options, while producers are focusing on innovations in meat alternatives, non-dairy milk, and ready-to-eat (RTE) vegan snacks. The shift towards veganism has moved beyond a niche activity to become a widespread lifestyle option, generating significant opportunities for local and international firms in the South Africa vegan food sector.

To get more information on this market, Request Sample

Broadening of retail channels

The expansion of retail outlets is fueling the South Africa vegan food market growth, as the availability and visibility of plant-based products is significantly influencing consumer adoption. As per the Trading Economics, retail sales in South Africa increased by 1.6% year-over-year in June 2025 compared to June 2024. With supermarkets, hypermarkets, and specialty health stores increasing shelf space for vegan food, people have easier access to a wide variety of plant-based alternatives, including meat substitutes, dairy-free beverages, and RTE vegan snacks. The growing presence of international and domestic vegan brands in mainstream retail outlets is making these products more affordable and convenient for a broader consumer base. In addition, the broadening of e-commerce platforms and online grocery delivery services has further widened access, particularly in urban centers where digital shopping is rising. Retailers are also actively promoting vegan food items through discounts, promotional campaigns, and dedicated sections, which is increasing awareness and trial among the non-vegan population. This retail-driven visibility and convenience are not only meeting existing demand but also stimulating new consumption, accelerating the growth of the market in South Africa.

South Africa Vegan Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, source, and distribution channel.

Breakup by Product:

- Dairy Alternatives

- Cheese

- Dessert

- Snacks

- Others

- Meat Substitutes

- Tofu

- TVP

- Seiten

- Quorn

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes dairy alternatives (cheese, dessert, snacks, and others), meat substitutes (tofu, TVP, seiten, Quorn, and others), and others.

Breakup by Source:

- Almond

- Soy

- Oats

- Wheat

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes almond, soy, oats, wheat, and others.

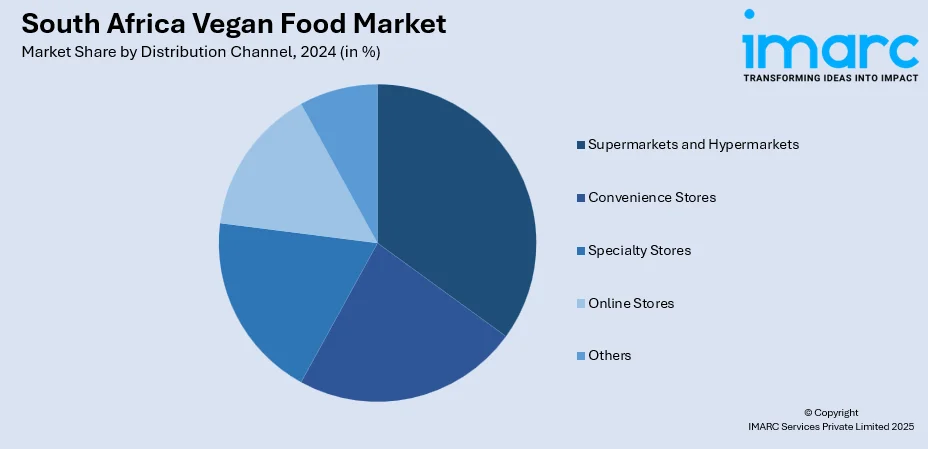

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Vegan Food Market News:

- In February 2025, the British international sandwich and coffee shop franchise, known as Pret, was launched in South Africa. It provided an extensive menu featuring sandwiches, salads, wraps, baked items, and snacks, along with vegetarian and vegan choices.

South Africa Vegan Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Sources Covered | Almond, Soy, Oats, Wheat, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa vegan food market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa vegan food market on the basis of product?

- What is the breakup of the South Africa vegan food market on the basis of source?

- What is the breakup of the South Africa vegan food market on the basis of distribution channel?

- What is the breakup of the South Africa vegan food market on the basis of region?

- What are the various stages in the value chain of the South Africa vegan food market?

- What are the key driving factors and challenges in the South Africa vegan food market?

- What is the structure of the South Africa vegan food market and who are the key players?

- What is the degree of competition in the South Africa vegan food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa vegan food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa vegan food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa vegan food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)