South East Asia Athletic Footwear Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Country, 2026-2034

Market Overview:

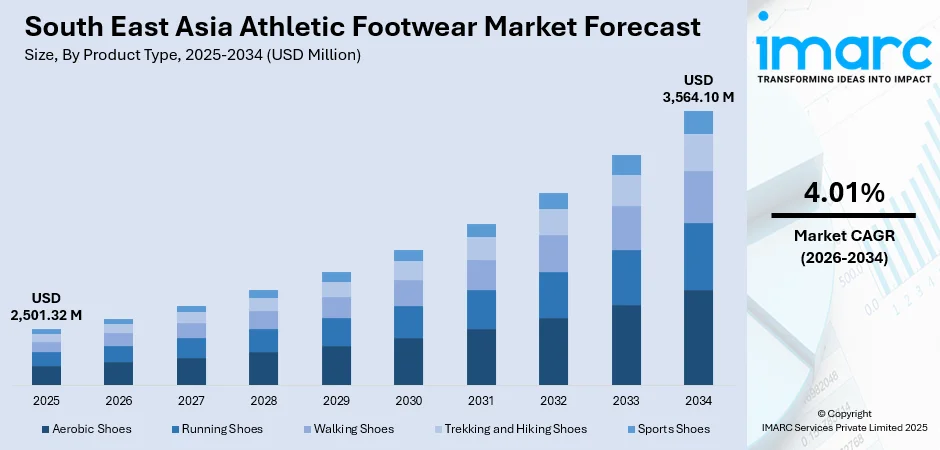

The South East Asia athletic footwear market size was valued at USD 2,501.32 Million in 2025 and is projected to reach USD 3,564.10 Million by 2034, growing at a compound annual growth rate of 4.01% from 2026-2034.

The South East Asia athletic footwear market thrives on expanding health consciousness, accelerating urban developments, and vibrant youth culture embracing athleisure fashion. Rising middle-class prosperity drives the demand for performance-oriented footwear that bridges functionality and style, while government initiatives promoting active lifestyles strengthen participation across recreational and professional sports activities.

Key Takeaways and Insights:

- By Product Type: Running Shoes dominate the market with a share of 35% in 2025, driven by versatile daily wear applications and increasing recreational fitness participation among urban populations.

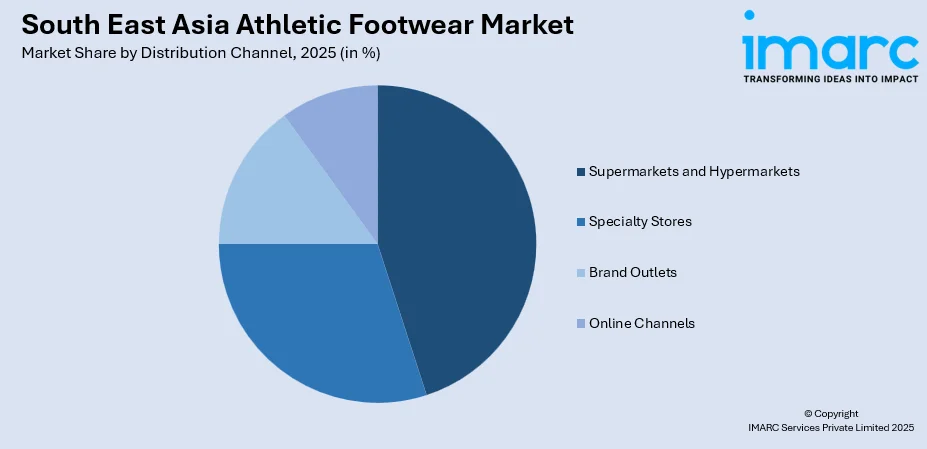

- By Distribution Channel: Online channels lead the market with a share of 40% in 2025, propelled by smartphone penetration, digital payment adoption, and expanding e-commerce infrastructure across metropolitan and semi-urban areas.

- By End User: Men represent the largest segment with a market share of 50% in 2025, attributed to higher sports participation rates, established athletic traditions, and growing athleisure adoption for professional and casual settings.

- Key Players: Brands in Southeast Asia are pushing hard on online channels, faster delivery, and localized drops. Major key players lean on apps, exclusive online releases, and new branded stores. Most players keep Vietnam and Indonesia central for sourcing to speed up regional supply. Some of the key players operating in the market include Adidas AG, Asics Corporation, New Balance Athletics, Inc., Nike Inc., Puma SE, and Under Armour Inc.

To get more information on this market, Request Sample

The South East Asia athletic footwear market flourishes through the convergence of demographic vitality and cultural transformation. Urban populations increasingly prioritize wellness alongside professional success, treating fitness as lifestyle integration rather than isolated activity. Government programs promoting physical education and national health campaigns cultivate long-term sports participation habits across age groups. Hari Sukan Negara, or National Sports Day in Malay, was officially inaugurated by Malaysia's Minister of Youth and Sports, Y.B. Hannah Yeoh, in Putrajaya on October 12, 2024. The idea of National Sports Day aligns with one of the 15 suggestions from the Olympic Agenda 2020+5, which aims to enhance collaboration with all parties involved, including event organizers and local governments, to advance the Olympic Journey and the Olympic Movement. Moreover, celebrity endorsements and local athlete sponsorships amplify brand visibility while creating aspirational value among younger demographics.

South East Asia Athletic Footwear Market Trends:

Athleisure Integration Transforms Everyday Wardrobes

Athletic footwear transcends traditional sports boundaries, becoming essential fashion staples in professional offices, social gatherings, and casual environments across Southeast Asian cities. Brands respond by developing hybrid designs featuring performance technologies within aesthetically refined silhouettes, enabling seamless transitions from gym sessions to dinner appointments while maintaining polished appearances. In 2024, the Olympic Council of Malaysia (OCM) collaborated with footwear brand Skechers Malaysia for the XXXIIII Olympic Games in Paris 2024. Skechers Malaysia served as the official footwear for the Malaysian Contingent, representing the brand's inaugural collaboration with the OCM. This partnership aimed for both organisations to initiate a lasting collaboration to enhance and develop local sports collectively.

Sustainability Consciousness Reshapes Consumer Preferences

Environmental awareness influences purchasing decisions as consumers increasingly seek footwear crafted from recycled materials, biodegradable components, and transparent supply chains. Brands introducing eco-friendly manufacturing processes gain competitive advantages, particularly among educated urban millennials who prioritize ethical consumption. In 2025, Kornit Digital Inc., a worldwide leader in eco-friendly, on-demand digital fashion and textile manufacturing technologies, revealed the commercial introduction of its innovative digital footwear solution for the sports and athleisure sectors. Following two years of rigorous development and strong collaboration with top global brands and its clients, the company is introducing its comprehensive footwear solution at ITMA Asia + CITME Singapore 2025, signaling a pivotal moment for digital production in footwear.

Digital Platforms Revolutionize Shopping Experiences

Social media influencers, livestream shopping, and virtual try-on technologies transform how consumers discover and purchase athletic footwear across Southeast Asia. Brands leverage digital storytelling, limited-edition collaborations, and exclusive online launches to create excitement and urgency. Mobile-first strategies dominate as smartphone penetration reaches unprecedented levels, enabling personalized recommendations, peer reviews, and seamless payment integrations that enhance convenience while building community engagement around fitness lifestyles. IMARC Group predicts that the Southeast Asia e-commerce market is projected to attain USD 1,480.7 Billion by 2033.

Market Outlook 2026-2034:

The heightened preferences for versatile products suitable for multiple activities and occasions is supporting the Southeast Asia athletic footwear market growth. The market generated a revenue of USD 2,501.32 Million in 2025 and is projected to reach a revenue of USD 3,564.10 Million by 2034, growing at a compound annual growth rate of 4.01% from 2026-2034. The market is propelled by demographic advantages and economic development across the region. Rise in middle-class populations with heightened disposable incomes create sustained demand for quality footwear that delivers performance benefits and fashion appeal.

South East Asia Athletic Footwear Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Running Shoes |

35% |

|

Distribution Channel |

Online Channels |

40% |

|

End User |

Men |

50% |

Product Type Insights:

- Aerobic Shoes

- Running Shoes

- Walking Shoes

- Trekking and Hiking Shoes

- Sports Shoes

Running shoes dominate with a market share of 35% of the total South East Asia athletic footwear market in 2025.

Running shoes maintain the leading market segment throughout the region, capturing substantial revenue driven by their multipurpose functionality beyond dedicated running activities. Urban consumers favor these designs for daily commuting, casual socializing, and light exercise, appreciating the comfort-focused engineering originally developed for performance athletics.

The segment benefits from continuous innovation in cushioning technologies, breathable materials, and lightweight construction that enhance all-day wearability. Brands successfully position running shoes as lifestyle essentials rather than specialized equipment, expanding appeal across demographics seeking comfortable footwear that accommodates active urban lifestyles without sacrificing style consciousness. In 2025, Skechers has introduced its new AERO Series in Malaysia, representing a major shift from comfort-centered footwear to high-performance running shoes.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Brand Outlets

- Online Channels

Online channels lead with a share of 40% of the total South East Asia athletic footwear market in 2025.

Mobile use across the region keeps rising, and people are browsing sneakers on their phones during commutes or breaks. These activities pushes brands to load their apps and sites with steady discounts, quick filters, and clearer sizing details. Smaller malls often carry limited styles, so online stores feel like the only place to find fresh colorways, extended sizes, and last season’s pairs at lower prices. Shoppers also trust online tracking now, which cuts the worry about late or lost parcels.

Brands lean into these habits by releasing app-only drops, early access deals, and reward points that build a sense of belonging. Courier networks in cities like Jakarta, Manila, and Bangkok have improved, shrinking delivery windows and making returns smoother. Moreover, the expansion of e-commerce channels in the region is driving the market. IMARC Group predicts that the Southeast Asia e-commerce market is projected to reach USD 1,480.7 Billion by 2033.

End User Insights:

- Men

- Women

- Kids

Men exhibit a clear dominance with a 50% share of the total South East Asia athletic footwear market in 2025.

The men demographic sustains the largest market segment, reflecting historically higher sports participation rates and established athletic footwear usage patterns across professional and recreational contexts. Cultural norms around masculine athleticism, combined with workplace casual trends embracing sneaker culture, drive consistent demand across age groups.

The segment also benefits from larger average product sizes requiring more materials, supporting higher price points. In 2024, Nike, alongside GMG, a global distributor and retailer located in the Middle East, launches Singapore’s latest sports center, Nike Orchard Road. The shop aims to cater to athletes of every age (boys, girls, and adults) in the city who love sports and being active. The Nike Orchard Road location spans three floors and covers 28,000 square feet, making it the largest single-brand Nike store in Asia, excluding China. The shop offers Nike’s online-to-offline (O2O) services and exclusive, Nike-specific digital interactions.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

In Indonesia sneaker demand rises fast as young buyers follow global drops and local hip-hop and basketball trends. Mid-priced models move well in secondary cities because of improving logistics. Brands focus on app sales, influencer tie-ins, and sport-focused community events. Jakarta stores push limited runs to build queues while online channels handle broader demand.

Shoppers mix fitness habits with fashion-driven buying in Thailand. Bangkok remains the main stage for launches, with malls hosting brand events that draw long lines. Online stores handle strong demand during sale seasons, especially among younger buyers from outside the capital. Brands partner with Thai athletes and dance groups to stay visible. Comfort and lightweight build are strong pulls, helping both global and regional labels to grow.

High disposable income in Singapore supports regular sales of high-end shoes, including technologically advanced running models and fashionable collaborations. Consumers research price comparisons across all touchpoints before making a purchase, so brands continually update online catalogs.

In Philippines, there is a high demand for comfortable, cushioned, and efficient sports shoes. Manila's resale culture fuels interest in high-heat drops, with online raffles pulling huge traffic. Outside major cities, e-commerce plays a bigger part since retail access is tighter. Brands run digital challenges and athlete-led campaigns to drive engagement. Value-priced shoes continue to be relevant-especially among students and first-time gym users who need durable pairs to handle everyday wear.

In Vietnam a strong manufacturing base keeps global brands active, and local familiarity with production quality bolsters trust. Young urban shoppers follow K-pop and streetwear, driving up demand for clean, minimalist styles. Running clubs in Hanoi and Ho Chi Minh City support interest in performance models. Brands invest in online storefronts to capture demand from smaller towns where in-store retailers are limited.

The active lifestyles in Malaysia further urge sales of running shoes, trekking pairs, casual sneakers for work, and weekends. Kuala Lumpur shoppers enjoy store try-ons, but nationwide buying leans heavily on online channels due to size availability. Promotions during national holidays do very well. Brands partner with local fitness personalities to keep products relevant.

For smaller Southeast Asian markets, buyers track regional trends on social media and tend to shop more online since there are fewer specialty shops. Buyers are more price-sensitive, meaning mid-range and durable pairs do better than premium lines. Influencer content strongly shapes preferences in running and casual wear. Improved logistics prompt buyers to make more frequent purchases, while brands test these markets with limited online drops before committing to physical stores.

Market Dynamics:

Growth Drivers:

Why is the South East Asia Athletic Footwear Market Growing?

Rising Health Consciousness Fuels Athletic Footwear Adoption

Southeast Asian populations demonstrate accelerating awareness about physical fitness benefits and preventive healthcare approaches, transforming athletic footwear from specialized equipment into lifestyle necessities. Urban professionals increasingly integrate exercise routines into busy schedules, viewing fitness as essential for stress management, disease prevention, and quality of life enhancement. This mindset shift generates sustained demand for comfortable, performance-oriented footwear supporting diverse activities from morning runs to evening gym sessions. Government initiatives promoting active living through public fitness campaigns, school sports programs, and community exercise facilities reinforce these behaviors across age groups. Starting in 2025, every child in Singapore from Primary 1 to 3 will receive a customized health plan as part of a new initiative aimed at encouraging healthy lifestyle choices and preventing diseases in the future. Grow Well SG, initiated on January 21, seeks to enable families to ensure that children reduce their screen time, consume nutritious meals, engage in physical activity, and get sufficient rest, with assistance from pre-schools, schools, healthcare organizations, and the community.

Youth Demographics Drive Fashion-Forward Athletic Footwear Demand

Southeast Asia's predominantly young population embraces athletic footwear as fashion expression beyond functional sportswear, creating vibrant market dynamics influenced by global trends and local cultural preferences. Social media platforms amplify sneaker culture, where limited-edition releases, celebrity collaborations, and brand storytelling generate excitement among fashion-conscious consumers seeking distinctive style statements. Youth populations prioritize comfort without compromising aesthetic appeal, gravitating toward designs that seamlessly transition between athletic activities and social contexts. This is encouraging a lot of brands to open their store in the region. For instance, in 2024, sports retailer Hoka opened its inaugural physical store in Singapore, aimed at expanding its retail presence in the APAC region. The new store at Ion Orchard, found on B4, will showcase Hoka’s complete range of footwear, including everyday walking shoes, running footwear, lifestyle options, and outdoor gear. As Singapore’s inaugural brand store, it features 3D foot scanning technology, SafeSize, to suggest the most suitable fits and models to customers.

Economic Development Expands Middle-Class Purchasing Power

Rising disposable incomes across Southeast Asian economies unlock athletic footwear accessibility for expanding middle-class populations previously constrained by budget limitations. Economic growth trajectories enable households to allocate resources toward quality lifestyle products including branded athletic footwear that delivers performance benefits and social recognition. The Association of Southeast Asian Nations (ASEAN) economies showed stable growth of 4.3% in 2024. Urban developments concentrate populations in cities offering superior retail infrastructure, employment opportunities generating stable incomes, and exposure to global consumer trends.

Market Restraints:

What Challenges the South East Asia Athletic Footwear Market is Facing?

Counterfeit Products Undermine Brand Value and Consumer Trust

Widespread counterfeit athletic footwear across Southeast Asia erodes legitimate brand revenues while exposing consumers to inferior quality products lacking performance features and safety standards. Sophisticated counterfeit operations replicate authentic designs with sufficient visual similarity to deceive casual observers, particularly affecting premium segments where profit margins incentivize illegal production. These fake products typically utilize substandard materials and manufacturing shortcuts that compromise durability, comfort, and injury prevention capabilities. In 2025, the activities of a counterfeit goods network spreading fake products across the country were disrupted after the confiscation of 15,000 pairs of shoes and slippers in a raid at a wholesale center on Jalan Tuanku Abdul Rahman.

Raw Material Cost Volatility Pressures Pricing Strategies

Fluctuating costs for rubber, textiles, synthetic materials, and specialized components create unpredictable expense structures challenging manufacturers' pricing stability and profit margins. Global supply chain disruptions, commodity market volatility, and geopolitical tensions contribute to material cost uncertainty that smaller brands struggle to absorb. Rising labor costs in traditional manufacturing centers compound these pressures, forcing difficult choices between maintaining affordability and preserving quality standards.

Environmental Sustainability Demands Increase Production Complexity

Growing consumer and regulatory pressure for sustainable manufacturing practices requires significant investments in eco-friendly materials, waste reduction technologies, and transparent supply chains. Athletic footwear production traditionally relies on petroleum-based materials and energy-intensive processes that conflict with sustainability objectives. Transitioning to recycled materials, biodegradable components, and circular economy models increases production complexity and costs while requiring supply chain restructuring.

Competitive Landscape:

The Southeast Asia athletic footwear market exhibits dynamic competitive intensity characterized by multinational corporations commanding substantial market shares alongside emerging regional players gaining traction through localized strategies and competitive pricing. International athletic brands leverage extensive marketing budgets, athlete endorsements, and advanced research capabilities to maintain dominant positions across premium segments. These established players invest heavily in brand building through sports sponsorships, flagship retail experiences, and digital engagement platforms that create aspirational brand equity. Local players capitalize on faster response times to market trends, cultural understanding, and distribution networks penetrating secondary cities where international brands maintain limited presence. The market also witnesses entry from athleisure-focused brands blurring traditional athletic footwear boundaries.

Some of the key players include:

- Adidas AG

- Asics Corporation

- New Balance Athletics, Inc.

- Nike Inc.

- Puma SE

- Under Armour Inc.

Recent Developments:

- In September 2025, Pos Malaysia Berhad, the country’s foremost provider of postal and parcel services, is excited to unveil a unique limited-edition sneaker line in partnership with the local brand SNIIKA, signifying the inaugural collaboration of this nature between two domestic brands. The limited-edition sneakers, costing RM130, can be pre-ordered from 25 August to 12 September 2025, with collections beginning on 25 November 2025. Customers have the option to pre-order the exclusive sneakers online or by visiting any Pos Malaysia outlet across the country during the pre-order phase.

- In July 2025, The Swiss sportswear label On has launched its inaugural flagship store in Singapore, situated at Jewel Changi Airport. The 9,300-square-foot, two-level shop displays On’s complete collection of performance and lifestyle items, featuring running shoes, technical clothing, trail equipment, and tennis shoes co-created with Roger Federer.

- In January 2025, 361°, a world leader in premium sports apparel, is excited to announce the launch of its inaugural retail outlet in Malaysia. This represents a crucial achievement in the brand’s strategic growth throughout Southeast Asia, highlighting its dedication to delivering cutting-edge sportswear options to athletes and fitness lovers in the area. Situated in Aeon Bukit Tinggi Shopping Centre, the new 361° outlet will provide a comprehensive selection of the brand’s acclaimed items, such as high-tech running footwear, sports clothing, and performance gear. The shop is crafted to provide a captivating and immersive shopping experience, highlighting the brand’s newest advancements in sportswear technology and performance-oriented design.

South East Asia Athletic Footwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Aerobic Shoes, Running Shoes, Walking Shoes, Trekking and Hiking Shoes, Sports Shoes |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Brand Outlets, Online Channels |

| End Users Covered | Men, Women, Kids |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Companies Covered | Adidas AG, Asics Corporation, New Balance Athletics, Inc., Nike Inc., Puma SE, Under Armour Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South East Asia athletic footwear market size was valued at USD 2,501.32 Million in 2025.

The South East Asia athletic footwear market is expected to grow at a compound annual growth rate of 4.01% from 2026-2034 to reach USD 3,564.10 Million by 2034.

Running shoes dominated the product type segment with a market share of 35%, favored for their versatility across multiple activities including daily wear, commuting, and recreational fitness. This segment's leadership reflects preference for comfortable, multipurpose footwear that seamlessly transitions between athletic performance and casual lifestyle applications.

Key factors driving the South East Asia athletic footwear Market include accelerating health and fitness consciousness among urban populations, rising disposable incomes enabling quality footwear purchases, expanding youth demographics embracing athleisure fashion trends, government initiatives promoting active lifestyles and sports participation, and cultural integration of athletic footwear into everyday wardrobes beyond traditional sports contexts.

Major challenges include widespread counterfeit product proliferation undermining brand value and consumer trust, volatile raw material costs pressuring pricing strategies and profit margins, increasing environmental sustainability demands requiring production complexity and investment, and rapid fashion trend cycles requiring continuous design innovation and inventory management agility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)