South East Asia Construction Equipment Market Size, Share, Trends and Forecast by Solution Type, Equipment Type, Type, Application, Industry, and Region, 2026-2034

South East Asia Construction Equipment Market Size and Share:

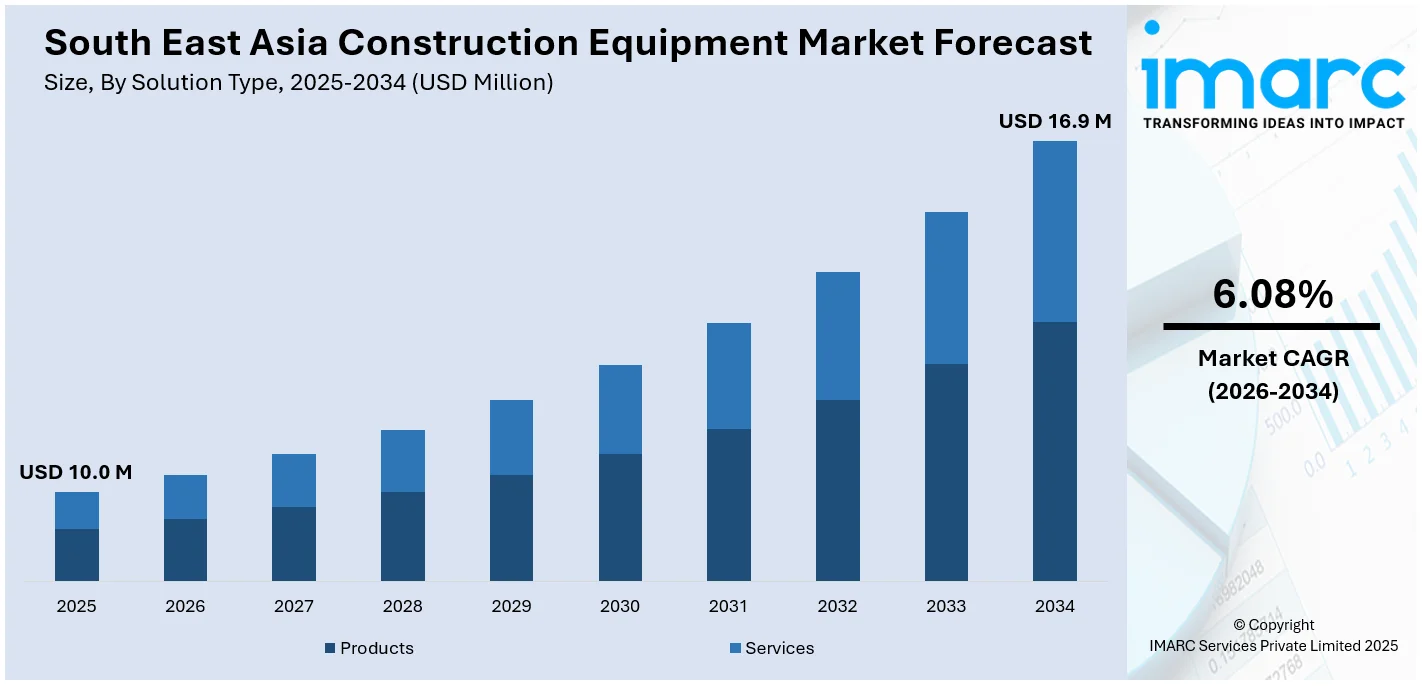

The South East Asia construction equipment market size was valued at USD 10.0 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 16.9 Million by 2034, exhibiting a CAGR of 6.08% during 2026-2034. Indonesia currently dominates the market, holding a significant market share of around 34.4% in 2025. The market is driven by rapid urbanization, infrastructure development projects, and increasing government investments in public works. Moreover, the rising demand for residential, commercial, and industrial buildings, along with growing smart city initiatives, further fuels the market expansion. Additionally, continual technological advancements in construction machinery and a shift toward eco-friendly equipment are enhancing efficiency and reducing operational costs, further augmenting the South East Asia construction equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10.0 Million |

| Market Forecast in 2034 | USD 16.9 Million |

| Market Growth Rate 2026-2034 | 6.08% |

The market is significantly influenced by fast-growing urbanization and an increase in infrastructure development activities across the region. With growing urban expansions, the need for residential, commercial, and industrial complexes increases, which is leading to a high demand for construction equipment. Further, the growth of logistics and supply chains within the region demands better transport infrastructure, which supports market growth. According to an industry report, Vietnam intends to start 13 large transportation infrastructure projects valued at USD 1.2 Billion in 2024. In line with this, the use of sophisticated building equipment with telematics, GPS tracking, and automation is gaining momentum. These technologies improve site efficiency, safety, and productivity, making them appealing to contractors.

To get more information on this market Request Sample

Moreover, the focus on the environment and sustainability of the construction business is playing a part in enhancing demand for green construction equipment, such as electric-powered vehicles. Apart from this, the increase in Southeast Asia's middle-class population is fueling the demand for housing. Thus, developers are building homes and housing complexes, which is increasing the need for construction equipment to perform excavation, foundation laying, and construction operations. In addition to this, the rising focus on smart cities and green building projects is a major factor driving the implementation of advanced construction technology and energy-efficient solutions. For instance, Vietnam commits to green building development, seeking to lower greenhouse gas (GHG) emissions by 9%-27% by 2030 and reach net-zero by 2050. As of the first quarter of 2024, there have been almost 430 completed building projects that are green-certified, with forecasts suggesting a rise to 582 by 2030. Also, the availability of renting construction machinery allows businesses to benefit from low-cost alternatives, leading to increased usage and market growth.

South East Asia Construction Equipment Market Trends:

Increase in Urban Population

The rapid increase in the urban population across Southeast Asia is leading to a growing demand for construction equipment to support urbanization and infrastructure development. According to an industry report, half of the region's population already lives in urban areas, with an additional 70 million expected to join urban centers by 2025. As more people migrate to cities for better job opportunities, housing, and living standards, the need for residential, commercial, and industrial infrastructure is expected to rise significantly. This urban expansion necessitates the construction of high-rise buildings, roads, bridges, and public transportation systems, which further propels the requirement for cranes, excavators, bulldozers, and other heavy machinery. This increase in urban population also accelerates the demand for optimal utilization of land and eco-friendly development. Therefore, the construction sector is leaning toward advanced technologies in construction machinery for quicker and cheaper projects. Moreover, the increase in infrastructure developments in metropolitan areas results in huge investments in construction machinery, thus driving the South East Asia construction equipment market growth.

Growth of the Hospitality Industry

The growth of the hospitality industry in Southeast Asia is another key trend influencing the demand for construction equipment. The region's rising tourism sector, driven by increased international arrivals and local tourism, is a major contributor to the expansion of hotels, resorts, and recreational facilities. According to an industry report, Singapore remains the largest source of tourists, contributing 7.6 million visitors from January to October 2024, followed by Indonesia with over 3.1 million arrivals, and Thailand and Brunei showing significant growth as well. Additionally, governments as well as private enterprises are heavily investing in grand hospitality projects to meet the growing demand for accommodations and leisure activities. Luxury hotel, resort, shopping mall, as well as entertainment complex construction demands specialized construction equipment for excavation, lifting, and foundation construction. With the growing popularity of Southeast Asia as a worldwide tourist destination, the hospitality sector emerges as one of the primary drivers for construction equipment, especially in developing economies such as Vietnam, Indonesia, and Thailand.

Government Support for Infrastructure Development

Governments across Southeast Asia are actively supporting infrastructure development as part of their long-term economic strategies, which is positively impacting the South East Asia construction equipment market outlook. Government investments in transportation networks, smart cities, and sustainable infrastructure projects are leading to an increased demand for construction machinery. For example, the Indonesian government intends to spend 400.3 Trillion rupiah (about USD 25.5 Billion) on infrastructure development next year, including continuing to build in the future capital city of Nusantara on Kalimantan Island. Additionally, projects like highway development, airport and port development, and metro rail expansion are fueling tremendous construction work, involving heavy machinery such as road rollers, concrete pumps, and backhoes. Furthermore, the government-supported funding and policies that enhance the region's connectivity are another factor propelling the boom in construction. In addition, the focus on sustainable infrastructure, such as green buildings and renewable energy projects, further increases the demand for specialized machinery that can withstand environmental requirements and lower construction costs.

South East Asia Construction Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South East Asia construction equipment market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on solution type, equipment type, type, application, and industry.

Analysis by Solution Type:

- Products

- Services

Products lead the market with around 87.6% of market share in 2025 driven by the growing demand for infrastructure development within the region. This encompasses a broad array of equipment like excavators, cranes, bulldozers, and concrete mixers, which are vital in large-scale construction projects, urban development, and industrial growth. As urbanization occurs at a fast rate and infrastructure improves in nations such as Indonesia, Vietnam, and Thailand, the need for efficient and advanced construction equipment has increased. The products offer construction companies the tools they need to improve productivity, be safer, and save on operational expenses. As the region moves towards more sustainable and advanced technology solutions, demand for automated and energy-efficient machinery is also increasing. Therefore, the products segment in the market is central, not only stimulating economic development but also enabling the construction sector to move towards contemporary, high-performance solutions.

Analysis by Equipment Type:

- Heavy Construction Equipment

- Compact Construction Equipment

Heavy construction equipment leads the market with around 76.7% of market share in 2025. The segment includes equipment like bulldozers, cranes, excavators, and loaders that are vital for large-scale construction activities, such as the construction of highways and bridges. With the region witnessing extensive urbanization and industrialization, there has been a heightened demand for heavy construction equipment. These tools can execute intricate tasks, ranging from earthmoving to material handling, making operations more efficient and safer. The growth of industries, particularly in nations such as Indonesia, Malaysia, and Thailand, also propels the need for heavy machinery. Besides this, the use of more sophisticated, fuel-efficient models and automated versions is also gaining limelight as the region emphasizes sustainability and decreasing carbon footprints. Thus, heavy construction machinery is at the forefront of addressing increasing needs in the construction sector, as well as fueling economic advancement in the region.

Analysis by Type:

- Loader

- Cranes

- Forklift

- Excavator

- Dozers

- Others

Excavator leads the market with around 39.8% of market share in 2025. Excavators are versatile and play a critical role in most construction activities. Excavators are very important in digging, trenching, lifting heavy loads, and demolition in large-scale infrastructure construction projects. With the fast pace of urbanization and the growing need for residential, commercial, and industrial projects in nations like Indonesia, Vietnam, and the Philippines, excavators are highly demanded. Their capacity to work under varied working conditions, ranging from city construction sites to distant regions, increases their importance. Besides, the market is also experiencing a transition to more sophisticated, fuel-efficient, and smaller models of excavators due to demands for sustainability and efficiency of operations. Excavators not only are at the core of large-size construction works but also perform a critical function in terms of improving productivity, minimizing the cost of labor, and facilitating timely project completion in the region.

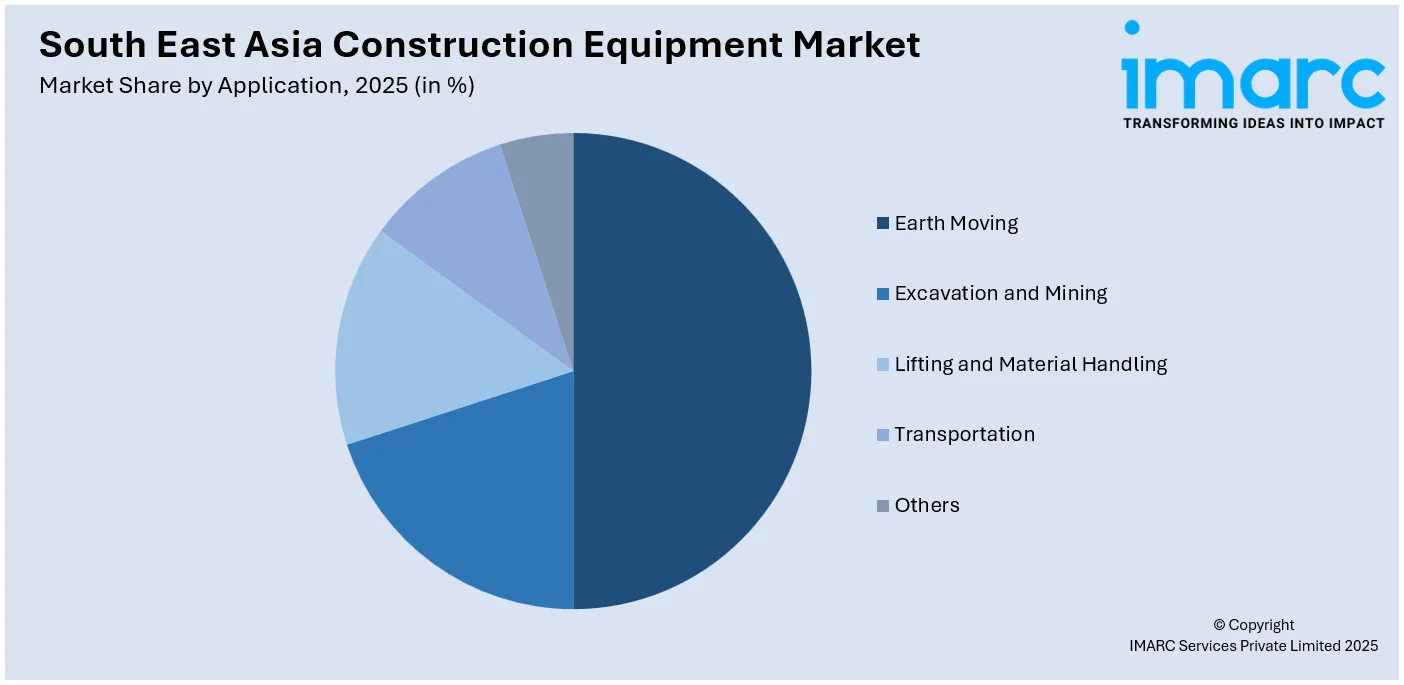

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Excavation and Mining

- Lifting and Material Handling

- Earth Moving

- Transportation

- Others

Earth moving leads the market with around 49.8% of market share in 2025 fueled by the region's high pace of infrastructure development and urbanization. This segment includes the usage of machines like bulldozers, excavators, and graders that are crucial for operations such as land clearing, grading, excavation, and site preparation. With countries such as Indonesia, Thailand, and the Philippines implementing large-scale infrastructure development, the demand for earth moving equipment also increases. These vehicles are essential for the construction of foundations for bridges, roads, and buildings, making them a necessity in the development of commercial and residential properties. Further, as the industry transitions towards sustainable construction, the demand for fuel-efficient and technologically advanced earth moving machines is increasing. The expansion of mining and energy industries in South East Asia further solidifies the significance of earth-moving equipment in sustaining productivity, enhancing efficiency, and guaranteeing the timely completion of projects in the region.

Analysis by Industry:

- Oil and Gas

- Construction and Infrastructure

- Manufacturing

- Mining

- Others

Construction and infrastructure lead the market with around 65.0% of market share in 2025. With rapid urbanization, rising industrialization, and large-scale infrastructure developments in nations such as Indonesia, Malaysia, and Vietnam, demand for high-end construction equipment has increased. This segment comprises the construction of highways, bridges, residential and commercial developments, and factory buildings, all of which involve heavy machinery in excavation, material movement, and site preparation. While governments and private builders emphasize the development of infrastructure to fuel economic growth, the construction and infrastructure industry is a major driver of market growth. In addition, the smart city and sustainable development trend is driving the procurement of energy-efficient and technologically superior building equipment to ensure that the region attains contemporary needs while upholding environmental objectives. Consequently, the segment is central to the progressive transformation of South East Asia's economic landscape.

Analysis by Country:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

In 2025, Indonesia accounted for the largest market share of over 34.4% due to its vast infrastructure development and urbanization plans. Indonesia is one of the region's largest economies and is spending heavily on public and private sector projects such as road construction, urbanization, and energy infrastructure. Such a speedy increase in construction work generates a high need for construction machines, specifically heavy machines like excavators, bulldozers, and cranes, that are crucial for a large-scale project. The government's ambitious initiatives towards developing the infrastructure, including the National Medium-Term Development Plan (RPJMN), also stimulate the demand for new and effective construction equipment. Apart from this, the rising industrialization, urbanization, and population pressure fuel the need for housing, commercial space, and transport infrastructure, all of which demand sophisticated construction solutions. As Indonesia grows economically, the market will witness consistent growth with a focus on technology and sustainability.

Competitive Landscape:

The market for construction equipment in South East Asia is extremely competitive, led by both domestic and overseas players. The market is characterized by high participation of manufacturers dealing in a variety of equipment such as excavators, loaders, cranes, and bulldozers, specifically designed to satisfy the multiple requirements of infrastructure, mining, and construction industries. Technological innovations, including automation, telematics, and electric motors, have emerged as a major differentiator among competitors, providing greater efficiency, sustainability, and reduced operating expenses. Pricing strategies also have an important part to play in competition, as firms tend to provide flexible financing arrangements to appeal to price-conscious markets. After-sales services, such as maintenance, repair, and supply of parts, are essential in maintaining long-term client relationships. According to the South East Asia construction equipment market forecast, the region's demand for construction equipment will increase at a consistent level due to more government spending on infrastructure and rising urbanization, which will open opportunities to both veteran and new players to increase market share.

The report provides a comprehensive analysis of the competitive landscape in the South East Asia construction equipment market with detailed profiles of all major companies, including:

- Caterpillar Inc.

- Hitachi Construction Machinery Co. Ltd. (Hitachi Ltd.)

- Kobelco Construction Machinery South East Asia Co. Ltd.

- Komatsu Ltd.

- Siam Kubota Corporation Company Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- April 2025: Konecranes supplied 14 cranes to Makino’s new manufacturing facility in Vietnam’s Hung Yen province to enhance high-precision machine production. The order included various crane types with up to 15 tons of capacity, improving material handling efficiency across Makino’s production, shipping, and storage zones.

- January 2025: Volvo CE launched its New Generation Excavators in Southeast Asia, marking its biggest update in 20 years. The EC210 to EC360 models offer enhanced efficiency, safety, durability, and fuel savings. The rollout began in Singapore, targeting regional customer needs with advanced features and lower ownership costs.

- January 2025: Volvo CE launched its New Generation EC210 Excavator in Thailand, highlighting the product’s enhanced fuel efficiency, durability, and safety. This strategic move strengthens Volvo CE’s presence in Thailand, ensuring improved customer support and increased competitiveness in the regional market.

South East Asia Construction Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Solution Types Covered | Products, Services |

| Equipment Types Covered | Heavy Construction Equipment, Compact Construction Equipment |

| Types Covered | Loader, Cranes, Forklift, Excavator, Dozers, Others |

| Applications Covered | Excavation and Mining, Lifting and Material Handling, Earth Moving, Transportation, Others |

| Industries Covered | Oil and Gas, Construction and Infrastructure, Manufacturing, Mining, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Companies Covered | Caterpillar Inc., Hitachi Construction Machinery Co. Ltd. (Hitachi Ltd.), Kobelco Construction Machinery South East Asia Co. Ltd., Komatsu Ltd., Siam Kubota Corporation Company Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia construction equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia construction equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia construction equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The South East Asia construction equipment market was valued at USD 10.0 Million in 2025.

The South East Asia construction equipment market is projected to exhibit a CAGR of 6.08% during 2026-2034, reaching a value of USD 16.9 Million by 2034.

The market is driven by rapid urbanization, infrastructure development, increased government spending on public works, and rising demand for residential, commercial, and industrial projects. Technological advancements in equipment, favorable government policies, and growing investments in transportation and energy infrastructure also contribute to market growth.

Indonesia currently dominates the South East Asia construction equipment market with a market share of around 34.4%. The dominance is fueled by robust infrastructure projects, rapid urbanization, implementation of government initiatives such as the "National Medium-Term Development Plan," and significant investments in transportation, energy, and industrial sectors.

Some of the major players in the South East Asia construction equipment market include Caterpillar Inc., Hitachi Construction Machinery Co. Ltd. (Hitachi Ltd.), Kobelco Construction Machinery South East Asia Co. Ltd., Komatsu Ltd., and Siam Kubota Corporation Company Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)