South East Asia Forage Market Report by Crop Type (Cereals, Legumes, Grasses), Product Type (Stored Forage, Fresh Forage), Animal Type (Ruminants, Swine, Poultry, and Others), and Country 2026-2034

Market Overview:

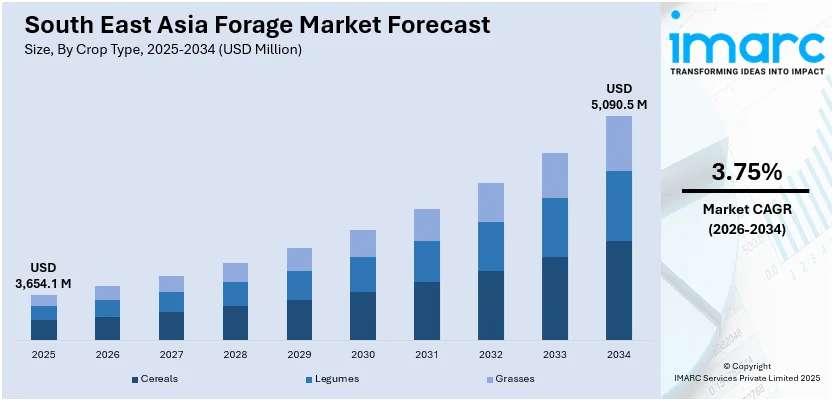

South East Asia forage market size reached USD 3,654.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 5,090.5 Million by 2034, exhibiting a growth rate (CAGR) of 3.75% during 2026-2034. The increasing advancements in agricultural technology, such as improved seed varieties, precision farming techniques, and better harvesting and storage methods, that can enhance forage production efficiency, leading to enhanced yields and improved quality, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3,654.1 Million |

| Market Forecast in 2034 | USD 5,090.5 Million |

| Market Growth Rate (2026-2034) | 3.75% |

Forage refers to the act of searching for food or provisions, typically in the wild or natural surroundings. It is an instinctive behavior observed in various animal species, including herbivores, omnivores, and even some carnivores. Foraging involves the utilization of sensory cues and environmental knowledge to locate and procure nourishment, such as edible plants, fruits, nuts, seeds, and occasionally small insects or other organisms. This process is vital for the survival and sustenance of many animal populations, especially those residing in habitats where food sources may be scarce or seasonally variable. Foraging behaviors can be highly adaptive and can vary depending on factors like species-specific dietary preferences, environmental conditions, and social dynamics. Some animals, like certain primates and birds, exhibit complex foraging strategies involving tool use and social learning. Additionally, foraging impacts ecosystem dynamics, as it can influence plant distribution, seed dispersal, and nutrient cycling, thereby playing a crucial role in the balance of natural ecosystems.

To get more information on this market Request Sample

South East Asia Forage Market Trends:

The forage market in South East Asia is influenced by several key drivers, contributing to its dynamic nature. Firstly, the growing regional population has led to an increased demand for livestock products, thereby bolstering the need for high-quality forage. Furthermore, the escalating trend of sustainable and organic farming practices has amplified the reliance on nutrient-rich forage, driving the market towards innovative and eco-friendly solutions. Additionally, the rising awareness regarding animal welfare and the importance of high-quality animal nutrition has propelled the forage market's growth trajectory as livestock owners increasingly prioritize the nutritional value of their animals' diets. Moreover, the shifting climatic conditions and the subsequent alterations in agricultural landscapes have underscored the necessity for resilient and adaptable forage varieties, further shaping the market's dynamics. Lastly, technological advancements in forage production and processing, which have significantly improved efficiency and quality, are expected to drive the forage market in South East Asia during the forecast period.

South East Asia Forage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on crop type, product type, and animal type.

Crop Type Insights:

- Cereals

- Legumes

- Grasses

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereals, legumes, and grasses.

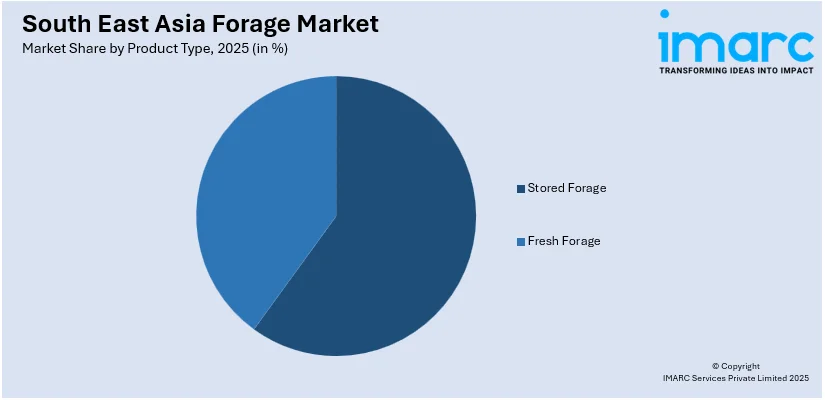

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Stored Forage

- Silage

- Hay

- Fresh Forage

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes stored forage (silage and hay) and fresh forage.

Animal Type Insights:

- Ruminants

- Swine

- Poultry

- Others

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes ruminants, swine, poultry, and others.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South East Asia Forage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Crop Types Covered | Cereals, Legumes, Grasses |

| Product Types Covered |

|

| Animal Types Covered | Ruminants, Swine, Poultry, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South East Asia forage market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the South East Asia forage market?

- What is the breakup of the South East Asia forage market on the basis of crop type?

- What is the breakup of the South East Asia forage market on the basis of product type?

- What is the breakup of the South East Asia forage market on the basis of animal type?

- What are the various stages in the value chain of the South East Asia forage market?

- What are the key driving factors and challenges in the South East Asia forage?

- What is the structure of the South East Asia forage market and who are the key players?

- What is the degree of competition in the South East Asia forage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia forage market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia forage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia forage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)