South East Asia Mobile Wallet Market Size, Share, Trends and Forecast by Type, Application, and Country, 2025-2033

Market Overview:

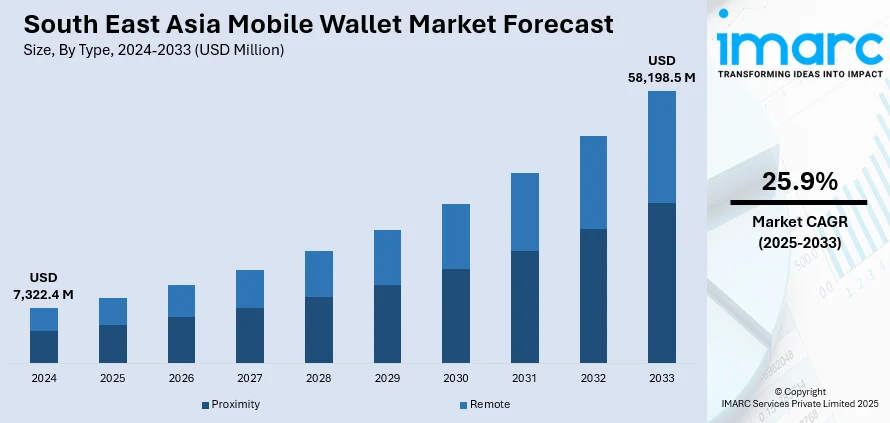

The South East Asia mobile wallet market size reached USD 7,322.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 58,198.5 Million by 2033, exhibiting a growth rate (CAGR) of 25.9% during 2025-2033. The significant expansion in the e-commerce industry, the growing smartphone penetration due to the increasing population, and the implementation of favorable government policies to support digital payments represent some of the key factors contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7,322.4 Million |

| Market Forecast in 2033 | USD 58,198.5 Million |

| Market Growth Rate (2025-2033) | 25.9% |

A mobile wallet is a digital application or software that allows users to store, manage, and transact with their financial assets, such as money, payment cards, loyalty cards, and cryptocurrency, directly from their mobile devices, such as smartphones or tablets. It is gaining popularity due to its convenience, security, and versatility. It is transforming the way individuals handle their finances by providing a seamless and efficient alternative to traditional physical wallets. It enables users to make various types of digital payments, including in-store purchases, online shopping, bill payments, and peer-to-peer money transfers, enabling users to link their bank accounts, credit cards, or debit cards to their mobile wallet for quick and easy transactions. It uses encryption technology and secure authentication methods such as PINs, biometrics including fingerprint or facial recognition, or two-factor authentication to protect user information and funds, which enhances security compared to carrying physical cash or cards. Additionally, it offers features such as storing digital loyalty cards, coupons, and offers from various retailers, which streamlines the shopping experience and encourages customer engagement. Nowadays, mobile wallets also support cryptocurrency storage and transactions, allowing users to buy, sell, and store cryptocurrencies within the same app, providing a unified financial management experience.

To get more information of this market, Request Sample

South East Asia Mobile Wallet Market Trends:

The market is primarily driven by the significant expansion in the e-commerce industry in South East Asia. In addition, the growing number of consumers are turning toward online shopping, which requires secure and efficient payment methods, including mobile wallets providing a seamless payment experience, contributing to the market growth. Moreover, several governments are implementing policies to support digital payments and financial inclusion with initiatives such as promoting cashless transactions and offering incentives for digital payments, which is encouraging consumers and businesses to embrace mobile wallet solutions, representing another major growth-inducing factor. Along with this, the growing smartphone penetration due to the easy availability of smartphones and the growing user base for mobile wallet services are encouraging businesses to invest in developing and promoting mobile wallet solutions, further propelling the market growth. Besides this, the growing efforts in consumer education provide knowledge regarding mobile wallet use for the public, with clear and simple guides on how to use mobile wallets are helping to bridge the knowledge gap and encouraging more individuals to give them a try, which is accelerating the market growth. Furthermore, mobile wallet providers are forming strategic partnerships with various businesses, including retailers, transportation services, and food delivery platforms, which makes mobile wallets more attractive and versatile for consumers, creating a positive market outlook.

South East Asia Mobile Wallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Proximity

- Remote

The report has provided a detailed breakup and analysis of the market based on the type. This includes proximity and remote.

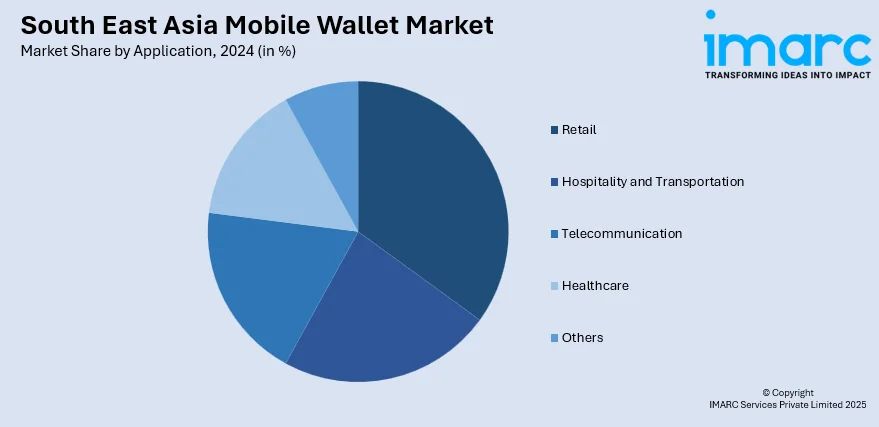

Application Insights:

- Retail

- Hospitality and Transportation

- Telecommunication

- Healthcare

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes retail, hospitality and transportation, telecommunication, healthcare, and others.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South East Asia Mobile Wallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Proximity, Remote |

| Applications Covered | Retail, Hospitality and Transportation, Telecommunication, Healthcare, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia mobile wallet market from 2019-2033.

- This research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia mobile wallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia mobile wallet industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mobile wallet market in South East Asia was valued at USD 7,322.4 Million in 2024.

The South East Asia mobile wallet market is projected to exhibit a CAGR of 25.9% during 2025-2033, reaching a value of USD 58,198.5 Million by 2033.

The Southeast Asia mobile wallet market is driven by increased smartphone penetration, the growing adoption of digital payments, and a shift towards cashless transactions. Enhanced convenience, improved security features, and government initiatives supporting financial inclusion also play vital roles. Additionally, rising e-commerce activities and changing user preferences further support the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)