South East Asia Non-Ferrous Metals Market Size, Share, Trends and Forecast by Type, Application, and Country, 2025-2033

South East Asia Non-Ferrous Metals Market Size and Share:

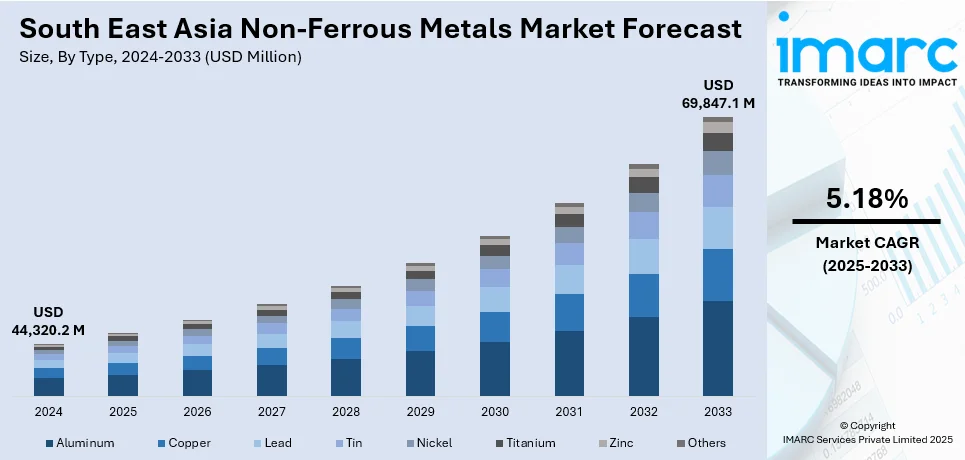

The South East Asia non-ferrous metals market size was valued at USD 44,320.2 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 69,847.1 Million by 2033, exhibiting a CAGR of 5.18% during 2025-2033. Indonesia currently dominates the market, holding a significant market share of over 32.8% in 2024. This can be explained due to its extensive natural resources such as bauxite, nickel, and copper. The country is a major world supplier with a growing industrial base and a growing demand for non-ferrous metals within the construction, automobile, and electronics sectors. Indonesia's export policies also aim to support the South East Asia non-ferrous metals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 44,320.2 Million |

|

Market Forecast in 2033

|

USD 69,847.1 Million |

| Market Growth Rate 2025-2033 | 5.18% |

The South East Asia non-ferrous metal market is fueled by fast-track urbanization and industrialization in the region, with heavy infrastructure development driving non-ferrous metal demand. Indonesia, Thailand, and Vietnam are experiencing growth in construction activities, particularly in urban areas where infrastructure projects are being undertaken at a fast track rate. Non-ferrous metals such as aluminum, zinc, and copper are critical in these applications, with aluminum widely utilized in light-weight structures and zinc in corrosion-proof coatings. Modern high-rise building construction, transport infrastructure, and inner-city dwellings have seen a greater dependency on these metals. The growth of the automobile industry, especially in nations such as Thailand, has seen the demand for light-weight metals soar, enhancing market size.

One of the major South East Asia Non-Ferrous metals market trends is the rising demand for renewable energy sources, particularly solar and wind power. The region's push toward clean energy solutions has spurred significant investments in renewable energy infrastructure, increasing the need for non-ferrous metals. Copper, essential for the electrical systems in solar panels and wind turbines, is in high demand. Countries like Vietnam and Thailand are making strides in renewable energy, with initiatives such as rooftop solar installations contributing to a greater need for these metals. The region’s focus on reducing carbon emissions through green energy solutions has further intensified the demand for non-ferrous metals in energy systems. As governments implement policies encouraging sustainability, the need for these metals will continue to grow. For instance, as per 2024 industry reports, South-East Asia is emerging as a major hub for metals recycling, driven by new facilities in Malaysia, Thailand, and Vietnam. Oryx, for example, launched a modern stainless steel recycling facility in Johor Bahru, Malaysia. Similarly, Chinese companies have introduced copper and aluminum recycling plants in Thailand, with plans for increased capacity. The region's rapid growth in recycling is supported by expanding infrastructure and increasing industry participation, with South-East Asia, especially India, becoming a key player in the global recycling market.

South East Asia Non-Ferrous Metals Market Trends:

Urbanization and Industrialization

The rapid urbanization and industrialization across Southeast Asia are central drivers of the non-ferrous metals market. Urbanization rates in the region vary significantly, with Cambodia at 24% and Singapore fully urbanized. As urbanization accelerates, the demand for infrastructure projects also increases, especially in the construction sector. The need for lightweight building materials and corrosion-resistant coatings is pushing the demand for aluminum and zinc. These non-ferrous metals are essential in constructing modern, energy-efficient buildings and transport infrastructure. Additionally, as industrialization continues, sectors such as manufacturing, construction, and transportation in countries like Indonesia and Vietnam rely on aluminum and zinc for various applications. With urban growth, these metals become increasingly vital, creating a positive South East Asia non-ferrous metals market outlook as cities expand and infrastructure projects increase in size and scope.

Automotive Industry Growth

The expansion of the automotive industry in Southeast Asia is a significant contributor to the demand for non-ferrous metals like aluminum, copper, and zinc. In 2023, Thailand solidified its position as a key automotive manufacturing hub in the region, producing 1.8 million cars, buses, and commercial vehicles, alongside 2 million motorcycles. Non-ferrous metals play a crucial role in the automotive sector, particularly in manufacturing lightweight vehicles that meet consumers’ increasing demand for fuel efficiency and reduced environmental impact. Aluminum and copper are essential for producing lightweight structures and electrical components in vehicles. The rise in demand for electric vehicles (EVs) in Southeast Asia further elevates the demand for aluminum and copper, as these metals are vital in EV battery production and overall vehicle efficiency, further driving market expansion.

Renewable Energy and Electronics Sectors

The increasing push toward renewable energy sources, such as solar and wind power, is significantly influencing the South East Asia non-ferrous metals market growth. Metals like copper are essential in the construction of electrical systems for renewable energy infrastructure, such as solar panels and wind turbines. The growing shift toward sustainable energy solutions, as seen in Vietnam’s solar initiatives, directly drives demand for copper in electrical systems. Similarly, the region’s rapidly expanding electronics and electrical appliances sector is another major contributor. Copper, aluminum, and other metals are vital in manufacturing wiring, connectors, and components for electronic devices. As consumer demand for electronics increases, so does the need for these metals, supporting Southeast Asia's continued position as a global manufacturing hub for electronics and renewable energy solutions.

South East Asia Non-Ferrous Metals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South East Asia non-ferrous metals market, along with forecast at the regional and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Aluminum

- Copper

- Lead

- Tin

- Nickel

- Titanium

- Zinc

- Others

Aluminum stand as the largest type in 2024, holding around 37.8% of the market. This is primarily driven by its extensive use in various industries, including construction, automotive, and packaging. Aluminum's lightweight, corrosion-resistant, and durable properties make it a preferred choice for building materials, lightweight vehicle components, and consumer goods. Its growing application in the automotive industry for fuel-efficient vehicles, as well as its use in infrastructure projects, supports its dominant position. Additionally, aluminum's increasing adoption in renewable energy systems, particularly in solar panels, further boosts its market share.

Analysis by Application:

.webp)

- Automotive Industry

- Electronic Power Industry

- Construction Industry

- Others

Automotive industry leads the market with around 44.3% of market share in 2024. According to South East Asia non-ferrous metals market forecast, this dominance is driven by the region's growing automotive manufacturing hubs, particularly in countries like Thailand and Indonesia, which are major producers of vehicles, including cars, commercial vehicles, and motorcycles. Non-ferrous metals such as aluminum, copper, and zinc are crucial for producing lightweight vehicles, reducing fuel consumption, and meeting environmental regulations. The increasing demand for energy-efficient and environmentally friendly vehicles further fuels the need for these metals, positioning the automotive sector as the largest market driver in the region.

Country Analysis:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

In 2024, Indonesia accounted for the largest market share of over 32.8%. This dominance can be attributed to the country's extensive natural resources, particularly in nickel, aluminum, and copper production. For instance, as per Internation Trade Administration, Indonesia, the largest economy in Southeast Asia, is projected to become the 5th largest economy globally by 2024. The country is rich in critical minerals, including 1.5 billion tons of nickel, 640 million tons of copper, 927 million tons of bauxite, and 1.2 billion tons of tin. These minerals are essential for sectors such as IT, electric vehicles, health tech, and renewable energy. Indonesia has enacted a regulation to prohibit the export of raw materials, aiming to develop its local smelting industry and attract foreign investment. Indonesia's commitment to critical minerals is also supported by the Indo-Pacific Economic Forum (IPEF). Indonesia's growing industrial base, including the rapidly expanding infrastructure and construction sectors, drives the demand for non-ferrous metals. Additionally, the country’s significant role in the global mining industry, coupled with increasing investments in renewable energy and the automotive sector, positions Indonesia as a key player in the region's non-ferrous metals market, supporting its substantial market share.

Competitive Landscape:

The competitive landscape of the South East Asia non-ferrous metals market is characterized by a dynamic environment with numerous key players across the region. The market is shaped by both local and international companies, with significant focus on the supply chain of metals such as aluminum, copper, and zinc. These companies are actively engaged in the production, refinement, and trade of non-ferrous metals, which are critical in several industries, including automotive, construction, and electronics. Strategic partnerships, mergers, and acquisitions have played a pivotal role in strengthening the market presence of major players, while regional governments' policies and sustainability initiatives also influence competition. Additionally, factors like technological advancements and supply-demand dynamics continue to drive innovation and competitiveness in the sector. For instance, in August 2024, Sumitomo Corporation formed a strategic partnership with BIA Group to enhance their non-ferrous metals distribution activities, particularly in the mining and construction machinery sectors across Europe and Africa. This partnership, with Sumitomo's minority investment in BIA Group, will leverage both companies' expertise in distributing Komatsu equipment, expanding their reach in the non-ferrous metals market. By sharing resources and best practices, the collaboration aims to strengthen market positions, improve operational efficiency, and drive growth in the mining sector, creating long-term value for all stakeholders.

The report provides a comprehensive analysis of the competitive landscape in the South East Asia non-ferrous metals market with detailed profiles of all major companies, including:

- Hanwa Thailand Co. Ltd. (Hanwa Co. Ltd.)

- LODEC Asia Pte Ltd.

- Shinsho (Malaysia) Sdn. Bhd. (Kobe Steel)

- Sumitomo Corporation

- Thai-MC Company Limited (Mitsubishi Corporation)

Latest News and Developments:

- February 2025: Blackstone Minerals announced a merger with IDM International to acquire the Mankayan Copper-Gold Project in the Philippines. Mankayan is among the largest undeveloped copper-gold porphyry systems globally, featuring historic drill intercepts up to 911m at 1.00% CuEq.

- January 2025: Abaxx Exchange launched nickel sulphate futures in Singapore. This move follows industry calls for alternatives to LME pricing after a major short squeeze disrupted the market in early 2022.

- November 2024: GRIPM Powder Materials' new ISO 9001-certified copper powder plant in Chonburi, Thailand, became operational. With a 5,000-ton annual capacity, it produces electrolytic copper powder used in sintered parts, friction materials, decorative finishes, welding, brazing, tooling, and electrical contacts.

- July 2024: bedra Vietnam Alloy Material Co., Ltd. launched new eco-friendly copper alloys bedra 270, 5800, 49250, EValloy 92, and PlugMax 11—targeting new energy vehicles and consumer electronics.

South East Asia Non-Ferrous Metals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Aluminum, Copper, Lead, Tin, Nickel, Titanium, Zinc, Others |

| Applications Covered | Automobile Industry, Electronic Power Industry, Construction Industry, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Companies Covered | Hanwa Thailand Co. Ltd. (Hanwa Co. Ltd.), LODEC Asia Pte Ltd., Shinsho (Malaysia) Sdn. Bhd. (Kobe Steel), Sumitomo Corporation, Thai-MC Company Limited (Mitsubishi Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia non-ferrous metals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the South East Asia non-ferrous metals market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia non-ferrous metals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The South East Asia non-ferrous metals market was valued at USD 44,320.2 Million in 2024.

The South East Asia non-ferrous metals market is projected to exhibit a CAGR of 5.18% during 2025-2033, reaching a value of USD 69,847.1 Million by 2033.

Key factors driving the South East Asia non-ferrous metals market include rapid urbanization, expanding infrastructure projects, growing automotive production, and the rising demand for renewable energy solutions. Additionally, increased industrialization, strong government policies supporting mining, and the region's critical mineral resources, such as nickel and copper, further contribute to market growth.

In 2024, Indonesia dominated the South East Asia non-ferrous metals market, accounting for the largest market share of 32.8%, with growth driven by its rich mineral resources, particularly nickel and copper, along with increased mining activities, government support for infrastructure development, and rising demand from industries such as automotive and electronics.

Some of the major players in the South East Asia non-ferrous metals market include Hanwa Thailand Co. Ltd. (Hanwa Co. Ltd.), LODEC Asia Pte Ltd., Shinsho (Malaysia) Sdn. Bhd. (Kobe Steel), Sumitomo Corporation, Thai-MC Company Limited (Mitsubishi Corporation), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)