South East Asia Private Equity Market Size, Share, Trends and Forecast by Fund Type, and Country, 2025-2033

Market Overview:

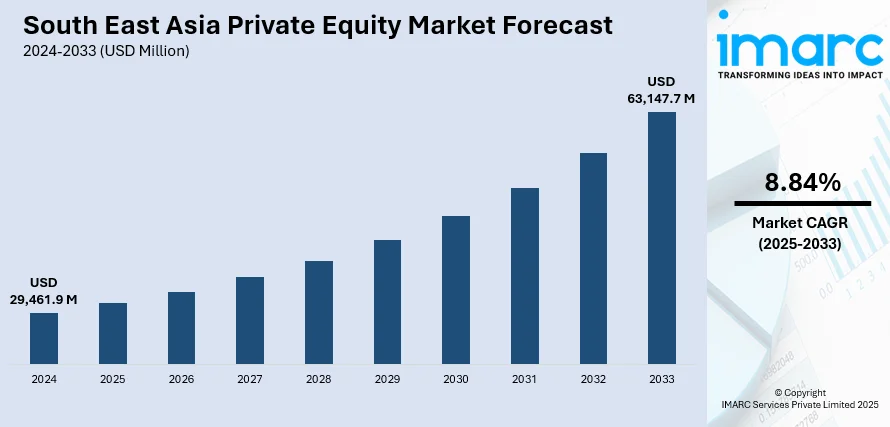

South East Asia private equity market size reached USD 29,461.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 63,147.7 Million by 2033, exhibiting a growth rate (CAGR) of 8.84% during 2025-2033. The robust economic growth, ongoing digital transformation, a rise in infrastructure development, and an influx of innovative startups, drawing both local and international investors while focusing increasingly on sustainable investments, represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29,461.9 Million |

| Market Forecast in 2033 | USD 63,147.7 Million |

| Market Growth Rate (2025-2033) | 8.84% |

Private equity refers to a form of investment where funds and investors directly invest in private companies or engage in buyouts of public companies, resulting in the delisting of public equity. Distinct from public stock markets, private equity investments typically involve a longer-term investment horizon where investors seek to improve financial performance and increase the value of their holdings through active management. These investors are often private equity firms, venture capital firms, or angel investors, each with a different strategy and investment stage preference. Private equity firms typically raise funds and take capital committed by wealthy individuals, pension funds, endowments, and other sources, then use these funds to acquire stakes in companies with potential. The focus is generally on generating value through improved operations, strategic repositioning, and growth acceleration, often preparing the company for a future sale or public offering. This investment strategy is notable for its potential to enhance a company's performance significantly but also comes with higher levels of risk and management fees. As a result, private equity is a critical driver of economic transformation, requiring careful consideration of its complexities and market dynamics.

To get more information of this market, Request Sample

South East Asia Private Equity Market Trends:

The South-East Asia private equity market is experiencing a dynamic phase driven by several key factors. Rapid economic growth across the region is creating fertile ground for investment opportunities, particularly in sectors like technology, healthcare, and consumer goods, which are benefiting from an expanding middle class and increasing digitalization. Moreover, the rise of local entrepreneurship is providing a robust pipeline of innovative startups, especially in tech hubs such as Singapore and Indonesia, further propelling the market growth. These startups are attracting local private equity funds and international investors seeking to capitalize on regional innovation and digital transformation. Additionally, the region's improving regulatory frameworks and economic reforms are enhancing the investment climate, providing clearer pathways for private equity transactions. In line with this, ongoing infrastructure development, partially spurred by China's Belt and Road Initiative, is another major growth-inducing factor, with investments in connectivity enhancing trade and logistics across South-East Asia. Furthermore, the relative under penetration of banking services is fueling the fintech sector, drawing significant private equity interest. Along with this, the emerging trend of strategic exits and buyout opportunities, as family-owned businesses look to private equity firms to facilitate succession planning and regional expansion, is contributing to market growth. Moreover, there is a heightened focus on sustainable and impact investing, responding to global environmental concerns and local community needs, which is positively influencing private equity investment strategies. Besides this, the coronavirus (COVID-19) pandemic, while initially disruptive, has accelerated the pace of digital adoption and transformation, highlighting the resilience and adaptability of South-East Asian markets. This, in turn, has reinforced investor confidence and commitment to the region, thus favoring market growth.

South East Asia Private Equity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on fund type.

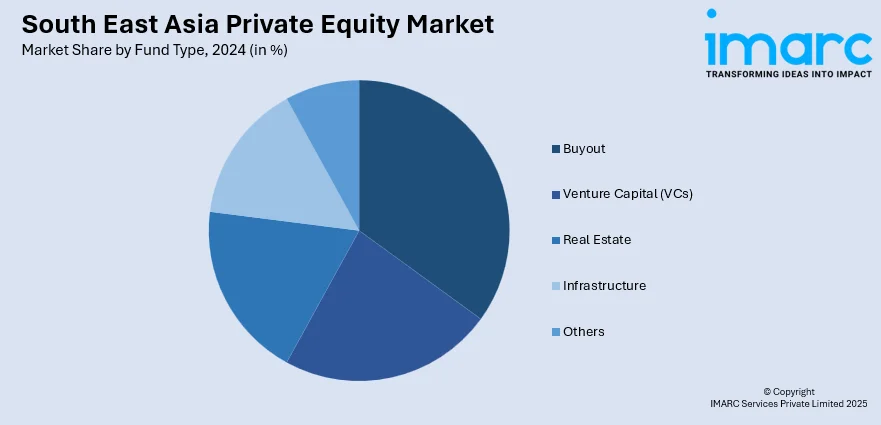

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South East Asia Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South East Asia private equity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The South East Asia private equity market size reached USD 29,461.9 Million in 2024.

The South East Asia private equity market is expected to reach USD 63,147.7 Million by 2033, exhibiting a CAGR of 8.84% during 2025-2033.

Market growth is driven by increasing foreign investments, expanding startup ecosystems, and rising demand for alternative financing solutions. The growing presence of venture capital firms, supportive government policies, and digital transformation initiatives across industries also contribute to private equity market expansion in the region. Additionally, economic growth and rising consumer spending power encourage more investment activities in Southeast Asia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)