South East Asia Risk Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Industry Vertical, and Country, 2025-2033

Market Overview:

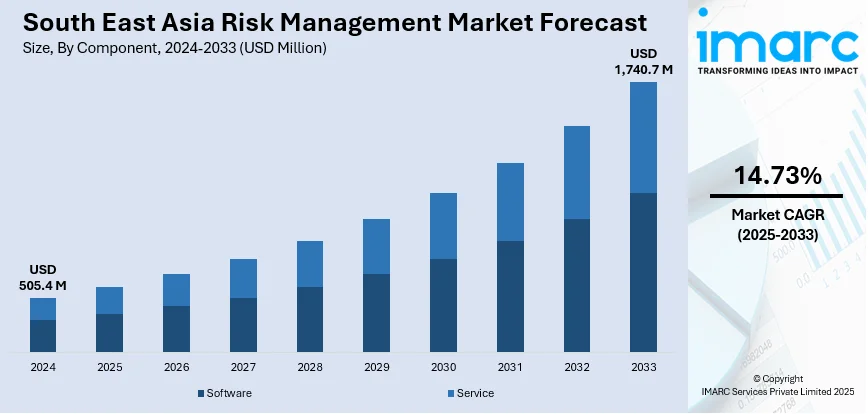

South East Asia risk management market size reached USD 505.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,740.7 Million by 2033, exhibiting a growth rate (CAGR) of 14.73% during 2025-2033. The increasing frequency and sophistication of cyber threats, which continue to push organizations to invest in comprehensive risk management solutions to safeguard their digital assets and sensitive data, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 505.4 Million |

| Market Forecast in 2033 | USD 1,740.7 Million |

| Market Growth Rate (2025-2033) | 14.73% |

Risk management is the process of identifying, assessing, and prioritizing potential risks to an organization or project. It involves the implementation of strategies to minimize, monitor, and control the impact of these risks. This systematic approach aims to proactively address uncertainties that could hinder the achievement of objectives or cause harm. Key steps in risk management include risk identification, risk analysis, risk evaluation, risk treatment, and risk monitoring and review. By identifying potential threats and opportunities, organizations can make informed decisions to mitigate adverse effects and capitalize on favorable circumstances. Effective risk management helps businesses protect assets, enhance decision-making, improve resource allocation, and increase overall resilience. It is an integral part of strategic planning and enables organizations to adapt to changing environments, ensuring sustainability and long-term success.

To get more information on this market, Request Sample

South East Asia Risk Management Market Trends:

The risk management market in South East Asia is a multifaceted discipline that is continually shaped by various drivers. Firstly, as regional interconnectedness intensifies, the prevalence of complex supply chains necessitates a comprehensive approach to risk management. Consequently, companies are increasingly prioritizing the adoption of sophisticated risk assessment tools to proactively identify and mitigate potential disruptions. Additionally, the escalating frequency and severity of cyber threats have spurred a heightened focus on cybersecurity risk management. Consequently, organizations are investing in innovative technologies and robust protocols to safeguard sensitive data and bolster their resilience against evolving digital threats. Moreover, the growing regulatory landscape underscores the significance of compliance-driven risk management strategies, compelling businesses to adhere to stringent standards and guidelines. Simultaneously, the mounting implications of climate change and environmental vulnerabilities are prompting firms to integrate climate risk assessment frameworks into their overall risk management strategies. Hence, the convergence of these market drivers emphasizes the necessity for a dynamic and adaptable risk management approach that can effectively navigate the contemporary business landscape.

South East Asia Risk Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country level for 2025-2033. Our report has categorized the market based on component, deployment mode, enterprise size, and industry vertical.

Component Insights:

- Software

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and service.

Deployment Mode Insights:

- On-Premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

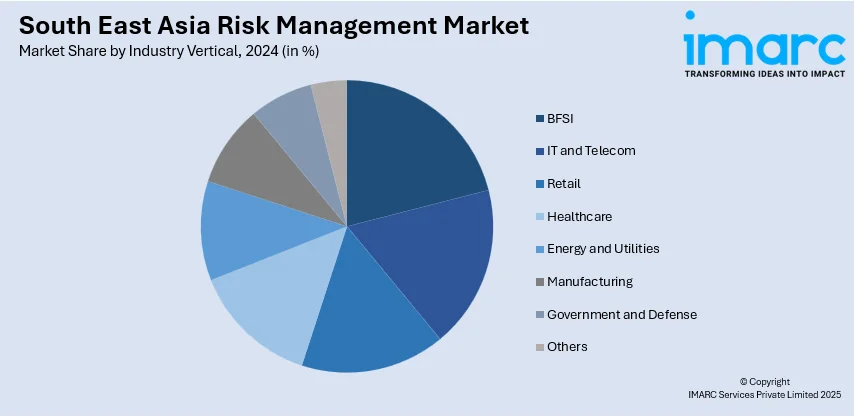

Industry Vertical Insights:

- BFSI

- IT and Telecom

- Retail

- Healthcare

- Energy and Utilities

- Manufacturing

- Government and Defense

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, IT and telecom, retail, healthcare, energy and utilities, manufacturing, government and defense, and others.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South East Asia Risk Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Software, Service |

| Deployment Modes Covered | On-Premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | BFSI, IT and Telecom, Retail, Healthcare, Energy and Utilities, Manufacturing, Government and Defense, Others |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South East Asia risk management market performed so far and how will it perform in the coming years?

- What is the breakup of the South East Asia risk management market on the basis of component?

- What is the breakup of the South East Asia risk management market on the basis of deployment mode?

- What is the breakup of the South East Asia risk management market on the basis of enterprise size?

- What is the breakup of the South East Asia risk management market on the basis of industry vertical?

- What are the various stages in the value chain of the South East Asia risk management market?

- What are the key driving factors and challenges in the South East Asia risk management?

- What is the structure of the South East Asia risk management market and who are the key players?

- What is the degree of competition in the South East Asia risk management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia risk management market from 2019-2033.

- The research report provides the latest in information on the market drivers, challenges, and opportunities in the South East Asia risk management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia risk management industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)