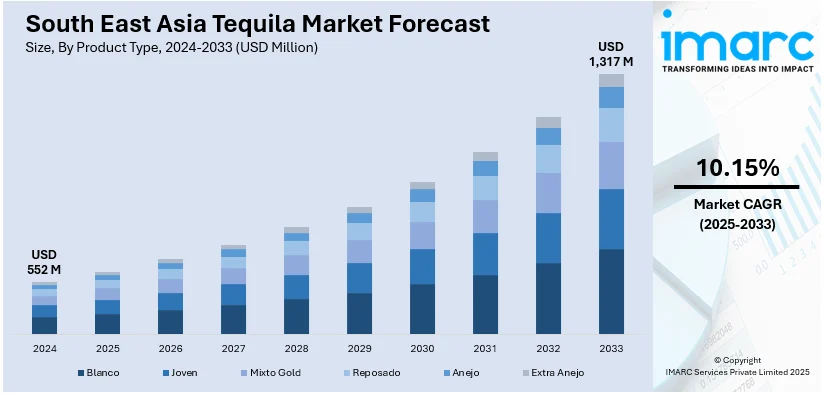

South East Asia Tequila Market Size, Share, Trends and Forecast by Product Type, Purity, Price Range, Distribution Channel, and Country, 2025-2033

South East Asia Tequila Market Size and Share:

The South East Asia tequila market size was valued at USD 552 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,317 Million by 2033, exhibiting a CAGR of 10.15% during 2025-2033. The market is driven by increasing consumer demand for premium alcoholic beverages, growing popularity of tequila-based cocktails, rising disposable incomes, and expanding social and cultural acceptance of tequila. Additionally, the region’s vibrant nightlife and tourism sectors contribute to the South East Asia tequila market share, positioning the country as a key player in the global industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 552 Million |

| Market Forecast in 2033 | USD 1,317 Million |

| Market Growth Rate 2025-2033 | 10.15% |

The market is driven by shifting consumer preferences toward premium spirits, influenced by increased disposable incomes and exposure to global drinking trends. Urban millennials and Gen Z are showing growing interest in craft cocktails and authentic international liquors, which boosts tequila demand. The rise of cocktail culture in metro hubs like Bangkok, Jakarta, and Manila is also significant. Tourism, especially in Thailand and Indonesia, has introduced more consumers to tequila, further aiding market penetration. Additionally, the presence of global hospitality chains and bars offering tequila-based drinks is broadening awareness. E-commerce alcohol sales and social media promotions have amplified visibility and accessibility. Regulatory improvements in alcohol import policies across several South East Asian nations are also contributing to smoother distribution and market expansion for imported tequila brands.

To get more information on this market, Request Sample

Premium tequila is gaining ground in South East Asia’s travel retail scene, with expanding availability in airports across Singapore, Malaysia, Vietnam, and the Philippines. Increasing traveler exposure, experiential promotions, and shifting consumer preferences are fueling interest in high-quality agave spirits in the region’s emerging spirits landscape. For instance, in August 2024, Teremana Tequila, backed by Dwayne Johnson, expanded in South East Asia’s travel retail market with launches at Singapore Changi and upcoming rollouts in Malaysia, Vietnam, and the Philippines. The brand aims to boost tequila’s regional visibility through interactive promotions and tastings. This move signals growing interest in premium tequila across key South East Asian hubs, driven by rising traveler engagement and demand for high-end spirits.

South East Asia Tequila Market Trends:

Urban Living Driving Beverage Evolution

The growing concentration of South East Asia’s population in urban areas is influencing changing consumption patterns. As city living becomes more widespread, preferences are gradually shifting toward products associated with modern lifestyles and global exposure. Higher accessibility to diverse retail formats, coupled with evolving social settings, is encouraging the acceptance of specialized alcoholic beverages. Based on South East Asia tequila market forecast, this urban shift, along with rising disposable incomes and exposure to global culture, is expected to support continued growth in demand, particularly in metropolitan centers where consumers are more likely to explore new options in both personal and social consumption contexts. For example, as of 2024, 54% of South East Asia's population resides in urban areas, according to the Population Reference Bureau.

Youthful Preferences Shaping Consumption

Based on the South East Asia tequila market outlook, a sizable share of South East Asia’s population now falls within younger age groups, whose preferences are reshaping the alcoholic beverage landscape. These consumers often seek products that reflect personal identity, novelty, and global influence, contributing to the rising appeal of spirits previously seen as niche. Tequila is gaining popularity among this cohort, driven by an openness to explore new flavor profiles and culturally associated drinking experiences. Social media and digital platforms play a key role in product discovery and community building, reinforcing interest and accelerating the shift toward diverse and distinctive offerings in both casual and social settings. According to an industry report, Gen Z individuals (born 1997–2012) account for around 25% of South East Asia’s population, a proportion comparable to that of Millennials (born 1981–1996).

Digital Growth Influencing Consumption Patterns

The fast-growing digital landscape in South East Asia is influencing how people discover and engage with products. With internet access now widespread, individuals are more exposed to diverse options and global influences. Online platforms play a growing role in shaping perceptions, encouraging exploration, and enabling convenient access to a broader range of offerings. In the alcoholic beverage space, this shift is supporting interest in distinctive and non-traditional choices. As digital engagement deepens, purchasing behavior is evolving toward informed decisions, social sharing, and experimentation, contributing to changing preferences and expanding the reach of various product categories across urban and semi-urban markets. These factors lead to the South East Asia tequila market growth. For instance, a study revealed that South East Asia’s digital economy expanded eightfold in the past eight years, currently exceeding USD 100 Billion in value. This growth is driven by rising internet penetration, which rose from 34% in 2013 to over 73% in 2024.

South East Asia Tequila Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South East Asia tequila market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type, purity, price range, and distribution channel.

Analysis by Product Type:

- Blanco

- Joven

- Mixto Gold

- Reposado

- Anejo

- Extra Anejo

Blanco, also known as silver tequila, is typically unaged and offers a fresh, pure agave flavor, making it popular among young consumers and mixologists for cocktails. Joven, on the other hand, is a blend of aged and unaged tequilas, offering a smooth taste with more complexity than Blanco. The rising popularity of cocktails and premium spirits in South East Asia has fueled demand for these types of tequila. Both varieties appeal to the evolving preferences of consumers seeking high-quality, versatile options for bars and home consumption, contributing to market growth.

Analysis by Purity:

- 100% Tequila

- 60% Tequila

100% tequila is made entirely from blue agave, offering a higher-quality product with a smoother, more authentic taste, which is increasingly sought after by premium spirit consumers. It appeals to both connoisseurs and those looking for a refined experience. On the other hand, 60% tequila, also known as mixto, contains a blend of agave and other sugars, making it more affordable. This makes it a popular choice among price-sensitive consumers, helping to expand the market. The growing awareness of tequila as a versatile cocktail base and premium drink option is further driving demand for both variants in the region.

Analysis by Price Range:

- Premium Tequila

- Value Tequila

- Premium and Super-Premium Tequila

- Ultra-Premium Tequila

Premium tequila refers to higher-quality, aged tequilas, often made from 100% blue agave, which appeal to affluent consumers seeking a refined drinking experience. These products are popular for sipping, as well as in high-end bars and restaurants, where quality and authenticity are prioritized. On the other hand, value tequila targets budget-conscious consumers and bars that require more affordable options, often made from a mix of agave and other sugars (mixto). This segment drives volume sales, especially in emerging markets where price sensitivity is high. The demand for both categories reflects the growing interest in tequila as a versatile spirit across South East Asia.

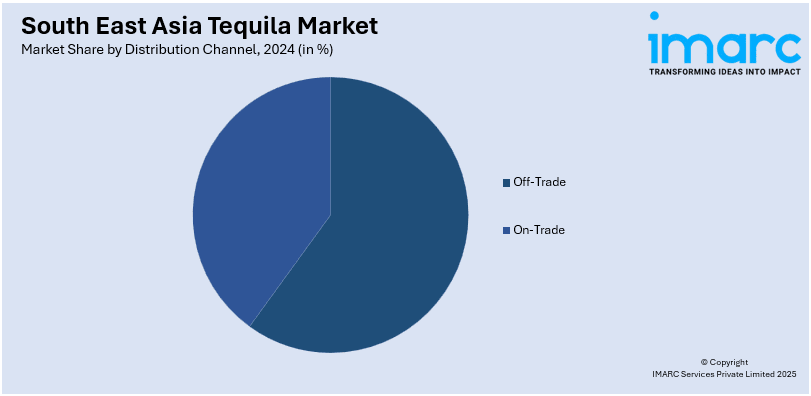

Analysis by Distribution Channel:

- Off-Trade

- Supermarkets and Hypermarkets

- Discount Stores

- Online Stores

- Others

- On-Trade

- Restaurants and Bars

- Liquor Stores

- Others

Off-trade refers to the retail sale of tequila for home consumption, including supermarkets, liquor stores, and online platforms. This segment is expanding due to increasing consumer interest in premium spirits, with tequila being purchased for personal use or social gatherings. On the other hand, on-trade involves the sale of tequila in bars, restaurants, and clubs, where the rise of cocktail culture and the growing preference for premium spirits are significant drivers. Both channels complement each other, with on-trade pushing trends and introducing consumers to new tequila options, while off-trade makes these products accessible for home consumption, fueling overall market growth in the region.

Country Analysis:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

premium spirits like tequila, especially in urban areas where cocktail culture is becoming more popular. Thailand, with its thriving tourism sector, has also seen a surge in tequila consumption, particularly in tourist hotspots like Bangkok and Phuket, where international visitors drive demand for diverse and high-quality spirits. Both countries are witnessing an increase in the number of bars and restaurants offering tequila-based cocktails, which further boosts market growth. The expanding social acceptance of tequila as a versatile spirit in these countries is a major factor driving market expansion.

Competitive Landscape:

The South East Asia tequila market is experiencing significant growth, driven by strategic partnerships, product launches, and educational initiatives. Brands like Teremana and Cincoro are expanding their presence through collaborations with duty-free retailers and distributors across key markets such as Singapore, India, China, and South Korea. These efforts are complemented by campaigns like Teremana's "Share the Mana," which educates consumers about tequila's heritage and production methods. Notably, government support and research and development activities are less prevalent in this sector compared to other industries. The report provides a comprehensive analysis of the competitive landscape in the South East Asia tequila market, with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: Tech firm Digimune secured rights to distribute Ignite Tequila in Indonesia, launching it with exclusive pouring rights at Bali’s Finns Beach Club. The company reportedly plans to follow with Ignite Vodka, leveraging its tech expertise for logistics, compliance, and brand-building in the FMCG liquor space.

- November 2024: Don Julio Rosado, a reposado tequila aged in Ruby Port wine casks, was launched in Manila. Signature serves included the Rosado Shot, Rosado Spritz, Passion Play, and Picture Perfect.

- September 2024: Suntory Global Spirits launched its first Route-to-Market in South East Asia, starting in Singapore. The in-market team will oversee sales and marketing of its premium spirits portfolio, enhancing brand presence and distribution efficiency across the region.

- May 2024: Charter Brands partnered with Drinks99 to distribute El Tequileño tequila in China, Hong Kong, and Singapore. The move supports El Tequileño’s goal to expand into over 40 countries in the near term, amid rising regional demand for premium, additive-free tequila.

South East Asia Tequila Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Blanco, Joven, Mixto Gold, Reposado, Anejo, Extra Anejo |

| Purities Covered | 100% Tequila, 60% Tequila |

| Price Ranges Covered | Premium Tequila, Value Tequila, Premium and Super-Premium Tequila, Ultra-Premium Tequila |

| Distribution Channels Covered |

|

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South East Asia tequila market from 2019-2033.

- The South East Asia tequila market research report provides the latest information on the market drivers, challenges, and opportunities in the market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South East Asia tequila industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tequila market in South East Asia was valued at USD 552 Million in 2024.

The market is expanding due to rising disposable incomes, urbanization, and a growing preference for premium spirits among younger consumers. The increasing popularity of cocktail culture and the influence of Western drinking habits further drive demand. E-commerce platforms enhance accessibility, while strategic marketing and celebrity endorsements boost brand visibility.

The tequila market is projected to exhibit a CAGR of 10.15% during 2025-2033, reaching a value of USD 1,317 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)