South India Cupcakes Market Size, Share, Trends and Forecast by Shelf Life, Weight, Filling, Egg vs Eggless, Wraps, Packaging, and State, 2025-2033

Market Overview:

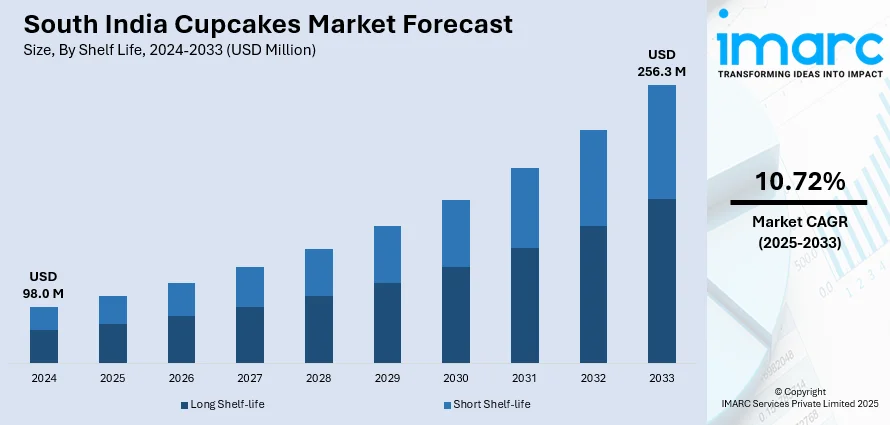

The South India cupcakes market size reached USD 98.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 256.3 Million by 2033, exhibiting a growth rate (CAGR) of 10.72% during 2025-2033. The increasing urbanization and shifting consumption patterns, the growing influence of western culture on the masses, the growing influence of social media platforms such as Instagram and Facebook, are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 98.0 Million |

|

Market Forecast in 2033

|

USD 256.3 Million |

| Market Growth Rate (2025-2033) | 10.72% |

Cupcakes are small, individual-sized cakes that are typically baked in small, cylindrical paper or aluminum cups. They are a popular dessert and are often enjoyed on their own or as part of celebrations such as birthdays, weddings, and other special occasions. They are known for their delightful flavors, moist texture, and decorative toppings and are made from a simple batter that includes ingredients such as flour, sugar, butter, eggs, and leavening agents like baking powder or baking soda. Cupcakes offer a wide range of flavors, allowing for a diverse selection to suit different tastes. Some popular cupcake flavors include vanilla, chocolate, red velvet, lemon, strawberry, caramel, and many more. They can also feature fillings such as fruit jams, cream fillings, or chocolate ganache, adding an extra layer of flavor and texture.

To get more information on this market, Request Sample

South India has a vibrant celebration culture, with numerous festivals, weddings, and other special occasions. Cupcakes are often used as a convenient and visually appealing dessert option for such events, which is escalating their demand during festive seasons. In addition, economic growth and rising disposable incomes in South India have led to an increase in spending on luxury and indulgent food items. Hence, consumers with higher purchasing power widely prefer cupcakes as a dessert option. Moreover, South India has seen an increased influence of Western culture, including food trends. As a result, cupcakes, being a popular dessert item in the West, have gained traction and contributed to the market growth. Besides this, cupcakes offer a high level of customization, allowing consumers to choose flavors, fillings, frostings, and decorations according to their preferences, which is also creating a favorable market outlook.

South India Cupcakes Market Trends/Drivers:

The increasing urbanization and shifting consumer preferences

Nowadays, with shifting consumer preferences, consumers are interested in experimenting with flavors like red velvet, salted caramel, matcha, fruit-infused, and fusion flavors that combine local and international tastes. They are also adopting cupcakes made with healthier ingredients and natural sweeteners that cater to specific dietary needs. Moreover, South Indian consumers are increasingly drawn to visually appealing food items. Consequently, cupcakes that are beautifully decorated with intricate designs, vibrant colors, and eye-catching toppings are gaining immense traction. Besides this, with rising disposable incomes, there is a growing preference for indulgent and premium food options. Cupcakes, with their attractive designs, varied flavors, and often decadent frostings, fit well into this category of indulgent treats.

The emergence of specialty bakeries and cafes

Specialty bakeries and cafes are known for their focus on unique and innovative desserts, including cupcakes. They are introducing a wide variety of flavors, fillings, frostings, and toppings that cater to diverse consumer preferences. The presence of these establishments in South India expands the options available to consumers, allowing them to explore new cupcake creations, thus contributing to market growth. Besides, the specialty bakeries are offering comfortable seating, aesthetically pleasing interiors, and a pleasant ambiance, making the cupcake consumption experience more enjoyable. These establishments are adopting traditional recipes and experimenting with premium ingredients, unique flavor combinations, and intricate decorations. This gourmet approach elevates the overall cupcake experience, attracting consumers who are willing to pay a premium for high-quality and indulgent desserts, representing another major growth-inducing factor.

The increasing adoption of packaged cupcakes

Packed cupcakes offer convenience and accessibility to consumers. They are pre-packaged and ready to consume, making them suitable for on-the-go consumption or quick indulgences. In addition, they are readily available in supermarkets, convenience stores, and online platforms, making them easily accessible to a wider consumer base, including those who may not have access to specialty bakeries or cafes. Moreover, packed cupcakes often have a longer shelf life compared to freshly baked cupcakes. This longer shelf life allows for easier storage and distribution, making packed cupcakes a viable option for retailers and consumers, thus propelling the market growth across the region.

South India Cupcakes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South India cupcakes market report, along with forecasts at the country and state levels from 2025-2033. Our report has categorized the market based on shelf-life, weight, filling, egg vs eggless, wraps and packaging.

Breakup by Shelf Life:

- Long Shelf-life

- Short Shelf-life

Long shelf-life cupcakes dominate the market

The report has provided a detailed breakup and analysis of the South India cupcakes market based on the shelf life. This includes long and short shelf-life cupcakes. According to the report, long shelf-life cupcakes represented the largest segment.

Long shelf-life cupcakes offer convenience and accessibility to consumers. They can be stored for longer periods without the need for immediate consumption. This convenience makes them readily available in a variety of retail outlets, including supermarkets, convenience stores, and online platforms. Moreover, these cupcakes can be distributed over a wider geographic area due to their extended shelf life. This allows cupcake manufacturers to reach consumers in remote areas or locations where freshly baked cupcakes may not be readily available. The ability to distribute these cupcakes over a larger territory can contribute to their dominance in the South India market.

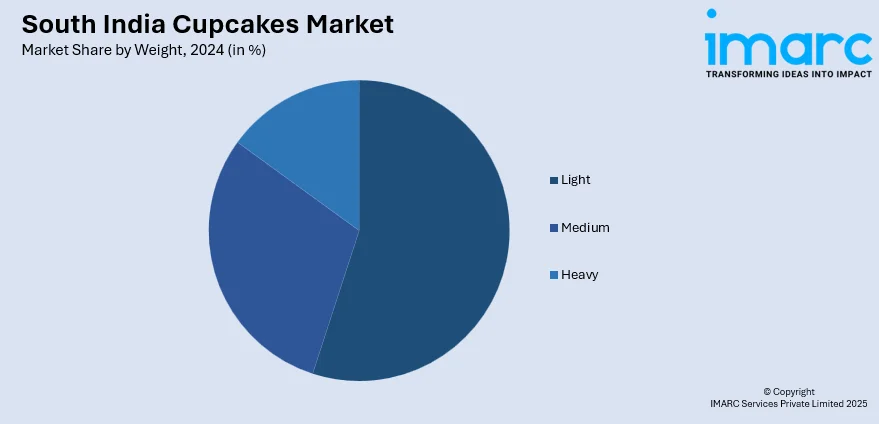

Breakup by Weight:

- Light

- Medium

- Heavy

Light weight cupcakes hold the largest share in the market

A detailed breakup and analysis of the South India cupcakes market based on the weight has also been provided in the report. This includes light, medium, and heavy. According to the report, light weight cupcakes accounted for the largest market share.

South India is known for its hot and humid climate. In such weather conditions, consumers often prefer lighter and less dense desserts that are refreshing and easier to consume. Light-weight cupcakes, which are typically airy and moist, can be more appealing and enjoyable to eat in this climate compared to heavier or denser options. Moreover, light-weight cupcakes, often made with soft and fluffy sponge cakes, align well with the region's preference for delicate and balanced flavors. These cupcakes can be infused with local ingredients such as coconut, cardamom, or tropical fruits, catering to the regional taste preferences, thus increasing their market share.

Breakup by Filling:

- Flavored

- Chocolate

- Vanilla

- Pineapple

- Others

- Plain

Flavored cupcakes represent the leading segment

The report has provided a detailed breakup and analysis of the South India cupcakes market based on the filling. This includes flavored (chocolate, vanilla, pineapple, and others) and plain cupcakes. According to the report, flavored cupcakes represented the largest segment.

South Indian cuisine is renowned for its rich and diverse flavors. Flavored cupcakes align well with the region's love for bold, aromatic, and distinctive tastes and flavors such as cardamom, coconut, mango, saffron, and rose are popular choices that resonate with the local taste preferences. Flavored cupcakes offer a platform for culinary experimentation and creativity and bakers in South India often infuse traditional flavors from local sweets and desserts into cupcakes, creating a fusion of traditional and contemporary tastes and escalating the demand for flavored cupcakes.

Breakup by Egg vs Eggless:

- Egg

- Eggless

Egg cupcakes exhibits a clear dominance in the market

A detailed breakup and analysis of the South India cupcakes market based on the egg vs eggless has also been provided in the report. This includes egg and eggless. According to the report, egg cupcakes accounted for the largest market share.

South Indian cuisine has a strong tradition of using eggs in various dishes. Eggs are commonly incorporated into many traditional sweets, snacks, and baked goods, reflecting the local taste preferences. Therefore, the familiarity and preference for egg-based desserts contribute to the dominance of egg cupcakes in the market. Moreover, eggs offer versatility in baking and contribute to the richness and flavor of cupcakes. They allow for the creation of a wide range of flavors and variations, accommodating diverse consumer preferences. This versatility allows bakers to experiment with different flavors, fillings, and frostings, making egg cupcakes appealing to a larger consumer base.

Breakup by Wraps:

- Paper

- Aluminum Foil

A detailed breakup and analysis of the South India cupcakes market based on the wraps has also been provided in the report. This includes paper and aluminum foil.

Paper wraps have a long-standing tradition in South India for packaging and serving various food items. It is a familiar and widely accepted form of packaging, making it a preferred choice for cupcake businesses. Moreover, paper wraps are considered more environmentally friendly compared to some other packaging materials and come in various colors, patterns, and designs, allowing cupcake businesses to showcase their creativity and enhance the visual appeal of their products. They also help protect the cupcakes from external elements, maintain their freshness, and prevent any potential contamination, thus increasing their adoption.

Aluminum foil wraps provide an attractive and professional presentation for cupcakes. The shiny and metallic appearance of foil wraps adds a touch of elegance and sophistication to the cupcakes, making them visually appealing, thus increasing their adoption.

Breakup by Packaging:

- Metalized BOPP

- Transparent BOPP

Metalized BOPP holds the largest market share

A detailed breakup and analysis of the South India cupcakes market based on the packaging has also been provided in the report. This includes metalized and transparent BOPP. According to the report, metalized BOPP accounted for the largest market share.

Metalized BOPP offers a shiny and reflective surface that adds a premium and eye-catching look to the packaging. The metallic appearance enhance the overall presentation of cupcakes, making them visually appealing and attractive to consumers. In South India, where aesthetics and visual appeal are often valued, the use of metalized BOPP packaging help cupcakes stand out on store shelves or in display cases. Moreover, this packaging type provides ample space for branding and custom printing, which is accelerating its adoption across the region.

Breakup by State:

- Karnataka

- Tamil Nadu

- Telangana

- Andhra Pradesh

- Others

Tamil Nadu exhibits a clear dominance, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major markets, which include Karnataka, Tamil Nadu, Telangana, Andhra Pradesh, and others. According to the report, Tamil Nadu accounted for the largest market share.

Tamil Nadu has a significant population, and its urban areas, such as Chennai, Coimbatore, and Madurai, have experienced substantial urbanization. Higher population and urbanization often lead to a larger consumer base and increased demand for food products, including cupcakes. Besides, the state has a vibrant celebration culture, with numerous festivals, weddings, and other special occasions throughout the year. Cupcakes are often used as a popular dessert option for these celebrations. Consequently, the demand for cupcakes during festive seasons and special events is contributing to the larger market share in Tamil Nadu.

Competitive Landscape:

The competitive landscape of the South India cupcakes market consists of various players, including bakery chains, specialty bakeries, local bakeries, cafes, and confectionery businesses. Nowadays, the leading players are providing a relaxed ambiance and a range of diverse cupcake flavors and customization options. They are also introducing vegan, gluten-free, sugar-free, and cupcakes made with naturally sourced flavors to attract health-conscious consumers. Moreover, bakery chains and specialty bakeries are expanding their store network by opening new outlets in different cities or locations within South India. They are also launching limited-time flavors, seasonal offerings, or innovative combinations to provide unique experiences and keep customers engaged. In addition, key players are collaborating with local brands, influencers, or celebrities to create brand awareness and strengthen their market foothold.

The report has provided a comprehensive analysis of the competitive landscape in the South India cupcakes market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Britannia Industries Ltd.

- Elite Foods Pvt. Ltd.

- Winkies

- Monginis

- McRennett

- Manna Food Products

- Wholefood India Confectionary Pvt. Ltd.

Recent Developments:

- Britannia Industries Ltd. launched two premium variants of egg-less Muffins in two flavors, namely chocolate and strawberry, in the low unit pack category to expand its consumer base.

- Elite Foods Pvt. Ltd. increased its product portfolio by including center filled cupcakes and innovative flavors such as butter cup and carrot pudding.

- Winkies is a well-known brand in India that specializes in baked goods and confectionery products. The brand has made available its well-known vanilla cupcake on various online platforms to increase its consumer reach.

South India Cupcakes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Shelf-lifes Covered | Long Shelf-life, Short Shelf-life |

| Weights Covered | Light, Medium, Heavy |

| Fillings Covered |

|

| Egg Vs Eggless Covered | Egg, Eggless |

| Wraps Covered | Paper, Aluminum Foil |

| Packagings Covered | Metalized BOPP, Transparent BOPP |

| States Covered | Karnataka, Tamil Nadu, Andhra Pradesh, Telangana, Others |

| Companies Covered | Britannia Industries Ltd., Elite Foods Pvt. Ltd., Winkies, Monginis, McRennett, Manna Food Products, Wholefood India Confectionary Pvt. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South India cupcakes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the South India cupcakes market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South India cupcakes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The South India cupcakes market was valued at USD 98.0 Million in 2024.

The South India cupcakes market is projected to exhibit a CAGR of 10.72% during 2025-2033, reaching a value of USD 256.3 Million by 2033.

The market for cupcakes in South India is driven by the growing demand for artisanal and high-end bakery goods, shifting consumer lifestyles, and rising disposable incomes. Urbanization and increased café culture contribute to popularity, while social media influence and the rise of home bakers and boutique bakeries further boost market growth.

Tamil Nadu currently dominates the South India cupcakes market, driven by increasing urbanization, a growing young population, and rising demand for Western-style desserts. Expanding café culture, online bakery platforms, and customized celebration trends contribute to growth. Additionally, local fusion flavors and premium packaging are attracting consumers seeking unique and indulgent cupcake experiences.

Some of the major players in South India cupcakes market include Britannia Industries Ltd., Elite Foods Pvt. Ltd., Winkies, Monginis, McRennett, Manna Food Products, Wholefood India Confectionary Pvt. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)