South Korea 5G Chipset Market Size, Share, Trends and Forecast by Chipset Type, Operational Frequency, End User, and Region, 2025-2033

South Korea 5G Chipset Market Overview:

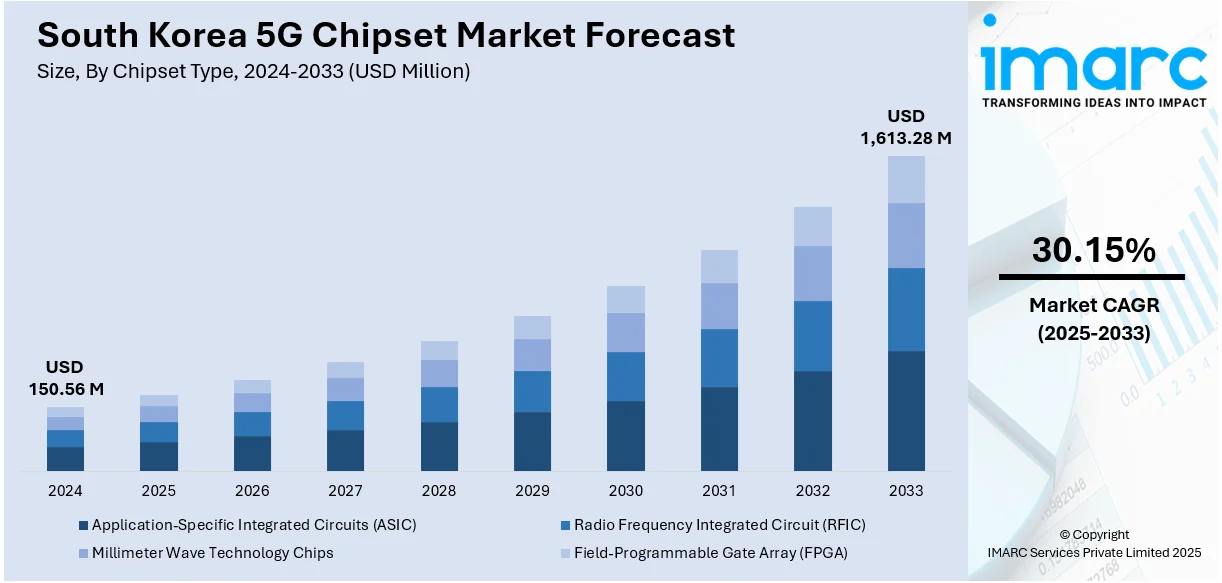

The South Korea 5G chipset market size reached USD 150.56 Million in 2024. The market is projected to reach USD 1,613.28 Million by 2033, exhibiting a growth rate (CAGR) of 30.15% during 2025-2033. The market is experiencing rapid growth, driven by advancements in telecommunications infrastructure and rising demand across consumer electronics, automotive, and industrial applications. Innovations in chipset design, expanding 5G coverage, and strong government support for next-gen connectivity are shaping market dynamics. Key players are focusing on technological integration and partnerships to stay competitive. As the ecosystem matures, diverse operational frequencies and end-user requirements will continue influencing development. These factors collectively strengthen the South Korea 5G chipset market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 150.56 Million |

| Market Forecast in 2033 | USD 1,613.28 Million |

| Market Growth Rate 2025-2033 | 30.15% |

South Korea 5G Chipset Market Trends:

Infrastructure and Policy Acceleration

In May 2024, South Korea launched a nationwide semiconductor support plan focused on expanding fabrication capacity, modernizing infrastructure, and enhancing collaboration between research institutions and telecom developers. At the same time, government officials began designating Yongin–Pyeongtaek as a key semiconductor and telecom development cluster to boost energy supply, logistics access, and land availability for advanced chip production. Regional zoning measures were revised to prioritize projects tied to next-gen communications and edge computing. In April 2025, those efforts were bolstered again when the administration expanded its support program, now emphasizing underground utility improvements and export-focused infrastructure enhancements to better serve advanced chipset manufacturers. Together, these initiatives make it much smoother for chipset developers to implement integrated modem–SoC architectures and RF front ends, accelerating deployment of edge-optimized 5G solutions. Across government, provincial, and municipal levels, investment coordination is highly targeted toward aligning physical infrastructure with emerging telecom needs. This unified approach is laying strong foundations for innovation and ensuring that South Korea remains at the forefront of global telecom-grade chipmaking, demonstrating clear momentum in South Korea 5G chipset market growth.

To get more information on this market, Request Sample

Tailored 5G Chipsets Drive Industrial Innovation

In February 2025, a landmark trial demonstrated the power of tailored 5G chipsets in industrial environments. The trial used a Reduced Capability (RedCap) 5G network to support real-time vehicle diagnostics within a major automotive manufacturing plant. This demonstrated how specialized 5G chipsets, designed for specific application needs, enable efficient data transmission with reduced complexity and power consumption. The approach supports operational improvements through seamless connectivity and precise control at the edge, which is essential for manufacturing, logistics, and smart factory systems. South Korea is increasingly focusing on such industry-specific solutions, which require chipsets optimized for ultra-reliable low latency as well as energy efficiency tailored to vertical applications. This shift contributed to reducing costs while enhancing performance in targeted use cases like automation and real-time monitoring. The growing emphasis on customized 5G chipsets marks a clear evolution in the market, transitioning from standardized designs toward purpose-built solutions that drive value across sectors. This development highlights a key aspect of South Korea 5G chipset market trends.

Focused Node Innovations and Global Positioning

South Korea’s 5G chipset landscape is increasingly shaped by advancements in semiconductor process nodes and supply chain self-reliance. In May 2024, the government introduced a new initiative aimed at accelerating domestic production of advanced semiconductors, with a focus on enhancing foundry capabilities and reducing reliance on foreign suppliers. By early 2025, local manufacturers had begun adopting sub-7nm process technologies more aggressively, enabling chipsets that are more compact, power-efficient, and better suited to the high-performance needs of 5G networks. These improvements are critical for edge-based devices and network hardware operating in bandwidth-intensive environments like smart cities and logistics hubs. Beyond fabrication, national investments have also supported improved access to skilled labor and critical materials across newly designated innovation zones. Together, these efforts are accelerating commercialization cycles for next-generation chips while strengthening South Korea’s strategic position in global telecom supply chains. The trend reflects a deliberate pivot toward deeper integration, technical precision, and independence in chipset development.

South Korea 5G Chipset Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on chipset type, operational frequency, and end user.

Chipset Type Insights:

- Application-Specific Integrated Circuits (ASIC)

- Radio Frequency Integrated Circuit (RFIC)

- Millimeter Wave Technology Chips

- Field-Programmable Gate Array (FPGA)

The report has provided a detailed breakup and analysis of the market based on the chipset type. This includes application-specific integrated circuits (ASIC), radio frequency integrated circuit (RFIC), millimeter wave technology chips, and field-programmable gate array (FPGA).

Operational Frequency Insights:

- Sub 6 GHz

- Between 26 and 39 Ghz

- Above 39 Ghz

A detailed breakup and analysis of the market based on the operational frequency have also been provided in the report. This includes sub 6 GHz, Between 26 and 39 Ghz, and above 39 Ghz.

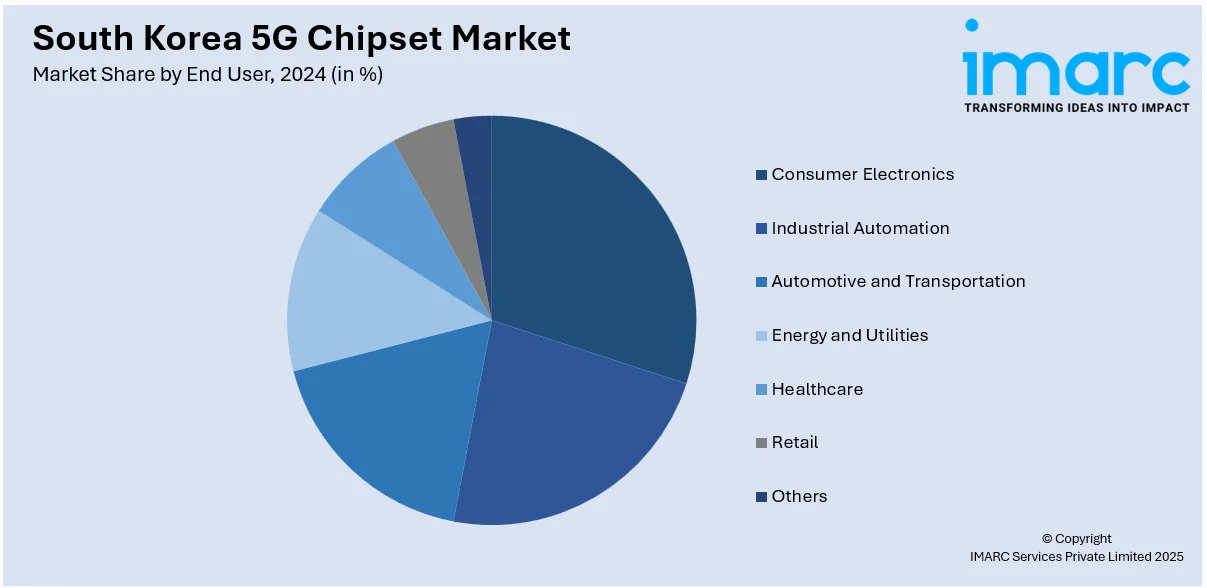

End User Insights:

- Consumer Electronics

- Industrial Automation

- Automotive and Transportation

- Energy and Utilities

- Healthcare

- Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes consumer electronics, industrial automation, automotive and transportation, energy and utilities, healthcare, retail, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea 5G Chipset Market News:

- February 2025: Samsung Electronics and Hyundai Motor Company have successfully completed the first end-to-end Reduced Capability (RedCap) trial over a private 5G network in South Korea. This collaboration demonstrates the potential of RedCap technology in enhancing industrial 5G connectivity. The trial utilized Samsung's private 5G solutions and Hyundai's Diagnostic SCAN (D Scan) equipment for vehicle inspection. The achievement underscores the commitment of both companies to advancing smart manufacturing capabilities. The successful trial will be showcased at MWC 2025 in Barcelona.

- March 2025: Ettifos, a South Korea–based innovator in next-generation V2X technology, has been selected for the country’s 2025 “Super Gap Startup 1000+” initiative led by the Ministry of SMEs and Startups. The program, aimed at startups working on system semiconductors, smart mobility, AI, and big data, highlights South Korea’s commitment to emerging industries. Ettifos was recognized for its software-defined 5G-V2X modem expertise and global growth potential, earning commercialization funding, access to international investment networks, and opportunities for corporate collaboration.

South Korea 5G Chipset Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chipset Types Covered | Application-Specific Integrated Circuits (ASIC), Radio Frequency Integrated Circuit (RFIC), Millimeter Wave Technology Chips, Field-Programmable Gate Array (FPGA) |

| Operational Frequencies Covered | Sub 6 GHz, Between 26 and 39 Ghz, Above 39 Ghz |

| End Users Covered | Consumer Electronics, Industrial Automation, Automotive and Transportation, Energy and Utilities, Healthcare, Retail, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea 5G chipset market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea 5G chipset market on the basis of chipset type?

- What is the breakup of the South Korea 5G chipset market on the basis of operational frequency?

- What is the breakup of the South Korea 5G chipset market on the basis of end user?

- What is the breakup of the South Korea 5G chipset market on the basis of region?

- What are the various stages in the value chain of the South Korea 5G chipset market?

- What are the key driving factors and challenges in the South Korea 5G chipset market?

- What is the structure of the South Korea 5G chipset market and who are the key players?

- What is the degree of competition in the South Korea 5G chipset market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea 5G chipset market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea 5G chipset market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea 5G chipset industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)