South Korea Acetic Acid Market Size, Share, Trends and Forecast by Application, End Use Industry, and Region, 2025-2033

South Korea Acetic Acid Market Overview:

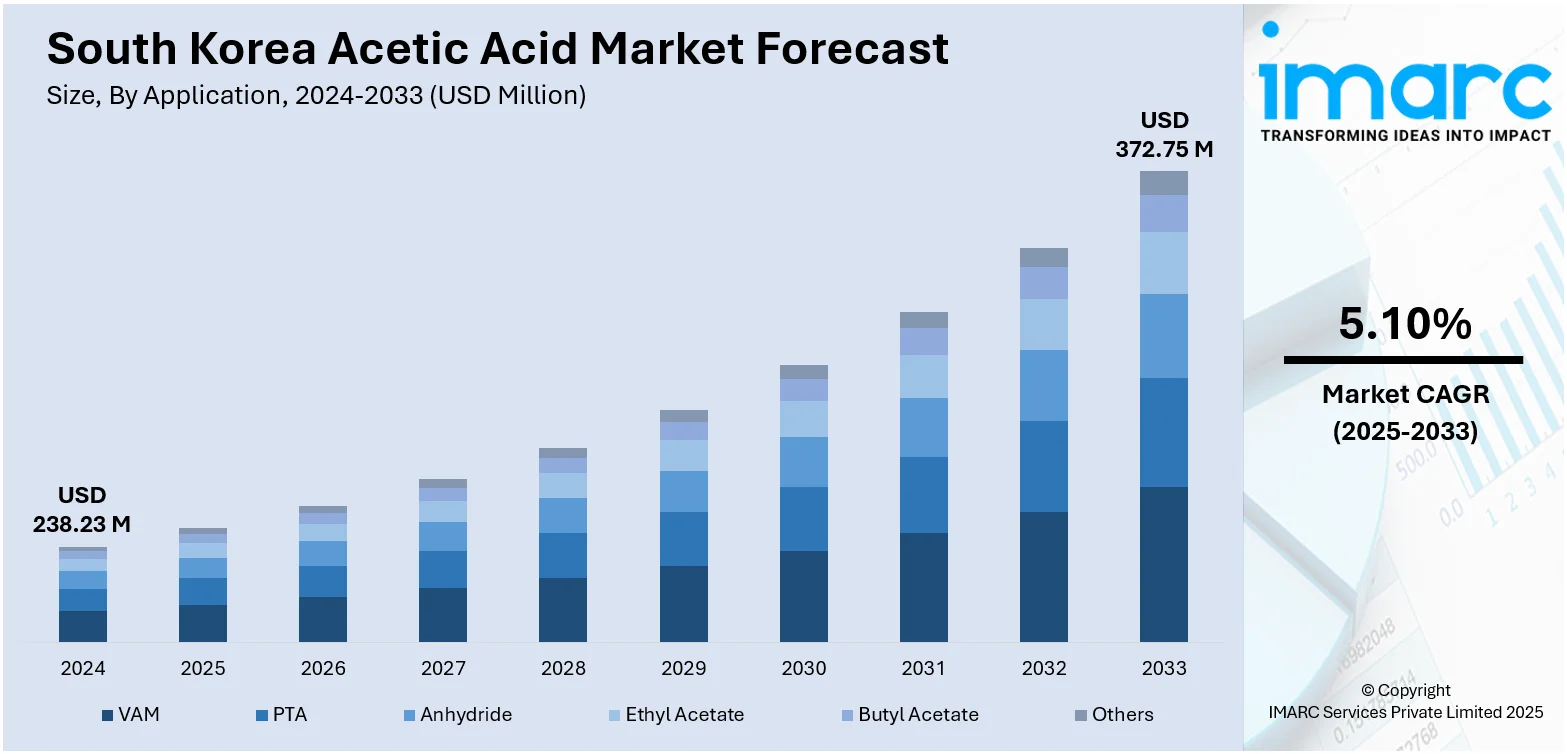

The South Korea acetic acid market size reached USD 238.23 Million in 2024. Looking forward, the market is projected to reach USD 372.75 Million by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The market is driven by strong demand across industrial applications, particularly in chemical intermediates and coatings, alongside notable advancements in production technology that improve efficiency and regulatory compliance. Regional export momentum, supported by logistics infrastructure and trade partnerships, continues to elevate the country’s competitive positioning, further augmenting the South Korea acetic acid market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 238.23 Million |

| Market Forecast in 2033 | USD 372.75 Million |

| Market Growth Rate 2025-2033 | 5.10% |

South Korea Acetic Acid Market Trends:

Rise in Industrial and Downstream Demand

South Korea’s broad manufacturing landscape, spanning textiles, paints, plastics, and adhesives, has consistently driven the need for core chemical intermediates. Acetic acid plays a central role in the production of vinyl acetate monomer, purified terephthalic acid, and acetate esters, which are widely used across multiple industrial verticals. As the nation strengthens its domestic chemical infrastructure, firms are expanding production capacities to reduce import dependency and improve supply reliability. Initiatives such as the Lotte–BP partnership have enhanced local output, ensuring timely availability of raw materials for high-growth sectors. At the same time, the electronics and automotive industries demand consistent volumes of solvent-grade chemicals to support adhesive formulations and coating applications. Cost optimization and improved logistics are further encouraging long-term supplier relationships across the value chain. These developments are reinforcing stable procurement pipelines and expanding the influence of local producers in regional markets. This sustained demand across industrial verticals is a key contributor to South Korea acetic acid market growth.

To get more information on this market, Request Sample

Technological Advancements in Production Processes

The domestic chemical industry has made significant strides in improving acetic acid production processes, particularly in the area of energy efficiency and sustainability. Most facilities continue to rely on methanol carbonylation, but newer installations are implementing advanced catalyst systems to optimize yield and minimize waste. These process innovations have reduced operational costs while helping manufacturers meet stricter emissions requirements set by national and international regulatory bodies. Firms such as Lotte and Hyosung Chemical are focusing on low-energy distillation systems, heat recovery integration, and wastewater treatment upgrades to ensure compliance with sustainability benchmarks. Additionally, research into bio-based production from renewable agricultural feedstock is gaining momentum, offering long-term alternatives to petrochemical routes. While bio-acetic acid production remains limited in volume, it represents a strategic pivot toward greener supply chains. Combined with government-backed initiatives to reduce carbon intensity across the manufacturing sector, these advances are enhancing both economic and environmental performance of production facilities.

Export Growth and Regional Trade Integration

South Korea’s position in the Asia-Pacific chemical trade has strengthened through increased exports of acetic acid to neighboring countries. With growing demand in Southeast Asia from the textile, adhesives, and coatings industries, local producers have identified new opportunities to expand their international footprint. Export volumes have grown steadily as capacity expansions and efficient port infrastructure support larger and more reliable shipments. Bilateral trade agreements and favorable tariff structures have further improved South Korea’s access to premium markets that value consistent product quality. Domestic firms are also improving supply chain transparency, digital tracking, and contract flexibility to meet the preferences of regional buyers. These developments align with broader economic strategies aimed at improving export diversification and reducing dependence on any single downstream segment. By leveraging logistical strengths and chemical expertise, South Korean producers are solidifying their role as preferred suppliers in fast-growing Asian markets.

South Korea Acetic Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and end use industry.

Application Insights:

- VAM

- PTA

- Anhydride

- Ethyl Acetate

- Butyl Acetate

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes VAM, PTA, anhydride, ethyl acetate, butyl acetate, and others.

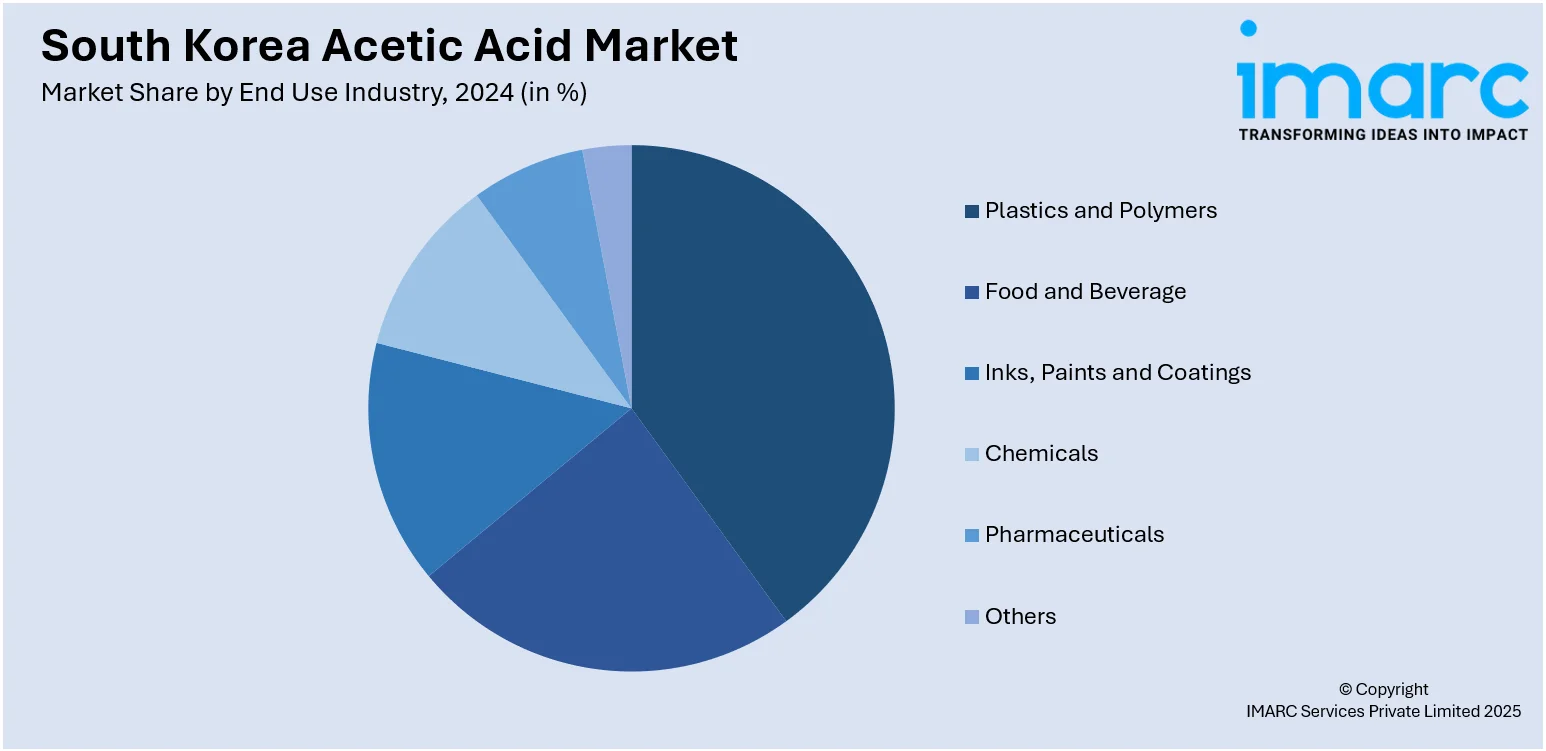

End Use Industry Insights:

- Plastics and Polymers

- Food and Beverage

- Inks, Paints and Coatings

- Chemicals

- Pharmaceuticals

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes plastics and polymers, food and beverage, inks, paints and coatings, chemicals, pharmaceuticals, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Acetic Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Application Covered | VAM, PTA, Anhydride, Ethyl Acetate, Butyl Acetate, Others |

| End Use Industries Covered | Plastics and Polymers, Food and Beverage, Inks, Paints and Coatings, Chemicals, Pharmaceuticals, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea acetic acid market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea acetic acid market on the basis of application?

- What is the breakup of the South Korea acetic acid market on the basis of end use industry?

- What is the breakup of the South Korea acetic acid market on the basis of region?

- What are the various stages in the value chain of the South Korea acetic acid market?

- What are the key driving factors and challenges in the South Korea acetic acid market?

- What is the structure of the South Korea acetic acid market and who are the key players?

- What is the degree of competition in the South Korea acetic acid market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea acetic acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea acetic acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea acetic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)