South Korea Alternative Data Market Size, Share, Trends and Forecast by Data Type, Industry, End User, and Region, 2026-2034

South Korea Alternative Data Market Overview:

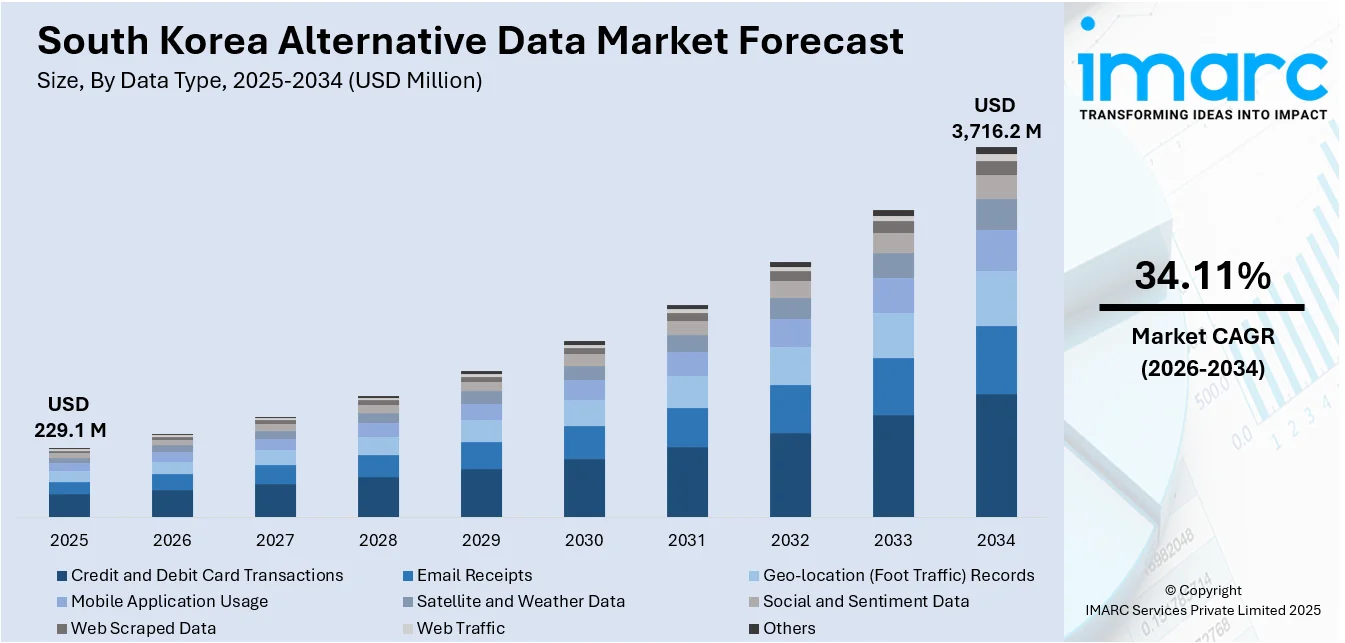

The South Korea alternative data market size reached USD 229.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,716.2 Million by 2034, exhibiting a growth rate (CAGR) of 34.11% during 2026-2034. Rapid digital transformation, widespread adoption of AI and big data analytics, government support for fintech innovation, and increasing demand for enhanced credit risk assessment and fraud prevention are key factors expanding the South Korea alternative data market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 229.1 Million |

| Market Forecast in 2034 | USD 3,716.2 Million |

| Market Growth Rate 2026-2034 | 34.11% |

South Korea Alternative Data Market Trends:

Integration of AI and Machine Learning in Data Analytics

The South Korea alternative data market growth is significantly propelled by the increasing integration of artificial intelligence (AI) and machine learning (ML) technologies. Financial institutions and fintech companies are leveraging these advanced analytics tools to extract valuable insights from unstructured and alternative data sources, such as social media activity, transaction logs, and mobile usage patterns. AI-driven models enable more accurate credit scoring, risk management, and fraud detection. Moreover, the adoption of ML algorithms enhances predictive analytics capabilities, facilitating real-time decision-making. This technological shift aligns with South Korea’s broader digital innovation strategies and helps institutions better serve previously underserved or thin-file borrowers, contributing to more inclusive financial services. For instance, in June 2025, TradePulse Technologies was named runner-up at the BattleFin Alternative Data Discovery Day 2025 in New York, showcasing its AI-driven real-time order flow analytics. The firm's PowerMap platform analyzes large Korean stock trades, while its U.S. platform covers 4,000+ tickers. The recognition highlights TradePulse’s impact on market intelligence innovation.

To get more information on this market Request Sample

Expansion of Data Sources and Types

The South Korea alternative data market growth is further fueled by the expansion of data sources beyond traditional financial records. Alternative data now includes utility payments, e-commerce activity, social media behavior, GPS location data, and mobile device usage. These diverse datasets provide a more holistic view of consumer behavior and creditworthiness. South Korean companies are increasingly adopting such multifaceted data streams to enhance risk assessment models and improve lending decisions. This expansion aligns with regulatory encouragement to innovate within the fintech sector while maintaining data privacy standards. The utilization of diverse alternative data sets enhances the granularity and accuracy of credit scoring, driving market growth and broadening financial inclusion across South Korea. For instance, in April 2025, South Korean fintech firm PFC Technologies Inc. acquired AIForesee, Investree’s credit scoring arm, enhancing its capabilities in SME lending. AIForesee uses AI-driven scoring models to improve credit assessments for small and medium enterprises. The acquisition signals growing momentum in Asia’s fintech space and underscores demand for advanced credit analytics platforms.

South Korea Alternative Data Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2026-2034. Our report has categorized the market based on data type, industry, and end user.

Data Type Insights:

- Credit and Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite and Weather Data

- Social and Sentiment Data

- Web Scraped Data

- Web Traffic

- Others

The report has provided a detailed breakup and analysis of the market based on the data type. This includes credit and debit card transactions, email receipts, geo-location (foot traffic) records, mobile application usage, satellite and weather data, social and sentiment data, web scraped data, web traffic, and others.

Industry Insights:

- Automotive

- BFSI

- Energy

- Industrial

- IT and Telecommunications

- Media and Entertainment

- Real Estate and Construction

- Retail

- Transportation and Logistics

- Others

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes automotive, BFSI, energy, industrial, IT and telecommunications, media and entertainment, real estate and construction, retail, transportation and logistics, and others.

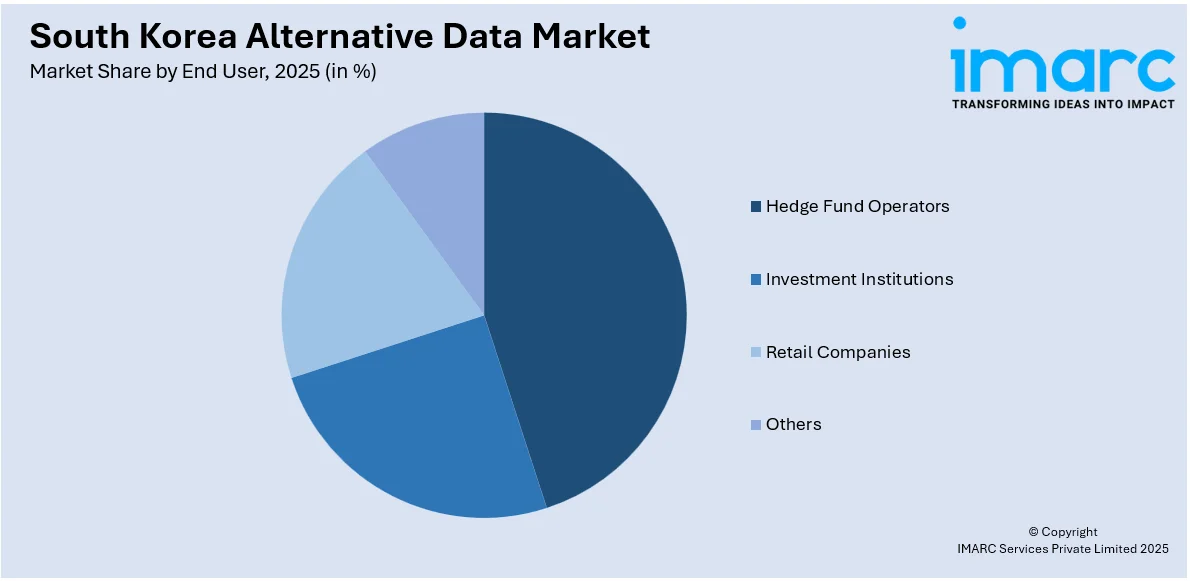

End User Insights:

Access the comprehensive market breakdown Request Sample

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hedge fund operators, investment institutions, retail companies, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Alternative Data Market News:

- In September 2024, Neudata has launched Neudata Ranger, a new product providing deep technical intelligence on market data sources. It offers tools for data buyers to confidently engage with vendors, analyze incumbent providers, and identify top-performing datasets across 14 categories, including pricing and consensus data. Supported by a 20+ member research team, this product enhances market and alternative data insights for investors, reflecting growing demand for improved data intelligence in the investment community.

South Korea Alternative Data Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Types Covered | Credit and Debit Card Transactions, Email Receipts, Geo-location (Foot Traffic) Records, Mobile Application Usage, Satellite and Weather Data, Social and Sentiment Data, Web Scraped Data, Web Traffic, Others |

| Industries Covered | Automotive, BFSI, Energy, Industrial, IT and Telecommunications, Media and Entertainment, Real Estate and Construction, Retail, Transportation and Logistics, Others |

| End Users Covered | Hedge Fund Operators, Investment Institutions, Retail Companies, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea alternative data market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea alternative data market on the basis of data type?

- What is the breakup of the South Korea alternative data market on the basis of industry?

- What is the breakup of the South Korea alternative data market on the basis of end user?

- What is the breakup of the South Korea alternative data market on the basis of region?

- What are the various stages in the value chain of the South Korea alternative data market?

- What are the key driving factors and challenges in the South Korea alternative data market?

- What is the structure of the South Korea alternative data market and who are the key players?

- What is the degree of competition in the South Korea alternative data market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea alternative data market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea alternative data market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea alternative data industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)