South Korea Ammonia Market Size, Share, Trends and Forecast by Physical Form, End Use, and Region, 2025-2033

South Korea Ammonia Market Overview:

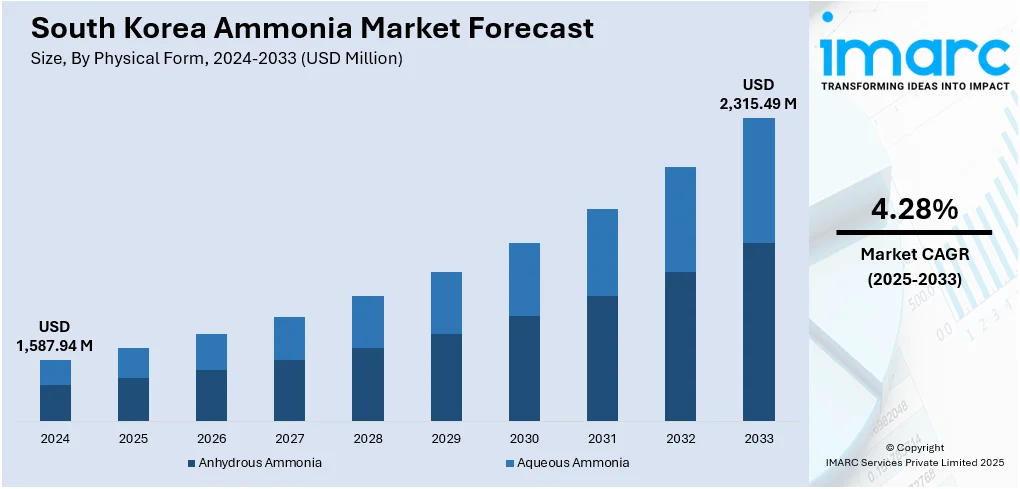

The South Korea ammonia market size reached USD 1,587.94 Million in 2024. The market is projected to reach USD 2,315.49 Million by 2033, exhibiting a growth rate (CAGR) of 4.28% during 2025-2033. The market is fueled by the increasing demand for ammonia in the agricultural sector, primarily for use in fertilizers. Apart from that, the growing focus on sustainable energy solutions, including ammonia as a potential hydrogen carrier, significantly contributes to market expansion. Further, strong industrial activities, particularly in chemicals and petrochemicals, continue to boost ammonia consumption, further augmenting the South Korea ammonia market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,587.94 Million |

| Market Forecast in 2033 | USD 2,315.49 Million |

| Market Growth Rate 2025-2033 | 4.28% |

South Korea Ammonia Market Trends:

Growing Integration of Ammonia in South Korea’s Energy Transition Strategy

South Korea is progressively positioning ammonia as a key carrier in its broader hydrogen and carbon-neutral energy roadmap. The government has outlined specific targets to reduce dependence on fossil fuels and achieve the net-zero target by 2050, and ammonia’s potential as a hydrogen carrier fits within this framework. Ammonia can be co-fired with coal in thermal power plants, reducing carbon emissions while using existing infrastructure. This has led to pilot programs and collaborative initiatives between energy utilities and global ammonia suppliers. In addition to this, major energy companies in South Korea are investing in long-term import contracts for low-carbon ammonia, both blue and green variants, as part of their fuel diversification strategy. There is also active research and engineering development in adapting burners and combustion systems to accommodate ammonia blending ratios without compromising efficiency or emissions compliance. These efforts are motivated by the dual pressure of energy security and emissions regulation, both of which are intensifying in the South Korean energy policy landscape.

To get more information on this market, Request Sample

Accelerated Demand from the Semiconductor and Electronics Manufacturing Sector

South Korea’s globally dominant semiconductor and electronics industries are driving a structural increase in industrial ammonia consumption, which is providing an impetus to South Korea ammonia market growth. As per industry reports, in 2024, electrical machinery and electronics emerged as South Korea’s top export category, accounting for USD 213 Billion in export value. This export performance is closely tied to domestic industrial demand for input materials like ammonia, particularly within cutting-edge fabs producing DRAM, NAND flash, and logic chips. As firms expand production nodes and ramp up capital expenditure on new facilities, the need for stable and high-purity ammonia supply chains grows in parallel. This has led to the development of localized ammonia purification facilities and long-term supply arrangements with specialty gas providers. Apart from this, this trend is closely linked to major capital expansions by leading semiconductor firms in South Korea. Domestic suppliers are being pushed to upgrade purification systems, while global players are competing to establish or expand local supply footprints. The ammonia used in this sector is highly specialized, necessitating tighter logistical control, dedicated storage infrastructure, and meticulous monitoring systems to meet both purity and safety standards. This industry-specific demand has become a distinct growth driver within the broader ammonia market in the country.

Emergence of Strategic Partnerships and International Supply Corridors

As global ammonia markets shift toward clean energy applications, South Korea is forming strategic alliances with producers in regions rich in natural gas or renewable energy. These partnerships are not merely transactional but involve equity investments, joint ventures, and long-term offtake agreements. Moreover, countries in the Middle East, Southeast Asia, and North America are emerging as key collaborators, supplying either conventional ammonia under stable pricing structures or low-carbon variants aligned with decarbonization goals. This geopolitical dimension is increasingly important for South Korean companies seeking to secure stable ammonia flows amid volatile global commodity markets. Besides, the establishment of dedicated ammonia import terminals and conversion facilities at South Korean ports reflects this strategic alignment. Also, the government is supporting these efforts with regulatory incentives, port infrastructure upgrades, and international diplomacy focused on energy cooperation. These developments are helping South Korea build redundancy into its ammonia supply chain while aligning with broader energy security objectives.

South Korea Ammonia Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on physical form and end use.

Physical Form Insights:

- Anhydrous Ammonia

- Aqueous Ammonia

The report has provided a detailed breakup and analysis of the market based on the physical form. This includes anhydrous ammonia and aqueous ammonia.

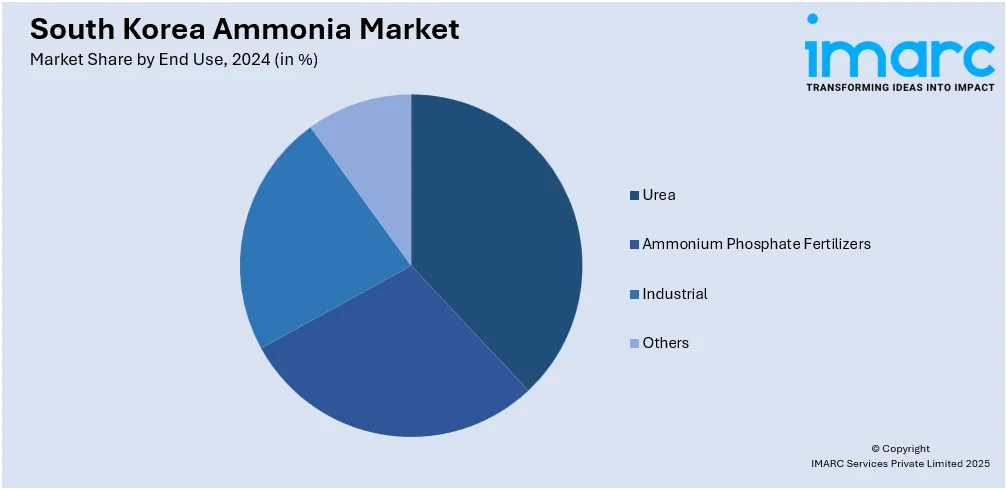

End Use Insights:

- Urea

- Ammonium Phosphate Fertilizers

- Industrial

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes urea, ammonium phosphate fertilizers, industrial, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Ammonia Market News:

- On July 16, 2025, Kazakhstan and South Korea’s YPP Corporation signed a USD 3.1 Billion framework agreement to establish a large-scale “Green Energy Complex” in Kazakhstan. This facility, powered by 2 GW of solar and wind generation, is expected to annually produce up to 310,000 tonnes of green ammonia, with the majority intended for export to global markets. The project will also include necessary infrastructure and is aligned with Kazakhstan’s strategic ambition to leverage its renewable energy potential.

- On January 3, 2025, South Korea’s LUPro signed a landmark agreement with Oman’s Muscat House and Thailand’s MA Corporation to establish a green ammonia production facility in Duqm, Oman, under a USD 4.5 Billion deal. The project’s initial phase plans to use a 2 GW renewable power complex to produce 1 Million Tonnes per year of green ammonia, generated from solar and wind energy, with exports to Thailand commencing around 2027 and growth to 5 Million Tonnes over five years, targeting markets across Southeast Asia, including Singapore, Malaysia, and South Korea.

South Korea Ammonia Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Physical Forms Covered | Anhydrous Ammonia, Aqueous Ammonia |

| End Uses Covered | Urea, Ammonium Phosphate Fertilizers, Industrial, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea ammonia market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea ammonia market on the basis of physical form?

- What is the breakup of the South Korea ammonia market on the basis of end use?

- What is the breakup of the South Korea ammonia market on the basis of region?

- What are the various stages in the value chain of the South Korea ammonia market?

- What are the key driving factors and challenges in the South Korea ammonia market?

- What is the structure of the South Korea ammonia market and who are the key players?

- What is the degree of competition in the South Korea ammonia market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea ammonia market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea ammonia market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea ammonia industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)