South Korea API Market Size, Share, Trends and Forecast by Type, Functionality and Purpose, Industry Vertical, and Region, 2025-2033

South Korea API Market Overview:

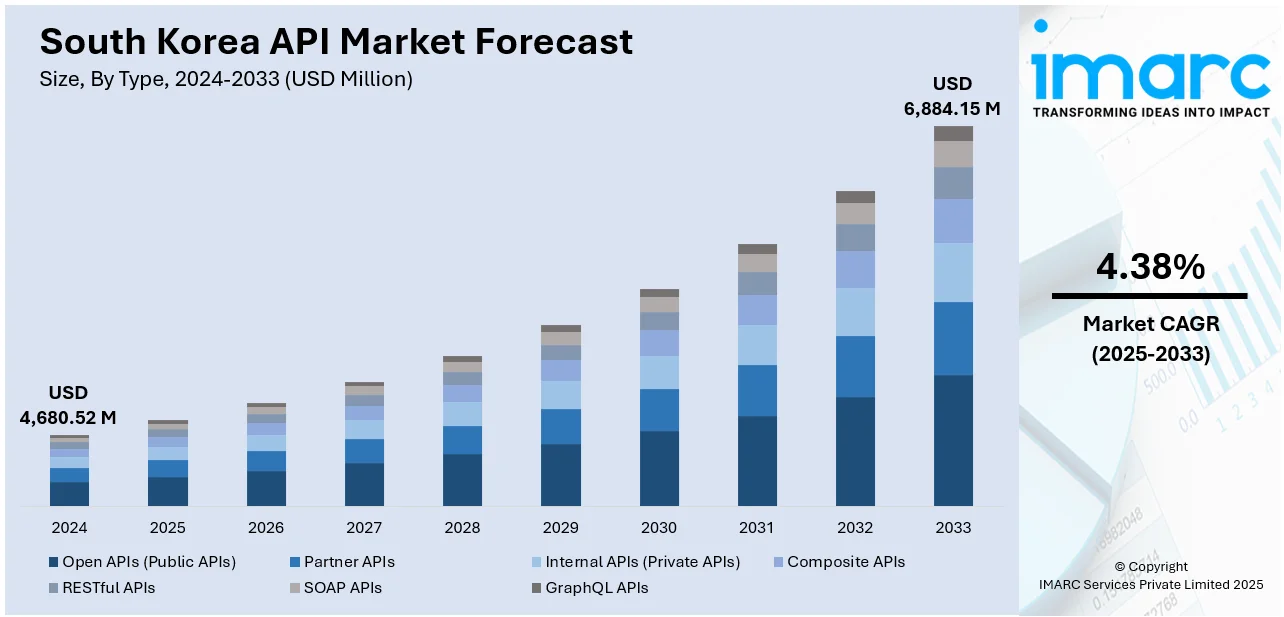

The South Korea API market size reached USD 4,680.52 Million in 2024. Looking forward, the market is expected to reach USD 6,884.15 Million by 2033, exhibiting a growth rate (CAGR) of 4.38% during 2025-2033. The market is expanding rapidly, fueled by the country’s strong digital transformation, advanced IT infrastructure, and rising adoption of cloud-based applications. Growing demand for seamless data integration, automation, and real-time connectivity across industries such as finance, healthcare, and e-commerce is enhancing market growth. Technological innovation and government support for digital ecosystems further strengthen the South Korea API market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,680.52 Million |

| Market Forecast in 2033 | USD 6,884.15 Million |

| Market Growth Rate 2025-2033 | 4.38% |

South Korea API Market Trends:

Government-Driven Digital Transformation and Open Banking API Initiatives

South Korea's API ecosystem is strongly driven by extensive government initiatives focused on promoting digital innovation and financial inclusion. The government introduced a standardized open banking API platform, allowing fintech companies to access financial services from all Korean banks without negotiating individual contracts. This centralized system has greatly reduced integration complexity and accelerated the rollout of new services. The platform's widespread adoption highlights rapid growth, positioning South Korea as a leader in open banking innovation globally. Additionally, the Digital New Deal aims to transition most traditional enterprises to digital platforms, creating significant demand for API management solutions across sectors. The MyData initiative, upgraded to MyData 2.0, further expands access through offline channels and lowers the minimum user age, enhancing consumer control over financial data while driving demand for secure API integration solutions. These coordinated policy measures have established South Korea as a hub for fintech advancement, with mobile payment platforms such as KakaoBank, Toss, and Naver Pay providing extensive API-enabled financial services. Ongoing government efforts in regulatory modernization and infrastructure development continue to cultivate a dynamic environment for API growth and adoption throughout the financial sector.

To get more information on this market, Request Sample

Integration of Artificial Intelligence and Machine Learning with API Infrastructure

The convergence of artificial intelligence technologies with API systems represents a transformative trend in South Korea's digital economy. On December 26, 2024, South Korea's National Assembly passed the Framework Act on Artificial Intelligence Development and Establishment of a Foundation for Trustworthiness, which was officially promulgated on January 21, 2025, making South Korea the first jurisdiction in the Asia-Pacific region to adopt comprehensive AI legislation. This regulatory framework introduces specific obligations for high-impact AI systems while providing substantial public support for AI development, including funding for AI data centers and projects that create training data. The government allocated approximately $390 Million to select five technology consortia, LG AI Research, SK Telecom, Naver Cloud, NC AI, and Upstage, to develop sovereign AI foundation models that achieve at least 95 percent of the performance of frontier models like ChatGPT. Major Korean technology companies are actively integrating AI capabilities into their API offerings, with SK Telecom's A.X AI platform attracting 10 million subscribers as of August 2025 and Naver's HyperCLOVA X model being trained using 6,500 times more Korean-language data than OpenAI's GPT-4. Financial institutions are deploying AI-powered APIs for credit evaluation, fraud detection, and personalized customer services, while healthcare providers are utilizing AI APIs for medical image analytics and diagnostic support. The Presidential Committee on AI announced policy directives in September 2024 establishing a National AI Computing Centre worth up to KRW 2 trillion based on public-private joint ventures. These initiatives are driving the South Korea API market growth by creating substantial demand for AI-integrated API solutions that enable machine learning model deployment, natural language processing, computer vision, and predictive analytics across diverse industry verticals.

Standardization and Interoperability of Network APIs Across Telecommunications Sector

South Korea's telecommunications industry is undergoing a significant transformation through coordinated efforts to standardize network APIs and enhance interoperability. In August 2024, the country's three largest mobile operators, SK Telecom, KT Corporation, and LG Uplus, signed a memorandum of understanding to develop and commercialize unified Network Open APIs, marking a departure from the previous fragmented approach where each operator maintained proprietary API standards. This collaborative initiative aims to lower entry barriers for developers, reduce application development time, and enable the creation of solutions that function seamlessly across all three operators' networks. The standardization effort aligns with global industry movements, including the GSMA Open Gateway initiative and the Linux Foundation's Camara Project, positioning South Korean telecommunications infrastructure for integration with international services. The unified API framework addresses a critical challenge in the industry, where previously incompatible API ecosystems deterred developers from creating multi-operator applications due to increased complexity and extended development cycles. Telecommunications networks are evolving beyond simple connectivity infrastructure to become platforms that generate new services through AI integration and information-based APIs. SK Telecom is actively engaging with international operators such as Deutsche Telekom through its Global Telco AI Alliance to drive service innovation based on common standards. This standardization movement is particularly significant given South Korea's advanced telecommunications infrastructure, with approximately 80 percent 5G population coverage and high consumer demand for 5G services. The initiative is expected to accelerate the deployment of network-dependent applications in areas such as Internet of Things connectivity, edge computing, network slicing, and quality of service management, thereby expanding the addressable market for API providers and facilitating the emergence of innovative telecommunications-based services across the economy.

South Korea API Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, functionality and purpose, and industry vertical.

Type Insights:

- Open APIs (Public APIs)

- Partner APIs

- Internal APIs (Private APIs)

- Composite APIs

- RESTful APIs

- SOAP APIs

- GraphQL APIs

The report has provided a detailed breakup and analysis of the market based on type. This includes open APIs (public APIs), partner APIs, internal APIs (private APIs), composite APIs, RESTful APIs, SOAP APIs, and graphQL APIs.

Functionality and Purpose Insights:

- Payment APIs

- Geolocation APIs

- Social Media APIs

- Weather APIs

- Machine Learning and AI APIs

- IoT APIs

A detailed breakup and analysis of the market based on the functionality and purpose have also been provided in the report. This includes payment APIs, geolocation APIs, social media APIs, weather APIs, machine learning and AI APIs, and IoT APIs.

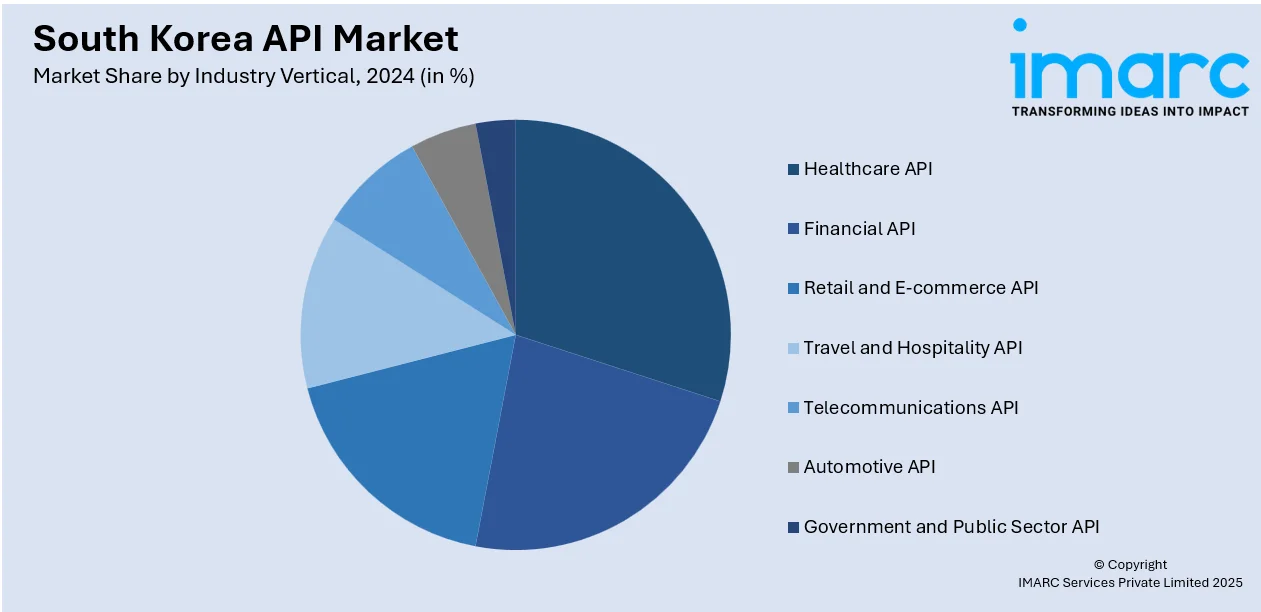

Industry Vertical Insights:

- Healthcare API

- Financial API

- Retail and E-commerce API

- Travel and Hospitality API

- Telecommunications API

- Automotive API

- Government and Public Sector API

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes healthcare API, financial API, retail and E-commerce API, travel and hospitality API, telecommunications API, automotive API, and government and public sector API.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea API Market News:

- September 2025: SK Telecom announced a strategic partnership with OpenAI, securing an exclusive business-to-consumer role following OpenAI's launch of its Seoul office. The collaboration includes a ChatGPT Plus promotion for SK Telecom customers through the T Universe platform, with plans to expand cooperation beyond consumer services to business-to-business applications and group-wide initiatives across SK Group. This partnership supports SK Telecom's dual strategy of self-strengthening and cooperation in building a customer-centric AI ecosystem.

- August 2025: South Korea's Ministry of Science and ICT selected five technology companies, LG AI Research, SK Telecom, Naver Cloud, NC AI, and Upstage, to lead the country's sovereign AI foundation model project. Each consortium was granted the titles of "K-AI model" and "K-AI company" with approximately $390 million in government funding. The program will conduct progress reviews every six months, eliminating underperformers while continuing to fund frontrunners until two companies remain to lead the nation's sovereign AI development initiative.

South Korea API Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Open APIs (Public APIs), Partner APIs, Internal APIs (Private APIs), Composite APIs, RESTful APIs, SOAP APIs, GraphQL APIs |

| Functionality and Purposes Covered | Payment APIs, Geolocation APIs, Social Media APIs, Weather APIs, Machine Learning and AI APIs, IoT APIs |

| Industry Verticals Covered | Healthcare API, Financial API, Retail and E-commerce API, Travel and Hospitality API, Telecommunications API, Automotive API, Government and Public Sector API |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea API market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea API market on the basis of type?

- What is the breakup of the South Korea API market on the basis of functionality and purpose?

- What is the breakup of the South Korea API market on the basis of industry vertical?

- What is the breakup of the South Korea API market on the basis of region?

- What are the various stages in the value chain of the South Korea API market?

- What are the key driving factors and challenges in the South Korea API market?

- What is the structure of the South Korea API market and who are the key players?

- What is the degree of competition in the South Korea API market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea API market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea API market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea API industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)