South Korea ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033

South Korea ATM Market Overview:

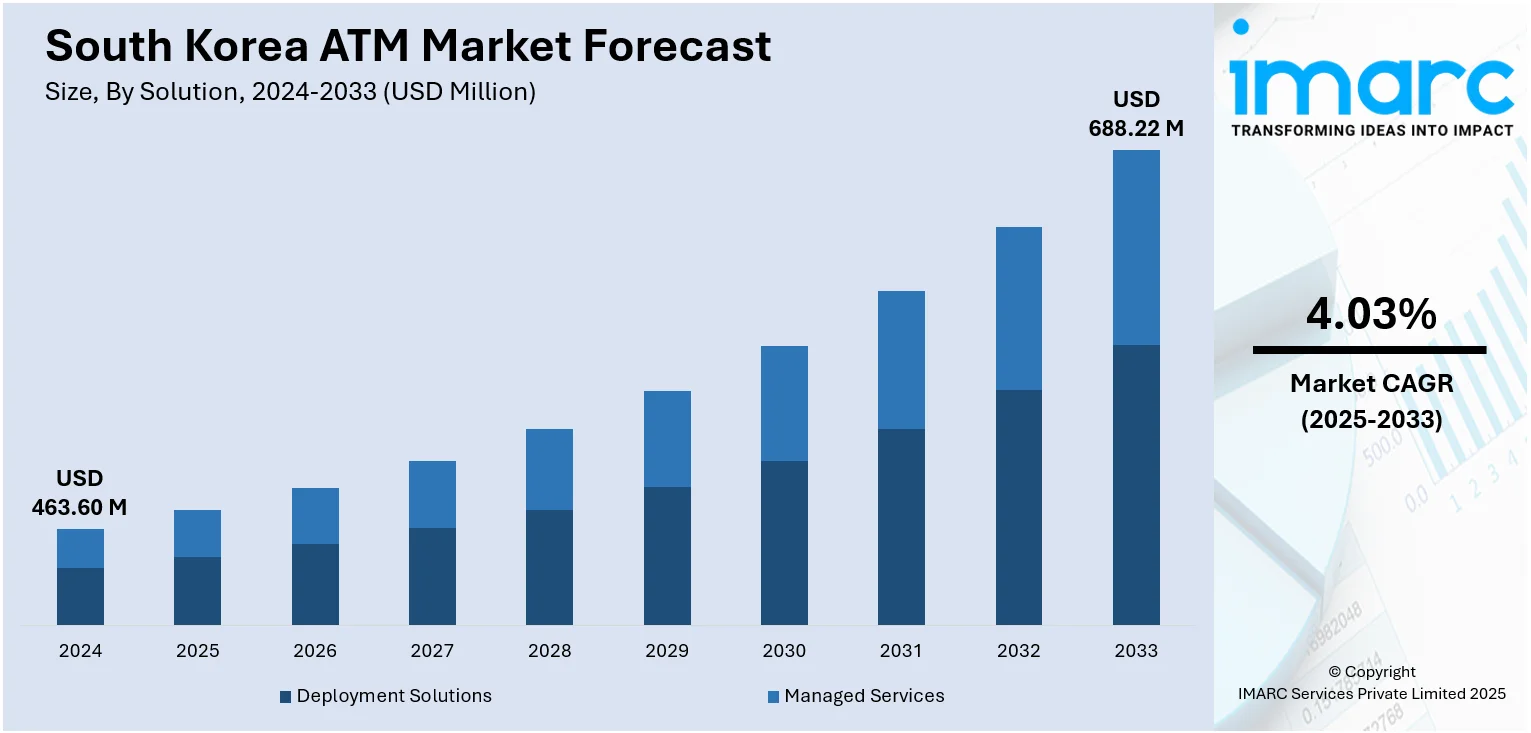

The South Korea ATM market size reached USD 463.60 Million in 2024. Looking forward, the market is expected to reach USD 688.22 Million by 2033, exhibiting a growth rate (CAGR) of 4.03% during 2025-2033. The market is evolving due to the integration of smart technologies, such as biometric authentication and cash recycling functions. Increasing demand for convenient, self-service banking and the expansion of multifunctional ATMs in urban centers are also driving this trend. Strong fintech collaboration and digital banking support further contribute to the dynamic South Korea ATM market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 463.60 Million |

| Market Forecast in 2033 | USD 688.22 Million |

| Market Growth Rate 2025-2033 | 4.03% |

South Korea ATM Market Trends:

Integration of Advanced Technologies and Smart ATMs

South Korea’s ATM market is being significantly fueled by the adoption of advanced technologies, including biometric authentication, NFC capabilities, and cash recycling features. Smart ATMs increasingly conduct multifunctional operations like deposits, utility bill payments, and cardless withdrawals. Such features contribute to improved customer experience through the shortening of waiting periods and making available 24/7 multiple financial services. Financial organizations upgrade legacy ATM systems to harmonize with the nation's wider thrust into digitization. Moreover, security features such as facial recognition and encrypted software counter fraud and enhance users' trust. As customers want more out of self-service banking, intelligent ATMs are increasingly becoming an integral part of the contemporary financial system, reinforcing the position of ATMs in spite of the popularity of mobile and internet-based banking.

To get more information on this market, Request Sample

High Urbanization and Strong Banking Infrastructure

South Korea's highly urbanized population and dense metropolitan areas create a favorable environment for ATM deployment, which is further driving the South Korea ATM market growth. Banks and financial service providers are expanding their ATM networks in cities and transportation hubs to cater to fast-paced urban lifestyles. These machines offer convenient, fast, and secure banking services without the need to visit physical branches. The country's well-established banking infrastructure supports ATM innovation and maintenance, ensuring high uptime and consistent service delivery. In addition, public transport stations, shopping centers, and office buildings increasingly house multifunctional ATMs, contributing to wider consumer accessibility. This urban demand for convenience and speed sustains strong ATM usage, even as digital alternatives grow, keeping ATMs relevant and necessary in everyday banking.

Collaboration Between Banks and Technology Providers

Strategic partnerships between South Korean banks and global technology firms are playing a pivotal role in driving ATM market growth. These collaborations focus on delivering cost-efficient, high-tech, and easily scalable ATM services. For example, banks are outsourcing ATM management to tech companies that provide ATM-as-a-Service models, which help reduce operational costs while upgrading user experience. Such alliances also facilitate quicker adoption of new features like touchless access, QR code functionality, and multilingual interfaces. These partnerships ensure that ATMs remain competitive in a digital-first financial environment. Furthermore, regulatory support and a pro-innovation approach by South Korea’s financial authorities encourage the deployment of next-gen ATM solutions, fueling further market expansion and technological adoption.

South Korea ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size Insights:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes 15" and below and above 15".

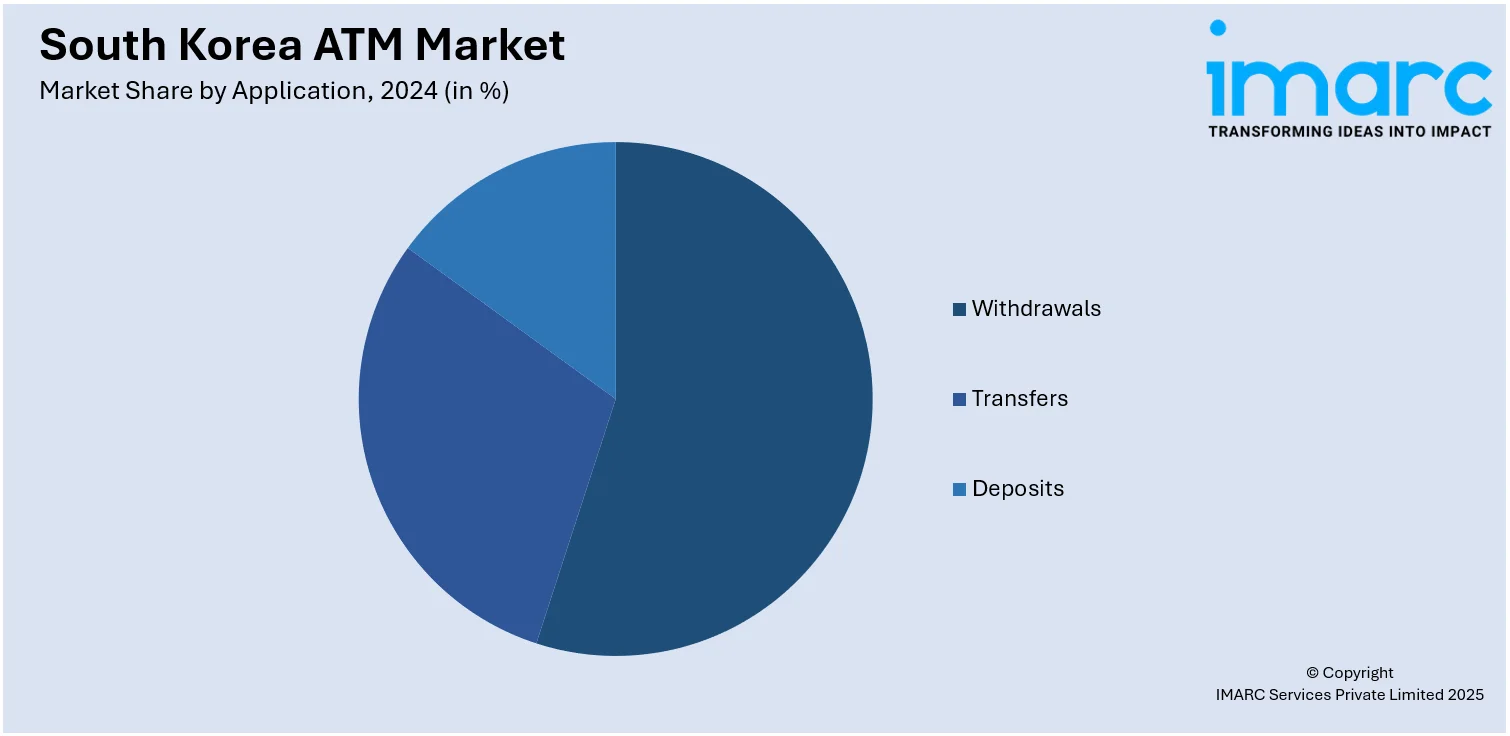

Application Insights:

- Withdrawals

- Transfers

- Deposits

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea ATM Market News:

- In May 2025, South Korea launched a new QR-based payment and ATM cash withdrawal service tailored for international travelers across Asia. This initiative builds on the nation's ongoing efforts to upgrade its financial infrastructure, which also includes the rollout of a digital currency pilot program. The service aims to improve financial accessibility and convenience for Korean tourists and foreign visitors, particularly in areas where conventional payment options are less widely accepted.

South Korea ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea ATM market on the basis of solution?

- What is the breakup of the South Korea ATM market on the basis of screen size?

- What is the breakup of the South Korea ATM market on the basis of application?

- What is the breakup of the South Korea ATM market on the basis of ATM type?

- What is the breakup of the South Korea ATM market on the basis of region?

- What are the various stages in the value chain of the South Korea ATM market?

- What are the key driving factors and challenges in the South Korea ATM market?

- What is the structure of the South Korea ATM market and who are the key players?

- What is the degree of competition in the South Korea ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)