South Korea Autocatalyst Market Size, Share, Trends and Forecast by Material, Catalyst Type, Distribution Channel, Vehicle Type, Fuel Type, and Region, 2025-2033

South Korea Autocatalyst Market Overview:

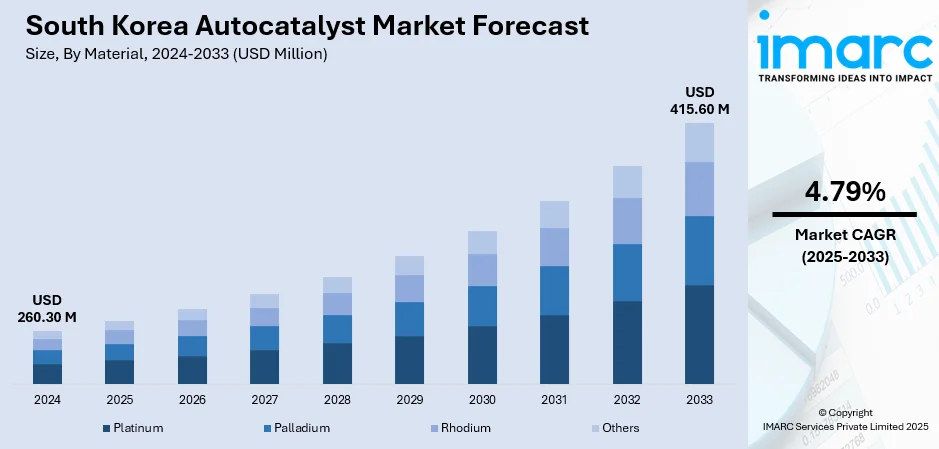

The South Korea autocatalyst market size reached USD 260.30 Million in 2024. Looking forward, the market is projected to reach USD 415.60 Million by 2033, exhibiting a growth rate (CAGR) of 4.79% during 2025-2033. The market is driven by mandated national emission standards and government-supported eco vehicle strategies requiring efficient converter systems, expanding vehicle production including exports necessitating compliance equipment, and continuous innovation in catalyst materials and manufacturing methods to reduce cost and enhance durability, further augmenting the South Korea autocatalyst market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 260.30 Million |

| Market Forecast in 2033 | USD 415.60 Million |

| Market Growth Rate 2025-2033 | 4.79% |

South Korea Autocatalyst Market Trends:

Stringent Emission Regulations and Vehicle Standards

South Korea has enforced rigorous vehicle emissions requirements, including Euro 6 and Korea Tier 5 standards, compelling vehicle manufacturers to mandate installation of high-efficiency catalytic converters to reduce nitrogen oxides, carbon monoxide, and hydrocarbons. The government also offers financial incentives such as tax breaks and subsidies to support clean vehicle technology adoption, promoting integration of advanced autocatalyst systems across both OEM and aftermarket segments. Regulatory assessments now demand proof of emissions performance over vehicle lifecycle, leading automakers to source catalysts with enhanced durability and precious metal load optimization to achieve compliance. The country ranks among the world’s top auto exporters, necessitating compliance with stricter standards in export regions such as Europe, North America, and ASEAN. In 2024, South Korea exported automobiles worth USD 34.7 Billion to the United States, comprising 49% of its total auto exports. Semiconductors, automobiles, and auto parts together made up 42% of South Korea’s total U.S.-bound exports in the same year. Production improvements such as precise washcoat layering, substrate design refinement, and thermal durability testing enhance functionality and reduce overall system mass. Domestic firms collaborate with global suppliers and automotive OEMs to co-develop next generation catalyst solutions that meet Euro 7 standards and electric hybrid powertrain applications. The emphasis on exhaust treatment infrastructure also drives R&D in noble‑metal formulations and compact converter design. This progression in environmental policy and performance criteria substantially influences South Korea autocatalyst market growth.

To get more information on this market, Request Sample

Automotive Market Expansion and Emission Control Equipment Demand

South Korea’s automotive sector continues expanding in both domestic and global markets, creating steady demand for emission control equipment. For instance, on March 19, 2025, researchers at Hanyang University ERICA in South Korea unveiled a breakthrough in green hydrogen production with a new boron-doped cobalt phosphide catalyst. This low-cost, highly efficient electrocatalyst significantly improves the hydrogen evolution and oxygen evolution reactions, showing potential for large-scale hydrogen production. The catalyst demonstrated superior performance with a cell potential of just 1.59 V and stability for over 100 hours, offering a promising solution for affordable and sustainable hydrogen generation, contributing to the reduction of global carbon emissions. Rising vehicle production volumes across Hyundai, Kia, and emerging manufacturers increase output of light‑duty gasoline and diesel vehicles, each requiring reliable catalytic converters. Adoption of passenger and commercial vehicles continues growing alongside government encouragement for clean auto technologies. Catalyst producers in South Korea are focusing on technological advancements to improve performance, reduce precious metal usage, and support environmental compliance. This includes development of palladium based, platinum based, and rhodium-based formulations optimized for higher conversion rates and extended lifecycle. Aftermarket replacement cycles and fleet renewal programs further support continuous penetration of autocatalysts, including three‑way, selective catalytic reduction, and lean NOx trap technologies. OEMs are investing in quality assurance and supplier localization to ensure availability and cost control.

South Korea Autocatalyst Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material, catalyst type, distribution channel, vehicle type, and fuel type.

Material Insights:

- Platinum

- Palladium

- Rhodium

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes platinum, palladium, rhodium, and others.

Catalyst Type Insights:

- Two-way

- Three-way

- Four-way

The report has provided a detailed breakup and analysis of the market based on the catalyst type. This includes two-way, three-way, and four-way.

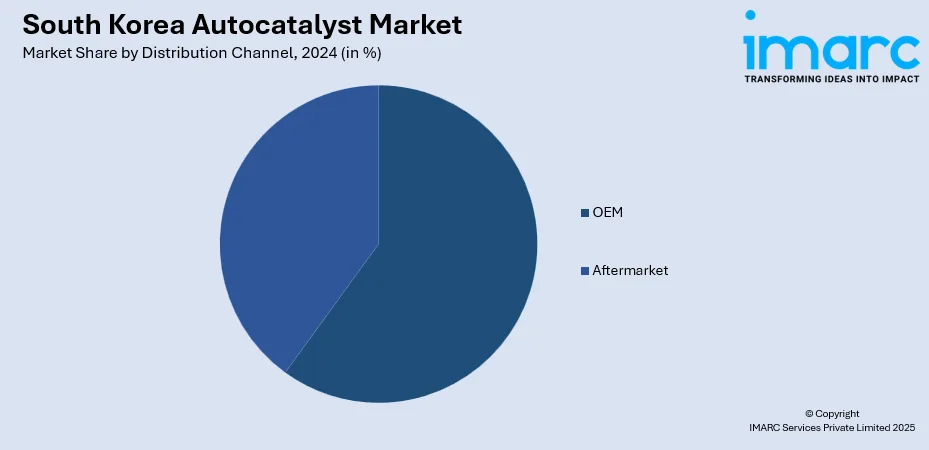

Distribution Channel Insights:

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes OEM and aftermarket.

Vehicle Type Insights:

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger car, light commercial vehicle, heavy commercial vehicle, and others.

Fuel Type Insights:

- Gasoline

- Diesel

- Hybrid Fuels

- Hydrogen Fuel Cell

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes gasoline, diesel, hybrid fuels, and hydrogen fuel cell.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Autocatalyst Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Platinum, Palladium, Rhodium, Others |

| Catalyst Types Covered | Two-way, Three-way, Four-way |

| Distribution Channels Covered | OEM, Aftermarket |

| Vehicle Types Covered | Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle, Others |

| Fuel Types Covered | Gasoline, Diesel, Hybrid Fuels, Hydrogen Fuel Cell |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea autocatalyst market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea autocatalyst market on the basis of material?

- What is the breakup of the South Korea autocatalyst market on the basis of catalyst type?

- What is the breakup of the South Korea autocatalyst market on the basis of distribution channel?

- What is the breakup of the South Korea autocatalyst market on the basis of vehicle type?

- What is the breakup of the South Korea autocatalyst market on the basis of fuel type?

- What is the breakup of the South Korea autocatalyst market on the basis of region?

- What are the various stages in the value chain of the South Korea autocatalyst market?

- What are the key driving factors and challenges in the South Korea autocatalyst market?

- What is the structure of the South Korea autocatalyst market and who are the key players?

- What is the degree of competition in the South Korea autocatalyst market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea autocatalyst market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea autocatalyst market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea autocatalyst industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)