South Korea Automation Testing Market Size, Share, Trends and Forecast by Component, Endpoint Interface, Enterprise Size, End User, and Region, 2025-2033

South Korea Automation Testing Market Overview:

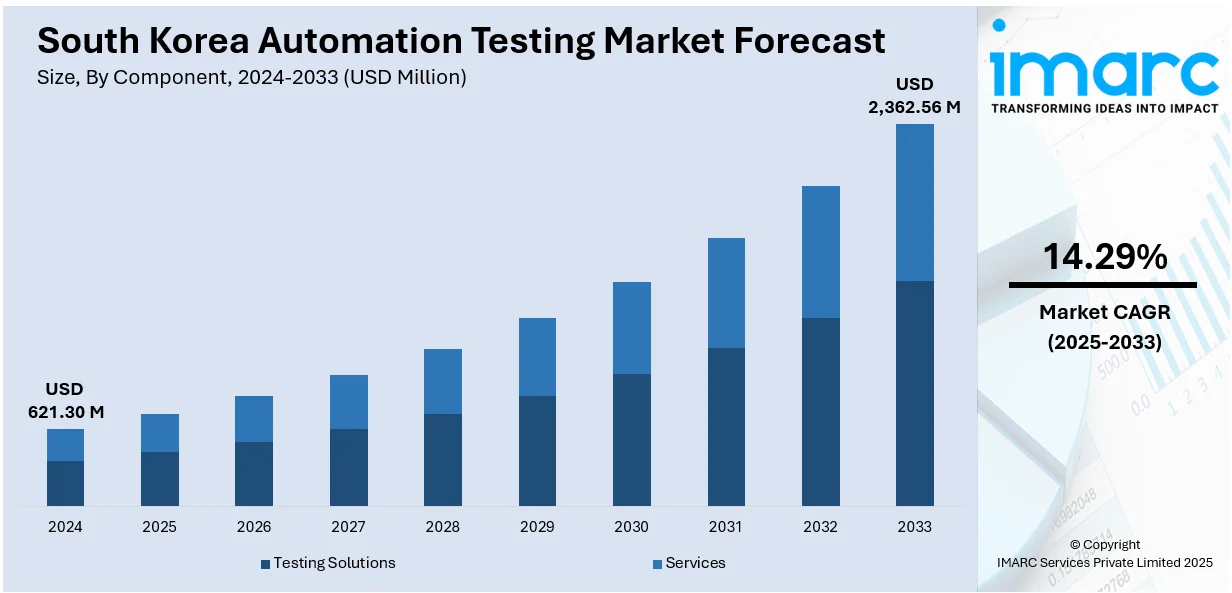

The South Korea automation testing market size reached USD 621.30 Million in 2024. Looking forward, the market is projected to reach USD 2,362.56 Million by 2033, exhibiting a growth rate (CAGR) of 14.29% during 2025-2033. The market is driven by rapid adoption of Agile and DevOps practices demanding continuous testing, widespread deployment of AI augmented and cloud-based tools enhancing testing efficiency, and government policy support aligned with semiconductor and smart factory modernization imperatives, further augmenting the South Korea automation testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 621.30 Million |

| Market Forecast in 2033 | USD 2,362.56 Million |

| Market Growth Rate 2025-2033 | 14.29% |

South Korea Automation Testing Market Trends:

Accelerated Software Development and Continuous Delivery Adoption

South Korean enterprises across finance, telecommunications, e‑commerce and automotive sectors are embracing Agile and DevOps methodologies to shorten release cycles and maintain quality standards. As development teams adopt continuous integration and continuous delivery pipelines, the integration of automated testing becomes essential to ensure rapid validation of code changes and regression coverage. Automated testing tools support functional, performance, API and mobile testing in repetitive and complex environments, enabling faster identification of defects without human delay. Enterprises are also deploying continuous testing frameworks to validate software quality throughout the development lifecycle. The proliferation of cloud‑native environments and hybrid on‑premise‑cloud platforms increases the importance of scalable, resilient testing infrastructures. In South Korea’s digitally mature ICT ecosystem, procurement decisions now prioritize automation and rapid feedback loops to support faster time to market and reduced error rates, thereby contributing to the South Korea automation testing market growth.

To get more information on this market, Request Sample

Technological Advancements Including AI‑Augmented and Cloud Testing Tools

The introduction of AI‑powered testing tools, predictive analytics and self‑healing frameworks is transforming the domestic testing landscape. AI‑augmented software testing platforms now automate test case generation, optimize regression suites, and detect anomalies through machine learning‑based pattern recognition. This improves efficiency and defect detection precision while reducing reliance on manual scripts. The rise of cloud testing solutions further supports remote execution, environment scalability and multi‑device testing at lower cost. Organizations can now deploy test infrastructure on demand, leverage hybrid cloud models, and rapidly parallelize test suites. These capabilities are particularly attractive to SMEs and global development centers in digital hubs such as Pangyo Techno Valley. The combination of AI automation and cloud delivery methods enables flexible, cost‑effective testing workflows, driving demand for platforms tailored to South Korea’s compliance and infrastructure context.

Government Policies, Smart Factory Agenda and Semiconductor Industry Requirements

Public policy in South Korea is fostering an environment conducive to automation adoption. National initiatives such as the Intelligent Robot Development Promotion Act and the establishment of the K‑Humanoid Alliance underscore a strategic push toward robotics and AI integration in industrial systems. With electronics and semiconductor fabrication at the core of its economy, South Korea requires rigorous automated testing across IC production and consumer device lifecycle sectors. Automated test equipment (ATE) demand is rising across memory and non‑memory IC manufacturers, driven by needs for high‑quality throughput in 5G, IoT and automotive components. The government’s Industry 4.0 vision and smart factory programs are further promoting in‑line process automation and real‑time quality assurance. Enterprises are embedding test automation within manufacturing and software pipelines to maintain competitiveness globally.

South Korea Automation Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, endpoint interface, enterprise size, and end user.

Component Insights:

- Testing Solutions

- Functional Testing

- API Testing

- Security Testing

- Compliance Testing

- Usability Testing

- Others

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes testing solutions (functional testing, API testing, security testing, compliance testing, usability testing, and others) and services (professional services and managed services).

Endpoint Interface Insights:

- Web

- Mobile

- Desktop

- Embedded Software

The report has provided a detailed breakup and analysis of the market based on the endpoint interface. This includes web, mobile, desktop, and embedded software.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises and large enterprises.

End User Insights:

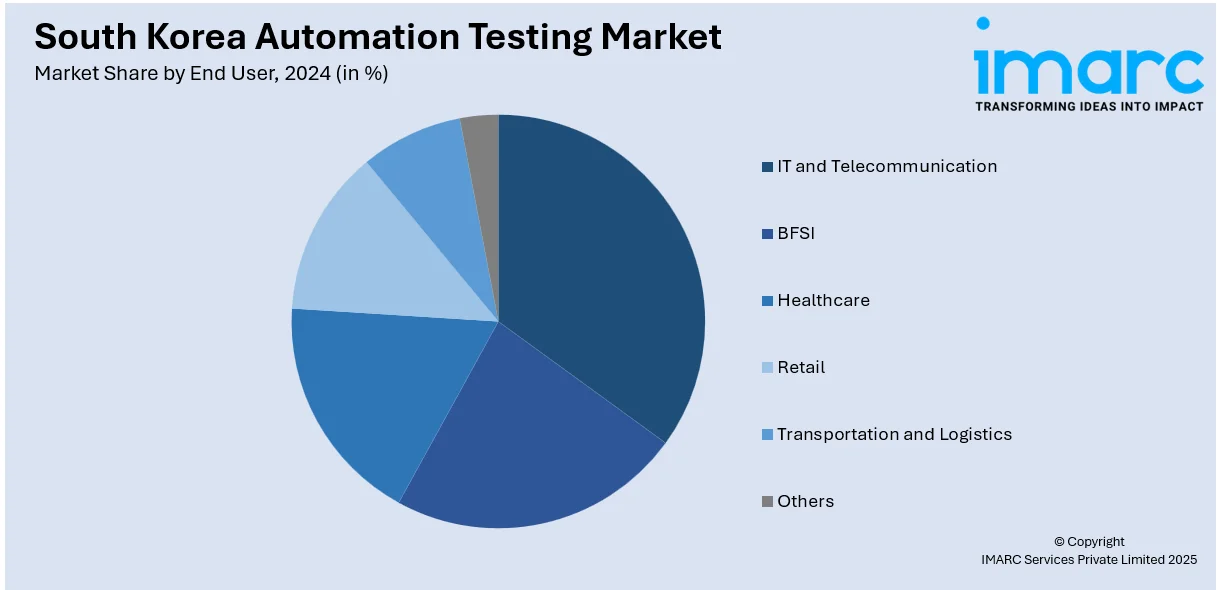

- IT and Telecommunication

- BFSI

- Healthcare

- Retail

- Transportation and Logistics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes IT and telecommunication, BFSI, healthcare, retail, transportation and logistics, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Automation Testing Market News:

- On August 22, 2024, IKEA South Korea implemented automated fulfilment systems at its Giheung store with an investment of EUR 11 Million (approx. USD 12 Million) to support rising e-commerce demands. The system, powered by wireless-controlled robots and automated packaging, can handle 2,000 orders daily and pack 300 boxes per hour, boosting picking efficiency eightfold. This automation initiative reflects the growing adoption of intelligent logistics and robotics in South Korea’s broader automation testing and smart warehouse infrastructure.

- On April 9, 2025, Seegene Inc. announced the development of CURECA™, a fully automated PCR system designed for 24/7 high-throughput testing, covering the full workflow from sample pre-treatment to result analysis. The system includes modular components for customizable sample processing and is aimed at reducing manual labor while increasing accuracy and efficiency in molecular diagnostics. This marks a major advancement in South Korea’s automation testing market, addressing growing global demands for scalable, integrated lab automation solutions.

South Korea Automation Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Endpoint Interfaces Covered | Web, Mobile, Desktop, Embedded Software |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Users Covered | IT and Telecommunication, BFSI, Healthcare, Retail, Transportation and Logistics, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea automation testing market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea automation testing market on the basis of component?

- What is the breakup of the South Korea automation testing market on the basis of endpoint interface?

- What is the breakup of the South Korea automation testing market on the basis of enterprise size?

- What is the breakup of the South Korea automation testing market on the basis of end user?

- What is the breakup of the South Korea automation testing market on the basis of region?

- What are the various stages in the value chain of the South Korea automation testing market?

- What are the key driving factors and challenges in the South Korea automation testing market?

- What is the structure of the South Korea automation testing market and who are the key players?

- What is the degree of competition in the South Korea automation testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea automation testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea automation testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea automation testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)