South Korea Automotive HMI Market Size, Share, Trends and Forecast by Product, Access Type, Technology, Vehicle Type, and Region, 2025-2033

South Korea Automotive HMI Market Overview:

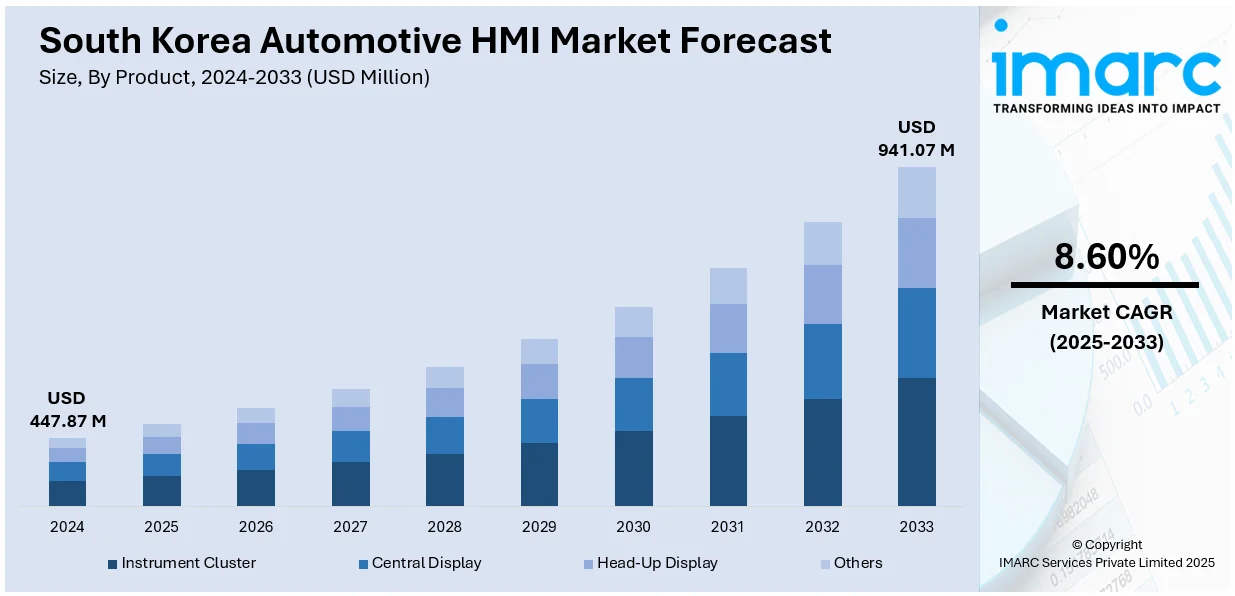

The South Korea automotive HMI market size reached USD 447.87 Million in 2024. The market is projected to reach USD 941.07 Million by 2033, exhibiting a growth rate (CAGR) of 8.60% during 2025-2033. The market is fueled by rising demand for cutting-edge in-car technologies to enhance the user experience as well as the safety of drivers. Apart from that, expanding customer demand for connectivity options, including touchscreens, voice command, and gesture control, are propelling the market growth. In addition, regulatory policies enhance environmentally friendly transportation and encourages the use of advanced HMI solutions, thus augmenting the South Korea automotive HMI market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 447.87 Million |

| Market Forecast in 2033 | USD 941.07 Million |

| Market Growth Rate 2025-2033 | 8.60% |

South Korea Automotive HMI Market Trends:

Integration of AI-Powered Voice Assistants

The increasing integration of AI-based voice assistants in vehicles is positively impacting the market. Consumers in the region are showing a strong preference for intuitive voice-based controls that allow hands-free operation of infotainment systems, navigation, and climate settings. This trend is supported by advancements in natural language processing and Korean-language AI development by domestic tech firms. Hyundai and Kia have been early adopters, embedding voice assistants in mid- to high-end models. For example, Hyundai Motor Group announced that it will begin integrating its new AI-powered infotainment system, PLeOS Connect, into vehicles starting Q2 2026. Developed in partnership with Naver, the system features an advanced voice assistant capable of processing complex driver commands, such as simultaneous navigation, weather updates, news, and schedule management. Besides, the convenience offered by voice interaction is especially valued in dense urban traffic, where minimizing distractions is critical. Moreover, these systems are increasingly capable of recognizing regional dialects and user behavior patterns, offering a tailored experience. Local software players are partnering with automotive OEMs to provide platforms that support smart home integration and real-time service updates through voice commands. This trend is further gaining momentum as 5G networks become more widespread, enabling faster and more reliable connectivity, which is essential for cloud-based voice processing.

To get more information on this market, Request Sample

Growing Focus on Personalization and UX Customization

Personalized HMI systems are gaining traction in South Korea as drivers increasingly expect digital experiences that adapt to their habits and preferences. OEMs are introducing user profiles that store individual settings for seating position, climate, music, and navigation history, which can be transferred across vehicles via mobile accounts. This trend is positively impacting the South Korea automotive HMI market growth. On July 3, 2025, Hyundai Motor Group inaugurated its UX Studio Seoul, a participatory, open‑research facility enabling customers to co‑create software-defined vehicle (SDV) features using VR testing, real‑time feedback loops, and interactive prototypes. Machine learning is used to track behavioral data over time and proactively adjust system responses. For instance, infotainment suggestions and route planning can be adapted based on prior patterns, time of day, and current traffic conditions. In addition to this, automakers are leveraging their partnerships with domestic tech companies to enhance the UX layer with localized content, including media platforms, restaurant recommendations, and real-time parking availability. Beyond convenience, personalization also supports accessibility by enabling interface adjustments for drivers with specific needs, such as vision or mobility impairments. The emphasis on personalization is accelerating as vehicles become connected hubs within the broader IoT ecosystem, with HMIs acting as the central interface for interacting with digital services inside and outside the car.

South Korea Automotive HMI Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, access type, technology, and vehicle type.

Product Insights:

- Instrument Cluster

- Central Display

- Head-Up Display

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes instrument cluster, central display, head-up display, and others.

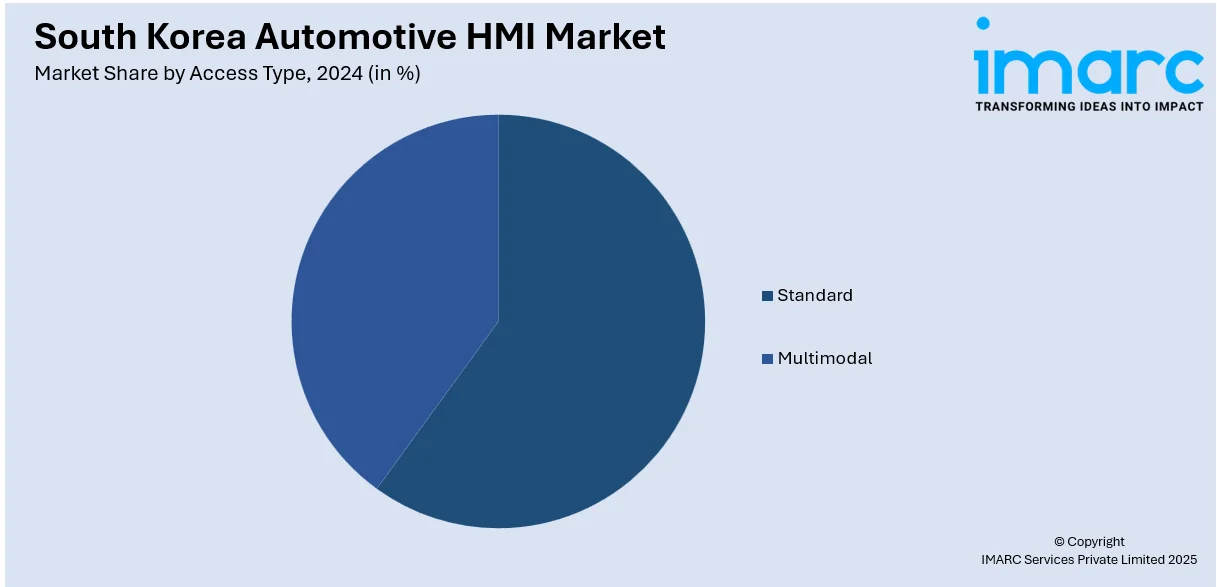

Access Type Insights:

- Standard

- Multimodal

A detailed breakup and analysis of the market based on the access type have also been provided in the report. This includes standard and multimodal.

Technology Insights:

- Visual Interface

- Acoustic

- Mechanical

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes visual interface, acoustic, mechanical, and others.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars and commercial vehicles.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Automotive HMI Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Instrument Cluster, Central Display, Head-Up Display, Others |

| Access Types Covered | Standard, Multimodal |

| Technologies Covered | Visual Interface, Acoustic, Mechanical, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea automotive HMI market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea automotive HMI market on the basis of product?

- What is the breakup of the South Korea automotive HMI market on the basis of access type?

- What is the breakup of the South Korea automotive HMI market on the basis of technology?

- What is the breakup of the South Korea automotive HMI market on the basis of vehicle type?

- What is the breakup of the South Korea automotive HMI market on the basis of region?

- What are the various stages in the value chain of the South Korea automotive HMI market?

- What are the key driving factors and challenges in the South Korea automotive HMI market?

- What is the structure of the South Korea automotive HMI market and who are the key players?

- What is the degree of competition in the South Korea automotive HMI market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea automotive HMI market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea automotive HMI market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea automotive HMI industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)