South Korea Automotive Plastics Market Size, Share, Trends and Forecast by Vehicle Type, Material, Application, and Region, 2026-2034

South Korea Automotive Plastics Market Overview:

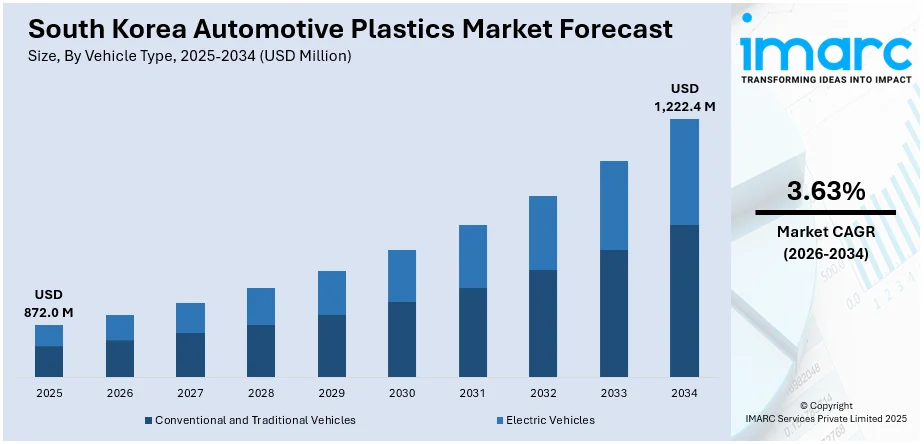

The South Korea automotive plastics market size reached USD 872.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,222.4 Million by 2034, exhibiting a growth rate (CAGR) of 3.63% during 2026-2034. South Korea’s electric vehicle (EV) expansion and focus on sustainable materials are driving the automotive plastics industry. Lightweight, high-performance plastics enhance EV efficiency, while recycled and bio-based materials support environmental goals. Government incentives and innovation foster continued advancement in both electric mobility and circular material use, contributing to the expansion of the South Korea automotive plastics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 872.0 Million |

| Market Forecast in 2034 | USD 1,222.4 Million |

| Market Growth Rate 2026-2034 | 3.63% |

South Korea Automotive Plastics Market Trends:

Expansion of the Electric Vehicle (EV) Sector

South Korea is a major player in the global electric vehicle (EV) market, fueled by strong government incentives and growing user demand for sustainable transportation. The country’s electric car market size reached USD 3,394.3 million in 2024, reflecting rapid adoption and production of EVs. This shift toward electric mobility is catalyzing the demand for automotive plastics, as EVs require different design specifications than traditional internal combustion engine (ICE) vehicles. Plastics are critical in reducing the overall vehicle weight, which directly improves battery range and energy efficiency, a key factors for EV performance. Beyond weight reduction, advanced plastics provide essential functions like efficient thermal management to prevent overheating, electrical insulation for sensitive electronic components, and lightweight yet durable structural parts that enhance vehicle safety and longevity. South Korea’s government policies promoting green mobility, including investments in EV infrastructure and incentives for individuals, further contribute to the South Korea automotive plastics market growth. As EV production and adoption accelerate, the automotive plastics sector grows in parallel, supported by ongoing innovation in polymer materials tailored for EV applications. This synergy between a booming EV market and advanced plastic technologies positions South Korea at the forefront of sustainable automotive development, ensuring continued expansion of the automotive plastics industry driven by the evolving demands of EV manufacturing.

To get more information on this market Request Sample

Advancement in Sustainable and Circular Automotive Materials

As environmental concerns and regulatory pressures intensify, automakers and material manufacturers are prioritizing circular economy principles to reduce waste and carbon footprints. The use of recycled plastics in vehicle components like interior trims, seats, and panels helps lower dependency on virgin materials while maintaining high performance and durability standards. This shift not only supports environmental goals but also enhances brand value by appealing to eco-conscious consumers. Furthermore, innovations in circular recycling technologies enable the production of high-quality automotive plastics from post-consumer waste, ensuring material reuse without compromising functionality. The growing collaboration between chemical producers and automotive manufacturers to integrate sustainable materials reflects a broader industry commitment to eco-friendly practices. These advancements are accelerating the development and commercial application of bio-based and recycled polymers, expanding the scope of automotive plastics. For instance, in 2024, SK chemicals and Hyundai-Kia collaborated to apply six recycled and bio-based automotive components to the Kia EV3 Study Car in South Korea. Using SK chemicals’ circular recycling technology, parts like headliners, seats, and door panels were made from recycled PET to enhance sustainability. This project marked a step toward a circular economy in the automotive industry, with plans for further eco-friendly material applications.

South Korea Automotive Plastics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on vehicle type, material, and application.

Vehicle Type Insights:

- Conventional and Traditional Vehicles

- Electric Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes conventional and traditional vehicles and electric vehicles.

Material Insights:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Polycarbonate (PC)

- Polyamide

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), acrylonitrile butadiene styrene (ABS), polyurethane (PU), polymethyl methacrylate (PMMA), polycarbonate (PC), polyamide, and others.

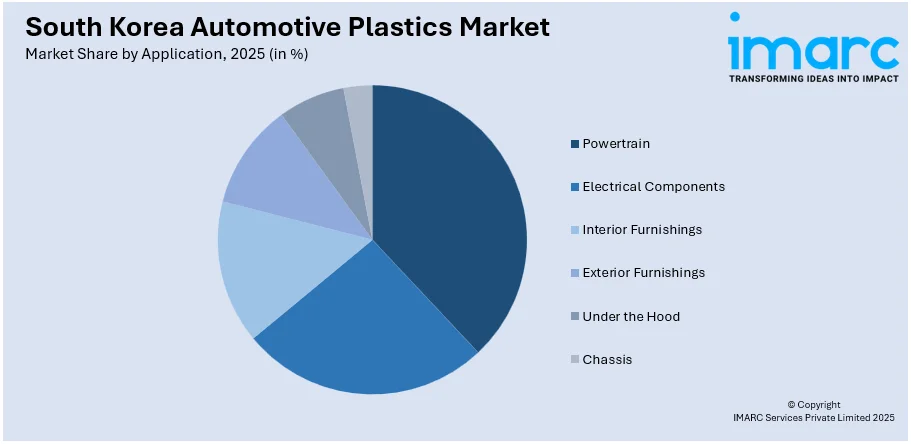

Application Insights:

Access the comprehensive market breakdown Request Sample

- Powertrain

- Electrical Components

- Interior Furnishings

- Exterior Furnishings

- Under the Hood

- Chassis

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes powertrain, electrical components, interior furnishings, exterior furnishings, under the hood, and chassis.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Automotive Plastics Market News:

- In April 2025, Hyundai-Kia in South Korea and BASF unveiled the Kia EV3 Study Car, featuring eight sustainable plastic materials to enhance performance and reduce carbon emissions. The collaboration highlights BASF’s innovative plastics solutions applied throughout the vehicle.

- In February 2025, SK chemicals announced it will establish a Waste Plastic Recycling Innovation Center in Ulsan, South Korea, to advance depolymerization technology. The center will recycle various plastics, including automotive parts, into high-quality raw materials like r-BHET.

South Korea Automotive Plastics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Conventional and Traditional Vehicles, Electric Vehicles |

| Materials Covered | Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Acrylonitrile Butadiene Styrene (ABS), Polyurethane (PU), Polymethyl Methacrylate (PMMA), Polycarbonate (PC), Polyamide, Others |

| Applications Covered | Powertrain, Electrical Components, Interior Furnishings, Exterior Furnishings, Under the Hood, Chassis |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea automotive plastics market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea automotive plastics market on the basis of vehicle type?

- What is the breakup of the South Korea automotive plastics market on the basis of material?

- What is the breakup of the South Korea automotive plastics market on the basis of application?

- What is the breakup of the South Korea automotive plastics market on the basis of region?

- What are the various stages in the value chain of the South Korea automotive plastics market?

- What are the key driving factors and challenges in the South Korea automotive plastics market?

- What is the structure of the South Korea automotive plastics market and who are the key players?

- What is the degree of competition in the South Korea automotive plastics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea automotive plastics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea automotive plastics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea automotive plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)