South Korea Automotive Sensors Market Size, Share, Trends and Forecast by Type, Vehicle Type, Application, Sales Channel, and Region, 2026-2034

South Korea Automotive Sensors Market Overview:

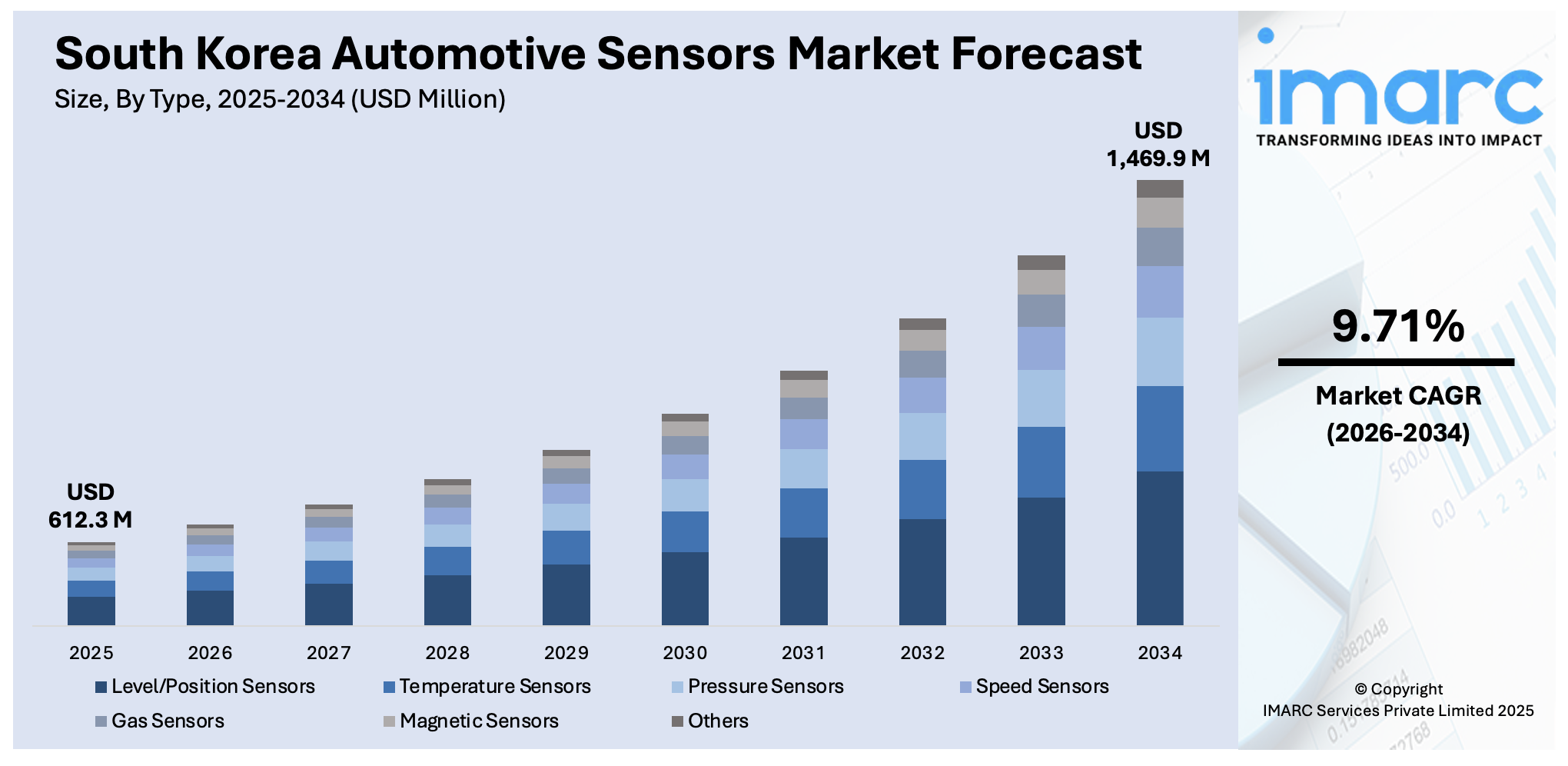

The South Korea automotive sensors market size reached USD 612.3 Million in 2025. Looking forward, the market is expected to reach USD 1,469.9 Million by 2034, exhibiting a growth rate (CAGR) of 9.71% during 2026-2034. The market is fueled by the country's dominance in semiconductor and electronics production, the booming EV and ADAS market driven by Hyundai and Kia, and state policies such as smart factory deployment, Green New Deal policies, and manufacturing innovation plans that spur the use of sensor-dense automation across car manufacturing lines. Korea's very strict emission and safety regulations for both home-market and export-market cars also necessitate real-time sensing systems to enable compliance, which cumulatively fuel the South Korea automotive sensors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 612.3 Million |

| Market Forecast in 2034 | USD 1,469.9 Million |

| Market Growth Rate 2026-2034 | 9.71% |

South Korea Automotive Sensors Market Trends:

Semiconductor-Powered Sensor Innovation

South Korea's automotive sensor market is specifically powered by its semiconductor industry. With the likes of Samsung and SK Hynix calling the country home, the semiconductor ecosystem in South Korea supports the creation of sophisticated MEMS, radar, LiDAR, and camera sensors custom-designed for cars. This convergence enables vertically integrated value chains wherein chip production, sensor module development, and auto assembly—particularly at Hyundai and Kia—can be tightly coordinated to deliver fast iteration and localization of sensor technologies. Further, startups like Seoul Robotics and Telechips are riding this ecosystem, engineering AI-powered LiDAR solutions and system-on-chip processors for in-car applications. The enthusiasm for software‑defined vehicle platforms, highlighted by Hyundai’s collaboration with Samsung on Exynos automotive SoCs, underscores a shift toward sensors powered by hardware sophistication along with deep integration with software and AI frameworks. Such integration fortifies Korea’s position at the forefront of innovation, further fueling the South Korea automotive sensors market growth.

To get more information on this market Request Sample

ADAS & Autonomous System Momentum

The growth of advanced driver assistance systems (ADAS) and autonomous vehicle pilots has heavily influenced sensor trends in South Korea. Regulatory drives requiring features like automatic emergency braking, lane-keeping, and parking assistance, have driven domestic demand for integrated radar-camera solutions. Local Tier 1 suppliers and automotive OEMs are working closely with each other, where LG Innotek and bitsensing co-develop digital imaging radar, and Bosch, Panasonic, and Denso have strong presences. K‑City test hub for autonomous driving and regular Seoul Mobility Show events feature locally developed ADAS and autonomy technologies, maintaining the spotlight on Level 2+‑enabled sensors. Support from industry is further bolstered by Hyundai‑supported BOS Semiconductors and Tenstorrent introducing chiplet-based automotive AI accelerators to process sensor information onboard, emphasizing need for high-throughput perception combined through radar, LiDAR, and camera feeds. These trends point to a convergence of South Korea's hardware, independence, and smart mobility platforms.

Smart Factory and Export-Driven Standards

South Korea's sensors in the automotive sector are not limited to cars, as domestic plants, such as Hyundai’s new Ulsan EV factory, are deploying real-time sensor networks for process control, emissions tracking, and powertrain diagnostics under smart factory frameworks bolstered by the government’s Green New Deal and “smart mobility” policies. This institutional backing supports widespread adoption of temperature, pressure, and current sensors - vital in both production and the EV components they yield. Simultaneously, export pressures force sensor conformity with EU, U.S., and UN safety protocols are driving innovation toward globally certified LiDAR and radar-camera fusion modules. Domestic partnerships among OEMs, semiconductor players, and R&D institutions further drive sensor localization and intellectual property development. Effectively, South Korea's automotive sensors industry matures as an ecosystem in which manufacturing greatness, regulatory requirements, export competitiveness, and sensor innovation are closely intertwined.

South Korea Automotive Sensors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, vehicle type, application, and sales channel.

Type Insights:

- Level/Position Sensors

- Temperature Sensors

- Pressure Sensors

- Speed Sensors

- Gas Sensors

- Magnetic Sensors

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes level/position sensors, temperature sensors, pressure sensors, speed sensors, gas sensors, magnetic sensors, and others.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars and commercial vehicles.

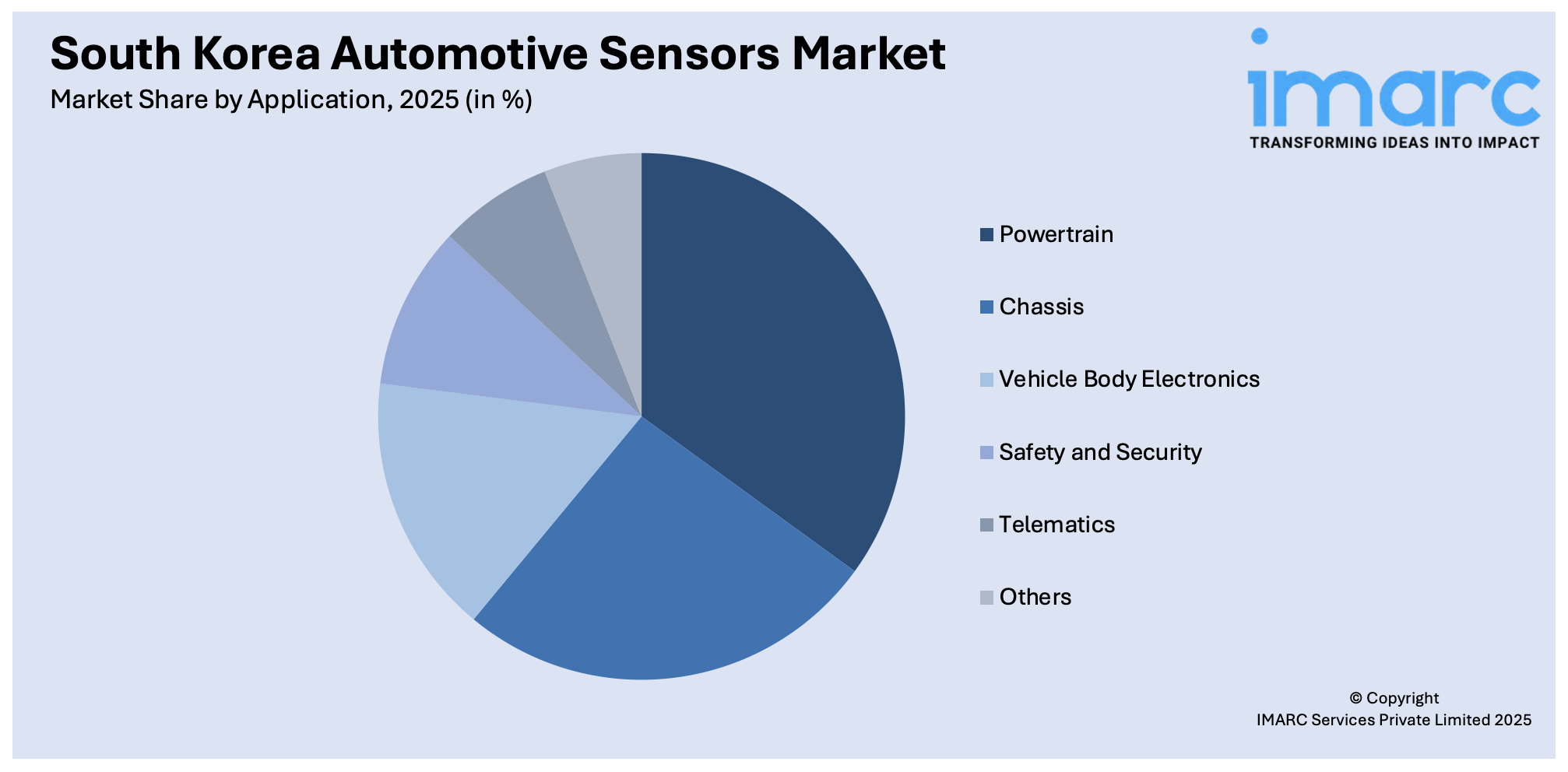

Application Insights:

Access the comprehensive market breakdown Request Sample

- Powertrain

- Chassis

- Vehicle Body Electronics

- Safety and Security

- Telematics

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes powertrain, chassis, vehicle body electronics, safety and security, telematics, and others.

Sales Channel Insights:

- Original Equipment Manufacturer (OEM)

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel has also been provided in the report. This includes original equipment manufacturer (OEM) and aftermarket.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Automotive Sensors Market News:

- In April 2025, at the recent Electronics Manufacturing Korea (EMK) and Automotive World Korea (AWK) exhibits, DuPont showcased its cutting-edge products that use silver nanowire technologies. Transparent heaters, smart surfaces, Advanced Driver Assistance Systems (ADAS), in-mold electronics (IME), transparent electromagnetic interference (EMI) shielding, infrared (IR) reflecting, and other applications in the automotive and consumer electronics sectors are just a few of the innovative products that DuPont has added to its lineup.

- In March 2024, the official opening of Valeo's new manufacturing facility in Daegu, Korea, to produce sensors for vehicle automation represents a major accomplishment for the global leader in automotive technology. French Ambassador to Korea Philippe Bertoux, Valeo Comfort and Driving Assistance Systems Business Group President Marc Vrecko, Valeo Mobility Korea CEO Kim Min-kyu, and Daegu Metropolitan Mayor Hong Joon Pyo attended the inauguration.

South Korea Automotive Sensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Level/Position Sensors, Temperature Sensors, Pressure Sensors, Speed Sensors, Gas Sensors, Magnetic Sensors, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Applications Covered | Powertrain, Chassis, Vehicle Body Electronics, Safety And Security, Telematics, Others |

| Sales Channels Covered | Original Equipment Manufacturer (OEM), Aftermarket |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea automotive sensors market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea automotive sensors market on the basis of type?

- What is the breakup of the South Korea automotive sensors market on the basis of vehicle type?

- What is the breakup of the South Korea automotive sensors market on the basis of application?

- What is the breakup of the South Korea automotive sensors market on the basis of sales channel?

- What is the breakup of the South Korea automotive sensors market on the basis of region?

- What are the various stages in the value chain of the South Korea automotive sensors market?

- What are the key driving factors and challenges in the South Korea automotive sensors market?

- What is the structure of the South Korea automotive sensors market and who are the key players?

- What is the degree of competition in the South Korea automotive sensors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea automotive sensors market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea automotive sensors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea automotive sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)