South Korea Automotive Software Market Size, Share, Trends and Forecast by Product, Vehicle Type, Application, and Region, 2026-2034

South Korea Automotive Software Market Overview:

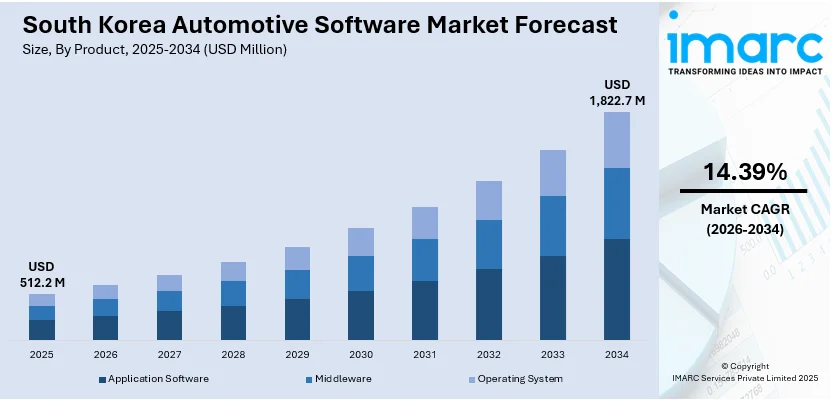

The South Korea automotive software market size reached USD 512.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,822.7 Million by 2034, exhibiting a growth rate (CAGR) of 14.39% during 2026-2034. At present, auto manufacturers and tech companies are paying special attention to embedding advanced infotainment, telematics, and autonomous driving capabilities into vehicles. Moreover, technological advancements in autonomous driving are contributing to the market growth. Apart from this, the increasing emphasis on electric vehicle (EV) integration is expanding the South Korea automotive software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 512.2 Million |

| Market Forecast in 2034 | USD 1,822.7 Million |

| Market Growth Rate 2026-2034 | 14.39% |

South Korea Automotive Software Market Trends:

Growing Need for Connected Cars

The South Korean automobile software industry is presently witnessing high growth, with the heightened need for connected cars. Auto manufacturers and tech companies are paying special attention to embedding advanced infotainment, telematics, and autonomous driving capabilities into vehicles. This trend is boosting the uptake of advanced software solutions meant to improve connectivity and deliver real-time analytics. Manufacturers are also working with technology companies to create software that will allow for smooth interaction between automobiles, infrastructure, and drivers. This is being led by government programs that are committed to increasing smart mobility solutions and Internet of Things (IoT) integration in the automotive system. With an increasing number of end-users expecting a better in-car experience, the regional automotive software industry is improving, with technologies such as over-the-air software upgrades and vehicle-to-vehicle (V2V) communication systems being implemented in the region. IMARC Group predicts that the South Korea connected car market is anticipated to reach USD 7,081.3 Million by 2033.

To get more information on this market Request Sample

Development in Autonomous Driving Technology

The South Korean market for automotive software is driven by technological advancements in autonomous driving. Firms are emphasizing the creation of software solutions that allow cars to drive autonomously across different road types while maintaining reliability and safety. With more investments in sensor technology, machine learning, and artificial intelligence (AI), automakers keep improving their software platforms to aid self-driving features. South Korea's government is also proactively investing in the development and testing of autonomous cars, and it has a positive climate for deploying advanced driver-assistance systems (ADAS). The integration of sophisticated algorithms, real-time data processing, and advanced sensor fusion technologies is contributing to the South Korea automotive software market growth. As autonomous driving becomes increasingly feasible, car manufacturers are investing in developing innovative technologies to improve the overall driving experience. In 2025, Hyundai Motor Group, the leading automotive company in South Korea, announced its plans to undertake a significant domestic investment of 24.3 trillion won ($16.65 billion) in 2025, representing a 19% rise from the year before. The alliance, which consists of Hyundai Motor and Kia, is presently the world’s third-largest car manufacturer by sales, following Toyota and Volkswagen. Hyundai's bold investment strategy encompasses 11.5 trillion won allocated for research and development (R&D), emphasizing next-generation technologies like electrification, software-defined vehicles, hydrogen-fueled products, and cutting-edge mobility solutions. It also includes 12 trillion won designated for increasing electric vehicle (EV) manufacturing and introducing new models, and 800 billion won allocated for strategic investments, covering autonomous driving technologies.

Increased Emphasis on Electric Vehicle (EV) Integration

The South Korean automotive software sector is currently driven by the rising emphasis on electric vehicle (EV) integration. As South Korea's automotive industry increasingly adopts the global move towards sustainability, software innovation for electric vehicles is picking up pace. Firms are creating software for enhancing battery management systems (BMS), energy efficiency, and charging infrastructure. This involves innovation around vehicle-to-grid (V2G) technologies, allowing energy to flow back and forth without interruption between electric vehicles and the grid. With the government facilitating EV adoption through incentives and policy support, automakers are increasingly integrating software that improves electric vehicle performance and user experience overall. Moreover, the increasing shift towards minimizing carbon footprint and fuel consumption is encouraging automobile software solutions to concentrate on managing energy, enhancing the integration of EVs into the market to become more efficient and affordable.

South Korea Automotive Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, vehicle type, and application.

Product Insights:

- Application Software

- Middleware

- Operating System

The report has provided a detailed breakup and analysis of the market based on the product. This includes application software, middleware, and operating system.

Vehicle Type Insights:

- ICE Passenger Vehicle

- ICE Light Commercial Vehicle

- ICE Heavy Commercial Vehicle

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Autonomous Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes ICE passenger vehicle, ICE light commercial vehicle, ICE heavy commercial vehicle, battery electric vehicle, hybrid electric vehicle, plug-in hybrid electric vehicle, and autonomous vehicles.

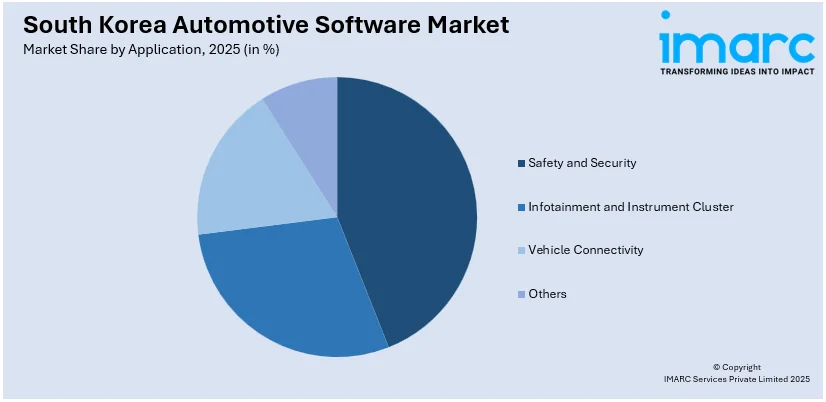

Application Insights:

Access the comprehensive market breakdown Request Sample

- Safety and Security

- Infotainment and Instrument Cluster

- Vehicle Connectivity

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes safety and security, infotainment and instrument cluster, vehicle connectivity, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Automotive Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Application Software, Middleware, Operating System |

| Vehicle Types Covered | ICE Passenger Vehicle, ICE Light Commercial Vehicle, ICE Heavy Commercial Vehicle, Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle, Autonomous Vehicles |

| Applications Covered | Safety and Security, Infotainment and Instrument Cluster, Vehicle Connectivity, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea automotive software market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea automotive software market on the basis of product?

- What is the breakup of the South Korea automotive software market on the basis of vehicle type?

- What is the breakup of the South Korea automotive software market on the basis of application?

- What is the breakup of the South Korea automotive software market on the basis of region?

- What are the various stages in the value chain of the South Korea automotive software market?

- What are the key driving factors and challenges in the South Korea automotive software market?

- What is the structure of the South Korea automotive software market and who are the key players?

- What is the degree of competition in the South Korea automotive software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea automotive software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea automotive software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea automotive software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)